In Today's Edition

Ethereum Leads Altcoin Surge

Coinbase Wallet Rebrands to Base App

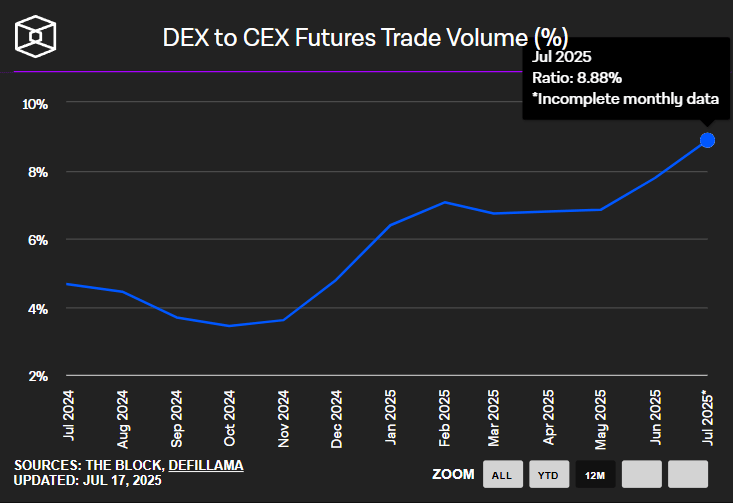

DEXs Capture More Market Share

Ondo Launches Treasury Fund on Sei

Today's edition of Token Metrics Research | Daily Newsletter is brought to you by Superhuman AI.

Find out why 1M+ professionals read Superhuman AI daily.

AI won't take over the world. People who know how to use AI will.

Here's how to stay ahead with AI:

Sign up for Superhuman AI. The AI newsletter read by 1M+ pros.

Master AI tools, tutorials, and news in just 3 minutes a day.

Become 10X more productive using AI.

Now let's get back to the top stories of the day.

1. Ethereum Leads Altcoin Surge

Ethereum's momentum is building rapidly, with ETH surging 6.5% to over $3,474, marking its strongest daily performance since March and a 22% monthly gain, as traders position for potential all-time highs. This rally is driven by unprecedented demand from U.S.-listed Ether ETFs, which posted a record $726.74M in daily net inflows, pushing cumulative inflows to $6.48 and holdings to nearly 5 million ETH, about 4% of the circulating supply. ETFs could absorb another 10% of supply within a year at current paces, creating a supply squeeze amplified by 30% of ETH staked and exchange reserves at 8-year lows.

Altcoins are capturing the spotlight as Bitcoin's dominance slips from 66% to 62%, with the total crypto market cap reaching a record $3.8T. Solana (SOL) climbed 5% to $170 on institutional accumulation, including Galaxy Digital's $55M buy.

For crypto natives, this signals a rotation into altcoins, with ETH's breakout above $3,400 resistance. Investors should watch for ETF-driven flywheels and monitor BTC froth, as short-term holders' unrealized profits could trigger pullbacks, positioning ETH as a hedge with stronger fundamentals.

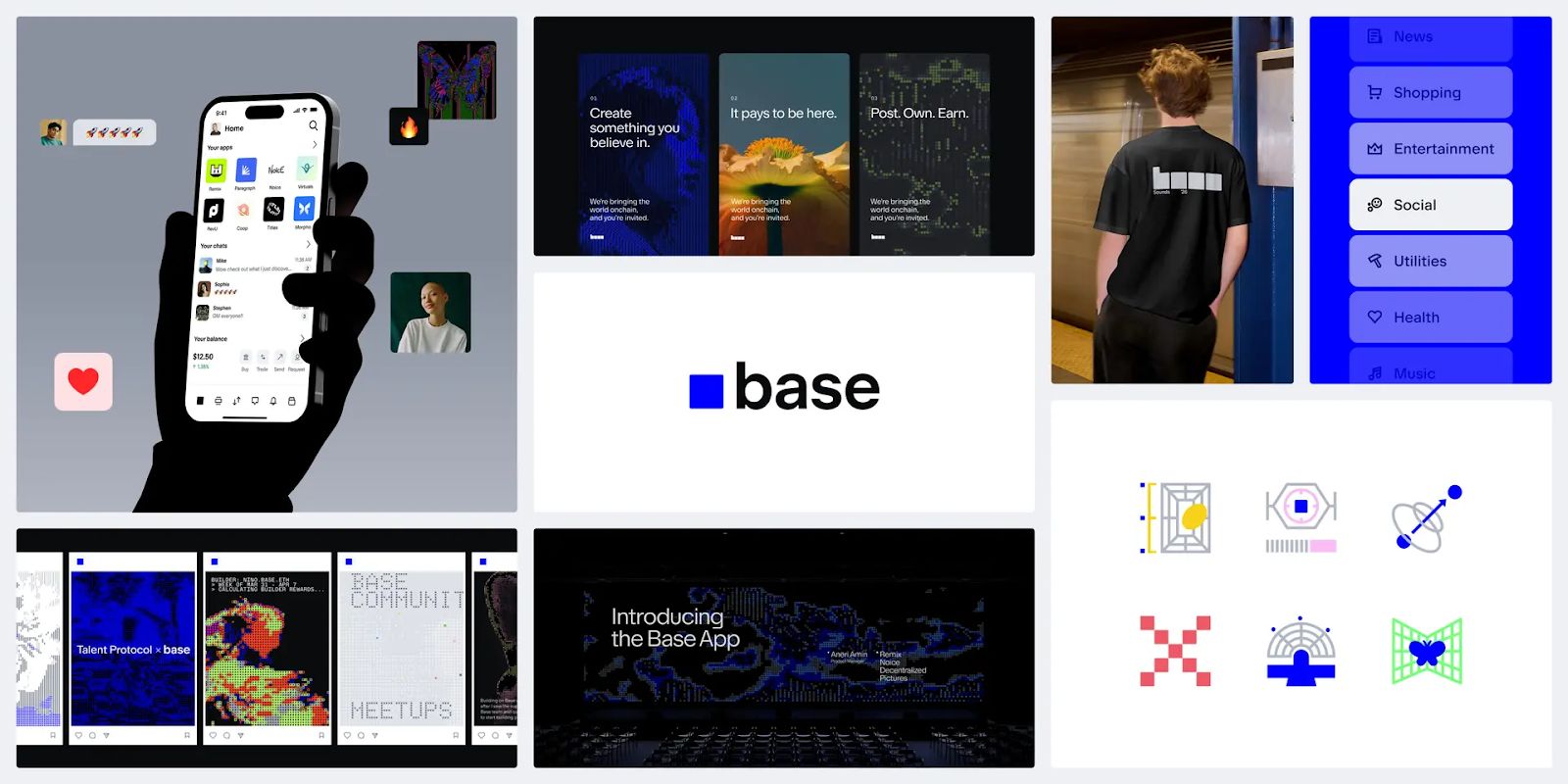

2. Coinbase Wallet Rebrands to Base App

Coinbase has transformed its Wallet into the Base App, evolving it into a comprehensive "everything app" that integrates social features, trading, payments, and mini-apps on its Ethereum Layer-2 Base chain.

The rebrand, announced during a "New Day One" event, bundles Farcaster-powered social feeds for tokenized posts, XMTP-encrypted messaging, in-feed trading, and NFC-enabled Base Pay for instant, fee-free USDC transactions with 1% cashback for U.S. users. New users receive a cross-chain smart wallet, while developers can build with "Sign in with Base" and leverage 200ms block times via Flashblocks for seamless experiences.

This positions Base as a Web3-native super app, rivaling traditional platforms by merging finance, social, and commerce; think posting, trading, earning, and chatting in one hub. Coinbase is leveraging Base to drive on-chain adoption, with DEX volumes picking up and ecosystem plays in gaming and memes, though it's still maturing.

For investors, this could boost user retention and TVL on Base, solidifying Coinbase's edge in a competitive L2 landscape; watch for beta impacts on activity metrics and potential token speculation, despite no confirmed $BASE launch. However, centralization risks remain, as this "innovation" may lock users into Coinbase's ecosystem.

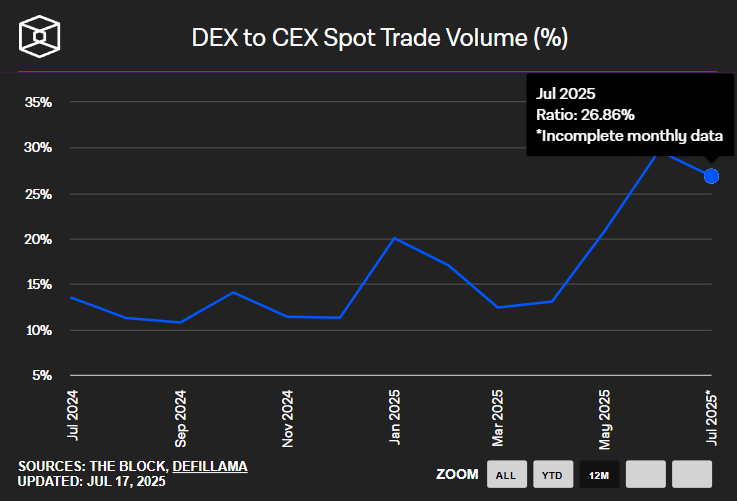

Decentralized exchanges are accelerating their encroachment on centralized platforms, with the DEX-to-CEX spot volume ratio hitting a record 0.23 in Q2 2025, up from 0.13, as traders prioritize self-custody amid regulatory pressures and innovation gaps.

DEX spot volumes jumped at least 25% to $877B across the top 10, while CEXs fell 28% to $3.9T; perpetual futures on DEXs reached $898B. PancakeSwap dominated with a 539% volume surge to $392.6B (45% share), fueled by Binance Alpha routing, making BSC the top chain over Ethereum and Solana. Hyperliquid led perps with $653B and 73% share, while dYdX volumes halved.

By June 2025, DEXs captured 27.9% of spot market volumes, reflecting a broader flight from CEXs amid macroeconomic uncertainty and low catalysts. The global crypto exchange market is projected to hit $71.35B in 2025 and grow to $260.17B by 2032 at a 24.4% CAGR, but DEX growth outpaces as users seek transparency and sovereignty.

For DeFi natives, this trend validates liquidity innovations and chain-specific advantages. Investors should target leading DEX tokens for upside, but hedge against volatility and scam risks in high-volume environments. Monitor CEX dominance (Binance at 37.5% in Q1) for reversal signals, as the shift could accelerate with more perp and spot integrations.

4. Ondo Launches Treasury Fund on Sei

Ondo Finance has introduced its USDY tokenized Treasury fund on the Sei Network, the first such product on this high-performance Layer-1, expanding real-world assets into scalable ecosystems. Backed by short-term U.S. Treasurys and bank deposits, USDY delivers a ~4.25% APY yield in a stablecoin-like format, available to non-U.S. entities and already live on Ethereum, Solana, Arbitrum, and Mantle. With $1.4B in TVL, Ondo, backed by World Liberty Financial, which holds ONDO in reserves, is enhancing RWAs through acquisitions like Strangelove for blockchain dev and Oasis Pro for broker-dealer access.

Sei's EVM-compatible design with 400ms finality makes it ideal for yield-bearing assets, positioning USDY as a composable primitive for on-chain apps. This launch highlights RWAs' maturation, bridging TradFi stability with DeFi composability. Ondo also offers OUSG (backed by BlackRock's BUIDL) and OMMF for low-risk income.

For investors, this could drive institutional flows into Sei and ONDO, with both tokens up 10%+ post-announcement. RWAs offer diversified yields in volatile markets, but regulatory hurdles for U.S. access persist. Eye ONDO's $1.4B TVL as a growth metric, as tokenized bonds gain traction in a $260B+ crypto exchange market.

Meme of The Day