1. Executive Summary

Veda is a leading DeFi vault infrastructure platform that simplifies the creation and management of yield-generating financial products for institutions, protocols, and applications. By providing a non-custodial, composable vault primitive called BoringVault, Veda addresses the complexities of DeFi yield optimization, securing over $3.8B in TVL across integrations like ether.fi Liquid and Lombard DeFi Vault. With recent funding from top investors like CoinFund and Coinbase Ventures, Veda is positioned for expansion into cross-chain yield strategies.

Operating in the rapidly growing DeFi yield vaults market, Veda stands out for its enterprise-grade security and compliance features. At the same time, it lacks a launched native token, but a points program hints at future tokenomics. Traction is strong, with $75M distributed via generated yield and 100,000+ depositors, but competition from other on-chain capital allocators like Spark remains fierce. Veda represents a high-potential infrastructure play in institutional DeFi, with scalable growth prospects.

Today’s edition of Token Metrics Research | Daily Newsletter is brought to you by Superhuman AI.

Find out why 1M+ professionals read Superhuman AI daily.

In 2 years you will be working for AI

Or an AI will be working for you

Here's how you can future-proof yourself:

Join the Superhuman AI newsletter – read by 1M+ people at top companies

Master AI tools, tutorials, and news in just 3 minutes a day

Become 10X more productive using AI

Join 1,000,000+ pros at companies like Google, Meta, and Amazon that are using AI to get ahead.

Now, let’s get back to the deep dive.

2. About the Project

2.1. Vision

Veda envisions a future where DeFi becomes seamless and accessible for institutions, enabling the launch of consumer-grade, cross-chain yield products without the need to rebuild complex infrastructure.

The platform aims to abstract away the intricacies of yield optimization, risk management, and cross-chain operations, empowering asset issuers, protocols, chains, wallets, and applications to integrate native yield into their offerings.

Ultimately, Veda seeks to make DeFi "disappear" by providing reliable, battle-tested infrastructure that supports products like crypto savings accounts, yield-bearing stablecoins, and ecosystem vaults.

2.2. Problem

DeFi's growth is hindered by high barriers to entry for institutions and developers, including the need to build custom smart contracts, manage cross-chain liquidity, ensure compliance, and mitigate risks in volatile yield strategies.

Traditional yield products often require reinventing pricing, accounting, and security mechanisms, leading to fragmented liquidity, high gas costs, and custodial risks. This complexity limits scalability and adoption, particularly for enterprise-grade applications seeking verifiable safeguards and regulatory compliance.

2.3. Solution

Veda offers a protocol-level vault primitive that handles pricing, accounting, securing, optimizing, and automating capital in a non-custodial, trust-minimized manner. At its core is the BoringVault, a modular smart contract that delegates functionality to external modules like the Teller (for deposits/redemptions), Manager (for rebalancing), Accountant (for exchange rates), and Oracle (for yield tracking).

Users deposit assets, which are dynamically allocated across DeFi protocols for yield, with off-chain AI-powered algorithms optimizing liquidity. This setup is chain-agnostic (EVM, SVM, MoveVM) and composable (e.g., vault shares as Aave collateral) and supports complex strategies while maintaining verifiable constraints via Merkle proofs.

3. Market Analysis

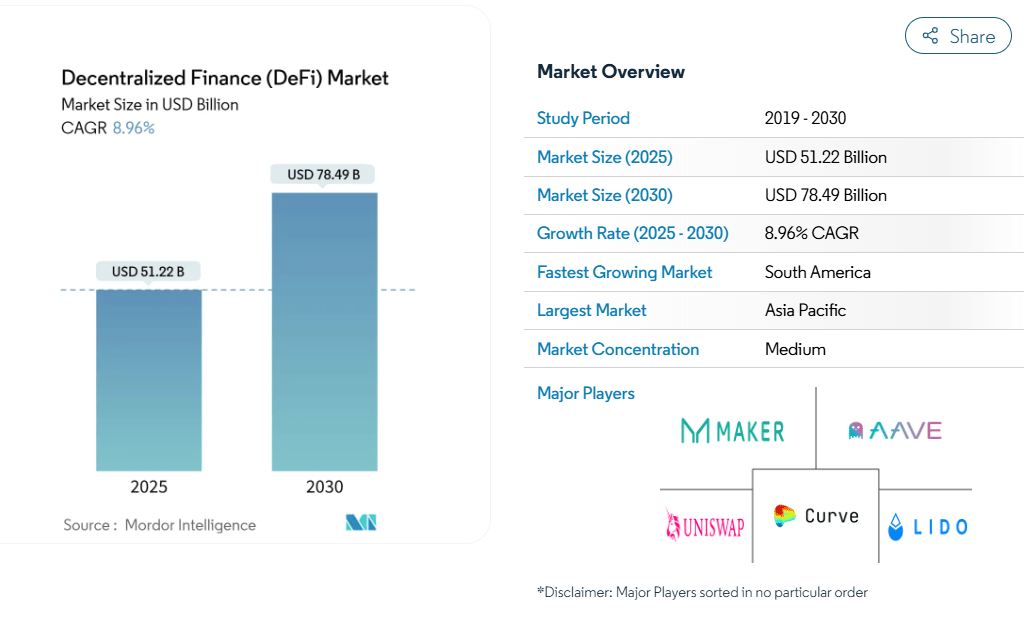

Veda operates in the DeFi yield vaults and optimization infrastructure segment, which focuses on automated yield farming, liquidity management, and tokenized strategies. This niche is part of the broader DeFi ecosystem, where vaults aggregate capital to maximize risk-adjusted returns across protocols like lending markets and DEXs.

The global DeFi market is estimated at $51.22B in 2025, driven by increasing institutional adoption and tokenized real-world assets (up 260% to over $23B this year). Specifically, the institutional DeFi subsector (including yield vaults) stands at $17.5B, with a 32% YTD growth. Projections from leading reports, such as those by Grand View Research, forecast DeFi to reach $231B by 2030, fueled by stablecoin expansion to $300B by end-2025 and derivative DEX volumes surging 872% in 2024-2025. Yield farming platforms offer 20-30% annual yields, attracting passive income seekers amid rising crypto asset management (projected to reach $2.5B by 2030).

3.1. Competition

Competitor | TVL | Similarities to Veda | Differences from Veda |

Automated yield optimization and liquidity management across DeFi protocols; supports cross-chain operations and risk-adjusted strategies. | Focuses on stablecoin liquidity (USDS, sUSDS) within the Sky (MakerDAO) ecosystem; emphasizes lending markets and RWA integrations rather than general vault primitives. | ||

Solv Strategies | Yield-generating vaults for asset optimization; non-custodial with liquid staking tokens for composability. | Specialized in Bitcoin staking and yield (e.g., SolvBTC LSTs); targets BTC holders with delta-neutral strategies, unlike Veda's broader asset-agnostic approach. | |

Turtle Club | Enhances yields for liquidity providers in partner protocols; non-custodial with reward boosting mechanisms. | Acts as an overlay distribution protocol without direct vaults; focuses on monetizing Web3 activities and democratizing liquidity deals, not building enterprise-grade infrastructure. | |

Upshift | Managed vaults for sophisticated yield strategies; emphasizes security, transparency, and composable receipt tokens. | Built on prime brokerage infrastructure, targets institutional-grade DeFi with curator-managed funds, less emphasis on AI optimization or vault primitives. | |

Lagoon | On-chain vault infrastructure for curators; modular and permissionless for launching scalable vaults. | Designed for asset managers and DAOs with segregated accounts; more focused on flexibility for SMAs and tokenized funds, without Veda's BoringVault architecture or compliance controls. |

4. Features

Enterprise-Grade Security: BoringVault secures $3.8B+ TVL with minimal code exposure, multiple audits, and Merkle-verified operations.

Configurable Compliance Controls: Address whitelists, deposit permissions, and curator roles for regulatory needs.

Chain and Protocol Agnostic: Supports EVM, SVM, MoveVM; integrates with lending (e.g., Aave), DEXs, and yield protocols.

Adaptive Allocation and Optimization: Off-chain AI algorithms for dynamic rebalancing; supports complex, multi-strategy vaults.

Composable Design: Vault shares can be used as collateral (e.g., first on Aave); they are non-custodial and have verifiable constraints.

White-Labeling Tools: SDKs, APIs, and smart contracts for branded products; 24/7 enterprise support with SLAs.

Rapid Iteration: Launch/update vaults in 48 hours; automated pricing/accounting for real-time balances.

5. Token

According to official documentation and its website, Veda did not launch a native token as of July 2025. Instead, it operates a live points program, likely as a precursor to a future token airdrop or governance mechanism, rewarding users for deposits and participation. No official details on supply or distribution are available, as the project focuses on infrastructure rather than immediate tokenization.

A potential future token could provide governance over vault strategies, fee sharing from protocol revenue, or staking rewards, based on similar DeFi primitives. Currently, utility derives from vault shares, which enable yield accrual, composability (e.g., as collateral), and seamless redemptions.

6. Team

Veda's team combines expertise in DeFi, fintech, and engineering. Sunand Raghupathi is a co-founder and CEO. He previously co-founded Seven Seas Capital and is experienced in DeFi strategy and capital markets. Joseph Terrigno is a co-founder and CTO. He leads technical architecture and has a background in software development for decentralized systems. Stephanie Vaughan is a co-founder and COO. She focuses on operations and compliance and has expertise in fintech and Web3. Other team members include Igor Lilic, a data science lead, specializing in DeFi analytics and optimization, and Josh Kessler, in business development, driving partnerships, and unlocking DeFi for institutional users. The team is supported by advisors from crypto funds, with GitHub activity showing active development.

7. Traction

Veda has achieved rapid growth since its launch:

TVL: $3.8B (ATH as of July 2025)

Deposits: $3.8B from 100,000+ depositors

Yield Generated: $75M+

Community: 38,200+ X followers; active on GitHub with audited repos.

Expansion: Recent Solana integration; partnerships with top exchanges planned.

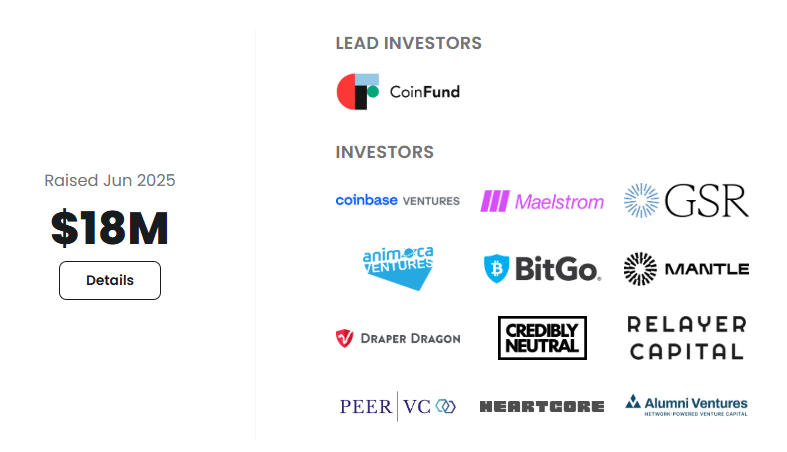

8. Investors

Veda raised a $18M Series A round in June 2025. CoinFund led it, and participants include Coinbase Ventures, Sandeep Nailwal (Polygon Co-Founder), GSR, Alumni Ventures, Maelstrom, Mantle EcoFund, Animoca Ventures, Credibly Neutral, and others.

9. Conclusion

Veda is a transformative force in DeFi infrastructure, addressing key pain points in yield optimization and institutional adoption through its innovative BoringVault primitive. With a rapid increase in TVL and integrations powering major products, Veda demonstrates strong market validation and scalability. Backed by $18M from prominent investors, the platform is well-equipped to leverage the DeFi market's expansion toward $150B+ by 2030, fueled by tokenized assets, stablecoins, and yield farming trends.

Potential hurdles include the lack of a native token, which could delay governance and incentives, alongside stiff competition from protocols like Spark Liquidity Layer. Regulatory uncertainties and smart contract risks also warrant caution.

In summary, Veda offers compelling potential for investors focused on institutional DeFi, particularly with its emphasis on security, composability, and cross-chain capabilities. Monitoring token developments, partnerships, and market dynamics will be crucial to realizing its long-term value in the evolving crypto landscape.