We're proud to have Money.com as today's lead sponsor of Token Metrics, supporting our mission to deliver cutting edge insights and connect the investment community.

Invest right from your couch

Have you always been kind of interested in investing but found it too intimidating (or just plain boring)? Yeah, we get it. Luckily, today’s brokers are a little less Wall Street and much more accessible. Online stockbrokers provide a much more user-friendly experience to buy and sell stocks—right from your couch. Money.com put together a list of the Best Online Stock Brokers to help you open your first account. Check it out!

Market Summary

Publication date: Dec 8, 2025

Welcome back to Token Metrics Daily, where we focus on the trends, flows, and narratives that actually matter for crypto investors.

As of December 8, 2025, crypto markets are stabilizing after a sharp retrace from October’s highs: Bitcoin has rebounded from local lows near $80K toward the low-$90Ks, aided by expectations of a Federal Reserve rate cut at this week’s FOMC meeting and a notable easing of long term holder selling pressure. Institutional sentiment is cautiously recovering, with crypto ETPs recording a second consecutive week of inflows and aggregate AUM ticking back above $180 billion, even as U.S. spot Bitcoin ETFs remain in a ‘wipeout year’ drawdown versus early October peaks. On the structural side, today’s launch of the Stable L1, bank led distribution via BPCE’s in app trading, and incremental protocol upgrades signal that infrastructure and access rails continue to deepen even in a choppy macro backdrop.

Crypto ETPs logged about $716M of net inflows last week after four weeks of heavy outflows, pushing aggregate AUM back above $180B. At the same time, Bitcoin’s long term holder supply is sitting at a cyclical low, hinting that most of the profit taking from October’s highs has already played out.

1. Stable L1 Mainnet and STABLE TGE Go Live With $1.1B+ Pre Deposits

Stable, a Tether- and Bitfinex backed, EVM compatible Layer 1 focused on stablecoin payments, is switching on mainnet today at 13:00 UTC. The chain is purpose built for payments: every transaction fee is paid exclusively in USDT, not in a volatile native gas token.

The pitch is simple: make on chain payments predictable for merchants and users. No more swapping into a separate gas asset and worrying about price swings. If you already hold USDT, you can pay for everything — transfers, DeFi interactions, and dApp calls — directly.

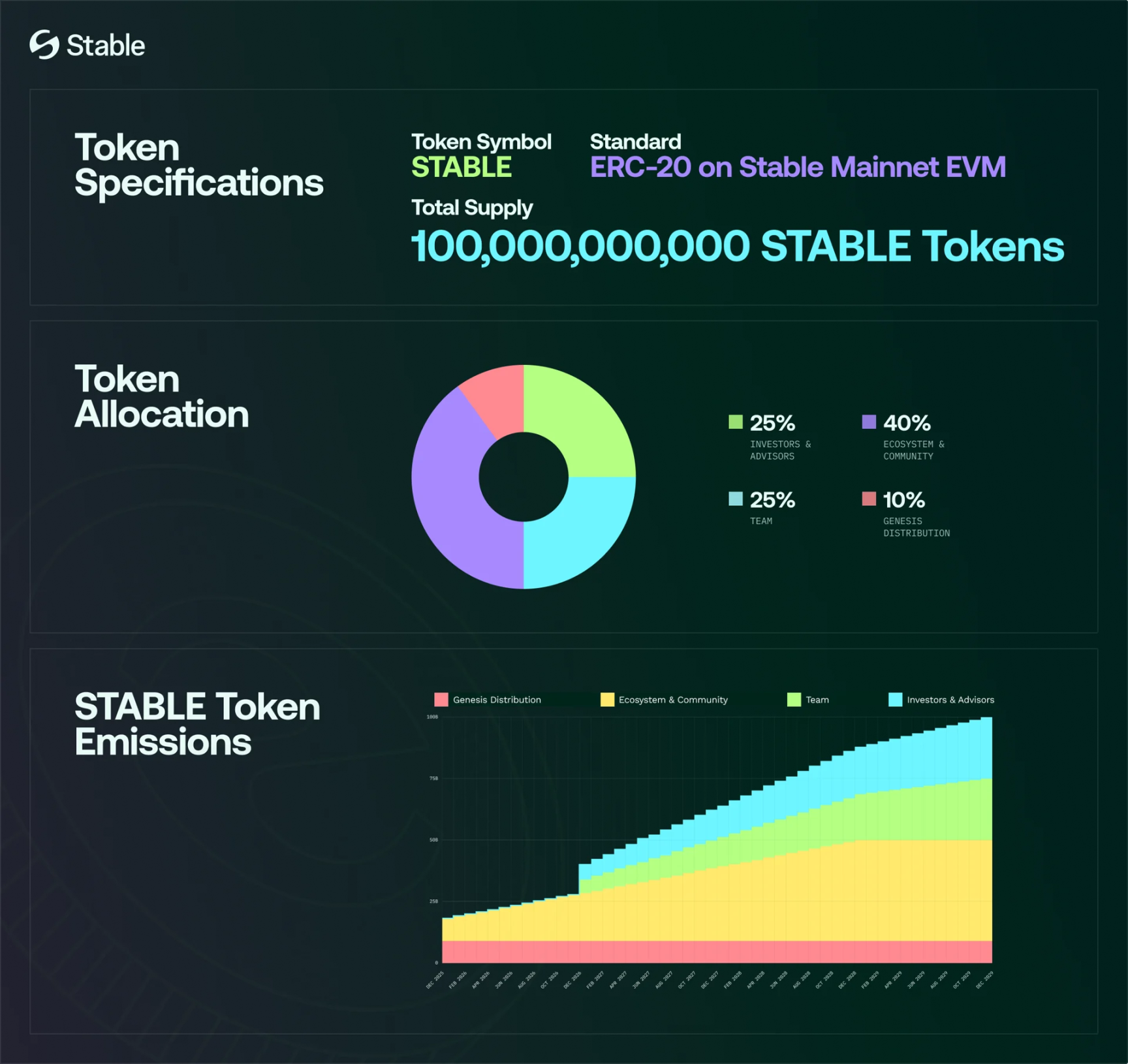

Stable’s TGE also lands today. The governance token, STABLE, has a fixed 100B supply deployed on the Stable mainnet (EVM, 18 decimals). Token distribution is front loaded to jump start activity:

- 10% (10B STABLE) for genesis distribution, fully unlocked at launch, targeting airdrops, liquidity, exchange campaigns, and rewards for early depositors and testnet users.

- 40% for ecosystem and community programs, with partial upfront unlocks and a three year linear vesting schedule.

- 25% to the team and 25% to investors and advisors, vesting over time.

Reported pre deposits already exceed $1.1B, signaling serious capital commitment before block one. Because gas and validator rewards are denominated in USDT, validator revenue effectively becomes USDT based real yield. STABLE stakers receive this USDT flow, rather than relying on inflationary token emissions to hit attractive APYs.

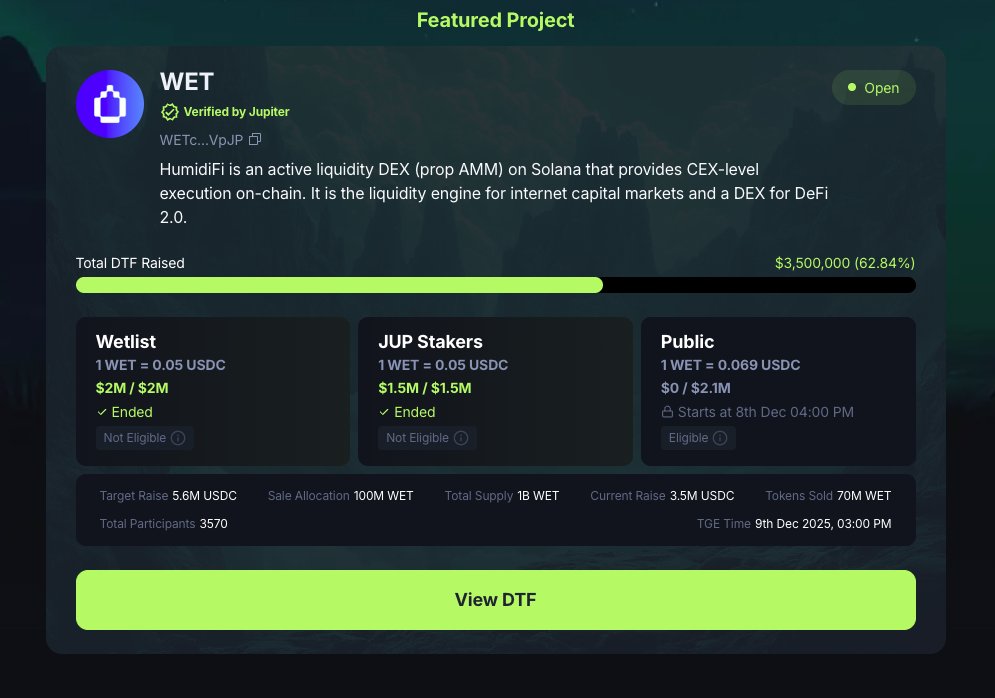

2. Jupiter’s HumidiFi (WET) Presale Relaunch After Sybil Attack

Jupiter, Solana’s top DEX aggregator, is relaunching the HumidiFi (WET) public sale and airdrop mechanics today after a controversial presale where a sniper accumulated roughly 70% of the allocation using thousands of wallets.

An on chain cluster, nicknamed ‘Ramarxyz’, controlled over 1,000 wallets and hoovered up the majority of the original WET presale. In response, Jupiter canceled the Dec 4 sale and committed to a full reset. The relaunch is scheduled for today at 23:00 (UTC+8) with a brand new WET token contract. Old WET tokens are explicitly invalid, and all prior participants are being fully refunded in USDC.

Under the new structure, users who earned allocations via the Wetlist program and JUP staking retain their allocations and will claim on TGE through the DTF claim interface. The reopened public sale targets a broader, more organic holder base instead of sybil dominated clusters.

Today's Token Metrics insights are brought to you in partnership with you.com.

AI is all the rage, but are you using it to your advantage?

Successful AI transformation starts with deeply understanding your organization’s most critical use cases. We recommend this practical guide from You.com that walks through a proven framework to identify, prioritize, and document high-value AI opportunities. Learn more with this AI Use Case Discovery Guide.

3. BPCE Switches On In App Crypto Trading for Millions

France’s #2 banking group, BPCE, has started rolling out direct crypto trading inside its Banque Populaire and Caisse d’Épargne mobile apps. Around 2M customers can now buy BTC, ETH, SOL, and USDC without leaving their standard banking interface, with plans to extend access to BPCE’s full 12M retail base by 2026.

BPCE manages roughly €1.5T in assets and serves more than 12M customers. Orders flow through a dedicated digital asset account managed by BPCE’s in house crypto unit, HexaRK, with a €2.99 monthly account fee and a 1.5% trading commission. Everything stays inside a familiar, fully KYC’d environment.

For retail users, this effectively turns a conservative banking app into a low friction DCA rail into majors. BTC and ETH gain another regulated channel for steady accumulation, while SOL and USDC move closer to traditional finance workflows like payments, savings, and merchant integrations.

4. Bitcoin Long Term Holder Supply Hits Cyclical Low

On chain data shows Bitcoin’s long term holder (LTH) supply — coins held for at least 155 days — dropped from about 14.77M BTC in July to roughly 14.33M BTC in November. That decline lined up with BTC’s pullback to local lows near $80K.

This was months of older cohorts taking profits into October’s all time highs and the subsequent volatility. The key is that LTH supply appears to have bottomed just as price based near $80K and started to grind back toward the low-$90Ks.

Unlike 2017 and 2021, this distribution phase did not coincide with manic retail blow off tops. Instead, it unfolded against heavy spot ETF activity, relatively contained leverage, and a more institutional holder base. New buyers — including ETF investors and on exchange accumulators — absorbed LTH sell pressure without triggering a deeper market breakdown.

With LTH supply sitting at a cyclical low and exchange balances still near multi year lows, incremental demand now has less overhead supply to chew through. Add in the recent $716M in ETP inflows and fresh bank led rails like BPCE, and the medium term supply/demand picture tilts constructive.

This does not eliminate volatility, especially around this week’s FOMC decision and macro data. But historically, exhaustion of LTH selling has been a strong mid cycle signal that the market is transitioning from distribution to a more balanced or accumulation driven phase.

Outlook

Today’s headlines rhyme: Stable’s USDT only L1, Jupiter’s WET relaunch, and BPCE’s in app trading all deepen the rails that connect users, capital, and real world activity to crypto.

On one side, Stable ties validator rewards directly to USDT velocity and pushes the real yield narrative into a payments focused L1. On another, Jupiter is stress testing how Solana DeFi handles sybil attacks while still rewarding genuine users at TGE. Meanwhile, BPCE shows that large European banks are increasingly comfortable embedding BTC, ETH, SOL, and USDC directly into regulated banking UX.

Underneath, Bitcoin’s on chain data and ETP flows suggest that the heavy spot driven selling phase is fading just as institutional demand starts to creep back. That combination creates a constructive medium term setup, even if macro volatility around the Fed keeps spot price action choppy.

Outside the main stories, incremental upgrades across ecosystems — from Pi Network’s AI KYC stack to Enjin and Terra network improvements — are quietly improving onboarding, NFT infrastructure, gaming rails, and DeFi tooling. These are the kind of plumbing upgrades that tend to be ignored in sideways markets but power the next leg of growth once liquidity and risk appetite return.

For now, focus on where real users, real fees, and sticky TVL are building: stablecoin payments, Solana DeFi, bank led on ramps, and Bitcoin’s evolving role as a yield bearing collateral asset. That is where the next wave of sustainable opportunities is likely to emerge.

Token Metrics is sponsored by Mindstream.

Turn AI Into Extra Income

You don’t need to be a coder to make AI work for you. Subscribe to Mindstream and get 200+ proven ideas showing how real people are using ChatGPT, Midjourney, and other tools to earn on the side.

From small wins to full-on ventures, this guide helps you turn AI skills into real results, without the overwhelm.