We're proud to have AARE as today's lead sponsor of Token Metrics, supporting our mission to deliver cutting edge insights and connect the investment community.

A New Income Opportunity

The secret to making money from real estate is buying quality properties when they’re undervalued.

And today’s commercial market is offering one of the most attractive entry points in over a decade.

High interest rates and $4T in maturing debt have pushed prices down by up to 40%, creating rare opportunities to acquire cash-flowing properties at deep discounts. Normally, buying these properties outright requires millions, putting opportunities like this out of reach for everyday investors.

REITs are investment funds that own income-producing properties and pay dividends to shareholders, allowing investors to participate without buying a building themselves.

By acquiring discounted assets and planning to distribute at least 90% of the REIT’s income, AARE aims to turn today’s market reset into long-term yield for its investors.

Take advantage of this opportunity and earn up to 15% bonus stock in AARE.

This is a paid advertisement for AARE Regulation CF offering. Please read the offering circular at https://invest.aare.com/

Projects in this issue

Disclaimer: This content is for educational purposes only. It is not financial advice. Crypto assets are risky and can lose value. Always do your own research and consider your risk tolerance.

1. Brevis Network

Sector: ZK infrastructure across decentralized prover network, zkVM, and on chain ZK data coprocessor

Status: ProverNet mainnet beta live. Pico zkVM open source. coChain AVS live on EigenLayer. Token not launched yet.

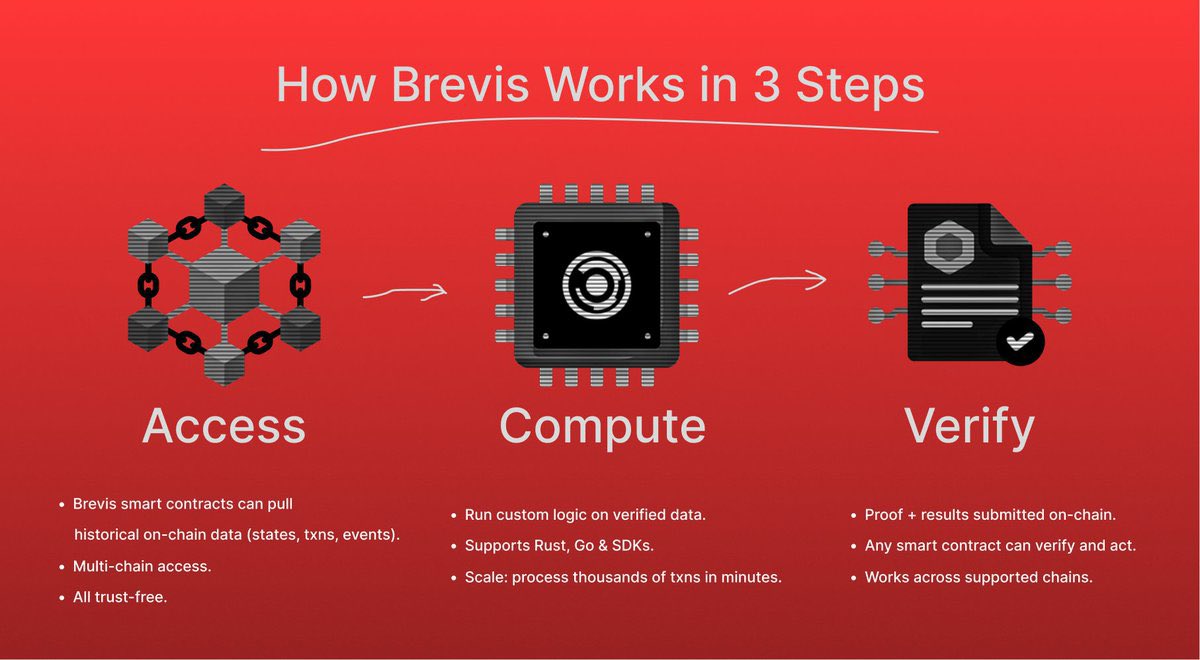

Brevis turns zero knowledge proofs and off chain computation into a programmable on chain commodity. Its marketplace called ProverNet matches application proof jobs to specialized provers with crypto economic security. A modular zkVM called Pico and an on chain ZK Data Coprocessor enable verifiable data driven features across multiple chains.

Why it matters: Brevis built production scale ZK infrastructure first, then opened a general proving market. Live results on consumer GPUs, a running AVS, and a mainnet beta marketplace place Brevis at the intersection of ZK, decentralized physical infrastructure, and the roadmap for real time proving on Ethereum.

Features

- ProverNet open market matches proof jobs to provers with auctions, permissionless onboarding, settlement in stablecoins during beta with a move to the native token at full launch.

- Pico zkVM follows a glue and coprocessor design that speeds up real world workloads and supports multiple proving backends.

- coChain AVS provides an optimistic path that is challengeable with ZK fraud proofs and secured by restaked assets.

- Pico Prism distributes proving across many GPUs and targets real time coverage for high gas blocks.

- Incentra packages ZK verified incentives with on chain claims for partner campaigns.

Team

- Michael Mo Dong co founder and CEO PhD in Computer Science from UIUC previously co founded Celer Network

Investors

Funding: 7.5 million dollar seed in November 2024

- Polychain Capital seed co lead

- Binance Labs also referenced as YZi Labs seed co lead

- IOSG Ventures seed

- Nomad Capital seed

- Bankless Ventures seed

- HashKey seed

Token

- Token: BREV planned

- Utility: Native settlement and staking token for ProverNet. Provers stake to secure work and can be slashed for misbehavior or missed deadlines. Settlement uses stablecoins during beta with a migration to BREV at full launch.

- Tokenomics: Not yet published

- Launch info: Activation planned at ProverNet full mainnet launch. No listings announced yet.

2. Gensyn

Sector: Decentralized AI compute and AI infrastructure

Status: Public testnet live. Token public sale announced for mid December 2025. Mainnet to be announced.

Gensyn connects global compute into a single open market for machine learning. The architecture standardizes execution, verification, communication, and coordination so training jobs can run across many devices with trustless payment and dispute resolution.

Why it matters: The team blends deep original research with working demos and on chain activity. This combination is rare in decentralized AI compute. The upcoming token event can act as a catalyst as the network scales participation.

Features

- RL Swarm enables collaborative reinforcement learning across the internet with verifiable attribution on the testnet.

- Verde with RepOps narrows disputes to a single operator and uses bitwise reproducible operators across hardware.

- Custom Ethereum rollup with smart wallet experience that supports sponsor paid transactions and session keys.

- Intelligence Market on testnet lets users trade performance stakes in model entries using test assets.

- Ecosystem apps include coding assistants and training tools that demonstrate real usage.

Team

- Ben Fielding co founder and CEO

- Harry Grieve co founder

Investors

Funding: more than 50 million dollars across pre seed, seed, and a 43 million dollar Series A

- Andreessen Horowitz lead for Series A

- Eden Block seed lead plus earlier pre seed support

- CoinFund, Protocol Labs, Canonical Crypto, Maven 11 Series A participants

- Galaxy Digital, Hypersphere, Zee Prime seed participants

- Sevenpercent Ventures, Counterview Capital, Entrepreneur First early backers

Token

- Token: AI

- Utility: Native asset for coordination and payments on the Gensyn rollup. Testnet apps use test assets today. Production utility will be confirmed at or after the token generation event.

- Tokenomics: Public sale indicates a total supply of ten billion with three percent offered via an English auction on Ethereum. Some venues require KYC. Details can change based on final foundation documents.

- Launch info: Public sale window targeted for December 15 through 20 on Sonar. No centralized listings announced at this time.

Today's Token Metrics insights are brought to you in partnership with Fisher Investments.

Retirement Planning Made Easy

Building a retirement plan can be tricky— with so many considerations it’s hard to know where to start. That’s why we’ve put together The 15-Minute Retirement Plan to help investors with $1 million+ create a path forward and navigate important financial decisions in retirement.

3. HumidiFi

Sector: DeFi DEX with proprietary automated market maker on Solana

Status: Active protocol with token live. Access primarily through Solana aggregators such as Jupiter.

HumidiFi operates as a proprietary market maker on Solana. Quoting and price discovery run privately while custody and settlement remain on chain. Most order flow arrives through aggregators which route to HumidiFi when it offers the best execution.

Why it matters: The model targets tighter spreads and lower slippage for liquid pairs while reducing front running. If reported volumes and share are accurate, an aggregator first venue without a retail pool UI has already reached meaningful scale. The setup carries added diligence needs given pseudonymous contributors and many copycat sites.

Features

- Private quoting with on chain settlement aims for improved price quality and reduced information leakage.

- Off chain strategy with on chain custody blends performance with user custody.

- Aggregator first access through Jupiter makes routing seamless for end users.

- Fee rebate staking using the WET token aligns active users with venue economics.

Team

- Pseudonymous contributors. Public materials reference Zero Position Foundation and Butterfly Research as key supporters and builders.

Investors

Funding: not disclosed

- Zero Position Foundation ecosystem contributor

- Butterfly Research also referenced as Temporal core engineering contributor

Token

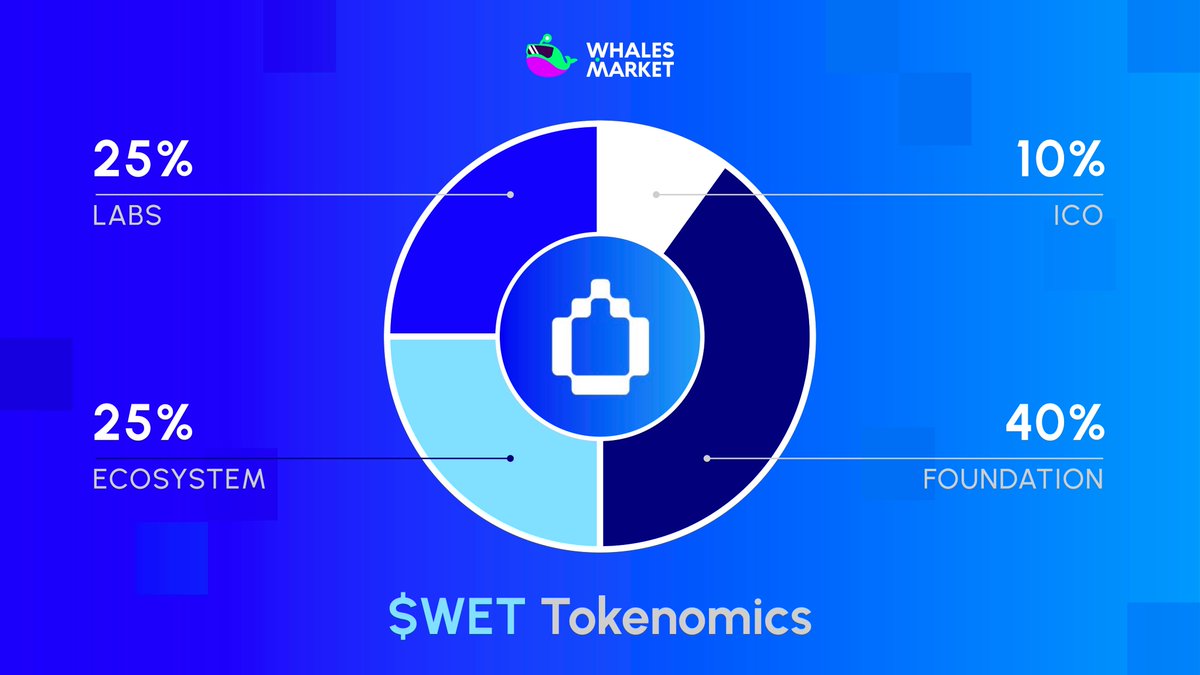

- Token: $WET

- Utility: Staking for trading fee rebates and participation tiers with a path to future parameter input.

- Tokenomics: Total supply one billion. Public materials indicate distribution through Jupiter DTF with allocations for a wetlist, JUP stakers, public tranches, and ecosystem pools.

- Launch info: TGE occurred in early December 2025 via Jupiter DTF with follow on exchange listings later that week. Contract on Solana SPL WETZjtprkDMCcUxPi9PfWnowMRZkiGGHDb9rABuRZ2U.

4. Klout

Sector: SocialFi and prediction based creator economy on Solana

Status: Active beta with a live web app, Genesis hashtag NFTs, Klout Kards gameplay, and the Shouts campaign that leads into TGE allocation.

Klout turns attention into a game economy. Users own hashtag or topic NFTs, play a daily game that predicts trends, and earn points and fee share that connect to future token allocation. An internal oracle scans the internet across many categories to determine the daily leaderboard.

Why it matters: This design shifts speculation from creators to topics and trends. The project combines fee flow tied to NFTs, a live daily game, and a clear path for community rewards. It is under the radar compared with more hyped SocialFi plays while backed by credible Solana native partners.

Features

- Genesis hashtag NFTs with fixed supply and rarity tiers that map to staking power for rewards from platform fees.

- Klout Kards daily trends game where players stake five Kards and score based on real world trending topics.

- Shouts campaign that allocates one percent of the future token supply to top contributors across two epochs.

- Powered by Meteora for liquidity tooling and Wallchain for quality scoring infrastructure.

Team

- Operated as a partner backed build. Communications describe Klout as incubated and powered by Meteora with Wallchain as a key integration partner.

Investors

Funding: not disclosed

- Meteora ecosystem incubator and partner

- Wallchain Quacks integration partner used for Shouts scoring

Token

- Token: KLOUT planned on Solana

- Utility: Community allocation through Shouts and gameplay points. NFT holders participate in fee share through the rewards pool.

- Tokenomics: One percent of total supply for Shouts split evenly across two epochs with three hundred winners per epoch. Full schedule to be confirmed at TGE.

- Launch info: Community communications reference snapshots in late November 2025. Always verify the official contract to avoid similarly named tokens.

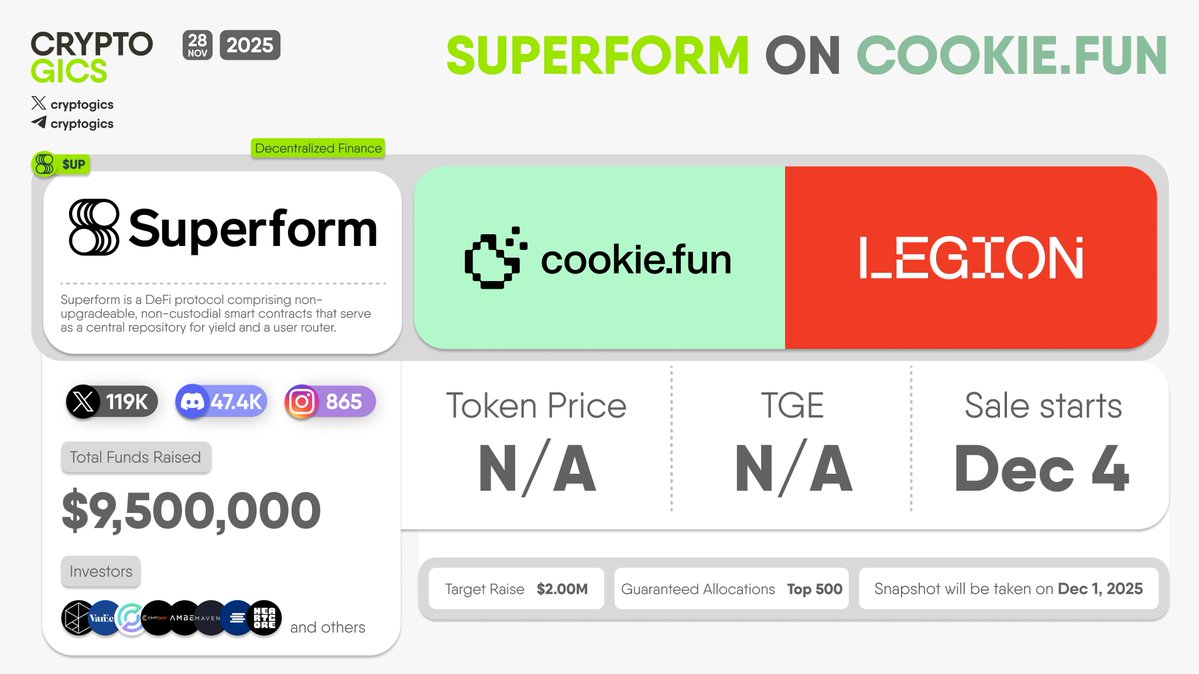

5. Superform

Sector: Cross chain DeFi yield aggregator and on chain neobank

Status: Web App v2 in open access. Protocol v2 live on multiple EVM chains. Mobile app in testing.

Superform is a universal yield marketplace. Users can move from any supported asset on any supported chain into their target vault in one flow. The system issues ERC 1155 SuperPositions that represent vault shares and unlock new distribution paths like SuperPools. The v2 stack adds omnichain rebalancing and smart accounts to simplify execution.

Why it matters: Yield is fragmented across chains and vault providers. Superform removes the need for manual swaps and bridges while keeping control in user wallets. The move toward a user owned model with the UP token aligns incentives for validators, strategists, and the broader community.

Features

- Single transaction cross chain deposits that bundle route, bridge, and vault actions behind one signature.

- SuperVaults v2 optimize yield across chains with clear on chain mandates and validator secured design.

- SuperPositions as ERC 1155 for portable positions plus SuperPools for direct swaps into cross chain yield.

- Permissionless listing for ERC 4626 vaults with analytics and admin tooling for partners.

Team

- Vikram Arun CEO and co founder previously at BlockTower Capital

- Blake Richardson co founder previously Head of DeFi at BlockTower Capital

- Alex Cort co founder previously Product Manager at Microsoft

Investors

Funding: 9.5 million dollars across seed and strategic rounds announced in December 2024

- Polychain Capital seed lead with participation from BlockTower, Maven 11, Circle Ventures and angels

- VanEck Ventures three million dollar strategic round lead with a group of crypto native funds

- Circle Ventures seed participant and ecosystem partner

Token

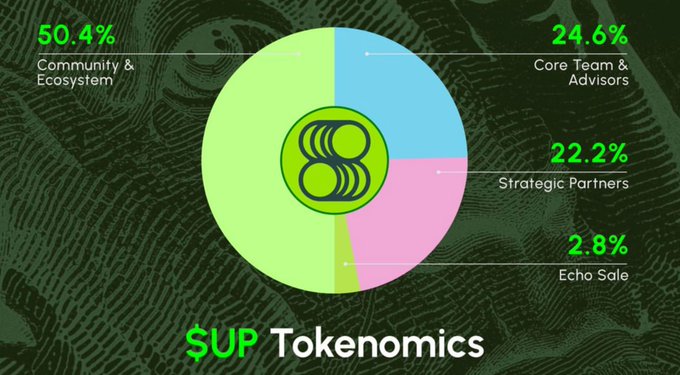

- Token: $UP

- Utility: Governance and coordination. Staked UP mints sUP for voting. Validator and strategist bonds align operators through slashing and rewards. Fee surfaces include vault, swap, SuperAsset, and execution fees.

- Tokenomics: Initial supply one billion with a three year hard cap. Allocations Community and Ecosystem 50.4 percent, Core Team and Advisors 24.6 percent with a twelve month cliff and twenty four month vest, Strategic Partners 22.2 percent, Echo Sale 2.8 percent. After year three governance can enable up to two percent annual inflation.

- Launch info: Tokenomics released in October 2025. Community sale details to be finalized by the hosting venue. No public market data at the time of writing.

Final notes

The five projects above offer exposure to zero knowledge systems, decentralized compute, Solana native trading innovation, social attention markets, and cross chain yield. They share a builder first mindset with live products or clear timelines. Position sizing and risk management are essential in early stage crypto. Key risks include execution, liquidity, competition, and regulation.

We're proud to have Masterworks as today's lead sponsor of Token Metrics, supporting our mission to deliver cutting edge insights and connect the investment community.

3 Tricks Billionaires Use to Help Protect Wealth Through Shaky Markets

“If I hear bad news about the stock market one more time, I’m gonna be sick.”

We get it. Investors are rattled, costs keep rising, and the world keeps getting weirder.

So, who’s better at handling their money than the uber-rich?

Have 3 long-term investing tips UBS (Swiss bank) shared for shaky times:

Hold extra cash for expenses and buying cheap if markets fall.

Diversify outside stocks (Gold, real estate, etc.).

Hold a slice of wealth in alternatives that tend not to move with equities.

The catch? Most alternatives aren’t open to everyday investors

That’s why Masterworks exists: 70,000+ members invest in shares of something that’s appreciated more overall than the S&P 500 over 30 years without moving in lockstep with it.*

Contemporary and post war art by legends like Banksy, Basquiat, and more.

Sounds crazy, but it’s real. One way to help reclaim control this week:

*Past performance is not indicative of future returns. Investing involves risk. Reg A disclosures: masterworks.com/cd