Happy Friday, TM Family!

Welcome to the Token Metrics Research | Daily newsletter, where we cover key market movements, regulatory updates, and early alpha for our readers and investors.

Let's dive in!

In Today's Edition

Solana’s TVL Rockets, Eyes Breakout

Humanoids Ignite Next Crypto Investment Wave

RWA Momentum: From Funds To Equities

Ethereum’s Dual Engine: Usage + Institutions

Today's edition of Token Metrics Research | Daily Newsletter is brought to you by Pacaso.

Keep This Stock Ticker on Your Watchlist

They’re a private company, but Pacaso just reserved the Nasdaq ticker “$PCSO.”

No surprise the same firms that backed Uber, eBay, and Venmo already invested in Pacaso. What is unique is Pacaso is giving the same opportunity to everyday investors. And 10,000+ people have already joined them.

Created a former Zillow exec who sold his first venture for $120M, Pacaso brings co-ownership to the $1.3T vacation home industry.

They’ve generated $1B+ worth of luxury home transactions across 2,000+ owners. That’s good for more than $110M in gross profit since inception, including 41% YoY growth last year alone.

And you can join them today for just $2.90/share. But don’t wait too long. Invest in Pacaso before the opportunity ends September 18.

Paid advertisement for Pacaso’s Regulation A offering. Read the offering circular at invest.pacaso.com. Reserving a ticker symbol is not a guarantee that the company will go public. Listing on the NASDAQ is subject to approvals.

Now let's get back to the top stories of the day.

1. Solana’s TVL Rockets, Eyes Breakout

Solana’s DeFi TVL hit a fresh all-time high around $12.2B, reinforcing a bullish setup as memecoin volumes and dApp activity climb; price action has tracked the TVL surge with multiple outlets flagging a breakout structure toward prior highs and a potential run at $300 if momentum holds.

Multicoin Capital’s Kyle Samani touts Solana’s potential to hit a $1T valuation, citing its edge in internet capital markets and DeFi innovation. Galaxy Digital boosts this surge, acquiring a $500M $SOL treasury to bolster its validator network and DeFi offerings

With on-chain activity surging 40% in the past month and institutional flows strengthening, Solana’s resurgence ignites investor interest. The time to stack $SOL is now.

2. Humanoids Ignite Next Crypto Investment Wave

The buzz around humanoid robotics is deafening, spilling into crypto markets. Industry titans predict humanoids will become one of the largest industries ever, with over half of investors still skeptical. This doubt is fading fast, with projections of a $38B market by 2035, driven by demand in manufacturing, mining, and disaster rescue.

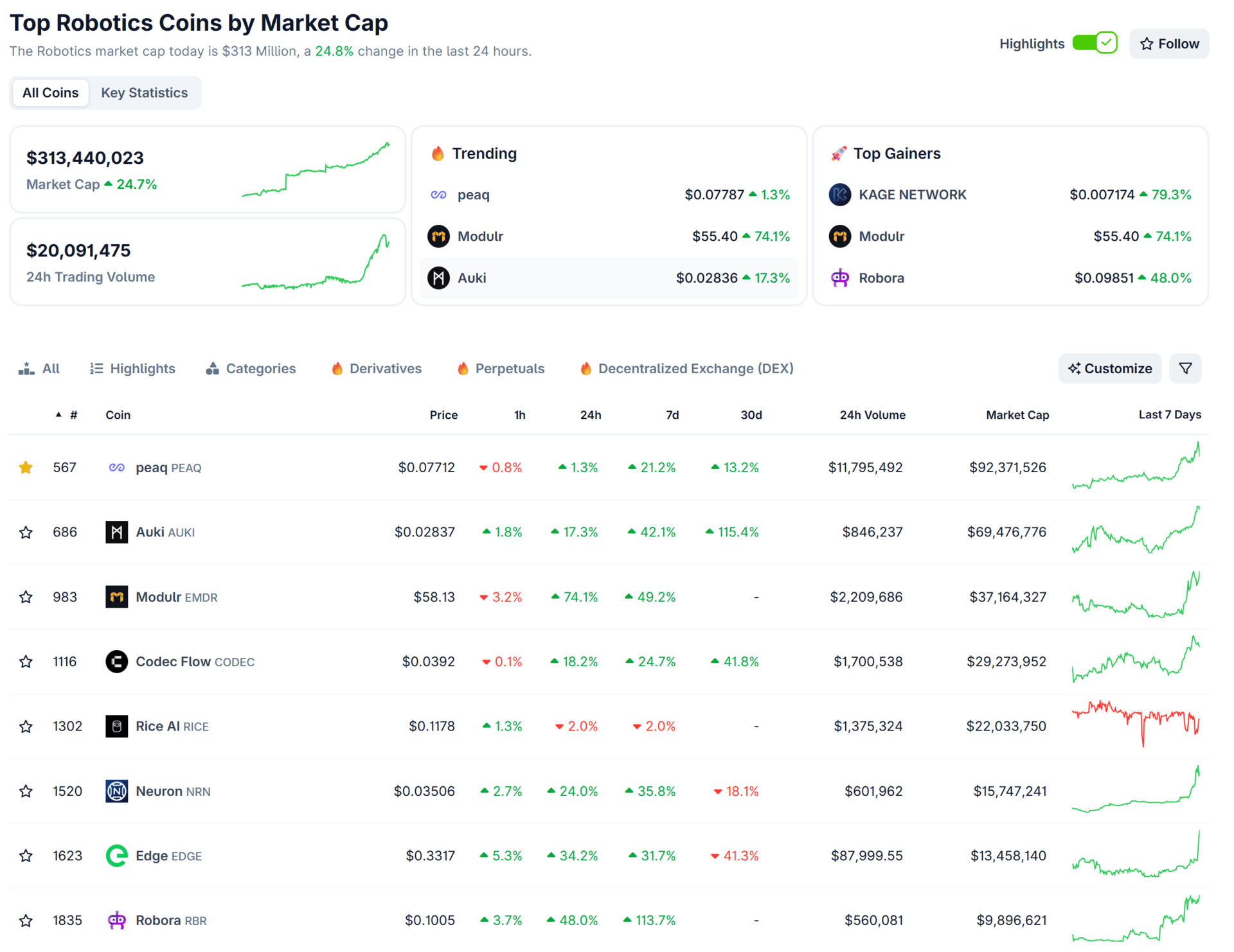

Crypto’s role emerges as robotics firms embrace blockchain for funding and payments, with 47% of service providers now accepting cryptocurrencies. Coins like $AUKI, tied to autonomous navigation demos at WOW Summit, hint at untapped investment potential, while $PEAQ, a layer-1 blockchain powering the Machine Economy, supports over 50 DePINs.

Notably, CoinGecko added a new category “Robotics” on its platform, with the sector’s market cap now over $300, reflecting a 9.5% increase in the last 24 hours and a 15% gain over the past week. The humanoid-crypto crossover is here—seize the opportunity.

This edition of the newsletter is co-presented by 1440 Media.

Seeking impartial news? Meet 1440.

Every day, 3.5 million readers turn to 1440 for their factual news. We sift through 100+ sources to bring you a complete summary of politics, global events, business, and culture, all in a brief 5-minute email. Enjoy an impartial news experience.

Now, let's continue with the TM Daily.

3. RWA Momentum: From Funds To Equities

Real-world assets are re-accelerating: sector tokens are near a $76B market cap while on-chain tokenized assets reached a record $29B, led by private credit and U.S. Treasuries—and anchored by flagship funds like BlackRock’s tokenized products on Ethereum.

Ondo’s push is emblematic of the shift, launching over 100 tokenized U.S. stocks and ETFs on Ethereum via Global Markets and lifting ONDO as TVL and market access expand across non-U.S. regions, with plans to extend to Solana and BNB Chain.

Animoca’s framing of a $400T TradFi addressable market underscores the runway, with interoperability and Ethereum’s share positioning the stack for sustained institutional adoption into 2025.

4. Ethereum’s Dual Engine: Usage + Institutions

Ethereum on-chain activity has pushed to records, with daily smart contract calls surpassing 12 million and staking climbing past 36 million ETH, tightening float as network throughput and fee revenue expand the settlement-layer thesis.

This on-chain strength has paired with accelerated institutional flows, with ETH outperforming amid expectations of a September Fed cut and renewed accumulation from larger players, helping ETH challenge prior highs and reprice toward the $4.5k - $5k band.

Exchange inflows have eased since early September, reducing spot-side sell pressure and aligning with the “dual engine” narrative highlighted by on-chain analytics coverage.

Meme of The Day

Helpful Links

Today’s newsletter is also powered by Stocks & Income.

Wall Street has Bloomberg. You have Stocks & Income.

Why spend $25K on a Bloomberg Terminal when 5 minutes reading Stocks & Income gives you institutional-quality insights?

We deliver breaking market news, key data, AI-driven stock picks, and actionable trends—for free.

Subscribe for free and take the first step towards growing your passive income streams and your net worth today.

Stocks & Income is for informational purposes only and is not intended to be used as investment advice. Do your own research.

That's all for today. Let's talk tomorrow.