We at Token Metrics scored multiple projects this week. Here are a few you should know about:

Pacifica

BULK

Falcon Finance

Collector Crypt

Please remember that some of these projects still need our code review process. Still, we want to highlight them here because they initially caught our attention through our fundamental analysis process.

Today’s edition of Token Metrics Research | Daily Newsletter is brought to you by Wallstreet Prep.

Earn Your Certificate in Real Estate Investing from Wharton Online

The Wharton Online + Wall Street Prep Real Estate Investing & Analysis Certificate Program is an immersive 8-week experience that gives you the same training used inside the world’s leading real estate investment firms.

Analyze, underwrite, and evaluate real estate deals through real case studies

Learn directly from industry leaders at firms like Blackstone, KKR, Ares, and more

Earn a certificate from a top business school and join a 5,000+ graduate network

Use code SAVE300 at checkout to save $300 on tuition $200 with early enrollment by January 12.

Program starts February 9.

Now, let’s get back to the hidden gems.

1. Pacifica

Sector - DeFi

Status - Active

Pacifica is a next-generation perpetual futures exchange built on Solana, launched in mid-2025 by a team of experienced builders from major cryptocurrency exchanges, including Binance, FTX, and Coinbase, as well as traditional finance giants such as Jane Street and Fidelity, and AI leaders like OpenAI and DeepMind.

The project addresses key pain points in decentralized trading, including slow execution speeds, high latency, suboptimal user interfaces, and limited accessibility to advanced strategies, which plague many existing platforms.

Pacifica's solution integrates a hybrid exchange model that combines centralized-like performance with decentralized principles, leveraging AI-powered smart trading tools to automate sophisticated strategies and deliver seamless, user-centric experiences.

The tech stack prioritizes high-performance infrastructure on Solana for low-latency trades, with a focus on transparency, user empowerment, and rapid iteration, as evidenced by its testnet launch in three months and mainnet launch in six.

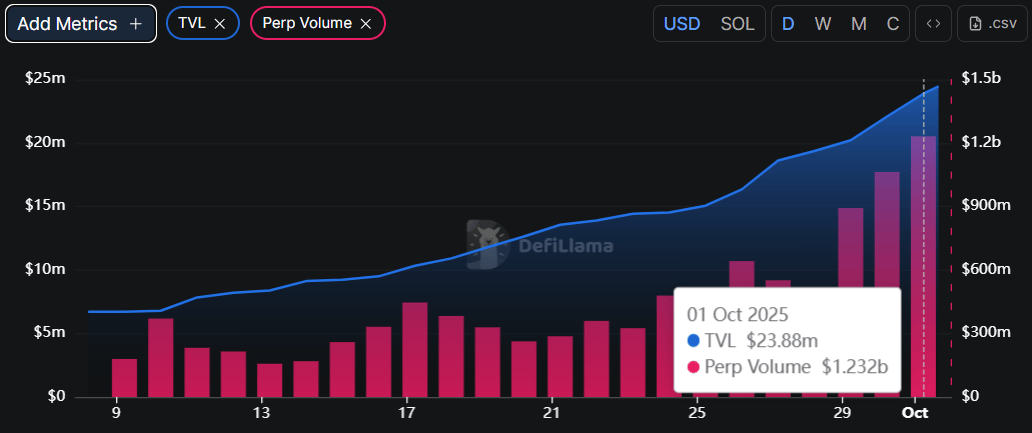

Currently self-funded without external capital, Pacifica has quickly achieved a TVL of $24.45M and over $1B in 24-hour trading volume, positioning it as a rising contender in the perp DEX space.

1.1. Features

AI-Powered Smart Trading Tools: Automates complex strategies like hedging and arbitrage, making them accessible to retail users without requiring deep technical knowledge.

Hybrid Exchange Architecture: Blends CEX-level speed and UX with DEX decentralization, enabling sub-second executions and reduced slippage on Solana.

Points System for User Rewards: Tracks trading activity to distribute points, fostering loyalty and potentially leading to future incentives or airdrops.

Transparent On-Chain Metrics: Real-time dashboards for volume, open interest, and fees, ensuring users can verify performance without intermediaries.

1.2. Token

Pacifica does not yet have a native token; instead, it operates a points-based system where users earn points through trading volume, referrals, and other activities, which are speculated to convert into a future token airdrop based on community discussions.

The points have no fixed total supply or formal distribution outlined, but they serve as a proxy for utility in rewarding early adopters and driving ecosystem participation.

2. BULK

Sector - DeFi

Status - Active

Bulk is an innovative, decentralized exchange on Solana, focusing on high-frequency order book trading. It addresses the performance gaps in on-chain DeFi that hinder the migration of traditional capital markets to blockchain ecosystems.

Launched in 2025 by a team emphasizing engineering excellence, the project addresses issues such as slow settlement times, high gas costs, and limited throughput that make decentralized trading unviable for institutional-grade activity.

Bulk's core solution is a novel execution architecture that delivers colocation-grade performance, think sub-millisecond latencies, while preserving decentralization, censorship resistance, and permissionless access, effectively bridging CeFi efficiency with DeFi principles.

The tech stack leverages Solana's high-speed consensus for its backend, with custom optimizations for order matching and risk management; however, specifics on the languages or frameworks used remain proprietary.

With rapid community growth to over 14,000 followers and trending status on platforms like the Solana Mobile dApp store, Bulk positions itself as Solana's answer to leading perp DEXes on other chains.

2.1. Features

Infinite Markets Support: Enables trading of any asset pair without liquidity constraints, powered by dynamic orderbooks that scale to unlimited markets.

Colocation-Grade Execution: Achieves near-zero latency for high-frequency trades, rivaling centralized exchanges while remaining fully on-chain.

Permissionless Liquidity Provision: Allows anyone to provide liquidity without KYC, with automated risk engines to prevent manipulation.

Mobile-Optimized Interface: Seamless integration with Solana Mobile, trending in dApp stores for easy access to advanced trading tools.

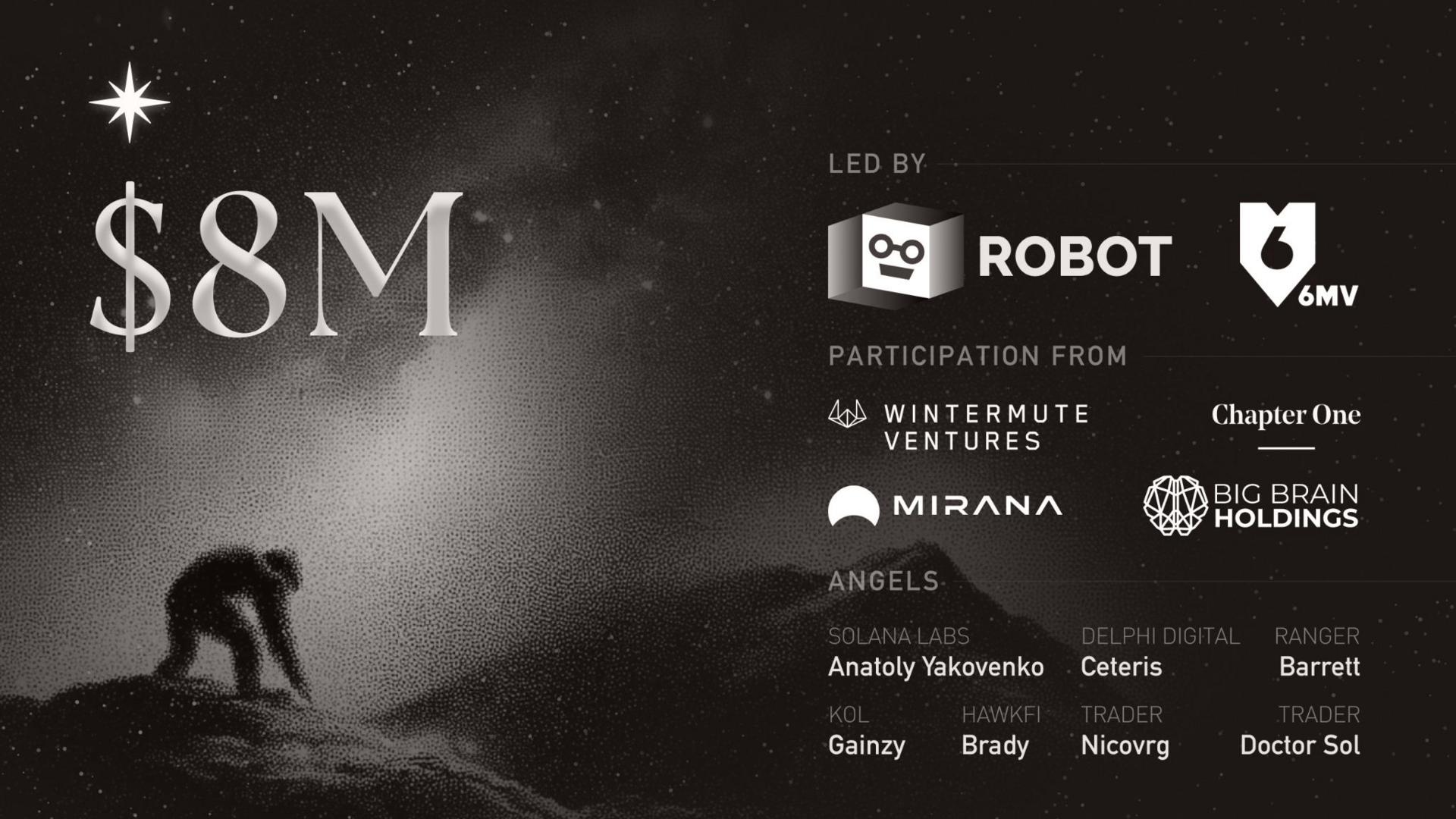

2.2. Investors

BULK raised $8M seed round in September 2025 to accelerate the end state of perpetual DEX trading.

This edition of the newsletter is co-presented by I Hate It Here.

The best HR advice comes from those in the trenches. That’s what this is: real-world HR insights delivered in a newsletter from Hebba Youssef, a Chief People Officer who’s been there. Practical, real strategies with a dash of humor. Because HR shouldn’t be thankless—and you shouldn’t be alone in it.

Now, let's continue with the hidden gems.

3. Falcon Finance

Sector - DeFi

Status - Active

Falcon Finance is a pioneering synthetic dollar protocol on Ethereum, established in 2025 to revolutionize collateralized yield generation in DeFi.

It addresses the shortcomings of traditional synthetic dollar platforms, which often rely on narrow strategies, such as positive funding rate arbitrage, that falter in volatile or bearish markets, leaving users with inconsistent returns and underutilized assets.

The solution introduces USDf, an overcollateralized synthetic dollar minted from diverse collaterals, including stablecoins, BTC, ETH, and altcoins, which can be staked into sUSDf, a yield-bearing token leveraging institutional-grade strategies such as cross-exchange arbitrage, negative funding spreads, and native staking.

The tech stack includes ERC-4626 vaults for efficient yield distribution, dynamic collateral frameworks with real-time risk assessments, and robust security via MPC, multi-sig, and hardware keys, all backed by regular audits and Proof of Reserves.

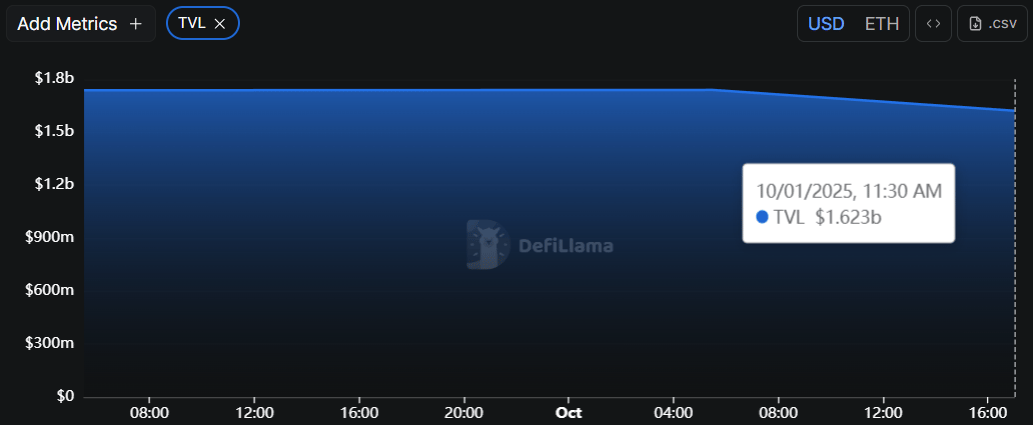

With a TVL exceeding $1.6B and over $1.8B in USDf circulation, Falcon sets a new standard for sustainable, market-agnostic yields in the synthetic asset space.

3.1. Features

Diversified Yield Strategies: Combines basis spreads, funding arbitrage, and altcoin staking for consistent APYs, even in adverse conditions.

Universal Collateral Acceptance: Supports stablecoins at 1:1 ratios and non-stables with OCR greater than 1, enabling flexible minting without liquidation risks.

Restaking Mechanism: Converts sUSDf into ERC-721 NFTs with fixed lock-ups, boosting yields and amplifying returns up to 2x.

Transparency Dashboard: Real-time views of reserves, weekly updates, and quarterly audits ensure verifiable asset backing.

3.2. Token

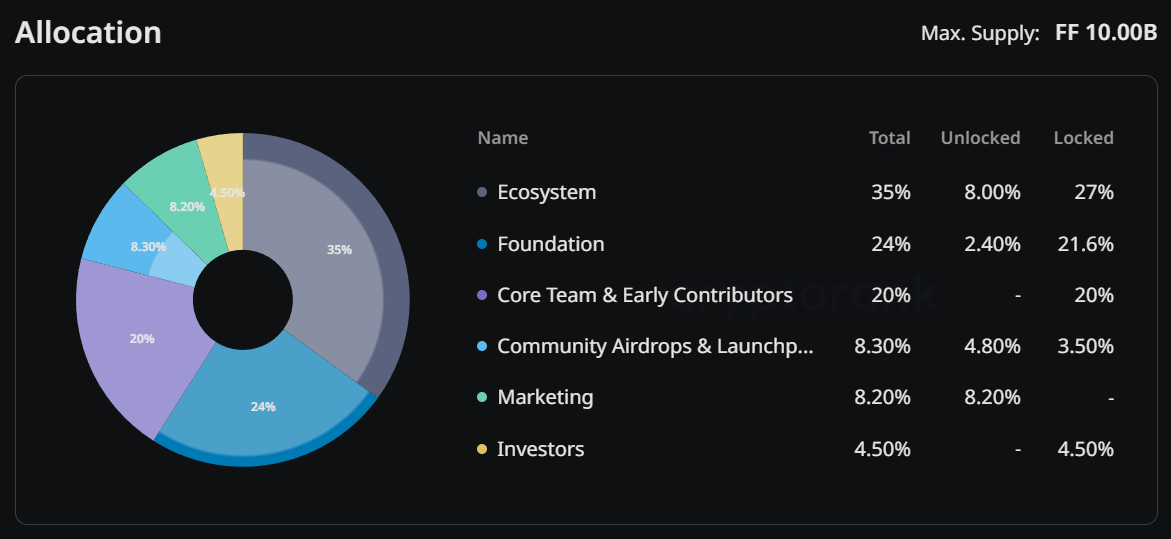

The native token, FF, has a fixed total supply of 10 billion, with 2.34 billion circulating at launch. Distribution includes 35% for ecosystem growth (airdrops, integrations), 24% to the foundation for liquidity and audits, 20% to the core team (1-year cliff, 3-year vesting), 8.3% for community airdrops and launchpad sales, 8.2% for marketing, and 4.5% to investors (similar vesting).

FF's utility encompasses governance voting on protocol upgrades, staking for enhanced yields and fee shares, as well as preferential terms such as improved capital efficiency in minting/redemptions.

3.3. Investors

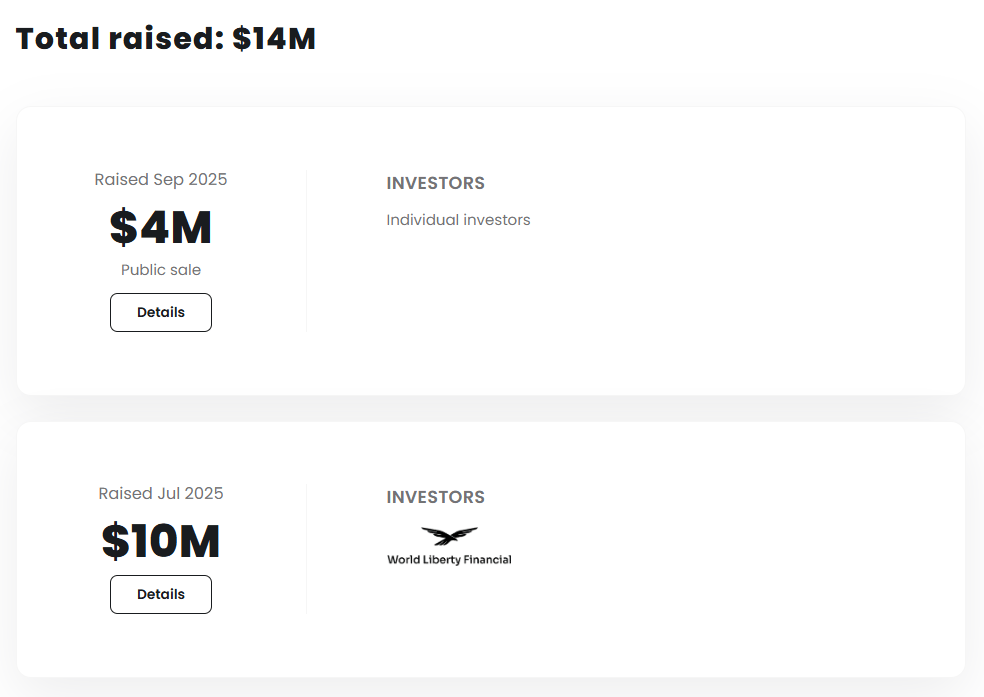

Falcon Finance has raised $14M across rounds: a $10M strategic round in July 2025 and a $4M IDO in September 2025. Key backers include World Liberty Financial, providing strong institutional support and signaling confidence in its yield infrastructure.

4. Collector Crypt

Sector - RWA

Status - Active

Collector Crypt is a Solana-based platform tokenizing physical Pokémon trading cards into redeemable NFTs, launched in 2025 to bridge real-world collectibles with blockchain liquidity.

It addresses longstanding issues in the trading card market, including illiquidity, high storage costs, authentication challenges, and limited global access, which currently restrict participation to physical collectors.

The solution digitizes graded cards into on-chain RWAs stored in secure vaults, enabling instant trading, fractional ownership potential, and gamified unboxing via gacha mechanics.

The tech stack utilizes Solana for fast, low-cost transactions, with integrations for AR displays, AI authentication, and NFT standards for seamless marketplace interactions.

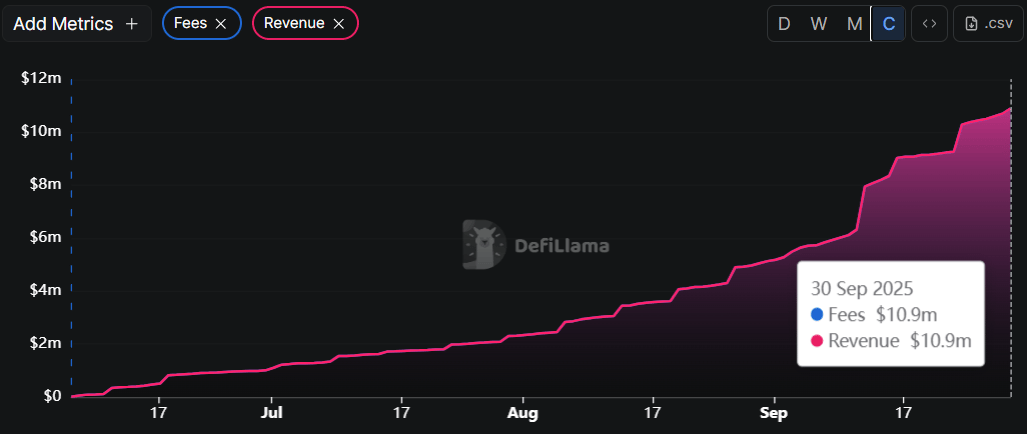

Having processed over $150M in transactions and generated $10M in revenue year-to-date, Collector Crypt has emerged as a leader in RWA collectibles, with a focus on Pokémon but expandable to other TCGs.

4.1. Features

Gacha Unboxing System: Gamified packs with rarities offering expected values and big-win chances up to 20%, blending luck with collectible acquisition.

Instant Buyback at 85% Value: Provides immediate liquidity for pulled cards, sourced from ALT/eBay pricing, reducing holding risks.

Tokenized Marketplace: Trade vaulted NFTs representing physical cards, with guaranteed authenticity and redeemable for real assets.

Revenue-Funded Acquisitions: 100% of net pack sales reinvested into sourcing more cards, creating a self-sustaining ecosystem loop.

4.2. Token

The native token, CARDS, has a fixed maximum supply of 2 billion. Utility ties directly to platform economics, including staking for fee discounts, governance on new card integrations, and revenue shares from pack sales, which incentivize holders to drive adoption.

4.3. Investors

Collector Crypt raised $1.9M in a pre-sale round in August 2025. Investors include prominent VCs like GSR, GBV Capital, Big Brain Holdings, MV Global, and Telos, bringing expertise in blockchain and gaming to fuel its RWA expansion.

Today’s newsletter is also powered by Mindstream.

Master ChatGPT for Work Success

ChatGPT is revolutionizing how we work, but most people barely scratch the surface. Subscribe to Mindstream for free and unlock 5 essential resources including templates, workflows, and expert strategies for 2025. Whether you're writing emails, analyzing data, or streamlining tasks, this bundle shows you exactly how to save hours every week.

That's all for today. Let's talk tomorrow.