1. Executive Summary

Zora is a decentralized protocol and Layer 2 (L2) blockchain built on the Optimism (OP) Stack. It is designed to empower creators by enabling seamless on-chain minting, distribution, and trading of digital media, including NFTs and "creator coins" (tokenized posts).

Initially launched in 2020 as an NFT marketplace focused on artist royalties and resale value capture, Zora has pivoted to a broader creator economy platform, emphasizing low-cost interactions and on-chain social features.

With over $370M in total trading volume, $27M in creator rewards distributed, and a native $ZORA token launched in April 2025, Zora positions itself at the intersection of NFTs, social media, and memecoins.

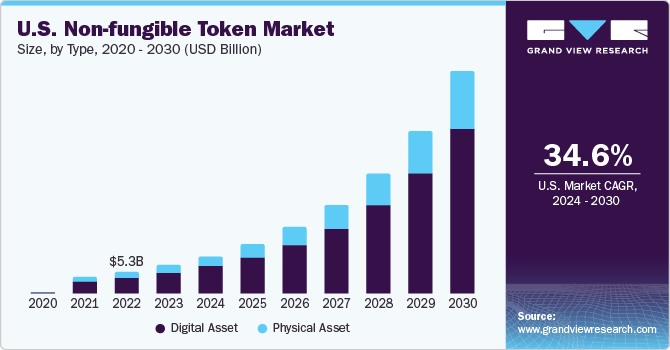

The NFT and creator economy sector is projected to grow significantly, with the global NFT market expected to expand from $35B in 2024 to $211B by 2030 at a CAGR of 34.5%. Zora differentiates through its focus on on-chain media protocols, gas-efficient minting, and innovative features like posts-as-coins, which blend social networking with financialization.

However, community sentiment on X is mixed: bullish on platform adoption and creator tools, but bearish on the $ZORA token due to perceived poor airdrop execution, VC-heavy allocation, and lack of utility beyond "fun" memecoin status.

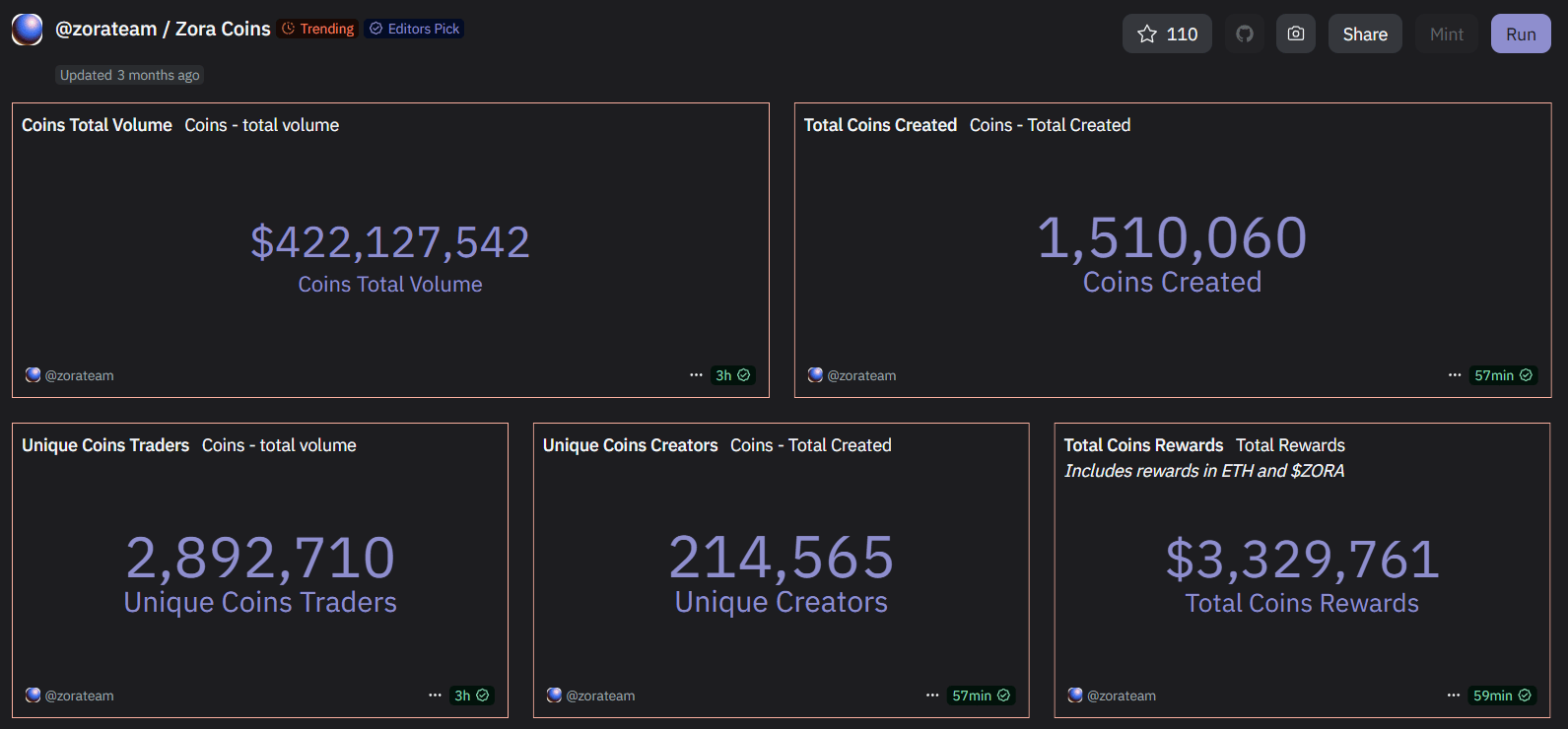

Key strengths include a strong team with crypto expertise, $60M+ in funding from top investors like Haun Ventures and Coinbase Ventures, and growing traction metrics (e.g., 1.5M+ coins created, 2.8M+ traders). Risks involve sector volatility, competition from established NFT marketplaces, and fading hype around creator coins.

Today’s Edition of Token Metrics Research | Daily Newsletter is brought to you by Crypto 101.

The Smartest Free Crypto Event You’ll Join This Year

Curious about crypto but still feeling stuck scrolling endless threads? People who get in early aren’t just lucky—they understand the why, when, and how of crypto.

Join our free 3‑day virtual summit and meet the crypto experts who can help you build out your portfolio. You’ll walk away with smart, actionable insights from analysts, developers, and seasoned crypto investors who’ve created fortunes using smart strategies and deep research.

No hype. No FOMO. Just the clear steps you need to move from intrigued to informed about crypto.

Now, let’s get back to the deep dive.

2. About the Project

2.1. Vision

Zora envisions a creator-centric internet where digital content is owned, monetized, and traded on-chain without intermediaries. By building an open protocol for media, Zora aims to democratize value capture for artists, musicians, and content creators, fostering a "new creator economy" where every post or creation can become a tradable asset. The platform seeks to "bring media on-chain," enabling scalable, low-cost interactions that blend social networking with blockchain financialization.

2.2. Problem

Traditional web2 platforms (e.g., Instagram, TikTok) extract value from creators through ads and algorithms while offering limited ownership or royalties. Creators face high barriers to entry in NFTs due to gas fees, complex tools, and fragmented resale markets. Additionally, the creator economy lacks integrated financial tools, leading to missed opportunities in speculation and community-driven value accrual. Community discussions on X highlight frustrations with "DOA pivots" and outdated models like enforced royalties, which fail in a post-authorship era where content is collectively remixed.

2.3. Solution

Zora addresses these through a decentralized Ethereum-based protocol and its own L2 network (Zora Network), powered by the OP Stack for fast, cheap transactions. Creators can mint NFTs or "creator coins" (tokenized posts) in seconds for under $0.50, capturing royalties and resale value on-chain.

The platform's apps allow users to "coin everything," turning social content into tradable assets, with built-in rewards for engagement. This creates a flywheel: creators earn from mints and trades, collectors speculate on content, and the network benefits from increased on-chain activity.

3. Market Analysis

Zora operates in the NFT and creator economy sector, a subset of the broader digital assets market. This includes platforms for minting, trading, and monetizing unique digital content like art, music, and social posts. The sector emphasizes ownership, royalties, and community-driven value, aligning with web3 principles.

The global NFT market was valued at $35B in 2024 and is projected to reach $211B by 2030, growing at a CAGR of 34.5%. Drivers include rising demand for digital collectibles, integrating metaverses and gaming, and expanding use cases in real-world assets (RWAs) like tokenized art and music.

Leading reports from Grand View Research highlight blockchain adoption and creator tools as key enablers, with Asia-Pacific and North America leading growth due to high crypto penetration. However, challenges like regulatory scrutiny and market volatility could temper short-term gains.

Zora is a specialized player in on-chain media, differentiating through its L2 focus on low fees and social-financial hybrids (content coins). Growth opportunities include expanding into AI-generated content, music NFTs, and cross-chain interoperability. Ethereum's ecosystem upgrades (Dencun for cheaper L2s) and rising creator economy participation are enablers. If adoption accelerates, Zora could capture share by targeting underserved niches like micro-content monetization.

3.1. Competition

Zora faces stiff competition from established NFT marketplaces. Below is a table of the top five closest competitors, based on 2025 rankings, with similarities and differences:

Competitor | Sector Focus | Similarities | Differences | Market Position |

OpenSea | General NFT Marketplace | Supports NFT minting and trading; Ethereum-based with royalties. | Broader asset support (e.g., gaming NFTs); no L2 native network or creator coins; higher fees. | Largest by volume ($39B+ lifetime); multi-chain. |

Blur (BLUR) | NFT Trading Aggregator | Focus on efficient trading and royalties; on-chain tools. | Trader-centric (e.g., lending, points farming); less emphasis on creators/social features. | $12B+ volume; popular for flips. |

Magic Eden (ME) | Multi-Chain NFT Marketplace | Low-fee minting; creator royalties. | Strong in the Solana ecosystem; gaming/metaverse focus over social coins. | Top Solana NFT hub; $4.5B+ volume. |

Rarible | Community-Owned NFT Platform | Decentralized protocol; user governance. | DAO-driven; broader DeFi integrations but no dedicated L2. | Emphasizes curation. |

Foundation | Curated Art NFT Marketplace | Artist-focused royalties and minting. | Invite-only curation; premium art emphasis, lacking memecoin/social elements. | $185M+ volume; elite creator network. |

Zora stands out with its social-financial innovation but trails in overall volume; differentiation via creator coins could drive niche dominance.

4. Features

Zora's core features revolve around on-chain media:

Low-Cost Minting: Create NFTs or creator coins for <$0.50 on Zora Network.

Creator Coins: Tokenize posts as tradable assets, blending social media with speculation.

Royalties and Rewards: Automatic resale value capture; $27M distributed to creators.

L2 Network: OP Stack for fast confirmations and scalability.

Apps and Tools: User-friendly interfaces for minting, collecting, and trading; referral rewards in ETH.

Interoperability: Bridges to Ethereum/Base; supports multimedia like images, videos, and music.

These enable a "coin everything" model, fostering viral on-chain content.

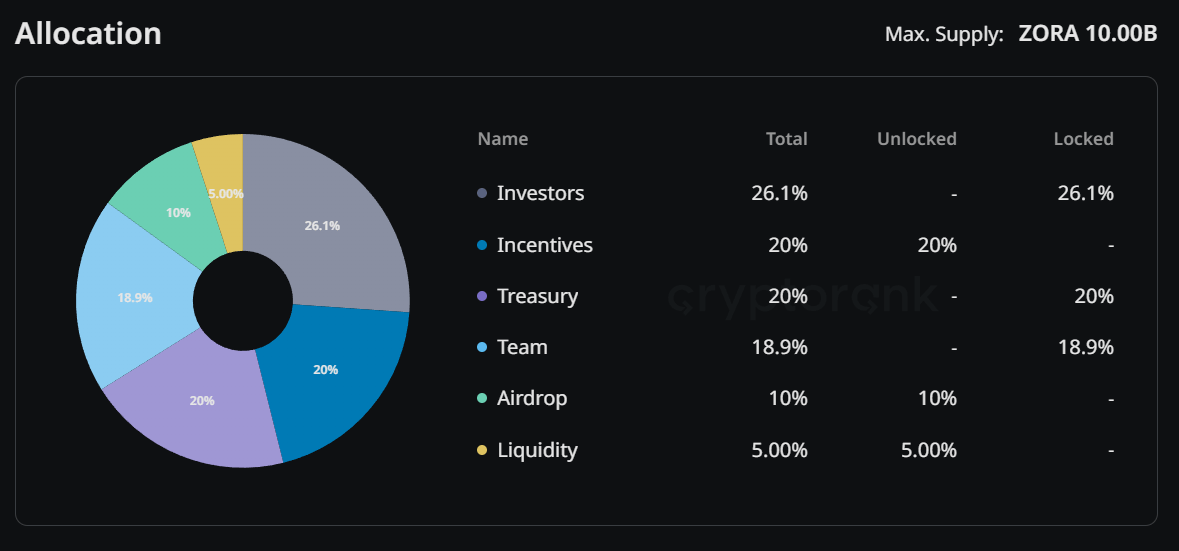

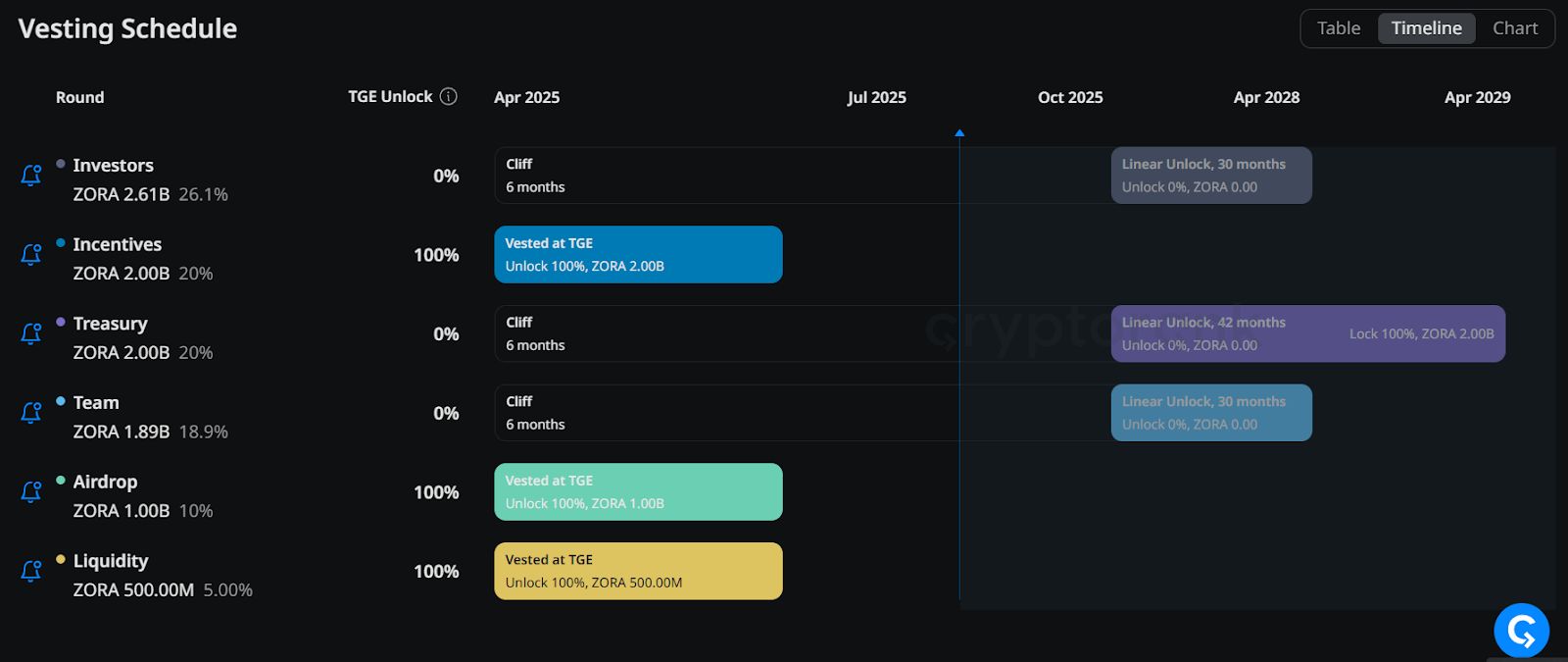

5. Token

The native token is $ZORA, launched on April 23, 2025, as an ERC-20 on the Base chain. The total supply is 10 billion tokens, and the circulating supply as of July 2025 is 3.2 billion.

5.1. Utility

$ZORA is positioned as a "memecoin for fun" with no equity or governance. Utility includes platform incentives (e.g., farming via mints), liquidity provision, and speculation tied to Zora's growth. It powers creator rewards and could evolve into staking or fee discounts, though currently limited.

6. Team

Zora was co-founded by Jacob Horne (CEO) and Dee Goens (Co-Founder). With deep crypto expertise, Horne previously worked at Coinbase on product development and has a background in building open music tools. Goens focuses on operations.

Key expertise: Blockchain product design, NFT protocols, and creator tools. Advisors are not publicly detailed but inferred from investors (e.g., Coinbase Ventures provides strategic guidance). The team's web3 tenure (since 2020) emphasizes sustainable models, though X critiques note tensions between profit and artist support.

7. Traction

User Metrics: 2.8M+ traders, 214K+ creators, 1.5M+ coins created.

Transaction Metrics: Seconds for confirmations; <0.50/mint; $422M+ coins volume.

Value Transfer: $27M+ creator rewards; Zora Network TVL is $15M+ as of mid-2025.

Other Data: Daily active users fluctuated but grew post-token launch; on-chain activity includes 30K+ daily unique transacting wallets.

8. Investors

Zora has raised $60M across rounds:

Seed (2020): $2M from undisclosed angels.

Series A (2021): $8M led by Kindred Ventures.

Series B (May 2022): $50M at $600M valuation, led by Haun Ventures; participants: Coinbase Ventures, Kindred Ventures.

Total: $60M; post-money valuation $600M.

Funds supported L2 development and creator tools. Investors bring web3 expertise, with Coinbase aiding integrations.

9. Conclusion

This report provides a comprehensive overview of Zora, detailing its evolution as a decentralized protocol and Layer 2 blockchain focused on empowering creators through on-chain minting, trading, and monetization of digital media.

Investors should assess the opportunity by evaluating Zora's alignment with broader market trends in NFTs and on-chain social features, monitoring key indicators like TVL growth on the Zora Network, user and transaction metrics for sustained adoption, community sentiment on platforms like X for potential risks or hype cycles, and the token's utility evolution amid sector volatility.

A balanced view of strengths (e.g., low barriers for creators) against challenges (e.g., competition and mixed sentiment) will help gauge long-term viability in the evolving crypto landscape.