This deep dive is brought to you by our sponsor, RAD Intel

The AI Race Just Went Nuclear — Own the Rails.

Meta, Google, and Microsoft just reported record profits — and record AI infrastructure spending:

Meta boosted its AI budget to as much as $72 billion this year.

Google raised its estimate to $93 billion for 2025.

Microsoft is following suit, investing heavily in AI data centers and decision layers.

While Wall Street reacts, the message is clear: AI infrastructure is the next trillion-dollar frontier.

RAD Intel already builds that infrastructure — the AI decision layer powering marketing performance for Fortune 1000 brands. Backed by Adobe, Fidelity Ventures, and insiders from Google, Meta, and Amazon, the company has raised $50M+, grown valuation 4,900%, and doubled sales contracts in 2025 with seven-figure contracts secured.

Shares remain $0.81 until Nov 20, then the price changes.

👉 Invest in RAD Intel before the next share-price move.

This is a paid advertisement for RAD Intel made pursuant to Regulation A+ offering and involves risk, including the possible loss of principal. The valuation is set by the Company and there is currently no public market for the Company's Common Stock. Nasdaq ticker “RADI” has been reserved by RAD Intel and any potential listing is subject to future regulatory approval and market conditions. Investor references reflect factual individual or institutional participation and do not imply endorsement or sponsorship by the referenced companies. Please read the offering circular and related risks at invest.radintel.ai.

Welcome back, Token Metrics readers!

This week, we're digging into a project at the intersection of AI and DeFi: Allora Network.

We're moving beyond hype to analyze its core mission: building a self-improving, coordinated AI to power the next generation of on-chain predictions. If you're interested in how composable intelligence could change the game, this deep dive is for you.

Official links: X (Twitter) | Discord | GitHub | Blog | Website

1. Executive Summary

Allora Network is building a decentralized AI platform that coordinates many independent machine learning (ML) models into a single, self‑improving intelligence layer. Structured as a Cosmos‑based Layer 1 blockchain, Allora connects four core roles: Workers (produce inferences), Reputers (evaluate and forecast model loss), Validators (secure the chain), and Consumers (request signals) to deliver high‑quality, on‑chain predictions that DeFi and other applications can trust and compose.

Where traditional oracles publish static data points, Allora focuses on collaborative inference synthesis: multiple models contribute to topic‑specific sub‑networks, and a regret‑minimization and forecasting mechanism weights each model’s contribution and rewards accuracy over time. The result aims to be an AI layer that learns, adapts, and resists manipulation without forcing developers to rely on any one centralized model or provider.

The project’s go‑to‑market is centered on DeFi. Early production signals power price‑direction feeds, yield forecasts, and risk metrics. A visible proof point is a live integration powering an AI‑driven prediction market on a major DEX’s Arbitrum deployment, where internal tests cited roughly 65% model accuracy and historical coverage across 400M+ assets by the team’s modeling lineage. Community snapshots of early usage reported thousands of users and tens of thousands of predictions shortly after launch, suggesting early product fit for learning‑based on‑chain intelligence.

Backed by leading crypto investors and originating from the team behind Upshot’s peer‑prediction and ML research, Allora is part of the growing AI x crypto wave. The near‑term focus is expanding production topics, hardening economic security for Workers and Reputers, and publishing definitive token mechanics. For investors and builders, Allora offers a differentiated thesis: a decentralized network of ML agents that improves with use, priced and secured on its own chain, and designed to plug directly into DeFi.

2. About the Project

2.1. Vision

Allora’s vision is to make advanced, privacy‑preserving AI broadly accessible to on‑chain applications. Rather than rely on a single model or centralized analytics vendor, Allora aggregates many independent ML agents into a self‑improving intelligence layer that emits trustworthy signals prices, risk, sentiment, yields, and beyond secured by a Cosmos‑based L1 blockchain. The long‑term goal is a composable, verifiable alternative to centralized AI providers, with incentives that continuously raise the quality of predictions.

2.2. Problem

DeFi and other on‑chain apps increasingly need predictions, not just prices. Protocols want to set dynamic loan‑to‑value ratios, route liquidity to the best yields, or quantify risk in real time. Today, teams either stitch together centralized analytics APIs or tap oracles that publish point estimates and do not learn from outcomes. Bringing ML fully on‑chain is hard: inference is expensive, verifiability is non‑trivial, and incentive systems must resist manipulation, collusion, and stale models.

2.3. Solution

Allora coordinates a network of specialized ML contributors around topic‑specific sub‑networks (for example, price direction on BTC/ETH, yield forecasts for stablecoin vaults, or volatility and liquidation risk). The network introduces four key roles:

- Workers: independent ML agents that produce inferences for a given topic.

- Reputers: evaluators who score Worker outputs and forecast the loss of each Worker’s predictions.

- Validators: consensus participants who secure the L1 and settle rewards, slashing, and state transitions.

- Consumers: dApps and users who request and consume the aggregated signal (e.g., a price‑direction feed).

A regret‑minimization/forecasting mechanism weights contributions based on historical performance and forecasted error. Participants are rewarded for accurate predictions and penalized for poor or adversarial behavior, so the aggregate signal becomes more robust over time. This collaborative inference synthesis is the core innovation: instead of betting on a single model, the network orchestrates many models and scores them against realized outcomes.

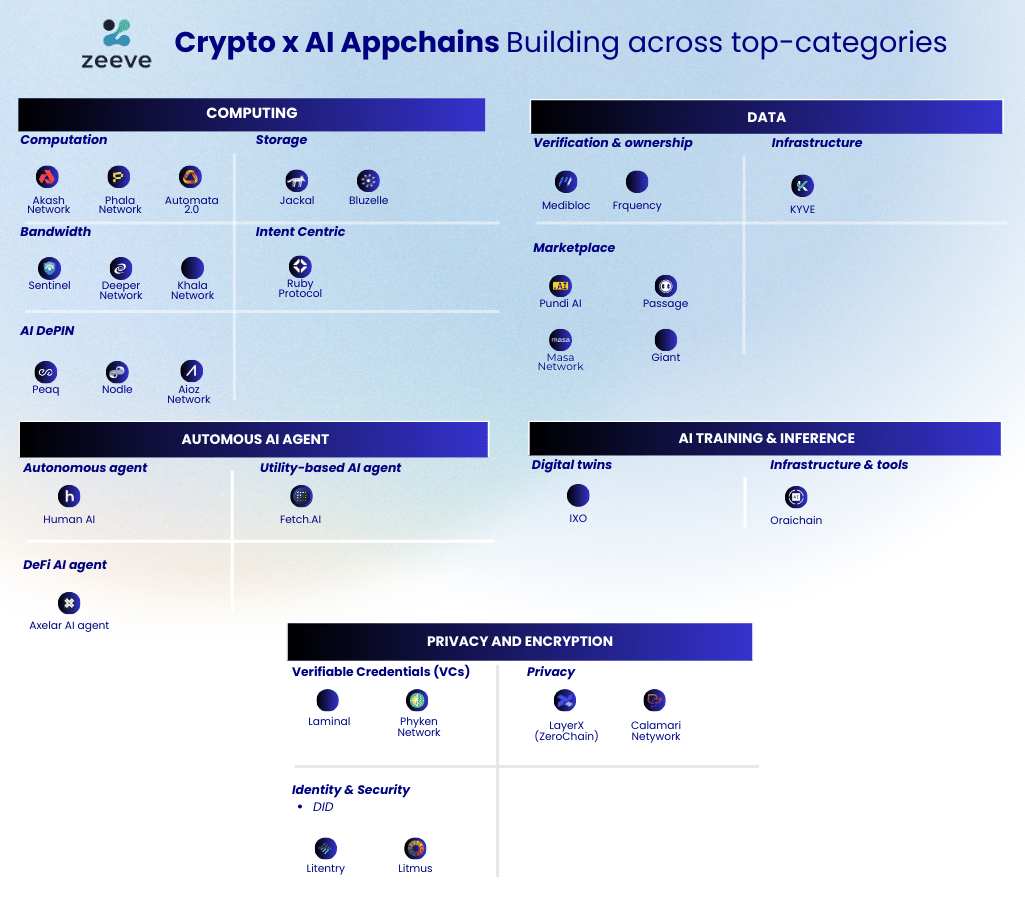

3. Market Analysis

AI x Crypto is one of the most active growth areas in Web3. As blockchains host more financial logic, static oracles (e.g., last price, simple averages) are not enough. Protocols want learning‑based signals for tasks like automated yield routing, dynamic risk management, and prediction markets. Allora targets this emerging demand head‑on with a network explicitly designed to improve with use, aiming to deliver lower regret and higher utility than any single off‑chain provider.

Adjacent categories provide context:

- General data oracles have proven the demand for reliable, low‑latency data feeds across chains.

- AI oracles and agent platforms are exploring verifiable inference and on‑chain AI agents.

Allora’s differentiation is its focus on multi‑model coordination and on‑chain incentives native to its own L1, paired with a reputation and forecasting system that tunes the network toward better accuracy over time. For DeFi apps that value composability and neutrality, a decentralized, self‑improving signal can become a strategic dependency especially for use cases where yesterday’s model is strictly worse than today’s.

3.1. Competition

| Project | Description |

|---|---|

| Chainlink | The dominant oracle provider with extensive integrations and reliability. Its core products are not designed as a self‑improving ML network; they publish robust data feeds rather than coordinate competing models. |

| ORA | Focuses on optimistic ML (opML) and on‑chain autonomous organizations for AI, emphasizing verifiable AI inference on Ethereum more than a Cosmos L1 with Workers/Reputers dynamics. |

| Oraichain | An AI‑themed oracle and L1 with an AI marketplace. It directly addresses AI + oracle needs but has a different architecture and adoption profile. |

| Switchboard | Emphasizes high‑speed, sub‑100ms feeds on Solana. It is optimized for latency rather than multi‑model synthesis and reputation‑weighted ML. |

Allora’s edge lies in: (1) a multi‑model, adversary‑aware design that rewards accurate forecasters and punishes poor behavior; (2) topic‑specific sub‑networks that allow depth in specialized domains; (3) a Cosmos‑based L1 that can tailor compute, settlement, and cross‑chain connectivity to AI‑native workflows; and (4) a builder‑first stack designed to attract external Workers and Reputers, not just core team models.

Fisher Investments also sponsor the this deep dive newsletter

Retirement Planning Made Easy

Building a retirement plan can be tricky— with so many considerations it’s hard to know where to start. That’s why we’ve put together The 15-Minute Retirement Plan to help investors with $1 million+ create a path forward and navigate important financial decisions in retirement.

4. Features

- Collaborative inference synthesis: Multiple ML models contribute predictions; the network aggregates them with weights informed by historical performance and forecasted error. This minimizes regret over time and avoids single‑model failures.

- Topic sub‑networks: Specialized markets for signals (price direction, yield forecasts, risk metrics, sentiment). Each topic can tune incentives, data cadence, and evaluation windows to its domain.

- Reputation and forecasting: Reputers don’t just score outcomes; they predict the loss of each Worker. Accurate reputation forecasts are themselves rewarded, aligning incentives to surface reliable contributors and demote stale or adversarial ones.

- Cosmos‑based L1 settlement: Incentives, rewards, and penalties are enforced at the chain level, with Validators securing state transitions. This provides a neutral coordination layer and consistent economic rules for all participants.

- Privacy‑preserving design: The network’s objective is to make advanced AI accessible without exposing proprietary model internals. Collaborations exploring privacy tech (e.g., use of advanced cryptography in adjacent ecosystems) point to a roadmap where sensitive signals can be contributed safely while still being evaluated and rewarded.

- Composable outputs for DeFi: Signals are designed to be drop‑in for dApps e.g., using a price‑direction feed to power a prediction market or using risk metrics to adjust collateral parameters algorithmically.

- Developer stack: Open‑source components include the Allora chain node, Python/TypeScript SDKs, and a builder kit to onboard external Workers and Reputers. This lowers the barrier for teams to contribute models or build on the signals.

5. Token

Community chatter often mentions a token ticker, but as of the latest public snapshots from major data platforms, no official token details (ticker, supply, emissions) have been formally confirmed. The project has communicated a tokenized incentive design, yet specifics remain pending an official announcement from the project or its foundation.

5.1. Utility

- Staking and incentives: Workers and Reputers are expected to stake and earn rewards based on performance. Accurate contributors should accrue outsized rewards; poor performance or malicious behavior should be penalized.

- Security and alignment: Staking aligns incentives with the long‑term accuracy of the network. Reputers who correctly forecast Worker loss improve signal quality and earn accordingly.

- Consumer fees: dApps requesting signals pay network fees that can be routed to contributors and Validators, funding the self‑improvement loop.

Note: Token mechanics, distribution, and supply parameters are expected to be published by the project. Until then, treat any token specifics as unconfirmed

6. Team

Allora’s core contributors emerged from Upshot, a research‑driven group known for peer‑prediction mechanisms and ML‑based valuation models.

- Nick Emmons (Co‑Founder & CEO): Previously CEO and co‑founder of Upshot. He led fundraising rounds that later rolled under Allora’s rebrand and has been a public spokesperson for the move to decentralized AI, authoring introductory materials outlining the network’s design and roadmap.

- Kenny Peluso (Co‑Founder): Co‑founder with product and systems exposure from the Upshot era; public profiles list him among Allora’s founding leadership.

Public communications suggest a foundation‑led launch path, common among Cosmos‑based L1s, with the open‑source repos and SDKs intended to seed a broad base of external Workers and Reputers.

7. Traction

DeFi integration: A high‑profile integration launched an AI‑powered prediction market on Arbitrum using Allora’s price‑direction feeds. According to the product team involved, internal testing showed around 65% accuracy for the AI signal, with historical model lineage covering 400M+ assets at high confidence for the most accurate predictions. Early community snapshots reported more than 5,000 users, over 60,000 predictions, and approximately $365,000 in volume within the initial weeks after launch. While community‑reported figures should be treated as directional, they indicate meaningful early interest.

Mindshare: Third‑party tracking labeled the project’s mindshare as Very High, with a snapshot showing 150+ notable posts in a single 24‑hour window. This level of attention is uncommon for pre‑token, pre‑mainnet AI networks and speaks to investor and builder curiosity around decentralized ML.

Open‑source and builder readiness: The public organization lists core repos for the chain node, Python/TypeScript SDKs, and a builder kit. This is important because Allora’s performance depends on attracting external Workers and Reputers; the more diverse and competitive the contributor set, the stronger the aggregate signal becomes.

Ecosystem research and collaborations: Beyond DeFi feeds, ecosystem partners have explored privacy‑preserving analytics such as an FHE‑based TrustPrice Index. These collaborations point toward a roadmap where secure computation and encrypted analytics can coexist with Allora’s on‑chain incentive design.

8. Investors

Allora (originating from Upshot) has raised $35M+ cumulatively across multiple rounds:

- Pre‑seed (2020): ~$1.25M

- Series A (May 2021): $7.5M co‑led by Framework Ventures and CoinFund

- Series A2 (March 2022): $23.3M led by Polychain Capital

- Strategic (June 2024): $3M with participation from Archetype, Delphi Ventures, CMS Holdings, ID Theory, and prominent angels including DCF God

Additional participating investors across the A/A2 rounds include Blockchain Capital, Slow Ventures, Mechanism, and Delphi Digital. The cap table combines crypto‑native funds, established venture firms, and influential individuals useful for distribution, integrations, and future token network effects.

9. Conclusion

Allora Network represents a credible path toward self‑improving, on‑chain intelligence for DeFi. By coordinating independent ML agents and rewarding accurate predictions, it avoids single‑model brittleness while delivering verifiable analytics that plug directly into protocols.

Strong foundations—early production traction, open‑source infrastructure, and solid backing—are offset by typical AI‑crypto challenges: defending against collusion, maintaining cost‑effective verifiability, and clarifying token economics for participants to properly price risk.

The opportunity is significant. If Allora scales its topic networks, hardens economic security, and formalizes tokenomics, it could establish itself as the AI signal layer for Web3—powering dynamic risk, yield, and market intelligence beyond static oracles. The next 12–18 months of mainnet hardening and ecosystem integration will determine whether Allora's collaborative inference becomes a core DeFi primitive.

Today we also have Superhuman AI as our co-sponsor

Go from AI overwhelmed to AI savvy professional

AI will eliminate 300 million jobs in the next 5 years.

Yours doesn't have to be one of them.

Here's how to future-proof your career:

Join the Superhuman AI newsletter - read by 1M+ professionals

Learn AI skills in 3 mins a day

Become the AI expert on your team