1. Executive Summary

Zama is building privacy infrastructure for public blockchains using fully homomorphic encryption (FHE). Its fhEVM stack allows smart contracts to compute on encrypted data while preserving composability. The company takes an open-source approach, publishing TFHE-rs, Concrete, and fhEVM with an EVM-first strategy.

Public blockchains suffer from radical transparency, creating MEV and deterring institutional adoption. Prior solutions mixers, TEEs, ZK impose trust assumptions or restrict composability. Zama makes confidentiality default without breaking composability.

The company raised a $57M Series B in June 2025 at a $1B+ valuation (following a $73M Series A). Zama launched an fhEVM coprocessor on Ethereum Sepolia and opened a public testnet in 2025. Strong developer traction: ~26k GitHub stars on fhEVM, early pilots in privacy-preserving DeFi and identity.

We're proud to have RAD Intel as today's lead sponsor of Token Metrics, supporting our mission to deliver cutting edge insights and connect the investment community.

$1K Could’ve Made $2.5M

In 1999, $1K in Nvidia’s IPO would be worth $2.5M today. Now another early-stage AI tech startup is breaking through—and it’s still early.

RAD Intel’s award-winning AI platform helps Fortune 1000 brands predict ad performance before they spend.

The company’s valuation has surged 4900% in four years* with over $50M raised.

Already trusted by a who’s-who roster of Fortune 1000 brands and leading global agencies. Recurring seven-figure partnerships in place and their Nasdaq ticker is reserved: $RADI.

This is a paid advertisement for RAD Intel made pursuant to Regulation A+ offering and involves risk, including the possible loss of principal. The valuation is set by the Company and there is currently no public market for the Company's Common Stock. Nasdaq ticker “RADI” has been reserved by RAD Intel and any potential listing is subject to future regulatory approval and market conditions. Investor references reflect factual individual or institutional participation and do not imply endorsement or sponsorship by the referenced companies. Please read the offering circular and related risks at invest.radintel.ai.

2. About the Project

2.1. Vision

Zama’s vision is to make confidentiality a default setting for public blockchains and cloud/AI systems. By making FHE practical and developer friendly, Zama wants users to benefit from verifiable on chain computation without exposing sensitive data. In other words, DApps should be able to prove that computation was performed correctly, while the plaintext data remains encrypted end to end.

2.2. Problem

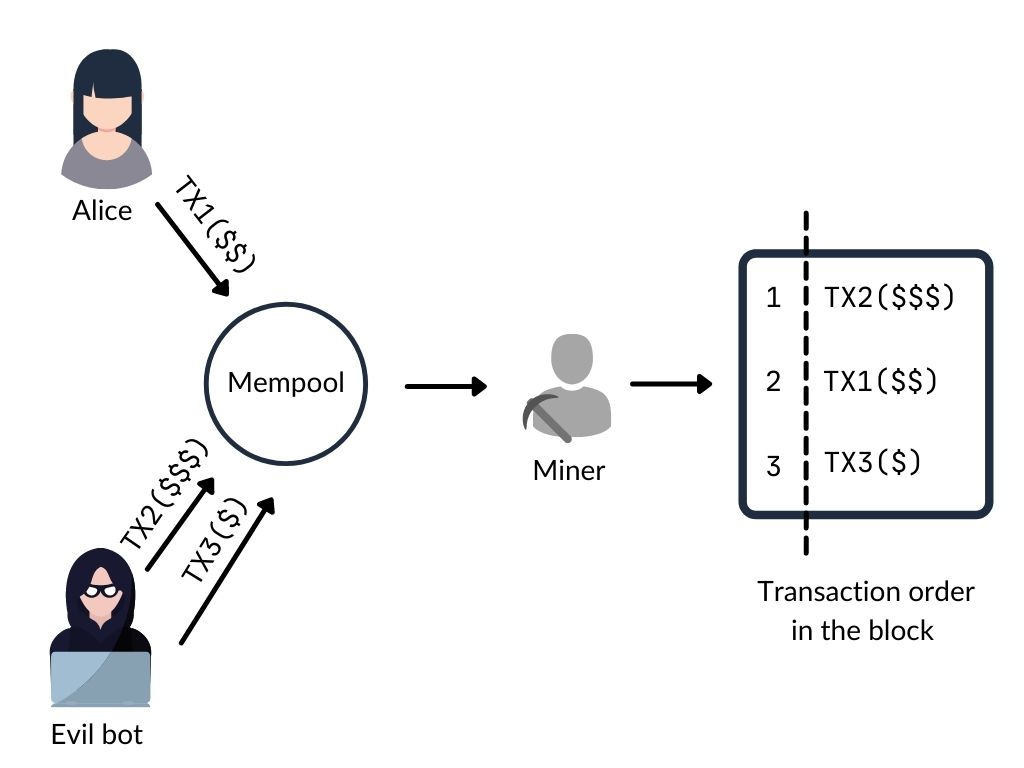

On public chains today, everything from orders and balances to parameters of trading strategies is transparent by default. That design fuels front running and other forms of MEV, erodes user trust for sensitive financial or identity use cases, and makes many institutions reluctant to transact on chain. Previous privacy approaches have made progress but fall short:

- Mixers can obfuscate linkages but sacrifice programmability and have drawn regulatory scrutiny.

- TEEs introduce hardware trust assumptions and potential centralization.

- ZK based privacy shines for proving statements about data, but generalized encrypted state and arbitrary computation on ciphertexts often require application specific circuits and can reduce composability.

The result is a gap between what DeFi and on chain AI could support versus what is practical with today’s privacy tooling.

2.3. Solution

Zama’s stack centers on the fhEVM and the Zama Confidential Blockchain Protocol. Developers can write Solidity contracts that operate on encrypted types; transactions, state, and outputs stay encrypted. The system uses:

- FHE coprocessor (off chain) to perform heavy duty homomorphic operations efficiently.

- Decentralized MPC based key management system (KMS) to enable threshold decryption without any single party holding decryption keys.

- On chain gateway contracts to orchestrate requests, verify proofs, and ensure data availability and composability.

This approach preserves on chain settlement and composability while keeping data confidential. For builders, it means designing private DeFi flows dark pools, confidential stablecoins, private lending, and payroll without giving up the EVM ecosystem’s network effects.

3. Market Analysis

Addressable market. Privacy is now table stakes across DeFi, identity, real world assets (RWA), and on chain AI. The near term addressable market for Zama includes:

- DeFi: Private order flow, dark pools, confidential AMMs, credit risk scoring with protected inputs, compliant yet private stablecoin transactions.

- Identity and Governance: Confidential voting, attestations, and reputation systems that can be verified without exposing personal data.

- On chain AI and data markets: Privacy preserving inference and training data monetization where model inputs and outputs remain encrypted.

Go to market. Zama targets the EVM first, where developer familiarity and tooling density are highest. The fhEVM coprocessor debuted on Ethereum Sepolia in late 2024, with the public testnet opening in 2025 and plans to support additional EVM chains. The strategy is to meet developers where they are, enabling Solidity with encrypted types rather than forcing a new programming paradigm.

Why now. Over the last two years, the industry has shifted from privacy as a niche feature to a requirement. As institutional on chain finance becomes more serious and AI meets crypto, confidentiality without sacrificing verifiability becomes essential. Zama’s timing aligns with this secular trend, and its open source posture has already attracted a critical mass of developer attention.

3.1. Competition

FHE first stacks. Multiple teams are pursuing FHE coprocessors and FHE enabled L2s for Ethereum. Zama’s differentiation includes:

- Open source cryptography leadership: Publishing TFHE rs and research grade libraries (Concrete, Concrete ML) that push the state of the art.

- EVM first framework: fhEVM integrates encrypted types into Solidity to preserve composability.

- Depth of the cryptography team: Veteran researchers and engineers with a track record of peer reviewed work and productization.

4. Features

1) fhEVM: write Solidity with encrypted types. The fhEVM extends Solidity with encrypted integers and booleans, enabling developers to implement private logic while using familiar EVM tooling. Contracts interact with ciphertexts; cleartext is never revealed on chain.

2) FHE coprocessor. An off chain coprocessor handles the computationally intensive homomorphic operations. This architecture keeps Ethereum settlement and data availability, while shifting heavy math off chain for performance. The coprocessor integrates with on chain gateway contracts that coordinate requests and verify results.

3) Decentralized MPC based KMS. Rather than a single party holding decryption keys, the KMS splits key material across participants. Threshold decryption only occurs when authorized conditions are met, and no single actor can decrypt user data unilaterally.

4) End to-end encryption with verifiability. Inputs, state, and outputs are encrypted. Yet applications can provide verifiable guarantees that computations were performed correctly. This pairing privacy with verifiability is essential for compliant finance and institutional grade workflows.

5) On chain data availability and composability preserved. Unlike privacy systems that move state into opaque side silos, fhEVM aims to keep state and commitments visible to the base chain for availability while protecting the plaintext. Other protocols can still compose with encrypted contracts using standard EVM patterns.

6) Open source toolchain. Zama’s OSS portfolio includes:

- TFHE rs for programmable bootstrapping and efficient boolean/integer circuits.

- Concrete and Concrete ML for FHE friendly ML and application building blocks.

- fhEVM for Solidity level integration.

7) Developer experience and EVM alignment. By starting with the EVM, Zama minimizes switching costs for teams. Existing Solidity codebases and libraries can be adapted to encrypted types rather than rewritten from scratch in a new language or framework.

8) Use cases.

- Dark pools and private order flow: Submit and match orders without revealing size or price until settlement.

- Confidential stablecoins and payments: Preserve privacy for everyday transactions, corporate payroll, and business to-business flows.

- Private credit and risk: Compute risk scores and interest rates on encrypted borrower data while maintaining regulatory auditability.

- Confidential governance: Enable provably fair voting without exposing voter preferences.

- On chain AI inference: Run model inference on encrypted inputs, yielding encrypted outputs verifiable on chain.

9) Security model. Security rests on well studied hardness assumptions underpinning FHE schemes and the correctness of MPC threshold decryption. The model avoids single operator trust by distributing key control. As with all cutting edge cryptography, rigorous auditing, standardization, and battle testing are crucial, and Zama has emphasized open source review to accelerate this process.

10) Performance considerations. FHE is computationally heavy. Zama’s architecture mitigates latency via a specialized coprocessor and optimized libraries. Still, developers should budget for higher costs and longer execution times compared to plain EVM logic. Expected performance envelopes will improve as libraries mature, hardware accelerates, and the coprocessor network scales.

Today's Token Metrics insights are brought to you in partnership with Google AdSense.

Easy setup, easy money

Your time is better spent creating content, not managing ad campaigns. Google AdSense's automatic ad placement and optimization handles the heavy lifting for you, ensuring the highest-paying, most relevant ads appear on your site.

5. Token

As of December 3, 2025, Zama has publicly announced the upcoming launch of its $ZAMA utility token via a pioneering sealed-bid Dutch auction on Ethereum, set for January 12-15, 2026, offering 10% of the total 11B token supply at a $55M FDV floor with immediate unlocks and FHE-encrypted bids to ensure fairness and prevent bots. The token powers the Zama Protocol economy for fees, staking, delegation, and securing FHE operations, aligning with the mainnet rollout and ecosystem expansion—investors and builders should monitor official updates for participation details amid strong community buzz.

6. Team

Co founder & CEO: Dr. Rand Hindi. A cryptography and AI entrepreneur, Hindi is the public face of Zama’s product and funding milestones across major crypto media. He has articulated the fhEVM roadmap and the goal of making confidentiality a default property of public blockchains and AI systems.

Co founder & CTO: Dr. Pascal Paillier. A renowned cryptographer known for the Paillier cryptosystem, Paillier is a key voice for Zama’s FHE approach. His background bridges foundational research and practical system design, an important advantage as Zama productizes cutting edge cryptography.

Engineering and research bench. Zama’s broader team spans cryptographers, systems engineers, and compiler/ML specialists who contribute to TFHE rs, Concrete, Concrete ML, and fhEVM. The company’s open source orientation has helped it attract contributors and external reviewers, accelerating iteration cycles.

7. Traction

$ZAMA Token Auction Launch. Zama ignited massive excitement on X with its December 1, 2025 announcement of the $ZAMA Public Auction—a sealed-bid Dutch auction for 10% of the token supply on Ethereum, powered by FHE for confidential bidding and fair distribution without bots or gas wars, amassing over 2,200 likes and 800,000+ views in days. The post sparked threads on price discovery, immediate unlocks, and mainnet timelines, positioning $ZAMA as the utility token for fees, staking, and securing FHE coprocessors ahead of the January 2026 event.

Creator Program Momentum. Just a day later on December 2, Zama's launch of Season 5 of its Creator Program went viral, offering $50,000 in prizes for top 100 creators and 1,006 OG NFTs, drawing 1,000+ likes and 80,000+ views with calls to "be the first" in the final pre-TGE push. Community replies flooded with sign-up hype, emphasizing fun prototypes and education on homomorphic primitives via GitHub integrations.

Devcon Highlights and Partnerships. Zama's November recaps of its Ethereum Devcon presence, including the Zama CoFHE Shop and World's Fair, generated sustained buzz with 500+ likes per thread, featuring fireside chats like Juan Benet's on FHE privacy and announcements of genesis operators like Conduit for securing the protocol. These events underscored ecosystem pilots in DeFi and identity, with Shiba Inu community nods to FHE infrastructure amplifying cross-chain confidentiality discussions.

Media and Thought Leadership. CEO Rand Hindi's Bankless podcast appearance on December 1, shared widely on X, racked up 450+ likes exploring FHE's role in confidential tokens and 2026 privacy visions, while a clarifying thread on the Zama Protocol as a cross-chain layer (not L1/L2) hit 1,500+ likes, educating devs on FHE+MPC+ZK hybrids for verifiable, scalable apps.

8. Investors

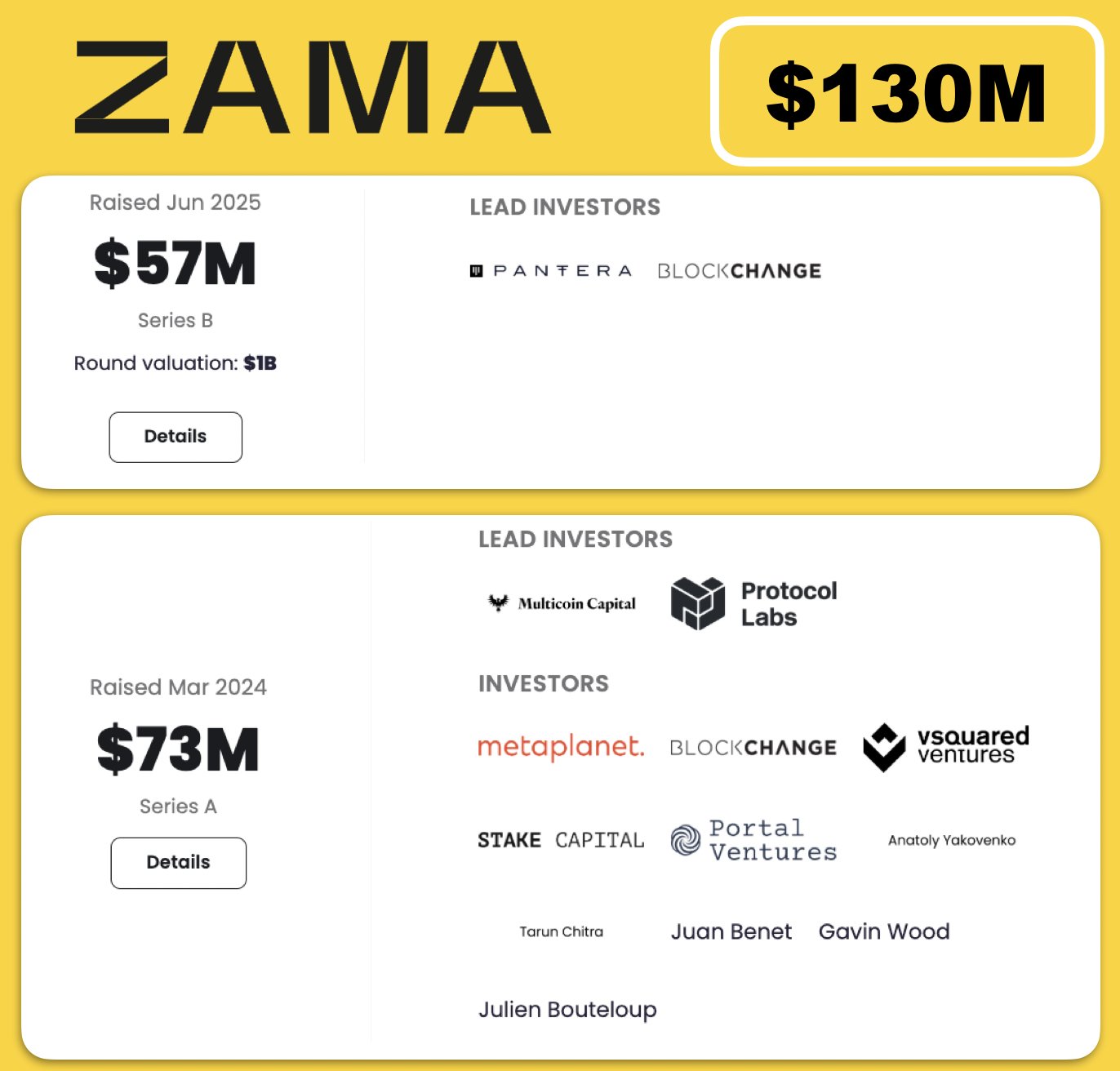

- Series B (June 25, 2025): $57M co led by Pantera Capital and Blockchange Ventures; valuation above $1B.

- Series A (March 7, 2024): $73M led by Multicoin Capital and Protocol Labs.

- Angels: Anatoly Yakovenko (Solana), Gavin Wood (Ethereum/Polkadot), Juan Benet (Filecoin).

Across rounds, Zama has assembled a cap table that blends leading crypto native funds with foundational protocol builders, a strong signal for technical credibility and go-to-market reach.

9. Conclusion

FHE promises a future where confidentiality and verifiability coexist on public blockchains. Zama has positioned itself at the center of that future with an EVM first strategy, a robust open source portfolio, and a pragmatic architecture that blends on chain settlement with an off chain FHE coprocessor and decentralized threshold decryption. The company now has the capital, talent, and early network effects to drive market education and adoption.

For investors and builders, the key questions are execution and timing. Can Zama continue to reduce performance overheads, scale a decentralized KMS, and standardize primitives through rigorous audits? Can the team convert developer enthusiasm into production deployments in DeFi, identity, and on chain AI? The 2025 public testnet, ecosystem pilots, and growing OSS traction are encouraging signals. If successful, Zama’s fhEVM could make privacy a default setting for the EVM unlocking new institutional, consumer, and AI native applications that were previously out of reach on transparent ledgers.

To explore the stack and follow progress: GitHub | Medium | X (Twitter) | Discord.

Token Metrics is sponsored by Superhuman AI.

Go from AI overwhelmed to AI savvy professional

AI will eliminate 300 million jobs in the next 5 years.

Yours doesn't have to be one of them.

Here's how to future-proof your career:

Join the Superhuman AI newsletter - read by 1M+ professionals

Learn AI skills in 3 mins a day

Become the AI expert on your team