Hidden Gems: 5 High‑Conviction Crypto Plays Building Through Volatility

By Token Metrics Research • November 5, 2025 • ~10 min read

Despite choppy markets, the best teams keep shipping. This edition surfaces five under‑the‑radar projects that marry strong tech with real utility across Layer‑1s, Ethereum L2s, Bitcoin DeFi, and modular ecosystems. Each has credible backers, clear differentiation, and catalysts on the horizon.

What’s inside

- Berachain — An EVM‑identical L1 with instant finality and Proof‑of‑Liquidity to route emissions to apps and users.

- Lombard — Bitcoin capital markets with yield‑bearing LBTC and a security‑first, multi‑chain design.

- Taiko (Alethia) — The first production “based rollup,” Type‑1 Ethereum‑equivalent with a multiproof roadmap.

- Initia — A Cosmos L1 that natively orchestrates modular L2s (“Interwoven Rollups”) with shared liquidity.

- Monad — A parallel EVM L1 targeting sub‑second finality while preserving bytecode compatibility.

Risk reminder: Early‑stage crypto assets are volatile and speculative. Execution, regulatory, and liquidity risks are real. This content is educational and not investment advice.

1. Berachain

Sector - Layer‑1 (EVM‑identical), DeFi‑focused | Status - Mainnet live (launched Feb 6, 2025)

Berachain is an EVM‑identical L1 that aligns security with onchain liquidity via Proof‑of‑Liquidity (PoL). By separating the gas/staking token (BERA) from the governance/rewards token (BGT) and introducing a native overcollateralized stablecoin (HONEY), Berachain channels emissions toward productive application‑layer activity rather than solely to validators.

Under the hood, Berachain runs unmodified Ethereum execution clients through the Engine API and achieves single‑slot finality with BeaconKit (built on CometBFT). The result is instant finality, full Ethereum tooling compatibility, and a design that can rapidly adopt upstream Ethereum upgrades.

Features

- Proof‑of‑Liquidity (PoL): Emissions flow to reward vaults that incentivize LPing and other useful onchain actions.

- EVM‑identical execution: Runs standard Ethereum clients and supports the full EIP/RPC surface.

- BeaconKit single‑slot finality: Modular consensus with instant finality and execution client diversity.

- Incentives marketplace: Protocols bid for validator‑directed BGT emissions using whitelisted tokens.

- Tri‑token economy: BERA (gas/staking), BGT (non‑transferable governance/rewards), HONEY (overcollateralized stablecoin).

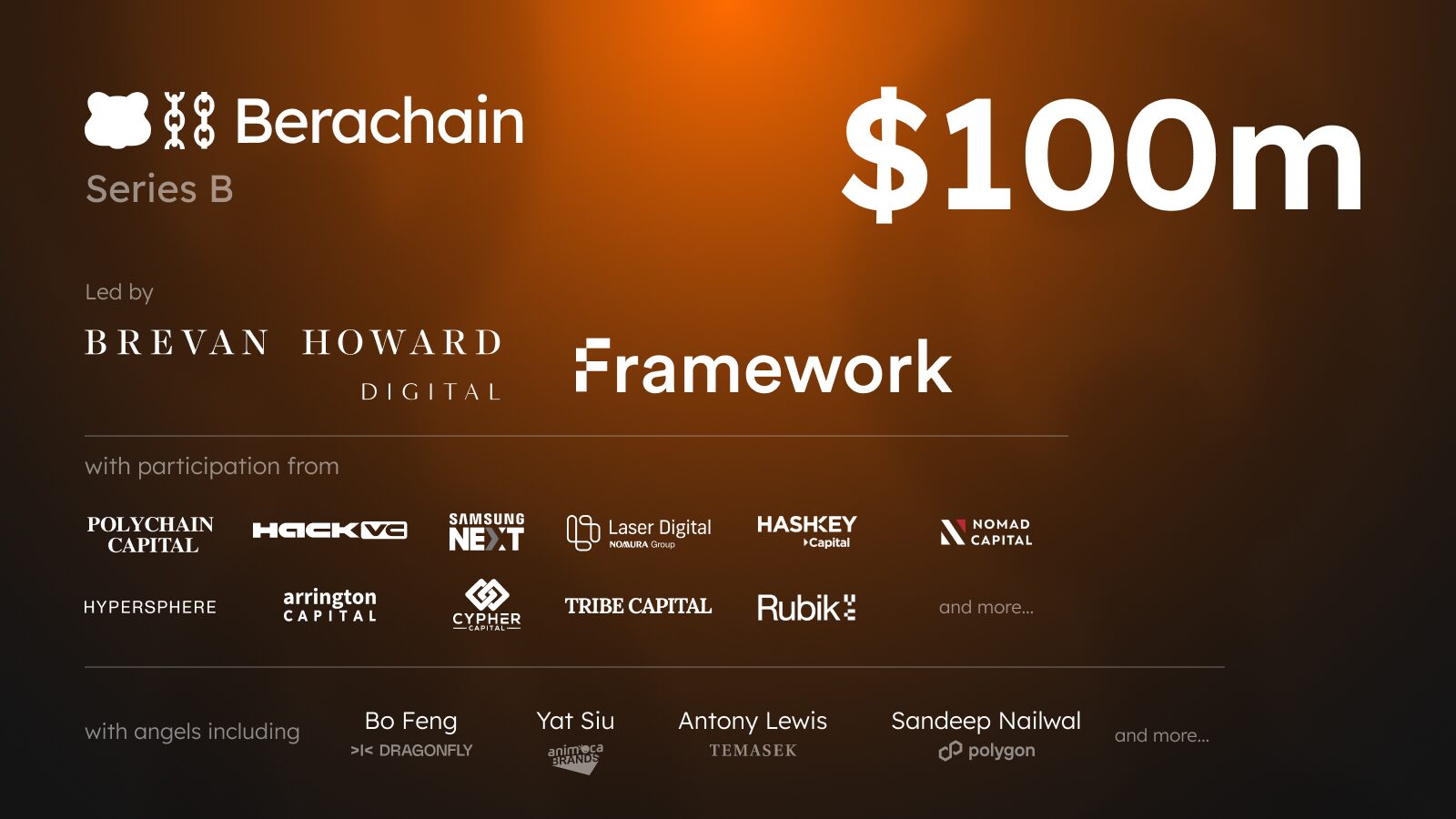

Investors

Funding: ~$142M across two rounds (Apr 2023: $42M; Apr 2024: $100M). Approx. ~$1.5B reported valuation around Series B.

- Brevan Howard Digital (co‑lead, $100M Series B)

- Framework Ventures (co‑lead, Series B)

- Polychain Capital (lead $42M round; also joined Series B)

- Hack VC, Samsung Next, Laser Digital (Nomura), HashKey, Arrington, Tribe, Hypersphere, and others

Team

Community‑driven founding team originating from the Bong Bears NFT culture, with contributors from Aave, Coinbase, Polygon, Chainlink, and more. Public‑facing co‑founder: Smokey the Bera.

Token

Utility

- BERA: Gas token and staking to secure the network; governs validator activation.

- BGT: Non‑transferable governance/rewards token; earned via PoL‑eligible activity or validator ops; can be burned 1:1 for BERA.

- HONEY: Overcollateralized, soft‑pegged USD stablecoin integrated across the Berachain DeFi stack.

Tokenomics

- PoL emissions in BGT during block production; validators allocate most emissions to reward vaults.

- Active set of 69 validators chosen by BERA stake; concave BGT boost encourages decentralization.

- Mainnet + TGE: February 6, 2025.

2. Lombard

Sector - Bitcoin DeFi, Liquid Staking (LST), Cross‑chain Capital Markets Infrastructure | Status - Active; LBTC yield‑bearing since Aug 11, 2025; BARD live

Lombard is building full‑stack Bitcoin capital markets. Its core product, LBTC, turns native BTC into a liquid, yield‑bearing asset staked via Babylon’s Bitcoin Staking Protocol. Rewards are reflected natively in LBTC’s value, enabling BTC to remain composable across DeFi without separate claim tokens.

Security and interoperability are first‑class: mint/burn operations require authorization from a 14‑member Security Consortium and Chainlink CCIP; a Proof‑of‑Reserves oracle and continuous monitoring harden the system. LBTC is live across major chains and integrated with dozens of protocols.

Features

- Yield‑bearing LBTC: Stake BTC, mint LBTC, and accrue native BTC‑denominated yield automatically.

- Security Consortium + CCIP: Multi‑party governance and secure cross‑chain operations.

- Proof‑of‑Reserves + monitoring: Onchain attestations and runtime defenses with audits and bug bounty.

- Cross‑chain native issuance: LBTC mints on multiple L1s/L2s to avoid wrapper fragmentation.

- Developer & partner SDK: One‑click BTC staking and strategy routing for exchanges and wallets.

Investors

Funding: ~$17M seed (July 2024) plus a $6.75M BARD community sale (Aug–Sep 2025) at $450M FDV.

- Polychain Capital (seed lead)

- Binance Labs (strategic), HTX Ventures, OKX Ventures

- Franklin Templeton and additional strategic participants (dao5, Foresight, Mirana, Nomad Capital, Mantle Eco Fund, Bybit)

Team

Led by co‑founder Jacob Phillips (ex‑Polychain; Perennial), with product, security, and research contributors from Polychain, Babylon, Argent, Coinbase, and Maple. The 14‑member Security Consortium augments operations.

Token

Utility

- Governance over protocol parameters, fees, and grants.

- Security alignment via staking for cross‑chain infrastructure.

- Protocol utility: access, discounts, and potential yield enhancements.

Tokenomics

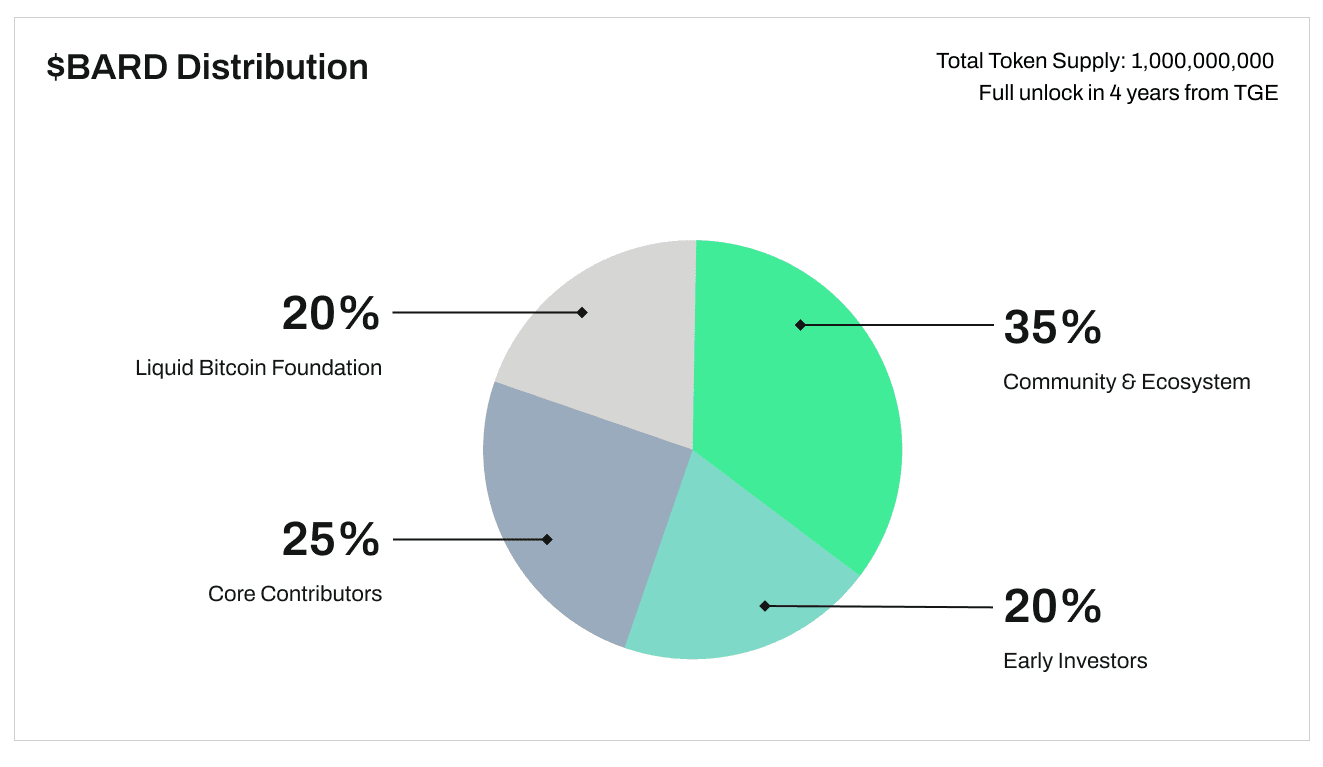

- Fixed supply: 1,000,000,000 BARD; initial circulating ~22.5% at TGE.

- Distribution: 35% Community & Ecosystem; 20% Liquid Bitcoin Foundation; 20% Early Investors (12‑month cliff, then linear); 25% Core Contributors (12‑month cliff).

- Community sale: $6.75M at $450M FDV; TGE mid‑Sep 2025.

3. Taiko (Taiko Alethia)

Sector - Ethereum L2 • Type‑1 Ethereum‑equivalent ZK rollup • Based rollup (Ethereum‑sequenced) | Status - Mainnet live; DAO and preconfirmations rolling out

Taiko is the first production “based rollup,” delegating sequencing to Ethereum L1 validators to maximize neutrality and censorship‑resistance. It maintains Type‑1 Ethereum equivalence so existing Ethereum dapps and tooling run unchanged, while pursuing a multiproof roadmap that combines TEE and ZK proofs with a contestable design.

Permissionless proposing and proving, along with decentralized preconfirmations, target a fast user experience without compromising Ethereum alignment.

Features

- Based rollup: Sequenced by Ethereum itself—no centralized sequencer.

- Type‑1 zkEVM: Unmodified Ethereum execution; full opcode and JSON‑RPC compatibility.

- Multiprover architecture: TEE + ZK with contestability and a path to full ZK coverage.

- Permissionless operators: Anyone can propose blocks and submit proofs.

- Preconfirmations: Rolling out to deliver ~2s UX while preserving decentralization guarantees.

Investors

Funding: $37M across three rounds (latest: $15M Series A, Mar 2024).

- Lightspeed Faction, Hashed, Generative Ventures, Token Bay Capital (Series A leads)

- Wintermute Ventures, Presto Labs, Flow Traders, Amber Group, OKX Ventures, GSR, WW Ventures (participants)

Team

Founded by Loopring veterans and Ethereum zk researchers: Daniel Wang (CEO), Brecht Devos (CTO), Terence Lam (co‑founder), with contributors including Ben Wan and Matthew Finestone.

Token

Utility

- Protocol governance via Taiko DAO and ecosystem incentives.

- Incentives for permissionless proposers/provers and liquidity programs.

- Grants and RetroPGF to fund public goods and ecosystem growth.

Tokenomics

- Max supply: 1,000,000,000 TAIKO with allocations across DAO, team, investors, airdrops, grants, and liquidity.

- Mainnet launch: May 27, 2024; TGE around June 5, 2024 with multiple exchange listings. Vesting schedules ongoing through 2026–2027.

4. Initia

Sector - Layer‑1 (Cosmos‑based) with native modular L2 rollups (“Interwoven Rollups”) | Status - Mainnet live (chain‑id: interwoven‑1)

Initia is a Cosmos‑SDK L1 that natively coordinates an ecosystem of application‑specific L2 rollups called “Minitias.” Each rollup can choose EVM, MoveVM, or WasmVM and posts data to Celestia for scalable data availability, while the Initia L1 acts as the orchestration and liquidity hub.

The stack integrates bridging, DA, liquidity (InitiaDEX), and incentives (VIP) so builders get sovereignty and performance without stitching external services—and users get a chain‑abstracted experience across the Interwoven ecosystem.

Features

- Interwoven Rollups: App‑specific L2s connected to Initia L1 with shared messaging and settlement.

- OPinit framework: Optimistic rollup design with fraud proofs/rollback and Celestia DA.

- Multi‑VM support: Choose MoveVM, EVM, or WasmVM per rollup.

- Enshrined Liquidity + InitiaDEX: L1 AMM and validator‑aligned LP staking to unify liquidity.

- VIP incentives: esINIT rewards distributed programmatically based on onchain value creation.

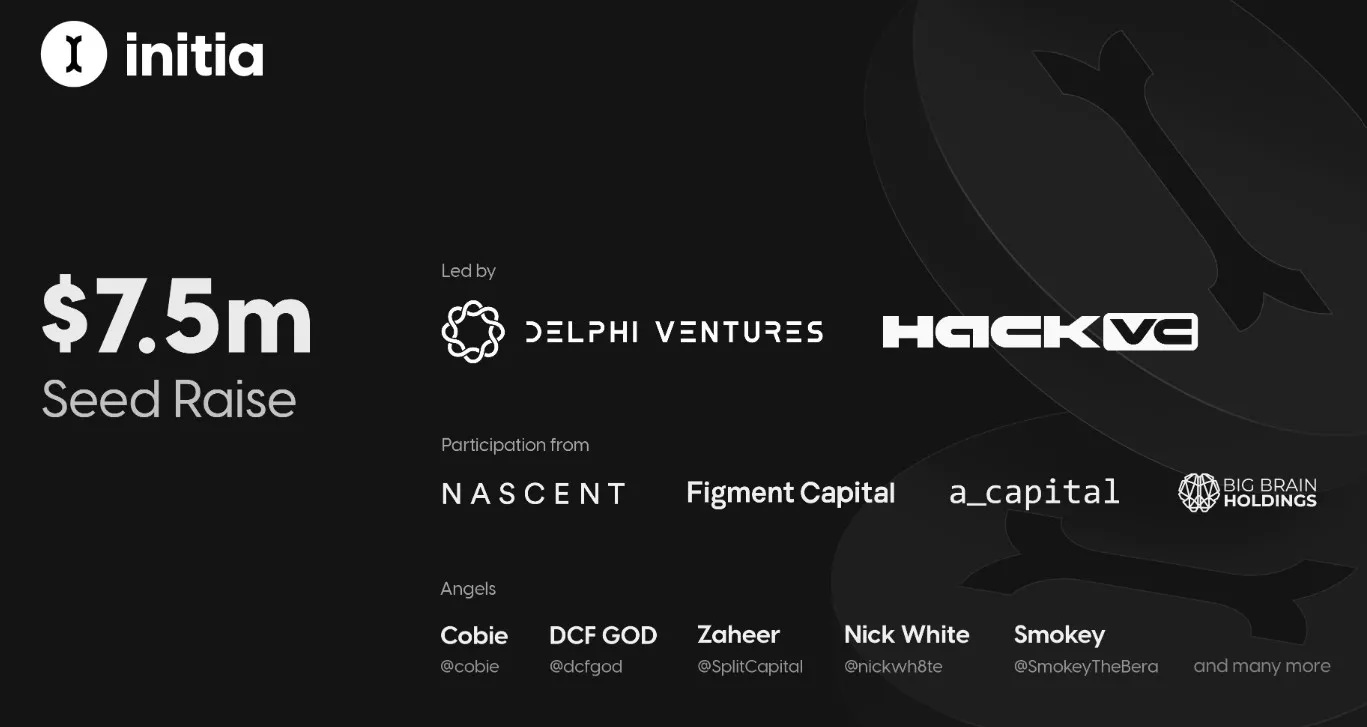

Investors

Funding: At least $7.5M disclosed (seed, Feb 2024). Some outlets later suggested higher totals; rely on official updates.

- Delphi Ventures (seed co‑lead), Hack VC (seed co‑lead)

- Binance Labs (early backer), Nascent, Figment Capital, A.Capital, Big Brain Holdings

- Notable angels: Cobie, DCF GOD, Zaheer Ebtikar, Nick White (Celestia), Smokey (Berachain), among others

Team

Founded by Stanford Liu and Ezaan “Zon” Mangalji (ex‑Terraform Labs), with contributors spanning Cosmos core and CosmWasm experience.

Token

Utility

- Gas on L1 and eligible L2s, staking/delegation for L1 security, and governance.

- Backbone of VIP (esINIT) and Enshrined Liquidity programs.

Tokenomics

- Max supply: 1,000,000,000 INIT.

- Binance Launchpool (Apr 18–23, 2025) allocated 3% (30M INIT) for farming; initial circulating ~148.75M (~14.88%).

- Spot listing began Apr 24, 2025 across major venues.

5. Monad

Sector - Layer‑1 blockchain (EVM‑compatible, parallel execution) | Status - Public testnet; mainnet approaching; MON airdrop claim window through Nov 3, 2025

Monad is an EVM‑compatible L1 pushing for Solana‑class performance while preserving Ethereum semantics. It combines a new BFT protocol (MonadBFT) with asynchronous and optimistic parallel execution, plus a purpose‑built state database (MonadDB). Targets include ~400ms blocks, ~800ms finality, and 10,000+ TPS.

The design decouples consensus from execution so validators agree on ordering first, then execute in parallel with conflict resolution—maintaining bytecode compatibility and tooling support.

Features

- 100% EVM bytecode compatibility: Deploy existing Solidity bytecode unchanged.

- Optimistic parallel execution: Speculative parallelism with conflict detection and re‑exec.

- Asynchronous execution: Consensus and execution run in separate pipelines.

- MonadBFT: Pipelined BFT with one‑round speculative confirmations and fast finality.

- MonadDB: Storage tuned for parallel state access over a Patricia‑Trie layout.

Investors

Funding: $244M disclosed (Seed: $19M led by Dragonfly; Series A: $225M led by Paradigm).

- Paradigm (Series A lead), Electric Capital, Greenoaks (participants)

- Dragonfly (seed lead), Placeholder, Lemniscap, Shima Capital, Finality Capital

- Notable angels: Naval Ravikant, Cobie, Hasu

Team

Founded by Jump Trading alumni: Keone Hon (CEO), James Hunsaker (CTO), and Eunice Giarta (COO/BD). The Monad Foundation stewards ecosystem growth; core client work continues at Category Labs.

Token

Utility

- Proof‑of‑Stake security (validator staking/delegation) and native fee token for transactions.

- Initial ownership distributed via an airdrop spanning community and power‑user cohorts.

Launch Notes

- Airdrop announced Oct 14, 2025 with claims open until Nov 3, 2025; full long‑term supply allocations to follow official releases.

Final Notes

These five projects aren’t just narratives—they’re shipping code, catalyzing liquidity, and aligning incentives in new ways. Size positions appropriately, track roadmap deliveries, and watch for ecosystem integrations and governance proposals as leading indicators.

— Token Metrics Research

Disclosures: This publication is for informational purposes only and does not constitute investment advice. Token Metrics or its affiliates may hold positions in assets discussed. Always do your own research.

Today's edition of Token Metrics Research | Daily Newsletter is brought to you by Crypto 101.

The Smartest Free Crypto Event You’ll Join This Year

Curious about crypto but still feeling stuck scrolling endless threads? People who get in early aren’t just lucky—they understand the why, when, and how of crypto.

Join our free 3‑day virtual summit and meet the crypto experts who can help you build out your portfolio. You’ll walk away with smart, actionable insights from analysts, developers, and seasoned crypto investors who’ve created fortunes using smart strategies and deep research.

No hype. No FOMO. Just the clear steps you need to move from intrigued to informed about crypto.

Today's edition of Token Metrics Research | Daily Newsletter is brought to you by CoW Swap.

Best Price, Every Trade.

Want the best price on every swap? CoW Swap evaluates routes across DEXs in real time and settles the most efficient path. Tighter pricing, higher success rates, fewer reverts. Find your best price.

Today’s newsletter is also powered by Mindstream.

Master ChatGPT for Work Success

ChatGPT is revolutionizing how we work, but most people barely scratch the surface. Subscribe to Mindstream for free and unlock 5 essential resources including templates, workflows, and expert strategies for 2025. Whether you're writing emails, analyzing data, or streamlining tasks, this bundle shows you exactly how to save hours every week.

That's all for today. Let's talk tomorrow.