We're proud to have RAD Intel as today's lead sponsor of Token Metrics, supporting our mission to deliver cutting edge insights and connect the investment community.

$1K Could’ve Made $2.5M

In 1999, $1K in Nvidia’s IPO would be worth $2.5M today. Now another early-stage AI tech startup is breaking through—and it’s still early.

RAD Intel’s award-winning AI platform helps Fortune 1000 brands predict ad performance before they spend.

The company’s valuation has surged 4900% in four years* with over $50M raised.

Already trusted by a who’s-who roster of Fortune 1000 brands and leading global agencies. Recurring seven-figure partnerships in place and their Nasdaq ticker is reserved: $RADI.

This is a paid advertisement for RAD Intel made pursuant to Regulation A+ offering and involves risk, including the possible loss of principal. The valuation is set by the Company and there is currently no public market for the Company's Common Stock. Nasdaq ticker “RADI” has been reserved by RAD Intel and any potential listing is subject to future regulatory approval and market conditions. Investor references reflect factual individual or institutional participation and do not imply endorsement or sponsorship by the referenced companies. Please read the offering circular and related risks at invest.radintel.ai.

Projects In This Issue

- River cross chain stablecoin liquidity with an omni CDP and native satUSD minting

- AltLayer restaked rollups and AVSs that add verification, finality, and sequencing to any stack

- Ritual an AI native execution layer with Infernet for model access and verifiable compute

- Particle Network chain abstraction accounts, liquidity, and gas with a coordination Layer 1

Disclaimer: This content is for educational purposes only. It is not financial, legal, or tax advice. Digital assets carry risk that includes market volatility, technology failures, competition, regulatory shifts, and liquidity constraints. Always do your own research and consider professional advice before making investment decisions.

1. River

Sector: Stablecoin and DeFi with chain abstraction and cross chain liquidity

Status: Active mainnet across multiple chains with satUSD live and an Ethereum deployment announced

River connects collateral, liquidity, and yield across ecosystems through an omni CDP design. Users can deposit BTC, ETH, BNB, or liquid staking tokens on one chain and mint satUSD natively on another without bridges or wrappers. This creates a single circulating supply for satUSD with movement handled by burn and mint through a cross chain messaging layer.

Traction signals include a growing list of partners across major EVM chains and Bitcoin Layer 2 networks, strong early TVL, and clear integrations with well known DeFi venues. The focus is simple to explain and valuable in practice. Provide collateral once and deploy stablecoin liquidity anywhere with minimal friction.

Features

- Omni CDP that mints satUSD on a destination chain based on collateral posted on a source chain

- satUSD as an over collateralized stablecoin with peg mechanisms and native cross chain supply

- satUSD plus staking to share protocol revenue with a yield bearing asset

- Smart Vault and Prime Vault for automated strategies and institutional access without liquidation risk on vault deposits

- Contribution and points layer where engaged users can earn eligibility for rewards

Investors

Funding: $2M seed with additional early backing

- CMS Holdings and RockTree Capital seed co leads

- Cypher Capital, Optic Capital, Side Door Ventures, Comma3 Ventures, Outliers Fund

- Metalpha, Paul Taylor, Yenwen Feng

- Web3Port Foundation and Waterdrip Capital early backers

Token

Tokens: $RIVER and satUSD

Utility: RIVER governs protocol parameters and incentives, powers yield boosts through vote escrowed mechanics, reduces fees, and can be staked with time based multipliers. satUSD is the native stable unit for liquidity across chains and can be staked to receive satUSD plus.

Tokenomics: RIVER total supply is one hundred million units. Allocation includes Community, Investors, Core Contributors, Advisors, Liquidity, Ecosystem Foundation, Ecosystem Partnerships, and Ecosystem Incentives with cliffs and linear schedules. Liquidity allocation unlocks at TGE.

Launch Info: Contract on Ethereum is 0xdA7AD9dea9397cffdDAE2F8a052B82f1484252B3. satUSD has published addresses across major EVM networks and Bitcoin aligned Layer 2 ecosystems.

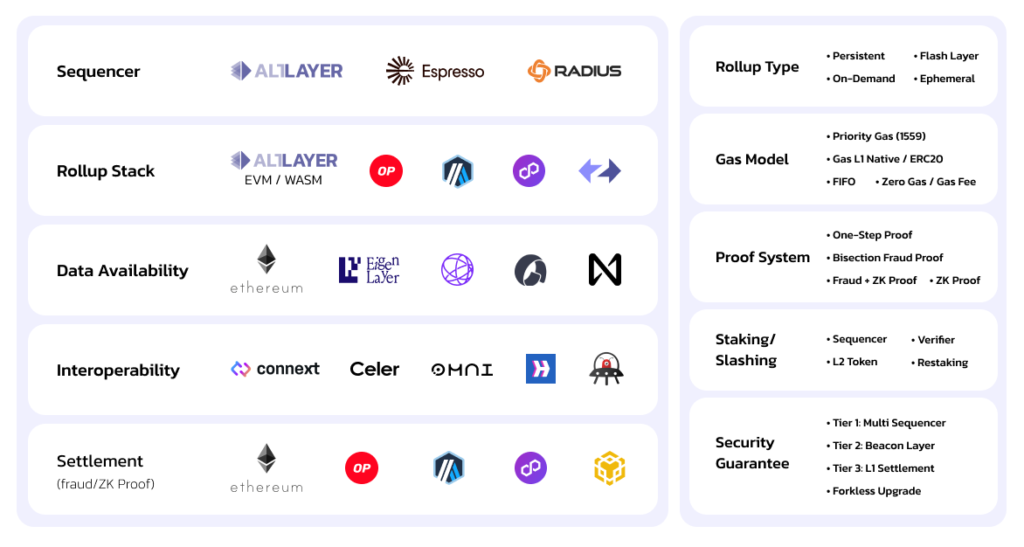

2. AltLayer

Sector: Modular rollups and RaaS with AVS on EigenLayer

Status: Active products with MACH AVS and a public Wizard for AVS deployment along with ongoing ecosystem rollouts

AltLayer upgrades app specific rollups by composing three restaked services for any stack. VITAL adds decentralized verification, MACH provides fast economic finality measured in seconds, and SQUAD decentralizes sequencing. Teams can launch custom rollups and AVSs quickly while borrowing economic security from staked assets on Ethereum through restaking.

The ecosystem has seen activity across gaming, AI, staking, and cross chain projects. The design aligns with the trend toward many specialized rollups that need decentralization, security, and user friendly finality without building core infrastructure from scratch.

Features

- Restaked rollups that bundle verification, fast finality, and decentralized sequencing

- No code RaaS dashboard to launch a rollup in minutes with choice of stack and data availability

- AVS as a Service Wizard for operator lifecycle, ECDSA or BLS support, and management tools

- ALT restaking so token holders can help secure AVSs and earn protocol incentives

- Support for OP Stack, Arbitrum Orbit, ZK Stack, and Polygon CDK with extensible SDKs

Investors

Funding: about $21.6M across seed and strategic rounds

- Polychain Capital and Hack VC strategic round co leads

- Binance Labs strategic backer

- Jump Crypto and Breyer Capital seed participants

- Notable angels include Gavin Wood, Balaji Srinivasan, Sean Neville, Ryan Selkis, Kain Warwick, and Jordan Momtazi

Token

Token: $ALT

Utility: ALT functions as an economic bond with slashing, a governance asset, and an incentive unit for operators and services. Holders can restake to secure AVSs.

Tokenomics: Ten billion ALT supply with initial circulation near eleven percent at TGE. Allocation across Investors, Team, Advisors, Protocol Development, Ecosystem and Community, Treasury, and a Launchpool distribution. Two private sales raised a combined twenty two point eight million dollars.

Launch Info: Listed through a Launchpool with multiple trading pairs and an airdrop for early participants.

Today's Token Metrics insights are brought to you in partnership with Google AdSense.

Banish bad ads for good

Google AdSense's Auto ads lets you designate ad-free zones, giving you full control over your site’s layout and ensuring a seamless experience for your visitors. You decide what matters to your users and maintain your site's aesthetic. Google AdSense helps you balance earning with user experience, making it the better way to earn.

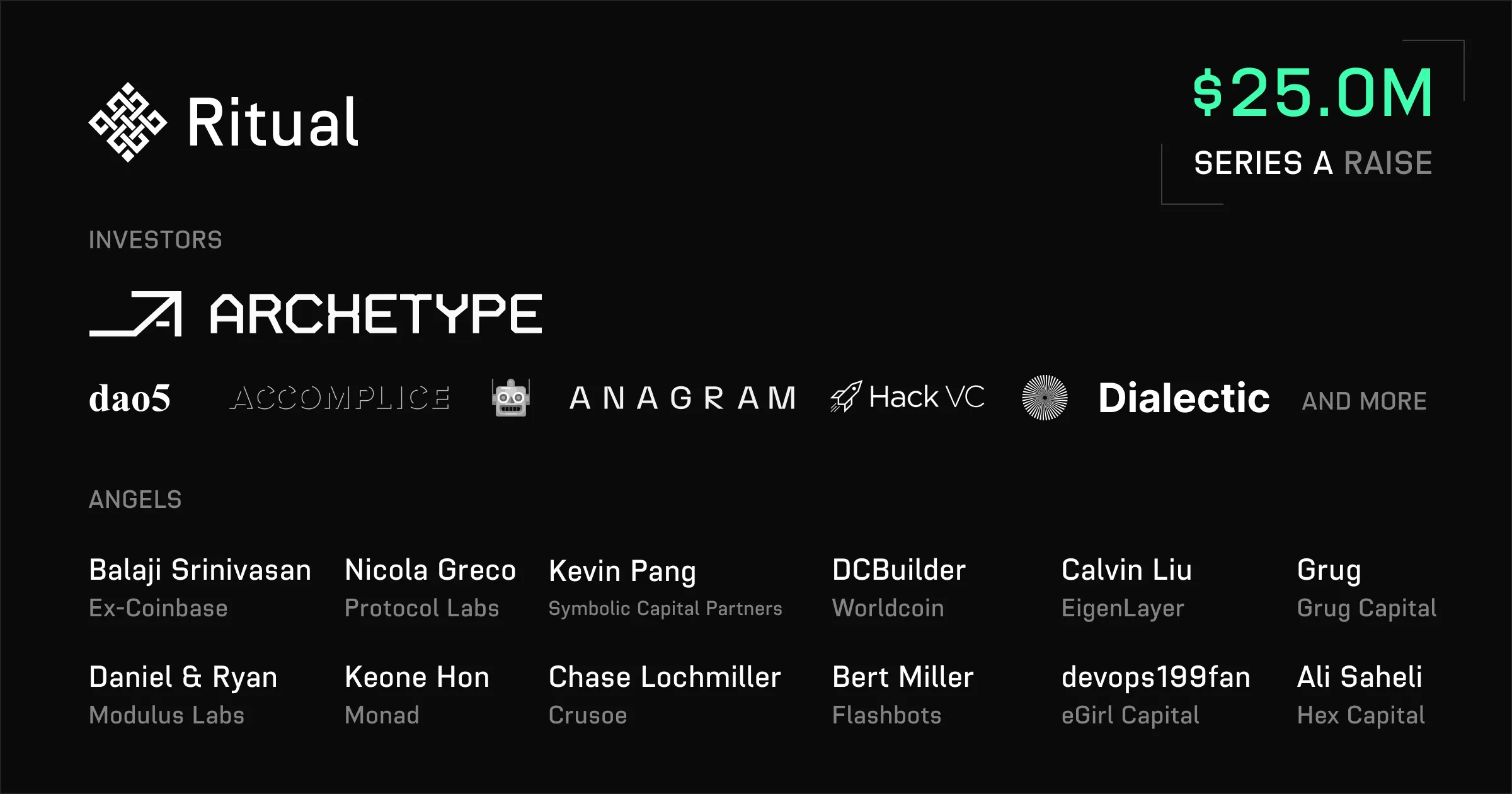

3. Ritual

Sector: Decentralized AI infrastructure with an AI first Layer 1 and a compute oracle network

Status: Active development with Infernet live across thousands of nodes and Ritual Chain in testing

Ritual aims to make AI models first class on chain citizens. The stack exposes model inference, fine tuning, and verification as primitives that contracts can call with a few lines of code. An AI native Layer 1 integrates a market for heterogeneous compute and provides integrity through a mix of ZK ML, TEEs, and probabilistic verification. Infernet acts as a decentralized oracle mesh that brings external compute to chains and apps.

The design targets a clear gap. Developers want easy access to AI models with correctness guarantees. By enshrining models and offering a choice of verification mechanisms, Ritual seeks to unlock new classes of on chain applications while also providing services to external chains through standard interfaces.

Features

- EVM plus plus with AI oriented precompiles, scheduled transactions, and account abstraction

- Execution sidecars that offload AI, zero knowledge, and TEE workloads without bloating core execution

- Resonance fee market that matches compute supply and demand for many workload types

- Symphony consensus with execute once verify many across shards and distributed verification

- Modular computational integrity including ZK ML and TEE attestations

Investors

Funding: $25M Series A with a later follow on

- Archetype lead

- Accel, dao5, Anagram, Avra, Dialectic, Hypersphere, Robot Ventures

- Polychain Capital additional investment after the Series A

Team

- Niraj Pant co founder and former leader at Polychain

- Akilesh Potti co founder with experience across Polychain, machine learning, and high frequency trading

- Advisors include Illia Polosukhin, Sreeram Kannan, Tarun Chitra, Arthur Hayes, and Noam Nisan

4. Particle Network

Sector: Chain abstraction infrastructure with a coordination Layer 1, wallet and account tooling, and public SDKs

Status: Universal Accounts and UniversalX live, Particle Chain adopting the Avalanche technology stack for sub second finality

Particle Network brings chain abstraction to life with one account, one balance, any chain. A coordination Layer 1 orchestrates ERC 4337 smart accounts across networks. Universal Liquidity routes value per transaction and settles through the coordination layer. A Paymaster enables Universal Gas so users can pay fees with any supported token. UniversalX showcases the full stack with non custodial, chain agnostic trading.

The team scaled Wallet as a Service and account abstraction tooling across thousands of apps before shipping the chain abstraction stack. This user and developer base, along with a focused Layer 1 for settlement and routing, gives Particle a credible path to become a universal transaction layer.

Features

- Universal Accounts that unify balances and permissions across many chains

- Universal Liquidity with atomic routing and settlement on the coordination layer

- Universal Gas that lets users pay network fees in the token they hold

- UniversalX as a live product to trade across ecosystems without manual bridging

- Wallet as a Service with MPC or social logins and developer friendly SDKs

Investors

Funding: $25M total announced across rounds

- Spartan Group and gumi Cryptos Capital recent co leads

- SevenX Ventures, Morningstar Ventures, HashKey Capital, MH Ventures, UOB Venture Management, Flow Traders, SNZ

- Earlier backers include LongHash Ventures, Animoca Ventures, Alibaba Group, ABCDE, GSR, OP Crypto, and others

Token

Token: $PARTI

Utility: Powers Universal Gas, secures the coordination Layer 1 through staking, settles Universal Liquidity, and participates in governance.

Tokenomics: Fixed supply of one billion. Distribution includes Team and Advisors, Private Sales, KOL, Liquidity, Community Growth, IDO, Binance Wallet and HODLer airdrops, and a Reserve. TGE occurred in March 2025 with staged unlocks.

Launch Info: Public sale and airdrops through Binance Wallet programs with an initial circulating amount near two hundred thirty three million units.

Token Metrics is sponsored by Masterworks.

Last Time the Market Was This Expensive, Investors Waited 14 Years to Break Even

In 1999, the S&P 500 peaked. Then it took 14 years to gradually recover by 2013.

Today? Goldman Sachs sounds crazy forecasting 3% returns for 2024 to 2034.

But we’re currently seeing the highest price for the S&P 500 compared to earnings since the dot-com boom.

So, maybe that’s why they’re not alone; Vanguard projects about 5%.

In fact, now just about everything seems priced near all time highs. Equities, gold, crypto, etc.

But billionaires have long diversified a slice of their portfolios with one asset class that is poised to rebound.

It’s post war and contemporary art.

Sounds crazy, but over 70,000 investors have followed suit since 2019—with Masterworks.

You can invest in shares of artworks featuring Banksy, Basquiat, Picasso, and more.

24 exits later, results speak for themselves: net annualized returns like 14.6%, 17.6%, and 17.8%.*

My subscribers can skip the waitlist.

*Investing involves risk. Past performance is not indicative of future returns. Important Reg A disclosures: masterworks.com/cd.