🎉 Today’s Sponsor: FinanceBuzz

Token Metrics readers get early access to FinanceBuzz’s newest guide on the best 0% intro APR cards — including one option with no interest on balance transfers until 2027.

View FinanceBuzz Picks ↓

Hands Down Some Of The Best 0% Intro APR Credit Cards

Balance Transfer cards can help you pay off high-interest debt faster. The FinanceBuzz editors reviewed dozens of cards with 0% intro APR offers for balance transfers and found the perfect cards.

Take a look at this article to find out how you can pay no interest on balance transfers until 2027 with these top cards.

Market Overview

GM Token Metrics community. Volatility is back in full force.

As of Nov 21, 2025, crypto markets are in a sharp corrective phase. Bitcoin has fallen to roughly $82–86K from its early October peak near $126K, dragging total market capitalization below $2.8T.

U.S. spot Bitcoin ETFs just posted about $903–904M in net outflows, their second worst day on record. Spot Ethereum ETFs have logged eight straight days of redemptions. That’s a clear institutional de risking signal.

Leverage is being flushed out fast. Nearly $2B in long liquidations hit over 24 hours, even as pockets of resilience emerge, including roughly $476M of continued inflows into new Solana spot ETFs. Overall sentiment is bearish and risk off, with macro uncertainty and regulatory noise compounding technical and flow driven weakness.

1. Crypto Market Crash Deepens: BTC Near $82K, $1.9B+ in Longs Liquidated

The latest leg of the selloff pushed Bitcoin down toward $81–82.6K intraday, a daily move of roughly 4–7% and a monthly drawdown north of 20%. It’s shaping up to be BTC’s worst month since mid 2022.

The damage is broad. Ethereum, Solana, BNB and other large caps have all posted double digit losses over the month. Total crypto market cap has slipped below $2.8T as traders de risk across majors, high beta L1s, and even parts of the DeFi blue chip set.

The mechanical driver: leverage. Derivatives data show more than $1.9B in leveraged long positions liquidated in roughly four hours, with close to $2B flushed over the full 24 hour window. Around 160K+ traders were liquidated, underscoring how crowded the long side had become after BTC’s run to $126K in October.

Open interest in Bitcoin futures has dropped by roughly one third from a peak near $94B. That’s a textbook deleveraging: forced selling into thin liquidity, perp funding flipping around, and basis compressing as the unwind hits both directional longs and carry traders.

Macro isn’t helping. A softer U.S. jobs print and shifting expectations around the timing and depth of Fed rate cuts have pushed global markets into a risk off stance. Equities are wobbly; crypto, as usual, is amplifying the move.

At the same time, ongoing headlines around DeFi exploits and ETF redemptions undermine confidence. Spot Bitcoin ETFs are seeing heavy outflows just as volatility spikes, which removes a key source of structural bid that supported the market on the way up.

From a cycle perspective, BTC is still far from historical max drawdowns, which cuts both ways. There is room for further downside if macro or flows deteriorate. But for longer term allocators running multi year horizons, washes like this often mark the early stages of value rebuilding—provided the market eventually finds equilibrium in funding, ETF flows, and realized volatility.

For active traders, the main edges now are in volatility and flow, not blind dip chasing. Implied vols have spiked, making options and structured products more attractive on a relative basis once the liquidation cascade cools. Watching funding rates, ETF flow data, and open interest trends will be key to spotting when forced selling gives way to more two sided trading.

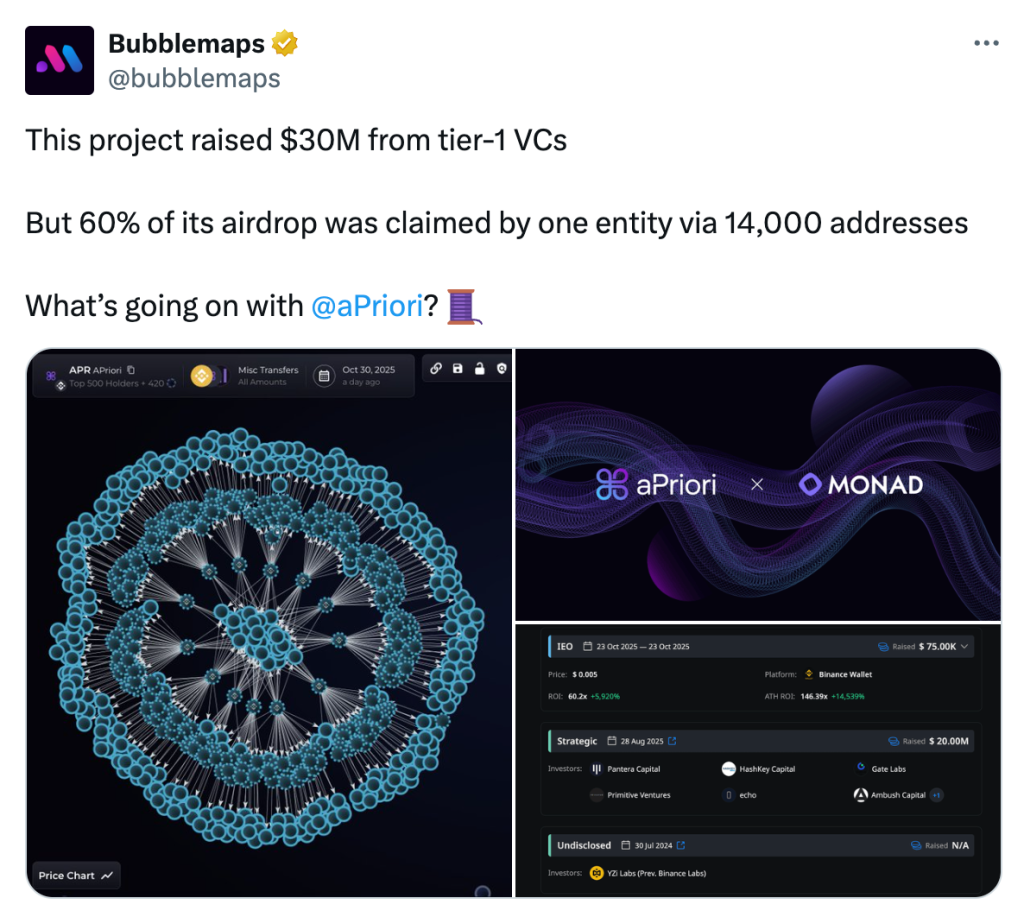

2. aPriori Airdrop Controversy: Single Entity Captures 60% of APR Tokens

aPriori, a liquid staking protocol building for the Monad ecosystem, is under heavy scrutiny after its APR token airdrop appeared to be dominated by a single sophisticated farmer.

Blockchain analytics highlighted that roughly 60% of distributed APR tokens ended up controlled by one entity spread across around 14,000 wallets. The clustering pattern resembled a coordinated Sybil operation, triggering accusations of insider farming and unfair distribution.

On Nov 21, the aPriori team issued a statement claiming it found no evidence that team or foundation members were behind the accumulation. Instead, it framed the event as an example of how aggressive Sybil strategies can still overwhelm loosely designed airdrop criteria.

To repair trust, aPriori committed to a new APR distribution specifically aimed at the Monad community when Monad mainnet goes live. This second airdrop is set to come with no lockups or restrictions, and with eligibility criteria focused more on genuine contributions than on pure on chain gaming.

The team reiterated that all existing APR tokens will be bridged to Monad mainnet, reinforcing that ultimate token utility and governance live there. Previous fundraising of roughly $30M has only amplified community expectations for a fair and transparent token rollout.

For airdrop hunters and early ecosystem participants, this saga is a reminder of two things:

- Post snapshot analytics matter. Even when airdrops are live, forensic tools can reveal whether the intended distribution actually happened or if a small number of players captured most of the supply.

- Teams that respond quickly and redesign incentives can sometimes turn a reputational hit into a second chance to align with real users.

Alpha wise, the fresh Monad focused distribution window could be interesting for on chain users who are willing to engage with the ecosystem early—but sentiment around APR itself may stay fragile until the new framework is published and verifiable on chain.

🗞️ Today’s Sponsor: 1440

Get fact-based news with zero bias. 1440 scans 100+ trusted sources and delivers a clean, balanced daily digest straight to your inbox.

See why millions read 1440 daily ↓

Fact-based news without bias awaits. Make 1440 your choice today.

Overwhelmed by biased news? Cut through the clutter and get straight facts with your daily 1440 digest. From politics to sports, join millions who start their day informed.

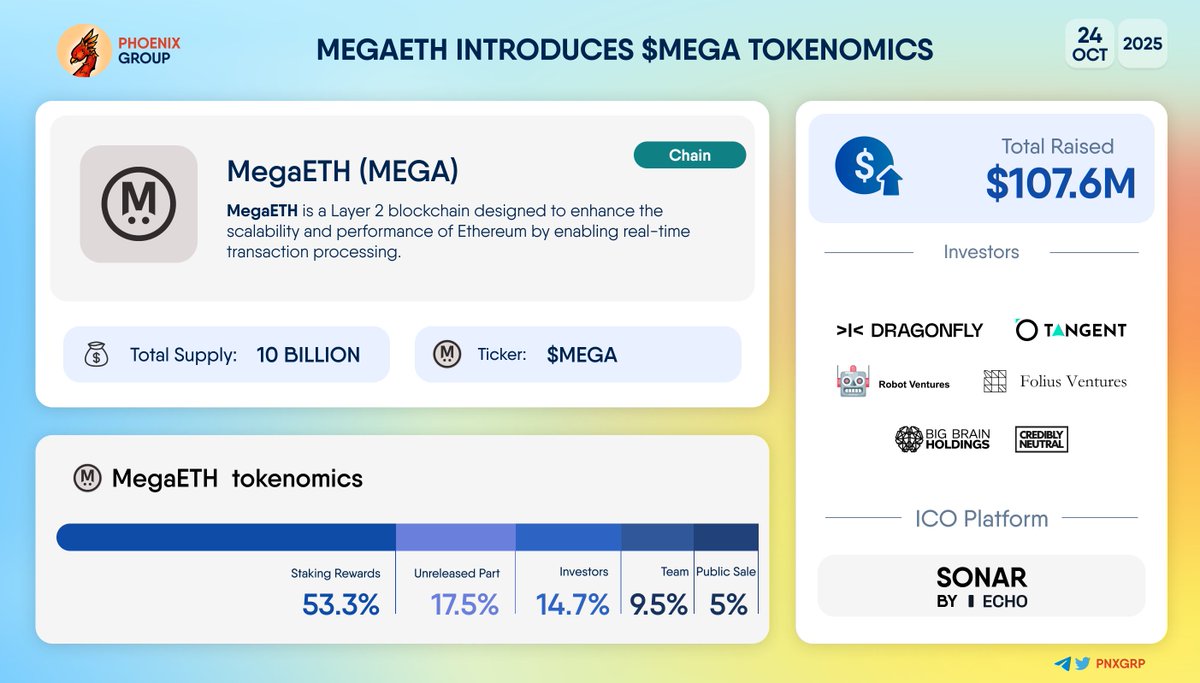

3. MegaETH Token Sale Concludes: Tokens Distribute Into Volatility

Amid the broader market shakeout, MegaETH is entering the wild. The high performance modular execution project has just wrapped its public token sale, with final token distribution and refunds scheduled between Nov 19 and Nov 21.

The sale, hosted via the Sonar platform, used a dynamic pricing band from $0.0001 to $0.0999 per MEGA, implying an initial fully diluted valuation between $1M and $999M. Participants paid in USDT on Ethereum, with allocation and refund mechanics settling into wallets during this week’s window.

Secondary markets are already ahead of the curve. On chain derivatives and perpetuals have been trading MEGA at implied valuations far above the sale band, with a recent snapshot pointing to an FDV around $5.2B. That gap between primary sale pricing and derivatives expectations sets up a classic price discovery showdown as spot liquidity goes live.

MegaETH’s tokenomics lean heavily into network incentives. More than half of the total supply is earmarked for KPI linked staking rewards to drive validator participation, sequencer performance, and on chain activity. The rest is split between team, investors, ecosystem growth, and liquidity.

With tokens landing in wallets right as the market is repricing risk, a few dynamics are worth tracking over the next 24–72 hours:

- Unlock mechanics vs. liquidity depth: How much of the circulating float is actually free to trade at TGE, and how quickly do deep pools form on DEXs and CEXs?

- Derivatives vs. spot convergence: If spot opens below the implied $5.2B FDV, leverage long speculators in perps could be underwater. If spot overshoots, it may offer opportunities for those able to hedge or short.

- Correlation with the modular stack: Flows into MEGA could spill over into other modular and Ethereum scaling plays, or vice versa, depending on how risk appetite evolves after the crash.

For investors with a longer time horizon, the key question is less about day one price and more about whether MegaETH can sustain real usage and fees in a crowded execution layer landscape. But in the near term, this TGE is likely to be one of the most closely watched events in the modular narrative.

4. RBI Governor Reiterates ‘Huge Risk’ from Crypto and Stablecoins

While markets were already under pressure from ETF flows and leverage unwinds, India’s central bank added another layer of cautionary rhetoric.

On Nov 21, Reserve Bank of India Governor Sanjay Malhotra again described cryptocurrencies and stablecoins as a “huge risk” to financial stability. The comments come on top of India’s already restrictive stance, including high tax rates on crypto gains and tax deducted-at source (TDS) rules on trading activity.

No new ban or explicit policy change was announced, but the timing matters. Regulators often lean on periods of market stress to justify more aggressive oversight. Even without fresh legislation, repeated warnings can influence how local banks, payment processors, and institutions interact with the sector.

For Indian users, the message is clear: the domestic environment remains hostile. That tends to push serious market participants toward offshore venues, P2P rails, or decentralized exchanges. The result is fragmented liquidity, more operational friction, and higher compliance complexity for anyone trying to stay within local rules.

Globally, the direct impact is modest compared with U.S. or EU policy moves, but India is still a major retail market. Negative statements from top officials during a drawdown can chill regional participation right when sentiment is most fragile. It’s another incremental bearish datapoint layered on top of a macro backdrop that already favors caution.

🎨 Today’s Sponsor: Masterworks

Wealthy investors are increasing exposure to blue-chip contemporary art, an asset class that’s outperformed stocks for decades. Masterworks makes it accessible to everyone.

Skip the waitlist ↓

Last Time the Market Was This Expensive, Investors Waited 14 Years to Break Even

In 1999, the S&P 500 peaked. Then it took 14 years to gradually recover by 2013.

Today? Goldman Sachs sounds crazy forecasting 3% returns for 2024 to 2034.

But we’re currently seeing the highest price for the S&P 500 compared to earnings since the dot-com boom.

So, maybe that’s why they’re not alone; Vanguard projects about 5%.

In fact, now just about everything seems priced near all time highs. Equities, gold, crypto, etc.

But billionaires have long diversified a slice of their portfolios with one asset class that is poised to rebound.

It’s post war and contemporary art.

Sounds crazy, but over 70,000 investors have followed suit since 2019—with Masterworks.

You can invest in shares of artworks featuring Banksy, Basquiat, Picasso, and more.

24 exits later, results speak for themselves: net annualized returns like 14.6%, 17.6%, and 17.8%.*

My subscribers can skip the waitlist.

*Investing involves risk. Past performance is not indicative of future returns. Important Reg A disclosures: masterworks.com/cd.