We're proud to have Attio as today's lead sponsor of Token Metrics, supporting our mission to deliver cutting edge insights and connect the investment community.

Introducing the first AI-native CRM

Connect your email, and you’ll instantly get a CRM with enriched customer insights and a platform that grows with your business.

With AI at the core, Attio lets you:

Prospect and route leads with research agents

Get real-time insights during customer calls

Build powerful automations for your complex workflows

Join industry leaders like Granola, Taskrabbit, Flatfile and more.

1. Executive Summary

Official links: Website | X (Twitter) | Discord | GitHub

2. About the Project

2.1. Vision

Cysic’s ambition is to make compute provable, programmable, and yield bearing on chain. The project frames this as ComputeFi: turning idle and active compute from GPUs to ZK focused ASICs into liquid assets that can be staked, scheduled, verified, and rewarded. In their own words, the goal is to “turn GPUs and ASICs into liquid, yield bearing assets,” unlocking a global marketplace where anyone can supply, verify, or consume compute with cryptographic guarantees.

2.2. Problem

Zero knowledge proving and AI inference/training are compute intensive, costly, and latency sensitive. For ZK rollups, prover bottlenecks constrain throughput and drive fees. For AI, decentralized compute networks often emphasize supply without strong, composable verification of the work performed. Today’s landscape is fragmented marketplaces, verifiers, and application integrations are siloed while verification of off chain work is frequently opaque, limiting trust, capital efficiency, and composability across chains.

2.3. Solution

Cysic tackles this via a vertically integrated approach:

- Custom silicon and acceleration: The C1 ASIC and products like ZK Air and ZK Pro are purpose built to accelerate ZK proving, improving cost and proofs per-watt compared with commodity CPUs and even general GPUs.

- Verification first network: Provers execute jobs off chain and produce results that are verified by validators before finality. This ensures correctness is checked before state transitions, elevating trust and composability.

- Proof of-Compute consensus: The L1 is secured by PoC, rewarding correctly executed and verified compute. Validators participate under a BFT model to attest to correctness.

- Open marketplace: A single interface connects compute suppliers (GPUs/ASICs), verifiers, and consumers (ZK rollups, AI inference, coprocessors, zkVMs), turning heterogeneous hardware into yield bearing on chain assets.

By unifying hardware acceleration with verifiable settlement, Cysic aims to offer a single, programmable substrate for ZK and AI workloads, where cost, latency, and trust are optimized holistically rather than piecemeal.

3. Market Analysis

The addressable market spans decentralized physical infrastructure networks (DePIN) for compute and the rapidly growing ZK and AI stacks. Demand drivers include:

- L2/ZK adoption: As more rollups move to proof systems for scalability and privacy, prover capacity becomes a key throughput and fee variable.

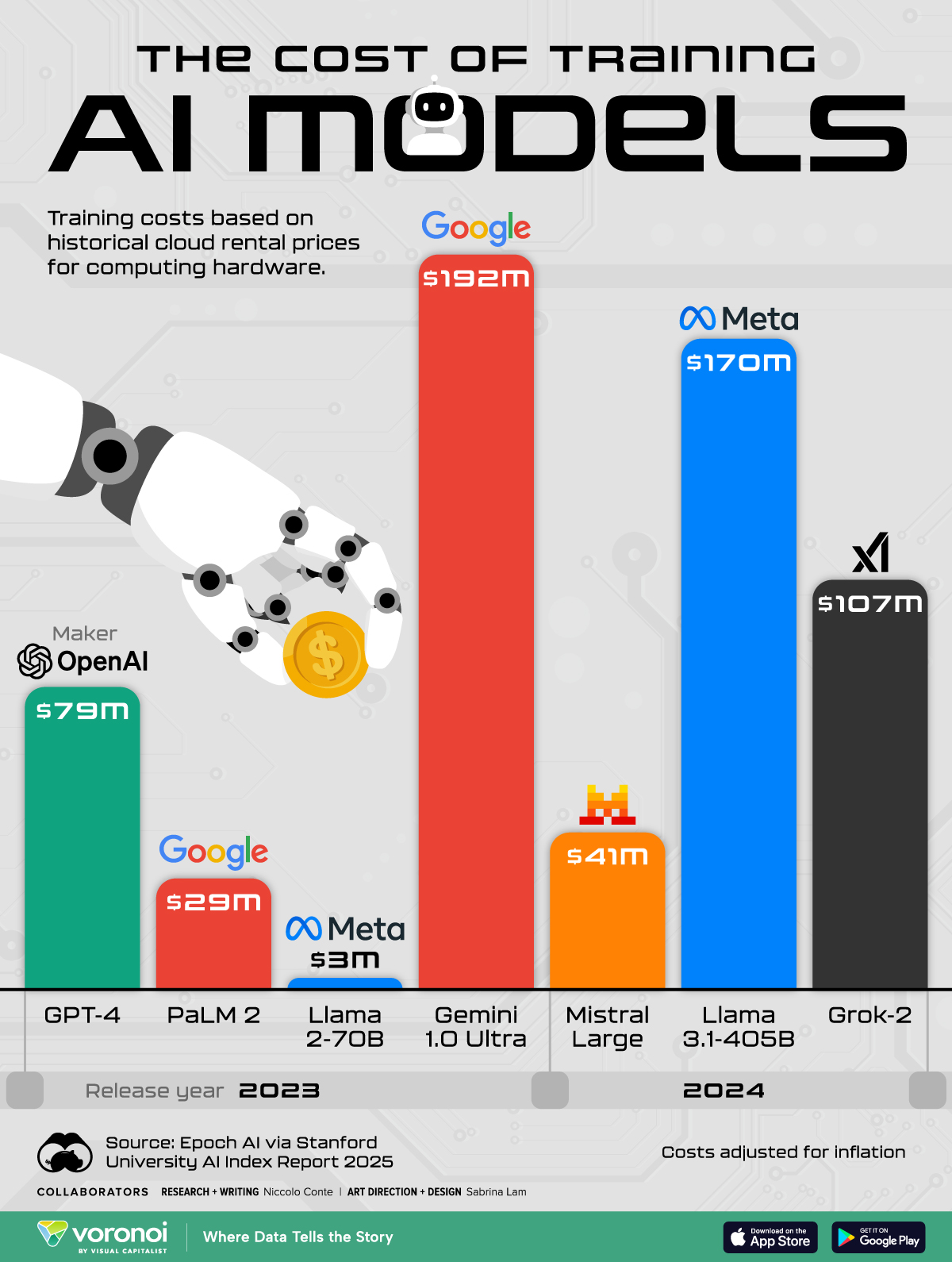

- AI inference and training: Model sizes and workloads rise quickly, pushing demand for flexible, cost optimized compute with verifiable outputs.

- On chain verifiability: Builders want off chain execution with on chain settlement that is cryptographically assured, improving composability for complex apps.

The sector has strong momentum with decentralized GPU and AI networks gaining adoption. Yet many solutions focus on marketplaces alone, without a robust, native verification layer or specialized silicon for ZK. Cysic’s edge is the combination of hardware acceleration, a verification first architecture, and a PoC secured L1 a full stack approach designed to serve both ZK rollups and AI use cases that require trust in results, not just access to raw compute.

3.1. Competition

Comparable projects illustrate sector breadth and help clarify Cysic’s positioning:

| Project | Focus & Description | Cysic's Differentiation |

|---|---|---|

| Akash Network (AKT) | A decentralized cloud marketplace on Cosmos, optimized for permissionless compute supply. Akash focuses on open access to resources. | Not purpose built for ZK acceleration or pre finality verification on an L1. Cysic differentiates with ZK centric hardware and PoC validation. |

| Aethir | A DePIN GPU cloud serving AI/ML and cloud gaming. It redistributes idle compute at scale. | Cysic's emphasis is on verifiable compute and ZK acceleration, paired with a consensus layer that rewards validated work. |

| IO.net | A decentralized GPU provider built for AI training/inference. Targets AI builders and model workflows. | Cysic prioritizes ZK proving performance with hardware specialization and a PoC verification first design. |

| Bittensor (TAO) | A decentralized AI network with a subnet economy and growing institutional attention. | Cysic is focused on verifiable compute for ZK/AI, aiming to make compute outputs universally provable and settleable on chain. |

Across these comparisons, the core differentiator is that Cysic attempts to integrate all three layers specialized hardware, a verification layer, and a PoC secured L1 marketplace rather than shipping a single layer in isolation.

4. Features

- Proof of-Compute (PoC) L1: Consensus is anchored to verified computation. Provers execute jobs; validators verify correctness prior to finality under a BFT model. This creates a strong trust foundation for settlement of off chain work.

- Custom Silicon: C1: Cysic’s in house ASIC targets ZK acceleration. By optimizing the critical math in proof generation, the chip aims to deliver superior proofs per-watt versus commodity silicon.

- Product Lines: ZK Air and ZK Pro: ZK Air targets more accessible proving services; ZK Pro is tuned for high throughput/low latency workloads. Together, they broaden the supply curve from consumer grade GPUs to enterprise grade accelerators.

- Verifiable Compute Pipeline: Results are accompanied by cryptographic proofs and attested by validators before being settled on chain, improving trust, composability, and DeFi like programmability of compute outputs.

- Open Marketplace: A single interface connects suppliers, verifiers, and consumers. Hardware owners onboard their GPUs/ASICs; consumers request jobs (ZK, AI, others); verifiers earn by validating correctness.

- Programmability and Tooling: SDKs and APIs allow L2s, zkVMs, and coprocessors to integrate directly. The aim is to make scheduling and payment transparent while turning compute capacity into a programmable primitive.

- Scroll Proving Collaboration: Cysic provides high performance proving capacity to enhance L2 throughput by reducing proof times “proof time reductions are key to L2 scaling.”

- Real Time Hardware Prover: Collaboration with Polyhedra to deliver real time hardware accelerated proving, aimed at reducing latency for compute heavy applications.

- Security and Economics: The PoC model ties rewards to correct work, and verification happens prior to state changes. This is designed to discourage incorrect results and promote reliable service quality.

Today's Token Metrics insights are brought to you in partnership with Superhuman AI.

Go from AI overwhelmed to AI savvy professional

AI will eliminate 300 million jobs in the next 5 years.

Yours doesn't have to be one of them.

Here's how to future-proof your career:

Join the Superhuman AI newsletter - read by 1M+ professionals

Learn AI skills in 3 mins a day

Become the AI expert on your team

5. Token

Ticker: $CYS

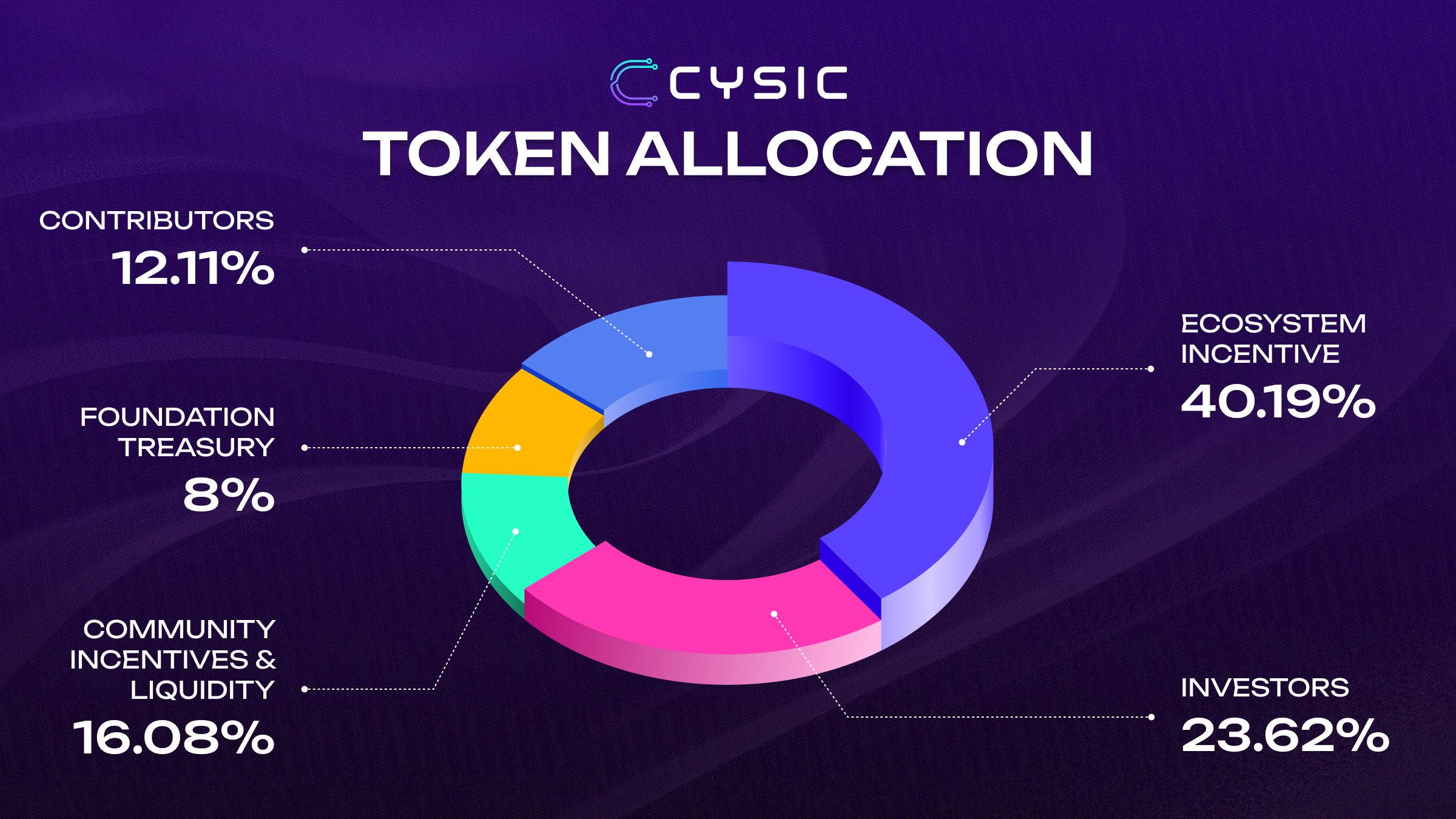

Role: CYS is the economic substrate of the network. It is used to pay for verified compute, secure consensus via staking, distribute rewards among provers and validators, and participate in governance through a dual asset model. Public materials indicate a max supply of 1B and point to a potential December 2025 launch timeline (subject to change). Circulating supply and token distribution details may evolve; investors should check official channels at launch.

5.1. Utility

- Payments for Compute: Consumers (e.g., L2s, AI inference tasks) pay in CYS for verified work.

- Staking and Security: Participants stake CYS to secure the PoC L1 and align incentives around correctness and availability.

- Rewards: Provers and validators earn CYS for delivering and validating correct computation prior to finality.

- Governance via CGT: Staking CYS mints CGT, a non transferable governance and scheduling credit used for network coordination, prioritization, and policy decisions.

In short, CYS links value to verified work, turning compute time into an on chain cash flow. CGT provides the non transferable coordination layer so that scheduling and governance aren’t distorted by purely speculative flows.

6. Team

Xiong (Leo) Fan, Founder & CEO PhD in cryptography (Cornell), former Assistant Professor at Rutgers CS, and a prior researcher at Algorand. He is an active public voice on ZK and Cysic’s ComputeFi vision of converting GPUs and ASICs into yield bearing assets.

Bowen Huang, Co founder (Hardware/ASIC) Six years at the Institute of Computing, Chinese Academy of Sciences; doctoral studies at Yale; experienced in chip development and patents. His background underpins Cysic’s pursuit of ZK specific silicon.

Leadership blends academic cryptography and practical chip design a rare combination that is central to Cysic’s hardware software co design approach.

7. Traction

- User Growth: Approximately 1.36M registered users in testnet phases.

- Network Activity: 11.9M+ testnet transactions.

- Node Participation: Around ~41k provers and ~223k verifiers, totaling over ~260k nodes involved during testing.

- Integrations: Collaboration with Scroll for high performance ZK proving; partnership with Polyhedra to deliver a real time hardware prover.

- Community: ~180.5k followers on X (Twitter), with ongoing engagement programs such as CyRunners.

- Testnet Milestones: Phase III completed on September 18, 2025, consolidating user, node, and transaction growth ahead of mainnet.

These metrics signal strong pre mainnet interest and demonstrate that the supply and verification sides can scale concurrently an essential proof point for a verification first compute network.

8. Investors

Cysic announced a $12M Pre A round in May 2024, co led by HashKey Capital and OKX Ventures. Participants include Polychain Capital, IDG, Matrix Partners, ABCDE, SNZ Holding, Bit Digital, CoinSwitch, and Web3.com Ventures. Investor commentary emphasized that ZK performance depends not only on algorithmic innovation but also on hardware acceleration a core tenet of Cysic’s thesis.

9. Conclusion

Cysic's thesis is straightforward: a full-stack, verification-first compute network can unlock growth for ZK rollups and AI by making compute provable, programmable, and yield-bearing on-chain. The C1 ASIC, ZK Air/Pro offerings, PoC-secured L1, and open marketplace position the project to serve L2 proving needs and AI workloads that demand verifiable results.

Key strengths: custom silicon paired with a verifiable compute L1 creates a hardware moat; proven demand from rollups like Scroll; robust testnet metrics signal healthy marketplace activity. Primary risks: hardware execution and supply chain hurdles, competition from other DePIN networks, coordination complexity across diverse hardware, and token launch volatility in uncertain markets.

The critical question is whether Cysic can sustain advantages in cost-per-proof efficiency, verification reliability, and rapid integration across ZK stacks. Success hinges on timely mainnet delivery, ecosystem expansion beyond Scroll, competitive proof economics, and sustained verified job volume—the catalysts investors should monitor closely.

Token Metrics is sponsored by Elite Trade Club.

If You Could Be Earlier Than 85% of the Market?

Most read the move after it runs. The top 250K start before the bell.

Elite Trade Club turns noise into a five-minute plan—what’s moving, why it matters, and the stocks to watch now. Miss it and you chase.

Catch it and you decide.

By joining, you’ll receive Elite Trade Club emails and select partner insights. See Privacy Policy.