Avantis (AVNT): Building the Universal Leverage Layer on Base

Publication date: November 04, 2025

1. Executive Summary

Avantis is a decentralized perpetuals exchange on Base that lets users trade crypto and synthetic real‑world assets (forex, metals, commodities, indices—with equities and more planned) with high leverage, a novel zero‑fee on profitable trades mechanic, and risk‑tiered liquidity vaults. Developed by core contributor Lumena Labs, Avantis has raised $12M across seed and Series A, launched its token AVNT on September 9, 2025, and has quickly become one of Base’s leading derivatives DEXs by volume and TVL.

- Vision: Build the “universal leverage layer” that brings every global market onchain—spanning crypto, macro, and new verticals like sports and prediction markets—while keeping trading fast, gasless, and permissionless. In June 2025 the team outlined Avantis v2: an AMM upgrade to support any price feed and a custom EVM‑compatible chain designed for fast, gasless trading and cross‑margin. Source

- Differentiators: Zero‑fee perps (fees apply only to profitable trades), a Loss Rebate mechanism to stabilize skew, dynamic open interest management, and tiered USDC vaults for LPs. Oracle architecture blends Pyth (low latency) and Chainlink (resilience).

- Market position: Operating within Base’s fast‑growing ecosystem and ranking among the top derivatives venues on Base by volume/TVL. The onchain perps segment shows robust demand—aggregated DeFi perps 7‑day volumes have hovered around the hundreds of billions, indicating a deep and expanding market. DefiLlama

- Key metrics (late Oct 2025): TVL ≈ $114M on Base; 30‑day perps volume ≈ $15.7B; cumulative volume $41B+; 30‑day fees ≈ $4.2M; open interest ≈ $40M. DefiLlama

- Token: AVNT (max supply 1B; ~258.2M circulating as of Oct 27, 2025; ≈83.6K holders). Post‑TGE, AVNT listed on multiple CEXs including Binance, Upbit, Bithumb. ATH: $2.66 (Sep 22, 2025); ATL: $0.1796 (Sep 9, 2025). CoinMarketCap; BeInCrypto

- Backers: Seed led by Pantera (with Founders Fund, Galaxy, Base Ecosystem Fund, Modular Capital); $8M Series A co‑led by Founders Fund and Pantera with Symbolic, SALT Fund, and Flowdesk participating. The Block

- Risks: Allegations of airdrop Sybil activity (≈$4M) under community scrutiny; competitive pressure from top perps DEXs; regulatory uncertainty for synthetic RWAs and future sports/prediction markets; oracle/latency risks when expanding to new feeds. BeInCrypto

As Pantera’s Paul Veradittakit put it, “Avantis is pioneering a new class of DeFi infrastructure by bringing global macro markets natively onchain.” Source

2. About the Project

Avantis is positioning itself as the universal leverage layer—a modular, transparent, onchain venue where traders can access leverage across crypto and macro assets under one roof. Built on Base, Avantis aims for a CEX‑like experience with DeFi’s transparency and self‑custody guarantees.

2.1. Vision

The team’s north star is clear: unify leverage across every market category onchain—crypto majors and long‑tail assets, forex, metals like gold, commodities such as crude oil, indices, and new verticals like sports and prediction markets—while preserving permissionless access and robust risk controls. In June 2025, CEO Harsehaj (“Sehaj”) Singh previewed Avantis v2: an AMM overhaul to support any price feed and a custom EVM‑compatible chain focused on fast, gasless trading and cross‑margin for RWA markets. The Block

“We’re setting clear goals and KPIs… to truly bring every global asset, market and event onchain.” — Harsehaj Singh Source

2.2. Problem

Onchain derivatives have historically faced four persistent challenges:

- Misaligned fees: Upfront trading fees that don’t correlate with outcomes can erode trader PnL and misalign incentives.

- Liquidity fragmentation and LP risk: AMM‑based perps often concentrate LP risk, leading to adverse selection during volatility.

- Limited market coverage: Most onchain venues have focused on crypto, lacking robust synthetic access to macro assets.

- Latency and oracle constraints: Extending into FX/commodities/equities requires low‑latency, resilient price feeds to avoid oracle manipulation and slippage.

2.3. Solution

Avantis’ design choices target these pain points directly:

- Zero‑Fee Perpetuals: Avantis charges a fee only on profitable trades, improving trader economics and aligning incentives between users and the protocol.

- Loss Rebate + Dynamic OI: A Loss Rebate mechanism—paired with dynamic open interest controls—helps stabilize long/short skew and reduce LP adverse selection during volatile regimes.

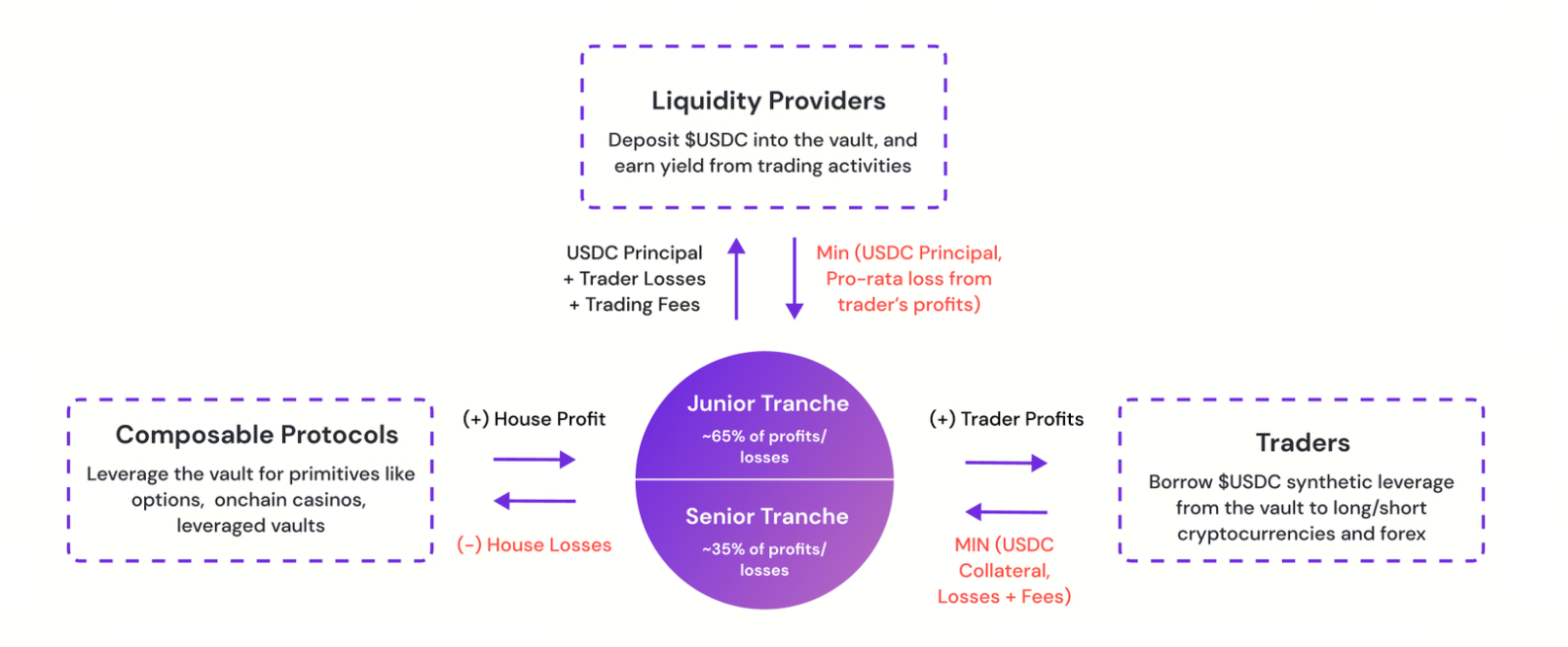

- Tiered USDC Vaults: LPs can select risk‑tranche exposure across tiered USDC vaults, better matching risk/return preferences rather than forcing one‑size‑fits‑all liquidity.

- Dual‑Oracle Architecture: Pyth for speed and Chainlink for robustness aim to balance latency with resiliency—key for synthetic RWA markets like forex, gold, and crude oil.

- v2 Roadmap: AMM overhaul to support any price feed, plus a custom EVM chain for fast, gasless trading, better UX, and cross‑margin across diverse markets. Source

Together, these mechanics target the dual mandate of trader performance and LP risk management, while expanding the universe of onchain markets.

3. Market Analysis

The onchain perps category is one of DeFi’s largest and most durable segments. Recent data suggests that aggregated DeFi perpetuals volume has reached substantial levels (7‑day volume around the hundreds of billions), reflecting sustained migration of sophisticated traders to non‑custodial venues. Within this backdrop, Base has emerged as a high‑throughput L2 ecosystem with rising liquidity and user growth—fertile ground for a derivatives exchange prioritizing speed and cost efficiency. DefiLlama

Avantis’ mix of zero‑fee on profitable trades, synthetic RWA exposure, and Base’s throughput positions it to capture flow from both crypto‑native traders and macro‑oriented users seeking access to FX/commodities without centralized intermediaries. The planned v2—especially the gasless custom EVM chain—could further compress trading friction, improving retention and market share if execution matches ambition.

3.1. Competition

Competition in onchain derivatives is intense, spanning AMM, orderbook, and hybrid models. DefiLlama lists peer protocols such as Synthetix V3, Gains Network, Aevo Perps, Apex Omni, Vest, and Wasabi among comparable onchain derivatives offerings. Outside those, category leaders like dYdX, GMX, and Hyperliquid compete for overlapping users/liquidity. DefiLlama

Where Avantis differentiates:

- Fee model: Zero‑fee on profitable trades is designed to improve trader PnL and volume velocity, contrasting with conventional taker/maker or flat fee schedules.

- Market coverage: Systematic push into RWA synthetics (FX, metals, energy, indices) with plans for equities, sports, and prediction markets.

- Risk controls: Loss Rebate and dynamic OI aim to curb skew and LP adverse selection—persistent issues for AMM perps.

- Roadmap: A custom, gasless EVM chain and AMM that supports any price feed could narrow the UX gap with CEXs while preserving self‑custody.

Still, incumbents hold advantages: dYdX’s mature orderbook liquidity, GMX’s brand and GLP‑style ecosystem, and Gains/Synthetix’s synthetic playbooks. For Avantis to carve durable share, v2 execution, asset breadth, and liquidity depth will be decisive.

4. Features

Avantis’ feature set is designed to align incentives, enhance UX, and broaden market access:

- Zero‑Fee Perps: Fees accrue only to profitable trades, addressing the misalignment of paying fees regardless of outcome. This can improve expected net PnL and encourage strategy iteration.

- Loss Rebate: Rebates a portion of losses under defined conditions to dampen one‑sided flows and reduce volatility‑driven LP drawdowns. Paired with dynamic open interest controls, it helps manage market skew.

- Tiered USDC Vaults (Risk‑Tranche Design): LPs opt into tranche exposures commensurate with risk tolerance, rather than pooling into a monolithic vault. Better risk/return matching can broaden liquidity participation.

- Oracle Architecture: Combines Pyth for low‑latency updates and Chainlink for resilience. This dual approach is critical for non‑crypto synthetics where pricing precision and liveness are paramount.

- RWA Synthetics: Supports trading of forex, gold, crude oil, and indices as perpetuals—without exposure to centralized custody or broker risk. Equities, sports, and prediction markets are planned.

- Avantis v2 (Planned): An AMM capable of ingesting any price feed, plus a custom, gasless EVM chain with cross‑margin, designed to offer an institution‑grade UX while preserving transparency. Details

In short, the feature roadmap emphasizes cost‑efficient trading, diversified market access, and LP sustainability—cornerstones for scaling an onchain derivatives venue.

5. Token

Ticker: AVNT. Max supply: 1,000,000,000. Circulating: ~258.2M as of Oct 27, 2025. Holders: ~83.6K. ATH: $2.66 (Sep 22, 2025). ATL: $0.1796 (Sep 9, 2025). CoinMarketCap

Following its TGE on September 9, 2025, AVNT secured listings on multiple major CEXs, including Binance, Upbit, and Bithumb, catalyzing liquidity and visibility. BeInCrypto coverage

5.1. Utility

Per CoinMarketCap, AVNT is the native utility token that powers the protocol—supporting governance, incentives, and platform functions. As the platform scales to new markets and potentially deploys its own EVM chain, governance around risk parameters, market listings, and incentive programs could become increasingly material to tokenholders.

Note on distribution: Community discourse has focused on a reported airdrop Sybil incident (≈$4M). The project’s response and any mitigation steps will be key to long‑term sentiment. BeInCrypto

6. Team

Avantis is developed by Lumena Labs as the core contributor. CEO Harsehaj (“Sehaj”) Singh publicly outlined the v2 roadmap—including the AMM overhaul and custom EVM chain—and confirmed a Series A round and a team size of about 12 as of mid‑2025. Source

Singh emphasizes measurable execution: “We’re setting clear goals and KPIs… to truly bring every global asset, market and event onchain.” The team’s credibility will be tested by the complexity of delivering gasless trading, cross‑margin, and an any‑feed AMM while managing risk across synthetic RWAs.

7. Traction

By late October 2025, Avantis has established itself among the top derivatives DEXs on Base by volume and TVL:

- TVL: ≈ $114M (trending above $100M in October). DefiLlama

- Perps volume (30d): ≈ $15.7B. DefiLlama Perps

- Cumulative perps volume: $41B+. DefiLlama

- Fees (30d): ≈ $4.2M. DefiLlama

- Open Interest: ≈ $40M snapshot. DefiLlama

- Users: 60,000+ cumulative as cited around mid‑2025. The Block

- Community: ~108K followers on X/Twitter (@avantisfi). Token holders ~83.6K. CMC

Momentum accelerated post‑TGE with top‑tier CEX listings and media coverage. Sustaining growth will depend on deepening liquidity, expanding market listings, refining fee/rebate parameters, and delivering v2’s gasless cross‑margin environment.

8. Investors

Avantis has raised $12M to date across its seed and Series A rounds:

- Seed (Sep 2023): Pantera Capital ($4M), with participation from Founders Fund, Galaxy, Base Ecosystem Fund, and Modular Capital.

- Series A (Jun 2025): $8M co‑led by Founders Fund and Pantera, joined by Symbolic Capital, SALT Fund, and Flowdesk. The Block

Investor thesis centers on Avantis’ attempt to bridge macro markets with DeFi’s transparency. As Pantera’s Paul Veradittakit notes, Avantis is “pioneering a new class of DeFi infrastructure by bringing global macro markets natively onchain.” Source

9. Conclusion

Avantis is executing on a bold idea: make onchain leverage the universal, permissionless layer for all markets—crypto and beyond. The protocol’s zero‑fee on profitable trades, Loss Rebate and dynamic OI design, and tiered USDC vaults are engineered to balance trader performance with LP sustainability. Layer in a dual‑oracle architecture and a v2 roadmap for gasless, cross‑margined trading on a custom EVM chain, and the result is a compelling thesis for market share capture on Base and potentially beyond.

From an investment perspective, the opportunity hinges on three pillars:

- Execution risk vs. upside: Delivering the v2 stack (any‑feed AMM + custom chain) is non‑trivial. If successful, it could compress friction sufficiently to rival CEX UX while preserving self‑custody.

- Market expansion: Sustained listing of synthetic RWAs (FX, metals, energy, indices) and future verticals (equities, sports, prediction) can diversify volumes and attract macro‑driven capital.

- Capital efficiency and risk: Fine‑tuning Loss Rebate, OI controls, and vault tranches will determine LP returns and long‑term protocol sustainability.

Investors should monitor: (1) concrete milestones for the gasless EVM chain and cross‑margin; (2) liquidity depth and slippage metrics across new markets; (3) governance cadence and token utility as AVNT’s role evolves; and (4) resolution of the airdrop Sybil controversy alongside ongoing compliance considerations for synthetic RWAs and any future sports/prediction markets.

With strong backers, rising traction on Base, and a differentiated product design, Avantis is well‑positioned—but not guaranteed—to become an enduring fixture in onchain derivatives. As always, conduct independent research and consider risk tolerance before allocating capital.

Official links: Website | X/Twitter | Discord

Key references: The Block | DefiLlama: Protocol | DefiLlama: Perps | CoinMarketCap | Decrypt Price | BeInCrypto (Listings) | BeInCrypto (Airdrop)

The Smartest Free Crypto Event You’ll Join This Year

Curious about crypto but still feeling stuck scrolling endless threads? People who get in early aren’t just lucky—they understand the why, when, and how of crypto.

Join our free 3‑day virtual summit and meet the crypto experts who can help you build out your portfolio. You’ll walk away with smart, actionable insights from analysts, developers, and seasoned crypto investors who’ve created fortunes using smart strategies and deep research.

No hype. No FOMO. Just the clear steps you need to move from intrigued to informed about crypto.

UN-Limited Limit Orders

Why pay gas for limit orders that never execute? With CoW Swap, you can set an unlimited number of limit orders – more than your wallet balance – then cancel them all at no cost to you. Try Limit Orders.

Choose the Right AI Tools

With thousands of AI tools available, how do you know which ones are worth your money? Subscribe to Mindstream and get our expert guide comparing 40+ popular AI tools. Discover which free options rival paid versions and when upgrading is essential. Stop overspending on tools you don't need and find the perfect AI stack for your workflow.