Today's sponsor RAD Intel is revolutionizing access to blue-chip art through fractionalization and blockchain-based securitization of high-value real-world assets.

Missed OpenAI? The Clock Is Ticking on RAD Intel’s Round

Ground floor opportunity on predictive AI for ROI-based content.

RAD Intel is already trusted by a who’s-who of Fortune 1000 brands and leading global agencies with recurring seven-figure partnerships in place.

$50M+ raised. 10,000+ investors. Valuation up 4,900% in four years*.

Backed by Adobe and insiders from Google. Shares at $0.81 until Nov 20 — then the price moves. Invest now.

This is a paid advertisement for RAD Intel made pursuant to Regulation A+ offering and involves risk, including the possible loss of principal. The valuation is set by the Company and there is currently no public market for the Company's Common Stock. Nasdaq ticker “RADI” has been reserved by RAD Intel and any potential listing is subject to future regulatory approval and market conditions. Investor references reflect factual individual or institutional participation and do not imply endorsement or sponsorship by the referenced companies. Please read the offering circular and related risks at invest.radintel.ai.

Welcome back to Token Metrics Newsletter!

Today we're presenting five hidden gems in the crypto market, undervalued projects with real traction across AI, DePIN, and RWA sectors. Let's explore the opportunities.

Despite market volatility, builders are shipping. This issue spotlights five projects executing across institutional credit, mobility data, AI first blockchains, real estate settlement, and confidential compute. Together, they provide diversified exposure to high-utility, revenue-adjacent verticals. positioned to benefit as adoption compounds.

Opportunity snapshot: Combined reported/arranged funding and facilities of roughly $4,072M across this cohort and their growth initiatives, with backing from recognized investors and ecosystems. Key risks include market and regulatory volatility, execution complexity, competition, and liquidity in smaller caps.

Projects in this issue

- 1. Clearpool . Institutional on chain credit + PayFi rails

- 2. DIMO Network . Mobility data protocol (DePIN)

- 3. Oraichain . AI first Layer 1 and AI oracle (Cosmos SDK + EVM)

- 4. Propy . Title & Escrow with on chain deed recording (RWA/PropTech)

- 5. Phala Network . Confidential compute cloud for AI & Web3

Nothing in this newsletter is investment advice. Crypto assets are volatile and involve risk. Do your own research and consider your risk tolerance.

1. Clearpool

Sector . DeFi / Real World Assets (RWA) / Decentralized Credit (Institutional) / PayFi

Status . Active (Prime + Dynamic live; PayFi Vaults and cpUSD rolling out multi chain)

Clearpool is a decentralized credit marketplace connecting KYC/KYB’d institutional borrowers with on chain lenders. Its dual-venue design combines a permissionless Dynamic market with a permissioned institutional venue, Clearpool Prime. Building on this stack, Clearpool is launching PayFi rails. short-duration, receivables-backed stablecoin credit that finances global payment flows. and a permissionless, yield-bearing asset, cpUSD, backed by PayFi Vaults and liquid stablecoin reserves. The protocol reports $800M–$850M+ in originations with a multi-chain footprint across Ethereum and leading L2s.

Features

- Clearpool Prime: Permissioned institutional credit with fixed-term pools, rolling loans, and call-backs.

- Dynamic Marketplace: Permissionless lending to whitelisted institutional borrowers; variable rates and no lender lockups.

- PayFi Vaults: On chain vaults channel short-cycle, receivable-backed loans to payment firms with third-party monitoring.

- cpUSD: A permissionless, yield-bearing asset minted via a BoringVault based structure allocating to PayFi Vaults and liquid stablecoin yield.

- Multi-chain + grants: Live on Ethereum and major L2s with ecosystem grants to scale distribution and liquidity.

Investors

- Seed ($3M, 2021): Sequoia India/SEA, Arrington Capital, Sino Global (Ryze Labs), HashKey Capital, Wintermute, and others.

- Ecosystem grants: Arbitrum Foundation (undisclosed), Mantle Foundation (250,000 MNT), Plasma Foundation ($400k XPL) to accelerate PayFi and cpUSD growth.

Token

CPOOL

- Utility: Governance over protocol parameters; staking for oracle/vault security; borrower staking to launch pools; buyback & burn funded by protocol revenue.

- Tokenomics: 1,000,000,000 CPOOL max supply. Allocations (docs): Team 15% (6-mo cliff, 24-mo linear), Rewards 20%, Liquidity 15%, Reserves 17.17%, Partnerships 10%, Ecosystem 10.15%, Investors 12.68% across seed/private/public.

- Launch: Oct 28, 2021 via DAO Maker SHO; initial public FDV ~$40M.

Team

- Robert Alcorn, CFA . Co-Founder & Chairman

- Jakob Kronbichler . Co-Founder & CEO

- Alessio Quaglini . Co-Founder & Senior Advisor

- Vadim Zolotokrylin . Chief of Product & Technology

2. DIMO Network

Sector . DePIN / Mobility Data Protocol

Status . Active (mainnet live; mobile app shipping regular updates)

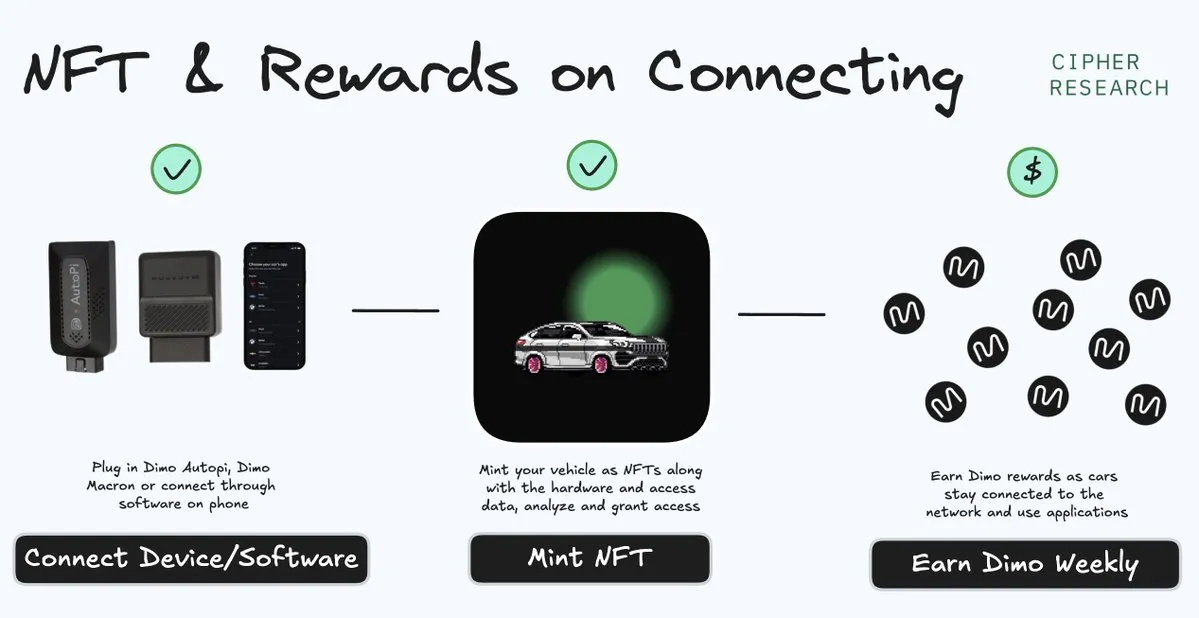

DIMO is an open mobility data protocol that gives drivers ownership of vehicle data and lets developers build apps using permissioned, on-chain primitives. Drivers connect via the DIMO Mobile app or dedicated R1 LTE hardware to stream verified telemetry, access services, and earn rewards. Developers and enterprises integrate through the DIMO protocol and Build console, turning vehicles into programmable data sources.

Features

- On-chain Vehicle ID: Mint a portable digital twin (VehicleID) and bind it to a user wallet and device.

- User-controlled permissions: Granular, revocable access to specific telemetry signals and location data.

- Verified telemetry: OEM and device data attested on chain; real-time events via R1 hardware.

- Marketplace: Drivers earn rewards and tap ecosystem services; developers monetize via data-access fees.

- Developer platform: SDKs/APIs, webhooks, and a Build console for app developers and enterprises.

Investors

- $11.5M Series A (2024) led by CoinFund; participants include Slow Ventures, Table Management, Consensys Mesh, Borderless Capital.

- $9M Seed (2022) with Variant, Slow Ventures, Table Management, Wonder Ventures, Streamr, Stratos, Lattice, and notable angels (e.g., Rick Wagoner, Amir Haleem).

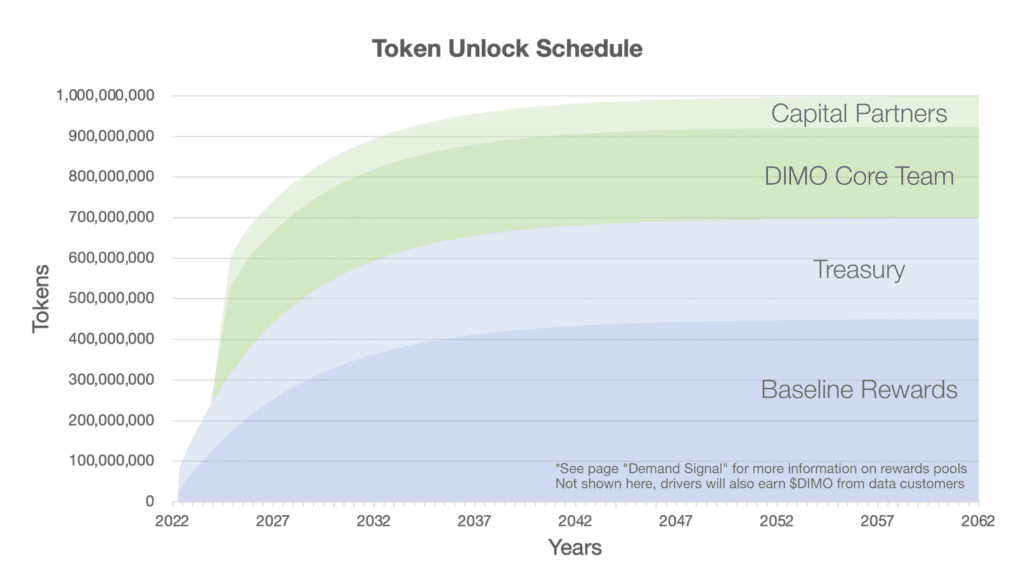

Token

DIMO

- Utility: Governance, payment for data access via DIMO Credits (DCX), staking/licensing (e.g., manufacturer licenses), and community rewards.

- Tokenomics: Fixed 1,000,000,000 supply; long-dated issuance for drivers, DAO treasury, team/investors with multi-year unlocks starting 2025.

- Launch: Mainnet/airdrop initiated Dec 2022 on Polygon; bridged to Ethereum; migration to Base slated for 2025.

Team

- Andy Chatham . Co-Founder & CEO (ex-Waymo/Transdev)

- Yevgeny Khessin . Co-Founder & CTO (ex-Argo AI/Ford)

- Alex Rawitz . Co-Founder & COO

- Rob Solomon . Co-Founder & CFO

Polymarket is leading the charge in decentralized prediction markets, building information protocols that span diverse industries and use cases.

Will NVIDIA Crush Earnings on November 19? (95.2% Accurate Forecast)

NVIDIA officially reports earnings November 19, but you can get a sneak peek right now.

On Polymarket (95.2% accurate), you can now profit from your conviction on earnings, without owning a single share of stock.

Here's how Earnings Markets work:

Trade simple Yes / No outcomes: Will NVDA beat revenue? Will guidance surprise?

Predict what executives will say on earnings calls

Profit directly from being right, regardless of how the stock reacts

See what top forecasters predict in real-time

NVIDIA has beaten expectations 8 quarters straight.

Will they make it 9?

3. Oraichain

Sector . AI first Layer-1 blockchain and AI oracle network (Cosmos SDK + EVM)

Status . Active mainnet (EVM compatibility; VRF and AI Execution subnetworks live)

Oraichain is an AI-focused L1 that brings verifiable AI services to smart contracts via an AI Oracle, unifying Cosmos IBC with a native EVM. Purpose-built subnetworks (e.g., VRF 2.0 and AI Execution) scale oracle workloads while providing cryptographic proofs of correctness and execution. With OraiDEX and OBridge, developers tap cross-chain liquidity alongside a full developer toolkit.

Features

- AI Oracle 2.0: Verifiable AI calls for smart contracts with proofs of execution/correctness.

- VRF 2.0: Threshold-crypto randomness. unpredictable, publicly verifiable, and bias-resistant.

- OraichainEVM: Native EVM support next to IBC and CosmWasm for broad dev accessibility.

- OraiDEX + Universal Swap: Seamless cross-chain swaps via integrated OBridge.

- Subnetworks: Optimistic/zk modules to scale oracle workloads while anchoring to L1 security.

Investors

- Strategic equity: Rikkeisoft (2020) for a 10% stake; ongoing DAO programs (e.g., ecosystem funding for 2024–2025).

Token

ORAI

- Utility: Gas/fees, staking for network security, and on-chain governance.

- Tokenomics: Max supply ~19.78M ORAI; circulating supply in the mid-teens (millions) with treasury/foundation/eco allocations; historical burns reduced supply.

- Launch: 2020 mainnet with ERC-20/BEP-20 bridges; OraiDEX’s ORAIX governance token launched later for the DEX.

Team

- Chung Dao . Chief Advisor & Chairman (Ph.D., University of Tokyo)

- Diep Nguyen . Chief AI Scientist/COO (Ph.D., Keio University)

- Tung Do . CEO, Oraichain Labs US

- Tu Pham . CTO

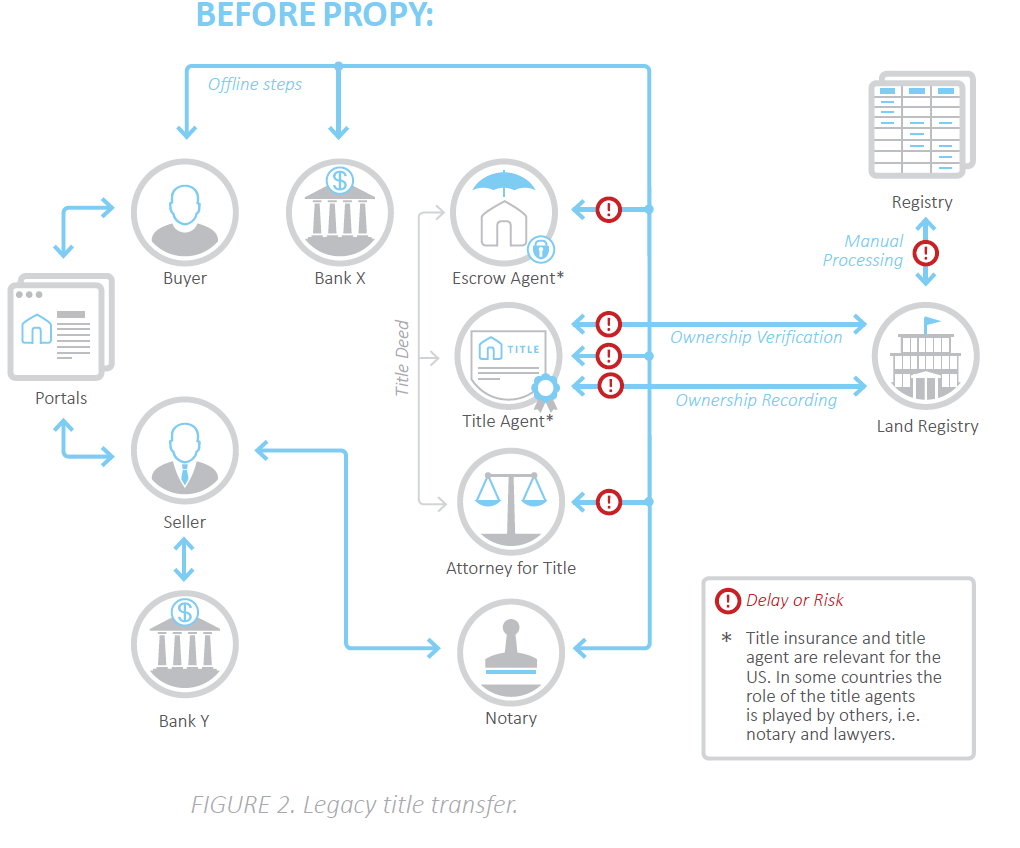

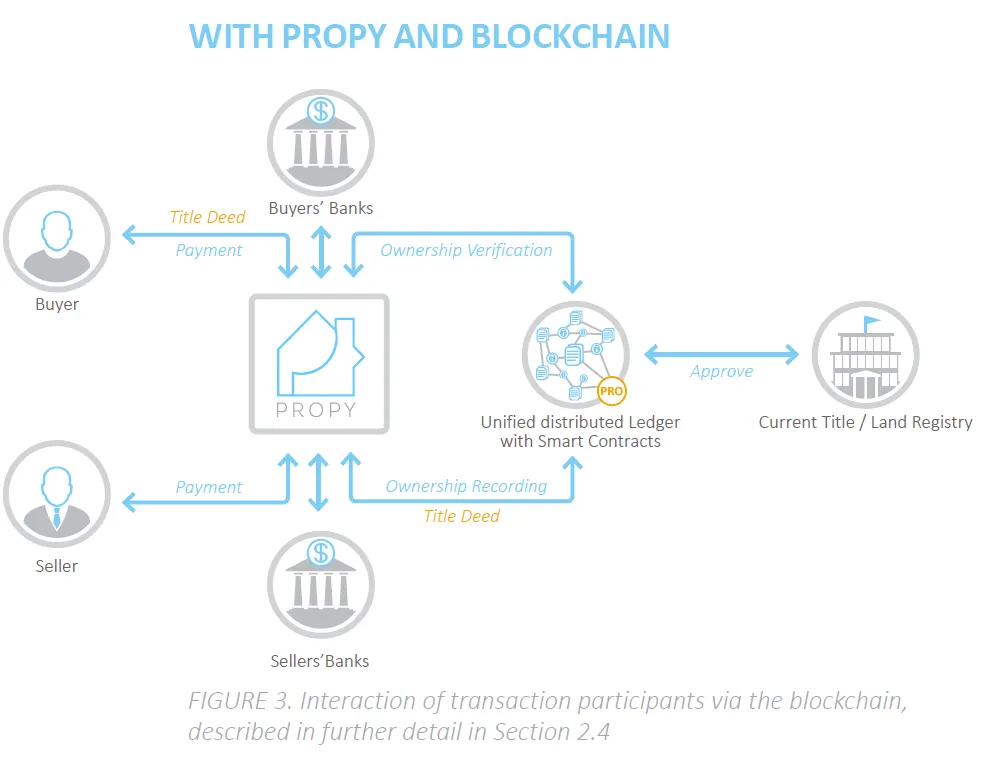

4. Propy

Sector . Real-world assets (RWA), PropTech . blockchain + AI title & escrow, on-chain deed recording

Status . Active (licensed Title & Escrow in multiple U.S. states; expansion underway via AI-led roll-up)

Propy combines licensed Title & Escrow operations with smart contracts and AI to digitize the entire real estate closing process. It supports fiat, crypto, and NFT-powered transactions and records deeds with counties and on-chain, issuing a blockchain certificate per closing. The company reports billions in facilitated transaction value and is deploying its AI escrow officer, “Agent Avery,” to automate compliance, communications, and fund flows.

Features

- AI escrow officer (Avery): 24/7 automation for checklists, communications, and compliance tasks.

- On-chain deed recording: County filings plus blockchain certificates for tamper-evident provenance.

- Licensed Title & Escrow: Close traditional or crypto deals with smart contracts mirroring escrow logic.

- Offer management suite: Centralized intake, comparisons, counters, and agent dashboards.

- Integrated KYC/notary: Digital identity verification and online notarization embedded in the flow.

Investors

- Token sale (2017): >$12.7M raised to bootstrap the network.

- Strategic/VC: Tim Draper (Draper Associates), Second Century Ventures (NAR REACH), plus advisors/backers including Dr. Michael S. Piwowar and Michael Casey.

- Growth facility (2025): ~$100M in private credit/DeFi financing to support an acquisition roll-up of regional title firms.

Token

PRO

- Utility: Pay registry fees for on-chain recording of title transfers and property events; staking/loyalty mechanics across the ecosystem.

- Tokenomics: Fixed 100,000,000 PRO supply; historical allocations include Token Sale (35%), Network Growth (35%), Company (15%), Donation (15%).

- Launch: Aug–Sep 2017 token sale; ERC-20 contract on Ethereum with 2025 exchange listings expansion.

Team

- Natalia Karayaneva . CEO, Propy; President, Propy Title

- Anna Atencio . CEO, Propy Title

- Eric L. Cruz . Chief Revenue Officer

- Advisors: Dr. Michael S. Piwowar; Michael Casey; Chris Campbell; Mike Jones

5. Phala Network

Sector . Confidential Computing / DePIN / Web3 + AI Infrastructure

Status . Active (mainnet; Phala Cloud + GPU TEE services live; expanded enterprise focus)

Phala is a decentralized confidential compute cloud that runs privacy-preserving workloads. including AI inference and agents. inside hardware Trusted Execution Environments (Intel SGX/TDX, NVIDIA Confidential Computing). Nodes produce cryptographic attestations proving code identity and enclave state, verifiable on chain or by Web2 systems. The platform now offers managed deployments via Phala Cloud and full-stack GPU TEE support for modern LLMs.

Features

- Confidential AI on GPU TEE: Run LLM inference on H100/H200/B200 GPUs with hardware isolation and attestation.

- Phala Cloud: Managed platform to deploy Dockerized apps as TEE contracts with per-second billing.

- AI Agent Contracts: Off-chain programs in TEEs that call Web2 APIs and settle back on chain.

- Trust Center: Public portal exposing real-time attestation chains from hardware to app.

- Decentralized compute network: Distributed worker nodes stake PHA and provide confidential capacity.

Investors

- Seed (~$10M, 2020) with IOSG Ventures, SNZ, Waterdrip, Incuba Alpha, and others; later strategic support from DWF Labs (2024).

Token

PHA

- Utility: Pay for confidential compute, stake/delegate for worker capacity and security, provider rewards, and governance.

- Tokenomics: 1,000,000,000 max supply; mining-style emissions with periodic halvings; investors (~15%), team (~5%), ecosystem/community and mining rewards make up the remainder.

- Launch: Sept 2020; native on Phala/Khala with ERC-20 representations for bridges; parachain campaigns distributed PHA from 2022.

Team

- Marvin Tong . Co-Founder & CEO (ex-Tencent/Didi)

- Hang Yin . Co-Founder & CTO (aka h4x3rotab; ex-Google)

- Zoé Meckbach . VP of Growth

Sponsored by Masterworks, specialists in cutting-edge infrastructure investments where artificial intelligence, robotics, and defense technology converge.

Where to Invest $100,000 According to Experts

Investors face a dilemma. Headlines everywhere say tariffs and AI hype are distorting public markets.

Now, the S&P is trading at over 30x earnings—a level historically linked to crashes.

And the Fed is lowering rates, potentially adding fuel to the fire.

Bloomberg asked where experts would personally invest $100,000 for their September edition. One surprising answer? Art.

It’s what billionaires like Bezos, Gates, and the Rockefellers have used to diversify for decades.

Why?

Contemporary art prices have appreciated 11.2% annually on average

…And with one of the lowest correlations to stocks of any major asset class (Masterworks data, 1995-2024).

Ultra-high net worth collectors (>$50M) allocated 25% of their portfolios to art on average. (UBS, 2024)

Thanks to the world’s premiere art investing platform, now anyone can access works by legends like Banksy, Basquiat, and Picasso—without needing millions. Want in? Shares in new offerings can sell quickly but…

*Past performance is not indicative of future returns. Important Reg A disclosures: masterworks.com/cd.