We scored multiple projects this week. Here are a few you should know about:

zora

PancakeSwap

Project X

swarms

SaucerSwap

Please remember that some of these projects still need our code review process. Still, we want to highlight them here because they initially caught our attention through our fundamental analysis process.

Today’s edition of Token Metrics Research | Daily Newsletter is brought to you by The AI Report.

Join 400,000+ executives and professionals who trust The AI Report for daily, practical AI updates.

Built for business—not engineers—this newsletter delivers expert prompts, real-world use cases, and decision-ready insights.

No hype. No jargon. Just results.

Now, let’s get back to the hidden gems.

1. zora

Sector - DeFi

Status - Active

Zora is an on-chain content protocol that enables creators to tokenize and monetize social media posts as tradable "content coins," shifting from traditional NFTs to a broader creator economy model.

Its vision is to challenge centralized platforms like Instagram and TikTok by giving users true ownership of their content through decentralized, permissionless minting and trading. The core problem it addresses is the lack of creator control and revenue sharing in Web2 social media, where algorithms and ads dominate value capture.

Zora's solution leverages Ethereum-compatible infrastructure for seamless tokenization of posts into ERC-20-like assets with built-in royalties and referral mechanics. Key technologies include integration with Farcaster for social feeds, EVM smart contracts on the Base Layer 2 network (developed by Coinbase) for low-cost, high-speed transactions, and APIs for custom apps.

In early 2025, Zora pivoted toward the "content coin" narrative, emphasizing tokenized social content. It was deeply integrated into Coinbase's rebranded Base App, an "everything app" combining trading, payments, and social features. This has driven a surge in daily coin creations from under 5,000 to over 10,000, positioning Zora as a hub for on-chain creator tools.

1.1. Features

Content Coin Minting: Enables users to tokenize social media posts or content into tradable ERC-20-like "content coins" with automatic royalty and referral mechanics, allowing creators to monetize directly on-chain via a simple interface.

Base App Integration: Seamless embedding within Coinbase's Base App for creating, trading, and managing content coins, combining social features with DeFi tools for an "everything app" experience.

On-Chain Royalties and Referrals: Built-in programmable royalties and referral rewards for promoters, ensuring sustained value flow to participants in secondary trades.

Permissionless Protocol: Open-source design on Base L2 allows developers to build custom apps, feeds, or marketplaces for tokenized content without gatekeepers.

Social Network Tools: Integrates with protocols like Farcaster for on-chain social feeds, enabling collectible posts, community governance, and viral distribution.

Low-Cost Scaling: Leverages Base's Ethereum L2 for near-instant, sub-cent transactions, ideal for high-volume content creation and trading.

Analytics and Dashboards: Provides on-chain metrics for creators to track engagement, earnings, and audience growth across tokenized assets.

1.2. Token

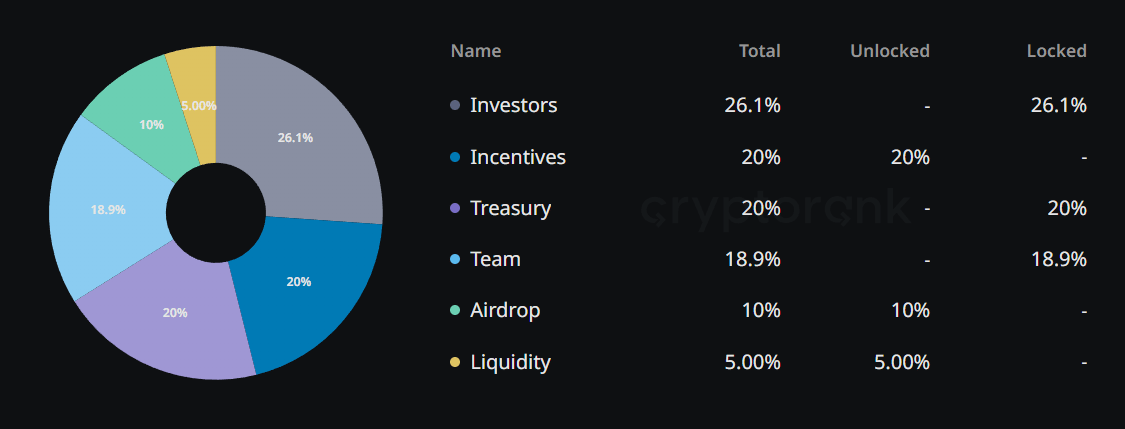

Zora's native token is $ZORA, an ERC-20 token on the Base chain (Ethereum L2) launched in April 2025. It has a total supply of 10 billion tokens, with a circulating supply building through distributions and trading.

Key distribution metrics include a 10% retroactive airdrop (1 billion tokens) to early creators, collectors, and users based on protocol activity, with the remainder allocated for ecosystem incentives, liquidity, and future rewards.

1.2.1. Utility

Governance: $ZORA holders participate in DAO votes on protocol upgrades, fee structures, and content curation via the Zora Network governance module.

Incentives and Rewards: Used to reward creators and referrers in the content coin ecosystem, including staking for boosted royalties or airdrop eligibility.

Transaction Fees: Contributes to protocol fees for minting and trading, with burns or redistributions enhancing scarcity and holder value.

Access and Premium Features: Unlocks advanced tools like custom dashboards, priority listings, or integrations in the Base App for enhanced content monetization.

Ecosystem Payments: Serves as currency for buying/selling tokenized content, apps, or services within Zora's social network.

1.3. Investor

Since 2020, Zora has raised approximately $60M across four funding rounds. The seed round in October 2020 raised $2M from investors like Kindred Ventures and Coinbase Ventures. An $8M equities sale followed this in March 2021. The largest round was a $50M Series A in May 2022, led by Haun Ventures at a $600M valuation, with participation from Paradigm and others.

2. PancakeSwap

Sector - DeFi

Status - Active

PancakeSwap is the leading decentralized exchange (DEX) on the BNB Smart Chain, offering seamless token swaps, liquidity provision, and yield farming with a fun, user-centric approach.

Its vision is to make decentralized finance accessible and enjoyable, turning "money into fun" by democratizing trading and earning. The primary problems it solves are high transaction fees on networks like Ethereum, lack of user ownership on centralized exchanges, and limited passive income opportunities for crypto holders.

PancakeSwap's solution leverages BNB Smart Chain's low-cost, high-speed infrastructure for instant, wallet-based trading without registration. Key technologies include automated market makers (AMM) with constant product formulas, open-source smart contracts verified on BscScan, and multichain support for broader liquidity.

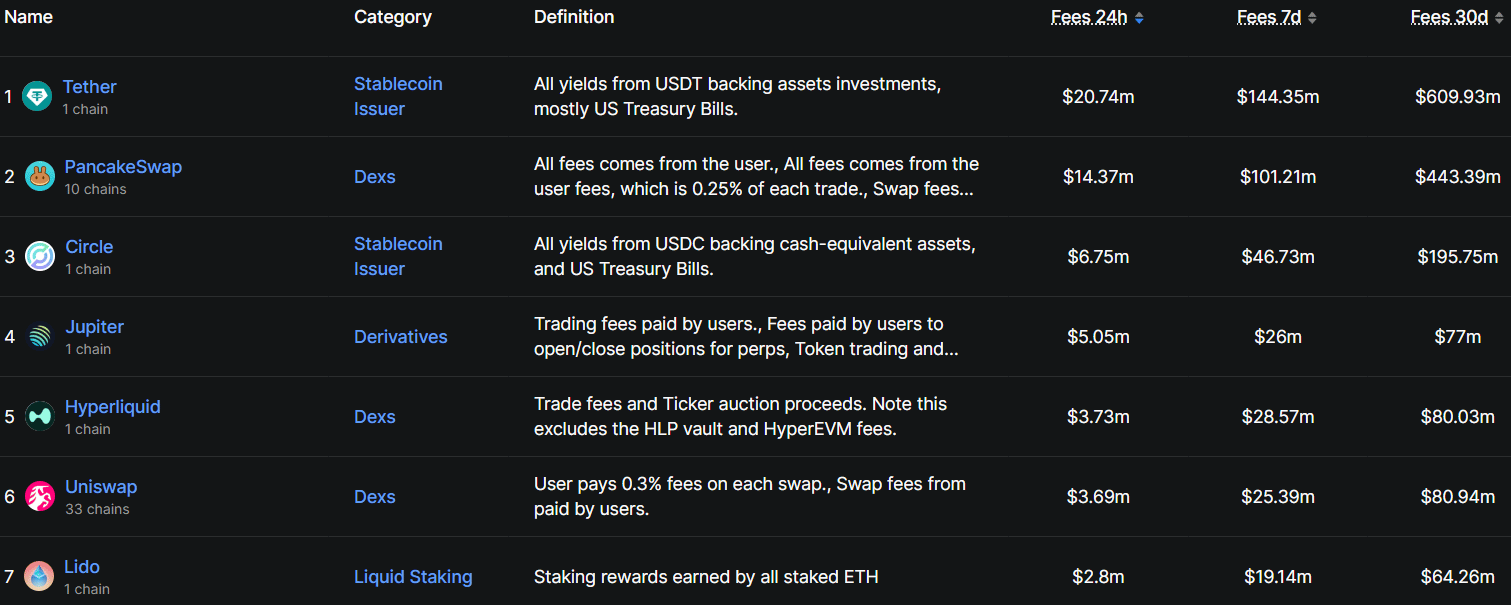

As one of the top fee-generating DEXs, PancakeSwap is potentially undervalued compared to peers like Uniswap (which has a higher market cap but doesn't distribute fees to holders) and Aerodrome (focused on revenue sharing but lower volume), with $1.01B market cap at $2.94 per token, it boasts higher trading volumes than Uniswap at times while implementing deflationary burns from fees, positioning it for stronger long-term value capture.

2.1. Features

Instant Swaps: Enables quick token trading directly from wallets with low fees on BNB Chain, supporting thousands of pairs without intermediaries.

Syrup Pools: Users stake CAKE to earn free tokens from projects, offering high APRs and weekly distributions for passive income.

Yield Farms: Stake LP tokens to farm CAKE rewards, with multichain options directing liquidity to productive pools for optimized yields.

Liquidity Pools: Provide liquidity to earn trading fees, with easy addition/removal tools and incentives like buy-back-and-burn.

Lottery and Prediction: Gamified features where users buy tickets or predict prices to win prizes, adding entertainment to DeFi.

Pottery: Deposit CAKE for randomized higher yields, combining staking with lottery mechanics for enhanced earning potential.

NFT Collectibles: Earn and trade NFTs from competitions, integrating fun elements with real value in the ecosystem.

2.2. Token

The native token is $CAKE, an ERC-20 equivalent on BNB Chain with a hard cap of 450M tokens (reduced from 750M in 2023 for deflation). Circulating supply is calculated by subtracting burned tokens (via Dune dashboard) from the total, with ongoing burns targeting 4% annual deflation and ~ a 20% supply reduction by 2030.

Distribution includes emissions for farms/lottery and burns from 23% of trading fees, 20% perpetual profits, and 100% IFO fees. Users participate by trading on pancakeswap. finance, staking in pools, or farming, acquire via swaps or earnings.

2.2.1. Utility

Staking Rewards: Stake in Syrup Pools or farms to earn CAKE and other tokens.

Governance: Vote on proposals via veCAKE for ecosystem decisions.

Fee Revenue: Contributes to burns, increasing scarcity and holder value.

Lottery/Prediction: Used to enter games for BNB/CAKE prizes.

Multichain Incentives: Powers rewards across chains for liquidity and growth.

2.3. Investors

PancakeSwap has raised limited traditional funding as a community-driven project, with a seed round in June 2022 for an undisclosed amount from Binance.

3. Project X

Sector - DeFi

Status - Active

Project X is a next-generation DEX built on HyperEVM. It focuses on seamless trading across EVM chains with aggregated liquidity. Its vision is to create a unified DeFi hub for multi-chain interactions, solving the problems of fragmented liquidity and high cross-chain costs.

The solution is an EVM aggregator that enables swaps, liquidity provision, and portfolio management in one place. It achieved rapid adoption, with $28M TVL in 24 hours after launch.

Key technologies include HyperEVM for high throughput, on-chain programmability, and referral-based point farming for user incentives, positioning it as a fast-growing protocol in the DEX space.

3.1. Features

Multi-Chain Aggregator: Aggregates liquidity from all EVM chains for optimal swaps and reduced slippage in a single interface.

Liquidity Provision: Users add liquidity to pools, earning fees and points for future rewards, with tools for efficient management.

Portfolio Tracking: Built-in dashboard for monitoring assets across chains, simplifying DeFi navigation.

Referral System: Invite friends to earn 10% bonus points, boosting community growth and user acquisition.

Point Farming: Earn points through swaps, liquidity, and invites, convertible to future tokens or airdrops.

High Throughput DEX: Leverages HyperEVM for fast, low-cost transactions, supporting token trading and advanced orders.

3.2. Token

Project X has not launched a token yet, but it operates a points program to reward early users ahead of a potential TGE. Points distribution is based on activity: swaps, liquidity provision, and referrals (10% bonus via links).

No fixed supply metrics available, but points are tracked on-chain for transparency. To participate, connect a wallet on prjx.com, perform trades or add liquidity, and use referral links for extras. Points may qualify for future airdrops or token allocations.

4. swarms

Sector - AI

Status - Active

Swarms is a production-grade framework for orchestrating multi-agent AI systems, designed for enterprise-scale applications in crypto and beyond. Its vision is to provide reliable infrastructure for deploying collaborative AI agents, addressing the problem of fragmented, unreliable multi-agent management in real-world scenarios.

The solution is a scalable platform that enables hierarchical swarms, parallel processing, and dynamic orchestration. Key technologies include multi-model support, extensive tool libraries, memory systems, and enterprise features like logging and error handling, making it ideal for on-chain AI integrations in DeFi and NFTs.

4.1. Features

Production-Ready Infrastructure: Offers high reliability with logging, error handling, and monitoring for enterprise deployments.

Multi-Agent Orchestration: Supports hierarchical swarms, parallel/sequential workflows, and dynamic agent rearrangement for complex tasks.

Flexible Integration: Multi-model compatibility, custom agents, tool libraries, and memory systems for versatile AI builds.

Scalable Architecture: Concurrent processing, resource management, load balancing, and horizontal scaling for large-scale operations.

Developer-Friendly Tools: Simple API, extensive docs, CLI, and community support for rapid prototyping.

Enterprise Security: Built-in rate limiting, audit logging, and robust error handling for secure AI swarms.

4.2. Token

Swarms' native token is $SWARMS, an SPL token on the Solana blockchain. It has a total supply of 1,000,000,000 tokens, with a circulating supply of approximately 999.98M (nearly fully unlocked, excluding minor burns or locks).

Distribution includes an initial allocation of 3% to the Swarms team, with the remainder distributed via community incentives, liquidity pools, and fair launch mechanics on platforms like Pump. fun; no pre-mined insider allocations are noted, emphasizing balanced growth for stakeholders.

Users can participate by acquiring $SWARMS on DEXs like Raydium or through ecosystem activities such as buying/selling agents and prompts on the Swarms Marketplace.

4.2.1. Utility

Payments: Serves as the default currency for transactions in the agent ecosystem, including refilling API credits, buying prompts/agents/tools on the Marketplace, and premium features like cost intelligence dashboards.

Governance: The Swarms AI Foundation enables decentralized decision-making, where holders influence updates, allocations, and protocol directions.

Incentives: Rewards contributors, developers, and users for building or deploying multi-agent systems, with future expansions to auctions, reputation systems, and interoperable templates.

Staking and Economics: Supports ecosystem growth via holdings that align with key pillars like innovation and sustainability, potentially including staking for yields or reduced fees in enterprise deployments.

5. SaucerSwap

Sector - DeFi

Status - Active

SaucerSwap is a leading DEX on the Hedera network, enabling peer-to-peer swaps of HBAR and HTS tokens with yield farming and staking. Its vision is long-term sustainability in DeFi, solving problems like high fees, slow finality, and MEV on Ethereum-like chains. The solution modifies Uniswap's AMM (V2 constant product, V3 concentrated liquidity) for Hedera's high-throughput, low-cost architecture using Hashgraph consensus.

5.1. Features

Cost Efficiency: USD-denominated fees and 3-5 second finality, minimizing slippage and costs.

MEV Resistance: Fair ordering via gossip protocol prevents front-running.

Liquidity-Aligned Rewards (LARI): Incentives for providers based on pool performance.

Yield-Bearing HBAR Wrapper: Stake for extra rewards while maintaining liquidity.

Fee Switch Mechanism: Directs 1/6 of fees to SAUCE buybacks for token value.

User-Friendly Interface: Web app with analytics, volatility strategies, and DAO governance.

5.2. Token

The native token is $SAUCE, which is used for governance and ecosystem incentives. Supply and distribution details emphasize buybacks from fees, with no hard cap specified but focused on sustainability via DAO. Users participate by trading on Saucerswap. finance, providing liquidity, voting in DAO, or acquiring via swaps or farming.

5.2.1. Utility

Governance: Vote on protocol parameters via SaucerSwap DAO.

Buybacks: Fees fund $SAUCE repurchases, increasing scarcity.

Staking/Farming: Earn rewards in pools and farms.

Incentives: Powers LARI for liquidity providers.