Introduction

Maple Finance is a decentralized credit infrastructure built primarily on Ethereum, designed to connect institutional borrowers with on‑chain capital from liquidity providers (LPs). Unlike retail‑oriented DeFi lending protocols, Maple focuses on professionally managed pools and corporate credit markets. Through smart contracts, LPs deploy funds into pools governed by Pool Delegates, who underwrite loans to institutions under transparent, on‑chain terms.

The protocol emphasizes modular design, operational flexibility, and a blend of on‑chain governance with off‑chain due diligence by professional actors.

Innovation

Maple introduces several distinctive innovations to DeFi credit markets:

Institutional Borrowing Layer:

Instead of anonymous borrowers, Maple’s pools target vetted institutional borrowers, combining on‑chain transparency with off‑chain credit assessments.Delegated Pool Management:

Pool Delegates manage lending pools, set underwriting parameters, and handle loan origination, enabling LPs to deploy capital passively while relying on delegate expertise.Hybrid Yield Strategy:

Yield is generated through primary credit markets (loans) and optional secondary DeFi strategies (e.g., depositing idle cash into Aave), integrating traditional credit with DeFi primitives.Modular Loan Types:

Supports both open‑term and fixed‑term loan structures, offering flexibility for different borrower needs while maintaining consistent contract logic.

Find out why 1M+ professionals read Superhuman AI daily.

In 2 years you will be working for AI

Or an AI will be working for you

Here's how you can future-proof yourself:

Join the Superhuman AI newsletter – read by 1M+ people at top companies

Master AI tools, tutorials, and news in just 3 minutes a day

Become 10X more productive using AI

Join 1,000,000+ pros at companies like Google, Meta, and Amazon that are using AI to get ahead.

Architecture

Maple’s architecture is composed of purpose‑built contracts with a clear separation of concerns:

Pools & PoolManagers:

Each pool is implemented as an ERC‑4626 vault, primarily handling deposits, withdrawals, and LP token issuance.One Pool is managed by one PoolManager, which orchestrates loan deployment and interacts with other protocol components.

LoanManagers:

Separate contracts track loan accounting.Fixed‑term LoanManagers and open‑term LoanManagers handle distinct loan types but follow similar accounting principles.

MapleLoan:

Represents individual loan agreements between a borrower and the pool, encoding terms and repayment logic.WithdrawalManagers:

Configurable modules that define withdrawal mechanics, providing custom liquidity profiles per pool.MapleGlobals:

A singleton contract controlling protocol‑wide parameters, time‑locked upgrades, and governance functions via the Governor multisig.External Strategies:

Pools can route excess liquidity into DeFi strategies, integrating with platforms like Aave or Sky for secondary yield.Supporting Roles:

Keepers handle liquidations within protocol constraints.

Security and Operational Admins provide emergency controls without overstepping governance.

This layered design keeps the Pool contracts lean while delegating complexity to specialized managers, promoting upgradeability and security.

Code Quality

The protocol demonstrates mature smart contract engineering practices:

Standards Compliance:

Pools adhere to ERC‑4626 vault standards, ensuring broad composability with the DeFi ecosystem.Separation of Concerns:

Key logic (loan accounting, liquidity management, and global parameters) is modularized, improving maintainability and auditability.Upgradeable Governance:

Controlled throughMapleGlobalswith timelocks, reducing upgrade risks.SDK Support:

maple-jsprovides a well‑designed JavaScript SDK for developers to interact with contracts, manage transactions, and subscribe to events, indicating developer‑focused tooling.Auditing and Flexibility:

While public audits and disclosures exist, the complexity of the multi‑contract system requires ongoing scrutiny, particularly around custom WithdrawalManagers and external strategy integrations.

Product Roadmap

Based on protocol design and recent upgrades, Maple’s roadmap likely emphasizes:

Enhanced Pool Management Tools:

Streamlining delegate operations and liquidity strategies.Expanded Loan Offerings:

Supporting new collateral types and tailored credit products.Cross‑Chain Deployment:

Current focus is Ethereum, but architectural patterns allow potential future deployment on L2s or other EVM‑compatible chains.Governance Refinement:

Increasing DAO involvement in vault curation, parameters, and delegate oversight.Developer Tooling:

Continued iteration on the SDK and APIs to encourage ecosystem integrations.

Usability

For Liquidity Providers:

A “set‑and‑forget” model—LPs deposit into chosen pools and receive ERC‑4626 LP tokens representing their share. However, they rely heavily on the due diligence of Pool Delegates.For Borrowers:

Institutions undergo off‑chain credit evaluation while final terms are enforced on‑chain. Borrowers interact with pools through straightforward smart contract interfaces once approved.For Developers:

Themaple-jsSDK simplifies contract interactions, but the protocol’s multi‑contract design can pose a learning curve for deeper integrations.

Overall usability is solid for its target audience, though it assumes professional participants familiar with institutional finance concepts.

Conclusion

Maple Finance stands out as a specialized DeFi credit protocol targeting institutional borrowing, backed by a modular smart contract system and professional pool management. Its architecture—built around ERC‑4626 pools, LoanManagers, and a robust governance layer—balances flexibility with operational control.

Maple Finance delivers a well‑engineered, focused solution for on‑chain institutional lending. Its design choices show technical maturity, with clear boundaries between protocol actors and extensible smart contract patterns, positioning it as a significant piece of DeFi’s credit infrastructure layer.

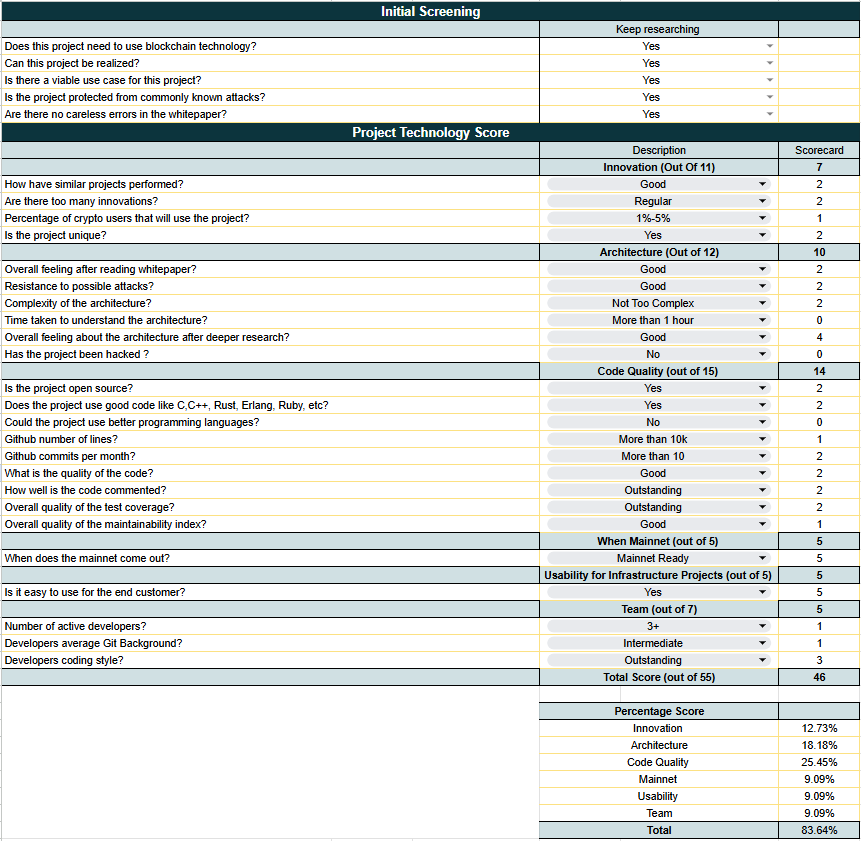

Maple Finance Scorecard