We're proud to have Superhuman AI as today's lead sponsor of Token Metrics, supporting our mission to deliver cutting edge insights and connect the investment community.

Go from AI overwhelmed to AI savvy professional

AI keeps coming up at work, but you still don't get it?

That's exactly why 1M+ professionals working at Google, Meta, and OpenAI read Superhuman AI daily.

Here's what you get:

Daily AI news that matters for your career - Filtered from 1000s of sources so you know what affects your industry.

Step-by-step tutorials you can use immediately - Real prompts and workflows that solve actual business problems.

New AI tools tested and reviewed - We try everything to deliver tools that drive real results.

All in just 3 minutes a day

Even in choppy markets, the best builders keep shipping. This edition surfaces five under the-radar projects tackling real problems across trading infrastructure, DeAI agents, stablecoins with covered yield, high performance L1s, and on chain RWAs and strategies. Collectively, these teams have raised roughly $80M and are positioned for asymmetric upside as the market matures.

Projects in this issue

- GTE (Global Token Exchange) — DEX + Aggregator + Launchpad (Hybrid AMM/CLOB)

- Talus — Decentralized AI agents infrastructure (DeAI), on chain agent framework on Sui

- Cap — Stablecoins / DeFi Lending + Restaking AVS

- Fogo — Layer 1 (SVM compatible) for high performance trading/DeFi

- Theo — Cross chain trading infrastructure, RWA tokenization, delta neutral vaults

Disclaimer

All content is for informational purposes only and should not be construed as investment, tax, or legal advice. Crypto assets are highly volatile and can result in total loss. Always do your own research.

1. GTE (Global Token Exchange)

Sector - DEX + Aggregator + Launchpad (Hybrid AMM/CLOB) | Status - Active — public testnet; audits live; mainnet independence from MegaETH announced Aug 2025

GTE is a fully on chain, vertically integrated trading venue that blends a high performance central limit order book with an AMM, a MegaETH wide router/aggregator, and a token launch stack. The goal: CEX like speed (~1 ms latency, 100k orders/sec) without compromising on custody, composability, or auditability.

Why it matters: unified asset creation to spot/perps under one roof, plus deep routing across MegaETH for best execution—all with an audited stack and credible market maker backing.

Features

- On chain CLOB for real time price discovery at near CEX latency.

- Integrated AMM for spot swaps alongside order book markets.

- Aggregator routing across MegaETH venues for best on chain prices.

- Launchpad + permissionless “Takeoff” bonding curve token launcher.

- Audited perps engine and vaults; SDKs incl. Python for builders.

Investors

Funding: ~ $25M raised to date (pre seed/seed/community + $15M Series A, June 2025).

- Paradigm — Series A lead ($15M)

- Maven 11 — Early round participant

- Wintermute — Early round participant

- Flow Traders — Seed participant

- Robot Ventures — Seed participant

- IMC Trading — Backer

- Auros — Backer

- Community via Echo (Cobie) — ~$2.5M community round

Team

- Enzo Coglitore — Co founder (ex Alchemy Ventures)

- Matteo Lunghi — Founder (ex Palantir tech lead)

- Nate Burbage — Co founder

2. Talus

Sector - Decentralized AI agents infrastructure (DeAI); on chain agent framework on Sui | Status - Active testnet; mainnet/Idol.fun targeted Q1 2026; TGE planned

Talus is building Nexus, a fully on chain agentic framework on Sui that lets developers compose autonomous agents and workflows with verifiable execution. Data and memory sit on Walrus, while an off chain Leader network orchestrates external tools and commits results back on chain. Consumer adoption will be driven by Idol.fun—an Agent vs Agent gaming/prediction app.

Why it matters: Talus brings agents, tools, and value transfer on chain—moving beyond off chain bots with wallets—and aligns tightly with Sui/Walrus for scale and distribution.

Features

- Nexus on Sui: define and execute agent workflows as composable DAGs in Move.

- Leader network: orchestrates LLMs/APIs and returns verifiable results on chain.

- Walrus integration for models, datasets, and agent memory.

- Tool and Agent marketplaces enabling Agent as-a Service.

- Idol.fun: consumer “Agent vs Agent” gaming and prediction to bootstrap users/liquidity.

Investors

Funding: > $10M across seed, strategic, and ecosystem rounds.

- Polychain Capital — Seed lead

- Sui Foundation — Strategic

- Walrus Foundation — Strategic

- dao5 — Seed

- Foresight Ventures; Animoca Brands — Strategic participation

- Hash3; TRGC; WAGMI Ventures; Inception Capital — Seed

- Angels incl. Sandeep Nailwal, Michael Heinrich

Team

- Mike Hanono — Founder & CEO

- Ben Frigon — Chief Strategy Officer

Token

- Token: $US (planned network token; not live as of Nov 19, 2025)

- Utility: Intended to power the Talus/PredictionAI economy (fees, staking, governance details to be finalized at TGE).

- Tokenomics/Launch: Tokenomics introduced at a high level in 2025 materials; full distribution and TGE timeline to be announced.

Today's Token Metrics insights are brought to you in partnership with Fisher Investments.

Retirement Planning Made Easy

Building a retirement plan can be tricky— with so many considerations it’s hard to know where to start. That’s why we’ve put together The 15-Minute Retirement Plan to help investors with $1 million+ create a path forward and navigate important financial decisions in retirement.

3. Cap

Sector - Stablecoins / DeFi Lending + Restaking AVS | Status - Active on Ethereum mainnet (Frontier program; cUSD + stcUSD live)

Cap issues cUSD (a redeemable, USD denominated stablecoin) and stcUSD (its yield bearing counterpart). Operators borrow reserve collateral to run strategies and are underwritten by restakers via shared security networks. If an operator defaults, slashed collateral is redistributed to backstop users—helping keep cUSD fully collateralized while letting stcUSD accrue covered yield.

Why it matters: clear separation of yield generation risk from end users, diversified collateral, objective slashing, and deep partner integrations.

Features

- Credible downside protection via automated slashing and redistribution.

- Dual asset design: cUSD (redeemable) and stcUSD (yield bearing).

- PSM with multi collateral mint/burn/redeem mechanics.

- Shared Security Networks (EigenLayer, Symbiotic) to underwrite operator risk.

- Multiple audits and a public bug bounty for transparency.

Investors

Funding: ~$11M seed (Apr 2025) + ~$1.9M pre seed (Oct 2024) + prior community round.

- Franklin Templeton (FTDA) — Seed lead

- Triton Capital — Seed

- SIG (Susquehanna) — Seed

- Flow Traders — Seed

- Nomura’s Laser Digital — Seed

- GSR; IMC Trading — Seed

- RockawayX; Superscrypt — Seed

- Kraken Ventures; Robot Ventures; ANAGRAM; ABCDE; SCB Limited — Pre seed

Team

- Benjamin Sarquis Peillard — Founder/CEO (ex QiDAO)

- Weso — Co founder/CTO (ex Beefy contributor/advisor)

- David “DeFi Dave” Liebowitz — Head of Growth

Token

- Tokens: cUSD (Cap USD) and stcUSD (Staked Cap USD)

- Utility: cUSD is a redeemable, basket backed stablecoin for payments/liquidity; stcUSD accrues covered yield from reserve performance and operator strategies.

- Tokenomics: cUSD is elastic supply with mint/burn at oracle value; stcUSD supply tracks staked cUSD. No governance token live; points via the Frontier program.

- Launch: Public mainnet rollout via Frontier began Aug 2025; audits and addresses published.

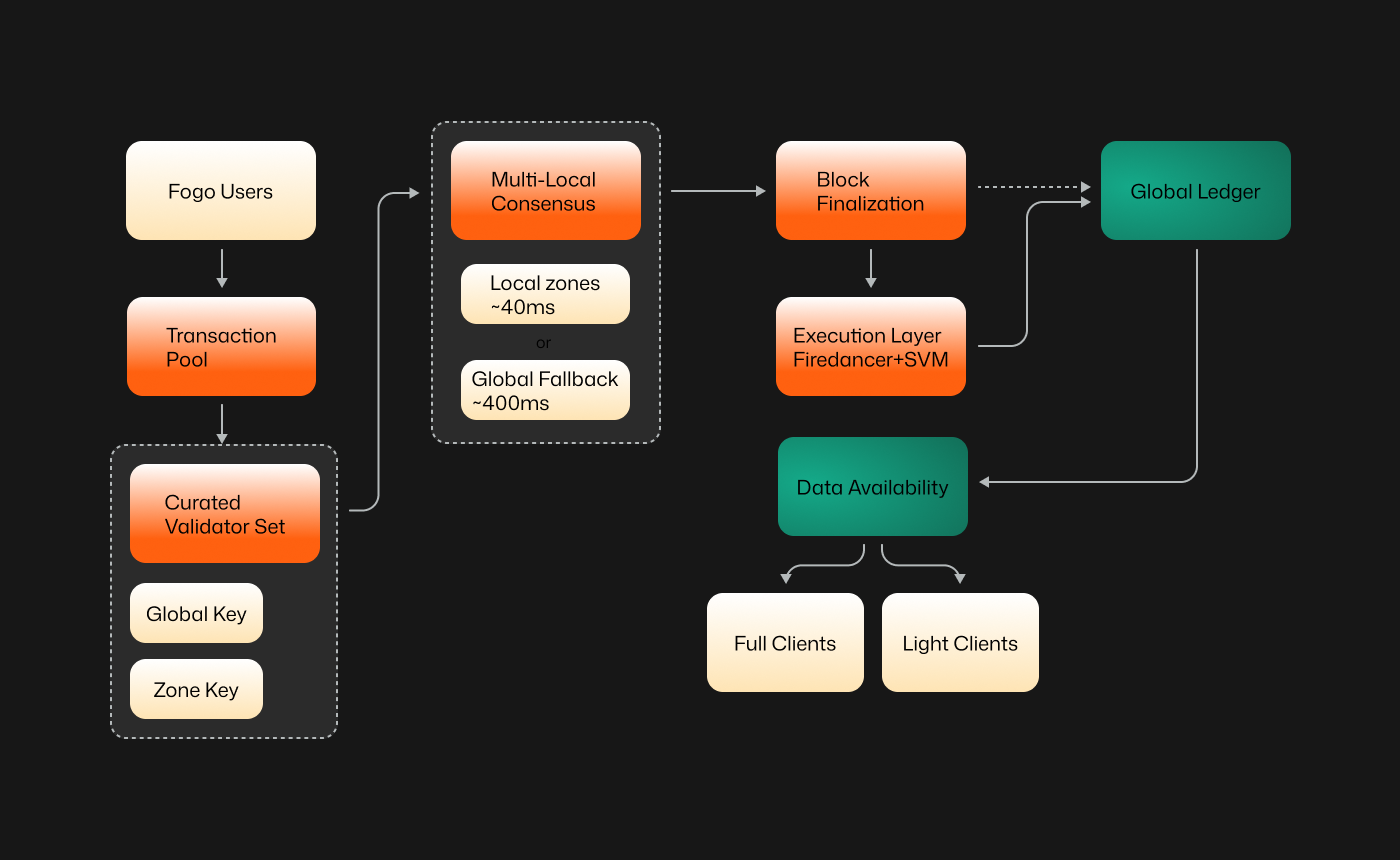

4. Fogo

Sector - Layer 1 (SVM compatible) blockchain for high performance trading/DeFi | Status - Public testnet live (since Mar 31, 2025); mainnet targeted for H2 2025

Fogo is an SVM based L1 purpose built for speed. It standardizes on a single canonical client (Firedancer) and introduces multi local (co location) consensus to keep network latency near hardware limits while rotating validator zones for resilience. The result: a trading first chain aiming for sub second confirmations and institutional grade throughput.

Why it matters: a clean slate to unlock Firedancer’s performance without slowest client bottlenecks, while retaining SVM compatibility for easy app migration.

Features

- Single canonical Firedancer client (initially via Frankendancer, migrating to full Firedancer).

- Multi local consensus with rotating geographic zones to minimize latency.

- Curated validator set with performance and MEV behavior standards.

- Full SVM compatibility for Solana tooling and apps.

- Trading first roadmap: enshrined DEX, native price feeds, co located LP vaults.

Investors

Funding: ~$13.5M (Seed $5.5M + Community $8M) at ~$100M FDV for token SAFTs.

- Distributed Global — Seed lead

- CMS Holdings — Seed + community participation

- The Echonomist (Cobie) — Community (Echo platform)

- Big Brain Collective — Community

- Patrons (incl. Kain Warwick) — Community

Team

- Robert Sagurton — Co founder (ex Jump Crypto)

- Douglas Colkitt — Founding contributor (Ambient Finance; HFT/TradFi background)

- Michael Cahill — Founding contributor (CEO, Douro Labs/Pyth)

- James Reilly — Head, Fogo Foundation

Token

- Token: FOGO (testnet)

- Utility: Production token expected for gas, staking, and governance of the L1.

- Tokenomics/Launch: SAFT based seed and community rounds at ~$100M FDV; mainnet tokenomics to be detailed at launch.

5. Theo

Sector - Cross chain trading infrastructure, RWA tokenization, delta neutral vaults | Status - Active: Straddle vaults live via partners; thBILL launched July 2025; $20M funding in Apr 2025

Theo connects on chain capital to global markets. Its Straddle vaults capture funding rate yield with delta neutral execution across Aave and Hyperliquid, while thBILL offers a yield bearing basket of tokenized U.S. Treasury bills—built for composability with ERC 4626 receipts and cross chain mobility.

Why it matters: regulated RWA rails plus production grade strategy execution gives Theo a credible bridge between DeFi and TradFi.

Features

- Straddle Delta Neutral Vaults: long collateral + short perp to harvest funding while controlling delta.

- thBILL — Tokenized T bill basket: non rebasing iToken designed as a stable core asset.

- Composable ERC 4626 receipts (tTokens & iTokens) for integrations.

- Cross venue execution layer coordinating swaps, leverage, and rebalancing.

Investors

Funding: $20M (Apr 2025).

- Hack VC — Co lead

- Anthos Capital — Co lead

- Manifold Trading; Mirana Ventures; Metalayer Ventures

- Flowdesk; SCB; MEXC; Amber Group

- Selini Capital

- Angels from Citadel, Jane Street, HRT, Optiver, IMC, 5 Rings, and JPMorgan

Team

- Abhi Pingle — Co founder (ex Optiver/IMC)

- Arijit Pingle — Co founder (ex Optiver/IMC)

- TK Kwon — Co founder

Token

- Tokens: thBILL (live iToken); THEO (ecosystem/governance token referenced; not yet launched as of Nov 19, 2025)

- Utility: thBILL provides on chain T bill exposure and is bridgeable across chains; THEO expected for incentives/governance when launched.

- Tokenomics/Launch: thBILL is non rebasing with KYC gated mint/redeem; THEO token details to be announced.

Final Notes

Thesis recap: we focused on teams with real users, audited or verifiable infrastructure, and clear differentiation—while diversifying across trading infrastructure, DeAI agents, stablecoins with covered yield, high performance L1s, and RWAs.

Key risks: market volatility and regulation, technical execution and delays, competition from incumbents, liquidity constraints for newer tokens, and team execution risk. Position sizing and ongoing diligence are essential.

Token Metrics is sponsored by 1440 Media.

Daily News for Curious Minds

Be the smartest person in the room by reading 1440! Dive into 1440, where 4 million Americans find their daily, fact-based news fix. We navigate through 100+ sources to deliver a comprehensive roundup from every corner of the internet – politics, global events, business, and culture, all in a quick, 5-minute newsletter. It's completely free and devoid of bias or political influence, ensuring you get the facts straight. Subscribe to 1440 today.