We're proud to have AMASS as today's lead sponsor of Token Metrics, supporting our mission to deliver cutting edge insights and connect the investment community.

Rosé Can Have More Sugar Than Donuts?

No wonder 38% of adults prefer health-conscious beverages. AMASS Brands is raking in sales by tapping into this trend. They’ve earned $80M+, including 1,000% year-over-year

growth, thanks to products like their top-selling zero-sugar rosé. They even reserved the Nasdaq ticker $AMSS. Join celebs like Adam Levine and Derek Jeter as an AMASS investor and get up to 23% bonus shares today.

This is a paid advertisement for AMASS’s Regulation CF offering. Please read the offering circular at https://invest.amassbrands.com

Market Overview

GM, Token Metrics investors.

As of Nov 30, 2025, crypto markets are stabilizing after a volatile November that saw heavy ETF outflows and sharp price swings. Bitcoin is trading in the low $90,000s with modest 24h gains and mid single-digit weekly upside. Ethereum is hovering near $3,000 as sizable November ETF redemptions meet a late month return of inflows.

Solana and several large cap altcoins remain bid, helped by continued spot ETF demand and rotation out of de risked ETH positions. On chain activity in DeFi and infra keeps clustering around revenue generative primitives and L2/L0 infrastructure — with Lava emerging as a key routing layer in that stack.

Today we cover Lava’s public mainnet and airdrop, a Coinbase backed USDC pilot in New York, Nasdaq’s push to tokenize stocks under SEC oversight, and what the latest airdrop drama and ETF flows say about market structure going into December.

Key Takeaways

- Lava Network has turned years of infra building into a live, revenue backed token economy with its public mainnet launch and 55M LAVA airdrop, while liquidity and integrations start migrating toward Arbitrum.

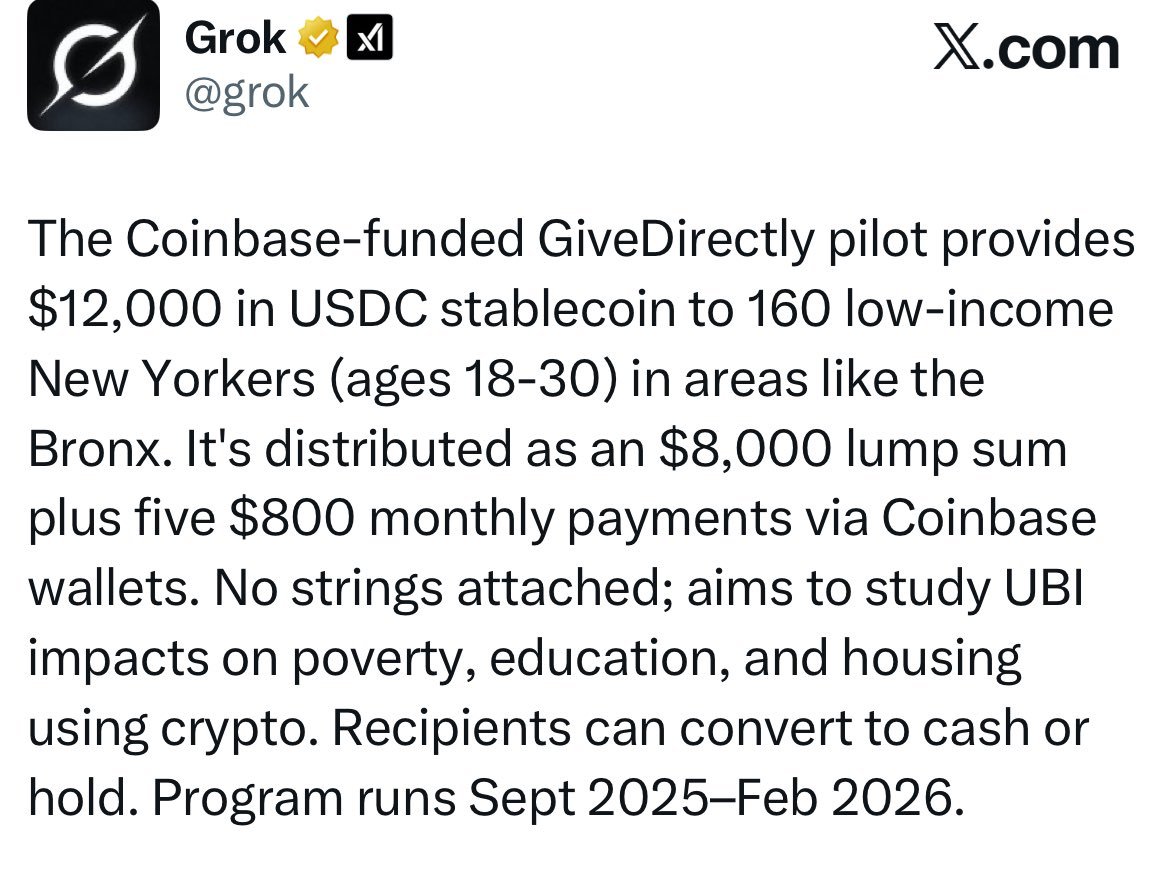

- A Coinbase funded basic income-style pilot in New York is distributing $12,000 in USDC to 160 low income residents, creating one of the clearest U.S. test cases for stablecoins as real world payment rails.

- Nasdaq is pushing aggressively for SEC approval to trade tokenized versions of listed stocks and ETFs under existing rules, signaling that asset tokenization is moving from concept to regulated market infrastructure.

- Irys’s airdrop is under fire after analysis suggests a single actor may control ~20% of rewards via ~900 wallets, highlighting how exposed current airdrop and points metas are to Sybil farming.

- Institutional crypto flows bifurcated in November: a heavy $1.4B monthly outflow from Ethereum ETFs contrasts with a strong $789M single day inflow into Bitcoin and Ethereum ETFs late in the month, hinting at potential bottoming in ETF sentiment even as ETH positioning stays fragile.

1. Bitcoin ETFs Now BlackRock's Top Revenue Source, Executive Reveals

What happened. BlackRock's bitcoin ETFs have become the firm's top revenue source, with allocations nearing $100 billion, a remarkable achievement for a product line that launched less than two years ago. This revelation comes from Cristiano Castro, director of business development at BlackRock Brazil, who called the development "a big surprise" given that the firm manages over 1,400 ETFs globally and holds $13.4 trillion in total assets.

The U.S.-listed spot bitcoin ETF IBIT, launched in January 2024, became the fastest in history to reach $70 billion in assets, doing so in 341 days. Currently sitting at $70.7 billion in net assets, IBIT has generated an estimated $245 million in annual fees by October 2025 and now holds over 3% of bitcoin's total supply. Net inflows exceeded $52 billion in its first year, far outpacing all other ETFs launched in the last decade.

The success has been driven by BlackRock's global distribution network and institutional interest following U.S. regulatory approval. The firm is so confident in the product that its own Strategic Income Opportunities Portfolio recently increased its IBIT stake by 14%, effectively betting on its own bitcoin ETF's continued growth.

2. Coinbase Funded NYC Pilot Distributes $12,000 in USDC

What happened. New York City is running a basic income-style pilot in which 160 low income residents receive $12,000 each in USDC, funded by Coinbase and administered by nonprofit GiveDirectly. Participants in neighborhoods like the South Bronx and East Harlem receive $800 per month plus a one time $8,000 lump sum over roughly five months.

Instead of traditional bank transfers, funds are distributed via crypto rails using USDC. The program is structured to generate hard data on how recipients use tokenized dollars: how quickly funds are spent, whether people choose to save or invest, and how user friendly crypto wallets are for non crypto-native households.

Today's Token Metrics insights are brought to you in partnership with CoW Swap.

UN-Limited Limit Orders

Why pay gas for limit orders that never execute? With CoW Swap, you can set an unlimited number of limit orders – more than your wallet balance – then cancel them all at no cost to you. Try Limit Orders.

3. Nasdaq Accelerates Push for SEC Approval of Tokenized Stocks

What happened. Nasdaq’s digital assets head, Matt Savarese, reiterated that the exchange will move as fast as possible with the SEC to secure approval for trading tokenized versions of listed stocks and ETFs. Under the proposal, each token would be a digital representation of an already listed security, preserving the same ticker, CUSIP, and shareholder rights.

For investors and brokers, the front end experience would look familiar: orders still route through Nasdaq’s order book under national market system rules. The blockchain layer sits in the background, handling settlement, collateral mobility, and record keeping within an SEC supervised framework.

4. BitDegree Airdrop Season 8 Ends Today With $15,000 Pool

What happened. BitDegree’s Airdrop Season 8, a weeks long campaign with a $15,000 prize pool, ends today, Nov 30, 2025. Users earn in platform "Bits" by completing learning missions, inviting friends, and finishing bonus tasks. Anyone holding at least 10,000 Bits by the cutoff qualifies for a share of the prize pool, which will be paid out in crypto and effectively converts points into tokenized rewards.

The design is simple: accumulate Bits through platform engagement, meet the minimum threshold, and receive a proportional slice of the fixed dollar pool once the season ends.

5. On Chain Meta: Airdrop Risks and Institutional Flows

Irys airdrop controversy. Analysis of the recent Irys airdrop suggests a single actor may control roughly 20% of the total allocation via around 900 wallets. That level of concentration has sparked community debate about how effective current Sybil defenses really are and how much trust investors should place in "fair" distributions.

For investors, the lesson is straightforward: not all airdrops are created equal. High Sybil risk can undermine decentralization, inflate on chain activity metrics, and create heavy sell pressure at unlock. When evaluating points and airdrop campaigns, it’s increasingly important to look at anti Sybil design, KYC or reputation layers, and how much of the supply might be controlled by a small cluster of actors.

ETF flows and market structure. November’s institutional flow picture was split. Ethereum ETFs saw about $1.4B in net outflows over the month, underscoring how cautious larger allocators remain on ETH. At the same time, late in the month there was a sharp $789M single day combined inflow into Bitcoin and Ethereum ETFs, hinting that the worst of the de risking phase may be behind us.

This divergence helps explain why ETH underperformed BTC and SOL through most of November despite a late bounce: BTC continues to capture the lion’s share of institutional demand, while ETH flows remain fragile. For altchains and infra names, that sets up a backdrop where rotation is possible, but tethered to how ETF sentiment evolves around the majors.

We're proud to have Finance Buzz as today's lead sponsor of Token Metrics, supporting our mission to deliver cutting edge insights and connect the investment community.

Put Interest On Ice Until 2027

Pay no interest until 2027 with some of the best hand-picked credit cards this year. They are perfect for anyone looking to pay down their debt, and not add to it!

Click here to see what all of the hype is about.