Happy Wednesday, TM Family!

Welcome to the Token Metrics Research | Daily newsletter, where we cover key market movements, regulatory updates, and early alpha for our readers and investors.

Let's dive in!

In Today's Edition

Corporate ETH Treasuries Surge

ETH/BTC Ratio Climbs to 2025 Highs

SEC Chair Paul Atkins Unveils Project Crypto

Wyoming's FRNT Stablecoin Launches Amid ETF Outflows

Today's edition of Token Metrics Research | Daily Newsletter is brought to you by Morning Brew.

Your career will thank you.

Over 4 million professionals start their day with Morning Brew—because business news doesn’t have to be boring.

Each daily email breaks down the biggest stories in business, tech, and finance with clarity, wit, and relevance—so you're not just informed, you're actually interested.

Whether you’re leading meetings or just trying to keep up, Morning Brew helps you talk the talk without digging through social media or jargon-packed articles. And odds are, it’s already sitting in your coworker’s inbox—so you’ll have plenty to chat about.

It’s 100% free and takes less than 15 seconds to sign up, so try it today and see how Morning Brew is transforming business media for the better.

Now let's get back to the top stories of the day.

1. Corporate ETH Treasuries Surge

The trend of public companies building massive Ethereum treasuries is accelerating, with several firms announcing significant accumulations and innovative shareholder incentives. This wave positions ETH as a core balance sheet asset, potentially driving long-term demand and challenging Bitcoin's lead in corporate adoption.

BitMine Immersion Technologies, led by Fundstrat's Tom Lee, has amassed a staggering 1.52M ETH valued at $6.6B, making it the second-largest public crypto treasury behind MicroStrategy's Bitcoin holdings. The company recently added over 373,000 ETH worth $1.7B, aiming for 5% of total ETH supply as part of a long-term bet on Ethereum's role in real-world asset tokenization, on-chain finance, and AI integration. Lee emphasizes ETH as a "macro trade" for the next decade, with BitMine's holdings now surpassing Mara Holdings' $5.9B BTC treasury and positioning the stock as one of the most liquid U.S. listings.

SharpLink Gaming joined the fray with a $667.4M ETH purchase, near all-time highs, boosting its total holdings to 740,760 ETH worth about $3.2B. Much of this is staked for yield, generating 1,388 ETH in rewards, though the firm flagged potential regulatory scrutiny on staking.

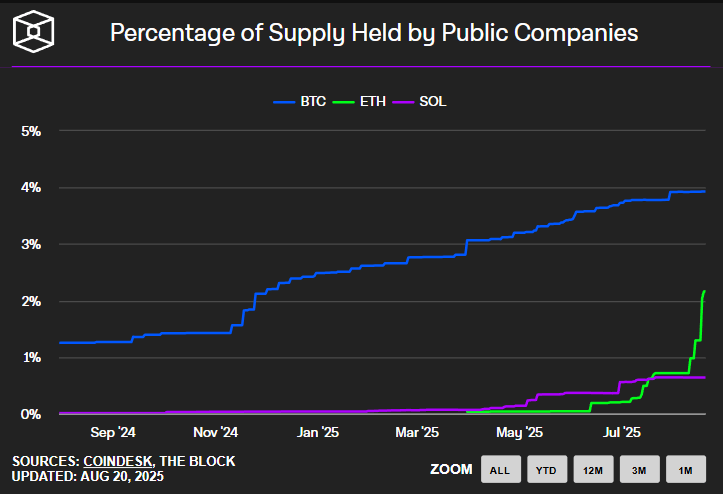

These treasuries hold over 2% of ETH's circulating supply, up from 0.2% just months ago, signaling a shift where ETH treasuries could eclipse BTC's in strategic appeal for yield-focused corporates. Watch for supply squeezes and potential ETH price floors from these HODLers, but monitor dilution risks in volatile markets.

2. ETH/BTC Ratio Climbs to 2025 Highs

Ethereum is reclaiming ground against Bitcoin, with key metrics flipping bullish and analysts forecasting stronger outperformance in a risk-on 2025 environment. Fueled by ETF inflows and treasury demand, this shift could mark ETH's resurgence as the high-beta play for growth-oriented portfolios.

The ETH/BTC ratio hit a 2025 peak above 0.037, with ETH up 70% since June versus BTC's 9%, driven by $9.4B in spot ETH ETF inflows and treasuries capturing 3.7% of supply since early June. Leveraged exposure is booming, with VolatilityShares' 2x Ether ETF adding 456,000 ETH equivalent, representing 61% of CME ETH futures open interest. In contrast, BTC derivatives cooled amid macro jitters, with premiums compressing and options skew signaling downside protection demand.

Ethereum's spot trading volume eclipsed Bitcoin's by nearly 3x last week, while the ETH/BTC perpetual futures open interest ratio dipped to a 14-month low of 0.71, indicating renewed speculative interest. ETH stabilized above $4,000, trading at $4,223 amid minor dips, with potential to push toward $5,000 if Fed rate cuts boost risk appetite.

ETH's utility in DeFi and staking offers asymmetric upside over BTC's store-of-value narrative. Consider reallocating for 2025 volatility plays, but hedge against macro headwinds like inflation data.

3. SEC Chair Paul Atkins Unveils Project Crypto

Under new SEC leadership, regulatory clouds are lifting, with Chair Paul Atkins signaling a pro-innovation stance that could redefine U.S. crypto policy. His announcements at the Wyoming Blockchain Symposium highlight a pivot toward on-chain finance, offering hope for clearer rules and reduced enforcement risks.

Atkins unveiled "Project Crypto," aimed at modernizing securities laws for digital assets, focusing on custody, investor protections, and on-chain migration of traditional assets like stocks and bonds. He declared it a "new day" for the industry, emphasizing innovation and future-proofing against "regulatory mischief." Crucially, Atkins stated that "very few" crypto tokens are securities, shifting from predecessor Gary Gensler's broad classification, focusing instead on packaging and sales methods.

Industry reactions are bullish: Bernstein called it the "boldest" vision from an SEC chair, potentially rewriting Wall Street rules, while Bitwise's Matt Hougan sees it as a 5-year investment roadmap. Wyoming's blockchain hub status amplifies the event's significance, fostering regulator-industry dialogue.

This could accelerate institutional inflows and token launches, reducing SAB 121-style hurdles. Monitor for details on Project Crypto's implementation, as it may unlock trillions in on-chain assets, position in compliant projects like layer-1s and DeFi protocols for regulatory alpha.

4. Wyoming's FRNT Stablecoin Launches Amid ETF Outflows

State-level innovation meets market turbulence as Wyoming debuts a multi-chain stablecoin. At the same time, spot BTC and ETH ETFs face heavy outflows, highlighting repositioning ahead of macro events but underscoring stablecoins' role in bridging tradfi and crypto.

Wyoming's Stable Token Commission is rolling out FRNT, a USD-backed, yield-bearing stablecoin on seven chains (including Ethereum, Solana, and Base) via LayerZero tech, with the Solana version live on Kraken imminently. Backed by short-term Treasurys, FRNT has no fixed supply and includes Visa card integration for spending. Per the 2023 Stable Token Act, profits will fund education, positioning Wyoming as a crypto pioneer for efficient, transparent transactions, potentially boosting adoption in emerging markets.

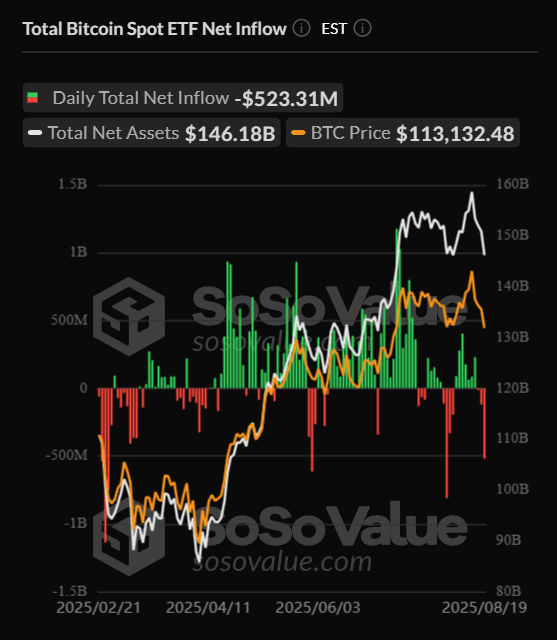

Conversely, spot BTC ETFs saw $523M in daily outflows (e.g., $246.9M from Fidelity's FBTC), while ETH ETFs shed $422.3M (led by Fidelity and Grayscale), the second-largest since launch. Institutions are repositioning before FOMC minutes and Powell's Jackson Hole speech, amid inflation fears and a stronger USD. Despite short-term pressure on prices, ETFs hold 6.47% of BTC and 5.17% of ETH market caps, with treasury buying offsetting some demand dips.

FRNT could challenge USDT/USDC dominance with state backing, ideal for cross-chain yield farming. ETF outflows signal caution. Use them as dip-buying opportunities if the Fed turns dovish, but diversify into stablecoin strategies for stability amid volatility.

Meme of The Day

Helpful Links

13 Investment Errors You Should Avoid

Successful investing is often less about making the right moves and more about avoiding the wrong ones. With our guide, 13 Retirement Investment Blunders to Avoid, you can learn ways to steer clear of common errors to help get the most from your $1M+ portfolio—and enjoy the retirement you deserve.