We're proud to have EnergyX as today's lead sponsor of Token Metrics, supporting our mission to deliver cutting edge insights and connect the investment community.

Exxon and Chevron Have an Unlikely New Competitor

Energy giants like Exxon and Chevron are buying land in America’s lithium hotspot. Now they’ve got a new neighbor. EnergyX has now acquired 35k gross acres in Southwest Arkansas, right next door. With tech that can recover 3X more lithium than traditional methods, they’re aiming for America’s lithium crown. General Motors already invested. Join them and 40k people as an early-stage EnergyX investor today.

Energy Exploration Technologies, Inc. (“EnergyX”) has engaged Nice News to publish this communication in connection with EnergyX’s ongoing Regulation A offering. Nice News has been paid in cash and may receive additional compensation. Nice News and/or its affiliates do not currently hold securities of EnergyX.

This compensation and any current or future ownership interest could create a conflict of interest. Please consider this disclosure alongside EnergyX’s offering materials. EnergyX’s Regulation A offering has been qualified by the SEC. Offers and sales may be made only by means of the qualified offering circular. Before investing, carefully review the offering circular, including the risk factors. The offering circular is available at invest.energyx.com/.

Market Snapshot

Welcome back, Token Metrics readers.

As of Dec 12, 2025, Bitcoin is trading in the low–$90,000s, consolidating after a volatile week shaped by recent Fed rate cuts, strong spot ETF inflows, and a large upcoming options expiry. U.S. spot Bitcoin ETFs just logged one of their strongest daily inflows in roughly three weeks, pulling in about $223.5M on Dec 10, led by BlackRock’s IBIT and Fidelity’s FBTC. Ethereum spot ETFs are seeing more mixed flows, with pockets of outflows tempering the narrative.

Majors are holding elevated ranges after the Q4 rally, with BTC hovering near all‑time highs and ETH steady above $3,000. Volatility has cooled from the recent spike but remains higher than in the summer chop. Institutional conversations today focus on renewed ETF demand, macro easing, and an expanding tokenization and stablecoin footprint. On the other side of the ledger, regulatory risk is front and center after high‑profile actions like Do Kwon’s 15‑year sentence over the Terra–Luna collapse, raising the bar for stablecoins and aggressive yield plays.

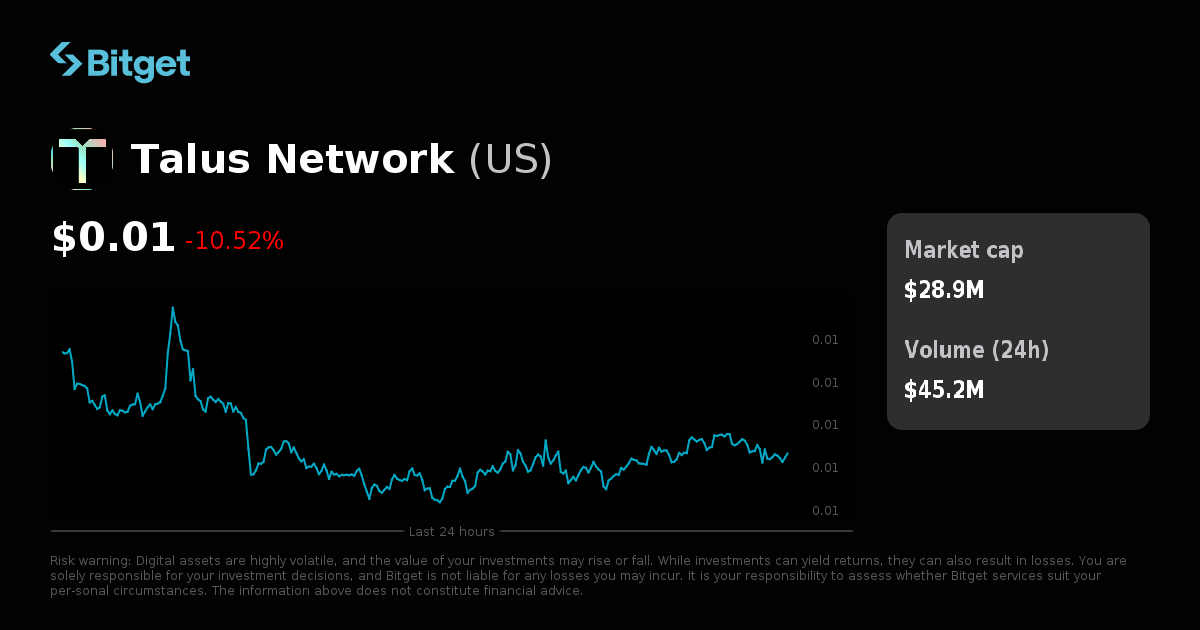

1. Bitget Launchpool Adds Talus (US) With 17.5M Token Rewards

Bitget just listed Talus (US), an AI agent infrastructure project, on both its Launchpool and spot market. The US/USDT pair went live on Dec 11, 2025, at 13:00 UTC, with deposits already open and withdrawals enabled from Dec 12, 2025, at 14:00 UTC.

The move comes with a short, high‑intensity farming window. From Dec 11, 2025, 16:00 UTC to Dec 14, 2025, 16:00 UTC, traders can lock assets in two Launchpool buckets to farm 17,500,000 US in rewards:

- BGB pool: 16,000,000 US in rewards. Users can lock 5–50,000 BGB, with caps scaled by VIP tier.

- US stablecoin pool: 1,500,000 US in rewards. Users can lock 250–25,000,000 US, again with per‑user caps.

Rewards are distributed pro‑rata based on each user’s share of total locked BGB or US, making this feel like a points‑style yield campaign tied to a TGE‑adjacent listing.

Talus positions itself as infrastructure for decentralized AI agents—autonomous on‑chain agents that can compete, earn, and settle in a verifiable way. Launchpool access effectively works as early distribution: BGB and US holders get in before broader secondary liquidity builds.

2. Ripple Payments Goes Live With First European Bank, AMINA Bank

Ripple just landed a meaningful win in Europe. Swiss FINMA‑regulated AMINA Bank AG is now live with Ripple Payments, making it the first European bank to adopt the stack in production.

The integration targets near real‑time cross‑border settlement for AMINA’s crypto‑native clients, reducing friction between blockchain settlement and traditional bank rails. Crucially, AMINA is using Ripple’s licensed, end‑to‑end payments solution, not just public XRPL infrastructure. That lets the bank plug Ripple into its existing compliance, KYC, and risk systems.

This is a strategic signal: a regulated European bank is leaning on crypto‑native plumbing for core payments, not just custody or trading. That’s a step‑change from pilots and proofs of concept.

Today's Token Metrics insights are brought to you in partnership with Climatize.

Invest in Renewable Energy Projects

People across the U.S. can invest in renewable energy projects through Climatize. More than $13.2M has been invested through the platform so far, with over $3.6M returned to investors to date. Returns not guaranteed.

You can explore American clean energy projects raising capital right now.

Climatize is an SEC-registered & FINRA member funding portal. Crowdfunding carries risk, including loss.

3. Wrapped XRP Launches on Solana, Unlocking New DeFi Utility

In parallel with Ripple’s banking push, XRP is going multi‑chain. Institutional custodian Hex Trust has launched Wrapped XRP (wXRP), a 1:1 backed representation of XRP, using the LayerZero OFT (Omnichain Fungible Token) standard. Coverage includes Solana and additional chains, giving XRP its broadest DeFi surface area yet. Details come via CoinDesk.

wXRP is minted when native XRP is locked in Hex Trust custody and burned on redemption, keeping circulating supply matched between the XRP Ledger and destination chains. Burn‑and‑mint logic preserves price parity while centralizing custody risk with a regulated institution, rather than a purely algorithmic bridge.

On Solana, wXRP can now plug into high‑throughput, low‑fee DeFi primitives—DEXs, perps venues, lending markets, yield aggregators, and structured products. Redemptions work in reverse: burning wXRP on Solana unlocks base‑layer XRP back on the XRP Ledger.

This is arguably one of the biggest utility upgrades XRP has seen in years:

- For XRP: It becomes a composable DeFi building block, not just a payments asset.

- For Solana DeFi: It gains a large‑cap asset with a deep, globally distributed holder base.

- For institutions: wXRP offers a regulated, custody‑backed way to access XRP exposure on fast L1s.

4. Tether Explores Tokenizing Equity After Targeting $20B Raise

Stablecoin giant Tether is reportedly considering tokenizing its own equity after a massive planned share sale. Per Bloomberg, summarized by The Block, the company is targeting up to $20B in fresh equity at a roughly $500B valuation.

At that scale, Tether would sit in the same valuation band as the world’s largest financial institutions. The current plan does not allow existing shareholders to sell into the round, which raises the question of how early investors eventually realize liquidity before any IPO path becomes clear.

Tokenizing equity is one answer. Using the same infrastructure that powers USDT, Tether could issue tokenized shares that trade on permissioned or semi‑permissioned venues. That would create one of the largest tokenized equity assets in crypto history and a flagship case study for on‑chain capital markets.

If executed, tokenized Tether stock would sit at the intersection of:

- Stablecoin dominance: Leveraging USDT’s global footprint to bootstrap new capital markets primitives.

- Private markets: Turning traditionally illiquid equity into tradeable, 24/7 assets.

- Regulation: Forcing regulators to confront tokenized securities at systemically meaningful scale.

Token Metrics is sponsored by Superhuman AI.

Go from AI overwhelmed to AI savvy professional

AI will eliminate 300 million jobs in the next 5 years.

Yours doesn't have to be one of them.

Here's how to future-proof your career:

Join the Superhuman AI newsletter - read by 1M+ professionals

Learn AI skills in 3 mins a day

Become the AI expert on your team