Happy Wednesday, TM Family!

Welcome to the Token Metrics Research | Daily newsletter, where we cover key market movements, regulatory updates, and early alpha for our readers and investors.

Let's dive in!

THE BULL MARKET IS OFFICIALLY BACK.

We're breaking down exactly what this means for your Portfolio, Bitcoin, and Altcoin Season.

"I think the bull run will peak anywhere from spring to fall 2026."

Watch our Founder and CEO Ian Balina cover it in the following video:

In Today's Edition

Altcoins Outperform: Memecoin Momentum Builds Steam

Project X Launches on HyperEVM

Bonk Ecosystem Accelerates: Buybacks and Bonk.fun Dominance

GENIUS Act, CLARITY Act, and Anti-CBDC Act Fail Procedural Hurdle

Today's edition of Token Metrics Research | Daily Newsletter is brought to you by The Rundown AI.

Stay up-to-date with AI

The Rundown is the most trusted AI newsletter in the world, with 1,000,000+ readers and exclusive interviews with AI leaders like Mark Zuckerberg, Demis Hassibis, Mustafa Suleyman, and more.

Their expert research team spends all day learning what’s new in AI and talking with industry experts, then distills the most important developments into one free email every morning.

Plus, complete the quiz after signing up and they’ll recommend the best AI tools, guides, and courses – tailored to your needs.

Now let's get back to the top stories of the day.

1. Altcoins Outperform: Memecoin Momentum Builds Steam

The crypto market is heating up, with altcoins stealing the spotlight from Bitcoin as broader economic indicators signal potential rate cuts. Bitcoin held steady near $118,000, up a modest 1.45% in the last 24 hours, amid June's U.S. CPI data showing core inflation rising just 0.1%-0.2% month-over-month, below forecasts and fueling bets for a September Fed rate cut.

This disinflationary print, combined with resilient institutional flows, has propelled altcoins higher. Ethereum (ETH) emerged as a standout, surging 5% to reclaim $3,164, its highest since February. It outperformed Bitcoin, with the ETH/BTC ratio jumping 5.96% to 0.02670, the best since May.

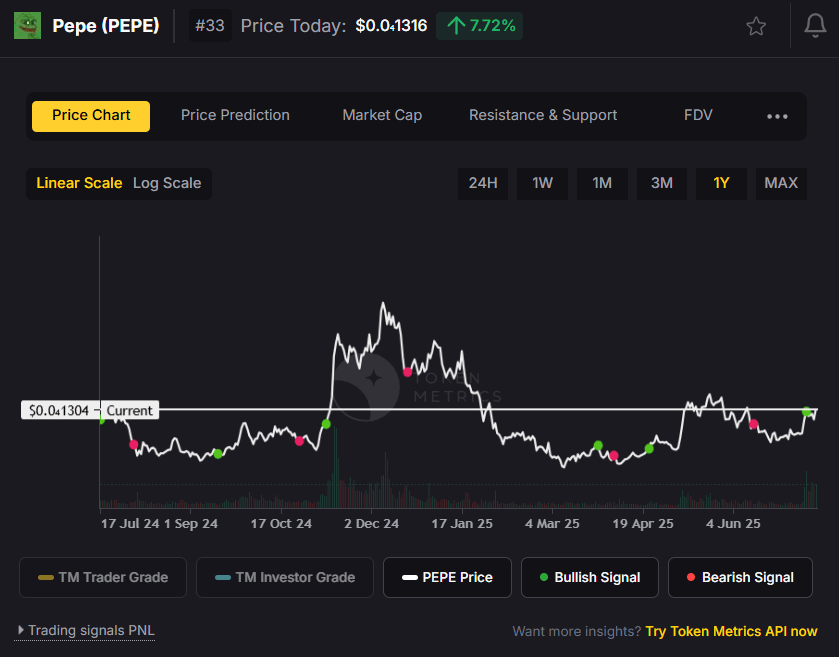

Memecoins are riding the wave. PEPE led the pack, climbing 8.7% amid intense volatility. Dogecoin (DOGE) added a modest 4.3%, while other alts like Solana (SOL) are up 4%. With BTC ETFs pulling $403M and total crypto resilience despite equity dips, alt season rotation feels imminent.

2. Project X Launches on HyperEVM

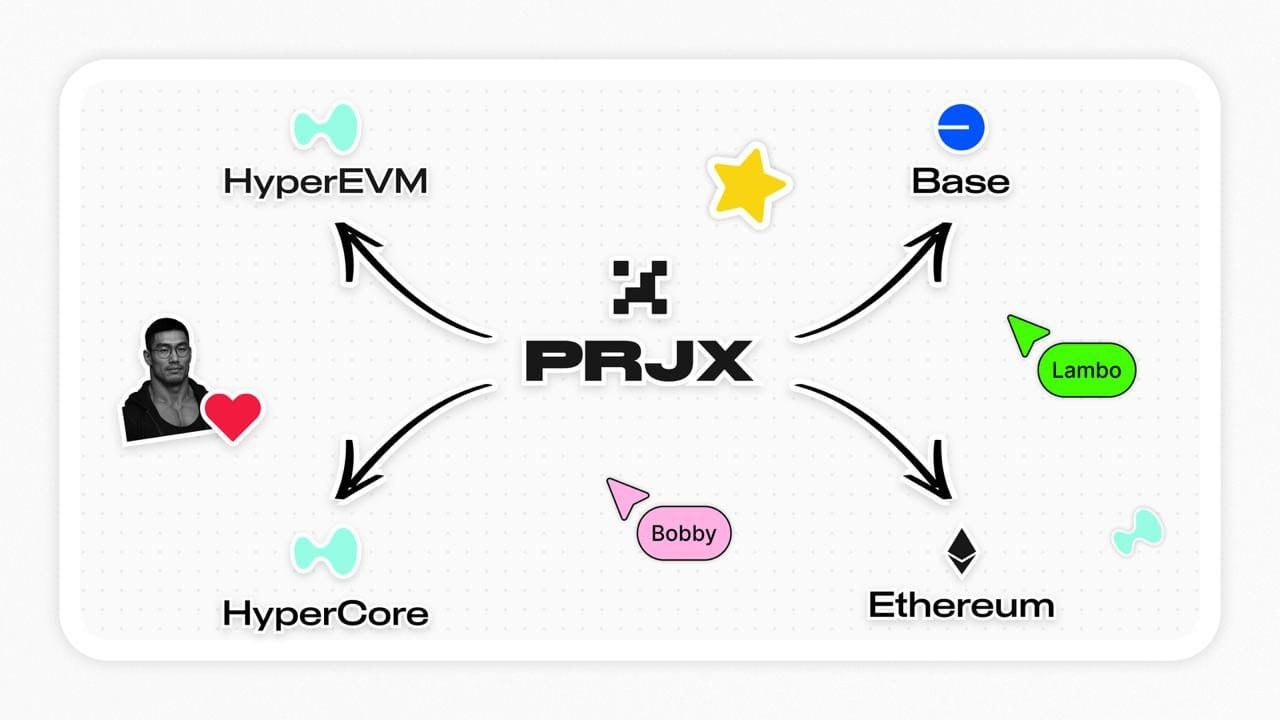

HyperEVM, the high-performance EVM-compatible layer built on Hyperliquid's infrastructure, welcomed a significant addition: Project X, a next-gen DeFi DEX launched on July 14, 2025. Positioned as a "Uniswap with extra rizz," Project X is a user-friendly, culture-first automated market maker (AMM) DEX focused on liquidity provision, yield earning, and cross-EVM trading with HyperCore integration. It's self-funded, audited by Peckshield and 0xquit, and secured by Privy for seamless wallets.

The rollout is phased: Phase 1 (live HyperEVM DEX) emphasizes swaps, LPing, and a points system rewarding early users with 1 million points daily (multipliers for top 100, 10% referral boosts). Phase 2 adds an EVM aggregator; Phase 3 is redacted but hints at "InfoFi" blending info/social signals with rewards.

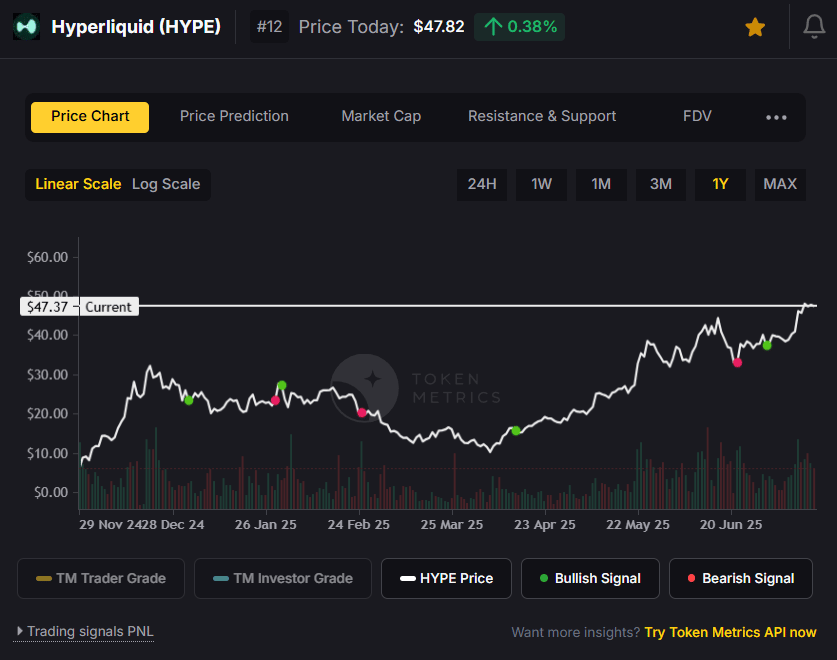

TVL hit $39M+ on launch, contributing to HyperEVM's overall $1.9B+ TVL. Adoption is booming: HyperEVM's ecosystem expanded rapidly post-launch, with 30+ projects announced, daily volumes hitting $8B, and the $HYPE token hitting a new all-time high of $49.75.

3. Bonk Ecosystem Accelerates: Buybacks and Bonk.fun Dominance

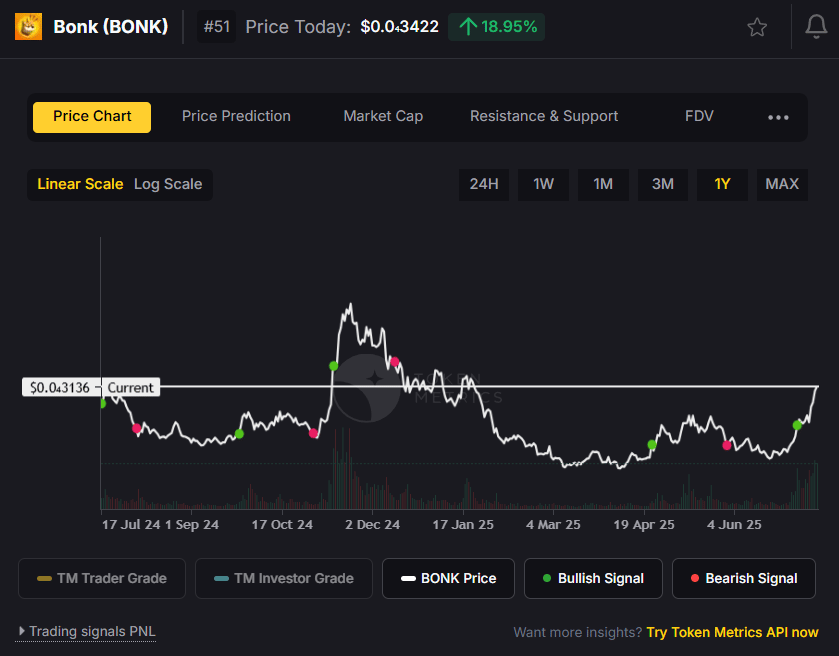

Bonk (BONK), the Solana-based memecoin, defies expectations with explosive ecosystem growth, up 20% in 24 hours. TVL is $18.22M, with 956,523 on-chain holders and trading volumes exceeding 134B tokens. The catalyst? Bonk.fun (aka LetsBonk.fun), a launchpad flipping Pump.fun in daily revenue ($1M+ even on slow days) and capturing 55% of Solana token issuances.

Bonk.fun's fee structure is ecosystem-aligned: 58%-50% to BONK buy/burn, 7.5% to $GP buyback/burn, and ~75% revenue retained in Solana. It generated $7.93M in fees over 7 days, translating to $2.8M+ monthly buybacks at current rates, potentially more with mania. Compared to Pump.fun ($37M monthly revenue, 25% buybacks pushing $PUMP to $6B+ MC), Bonk.fun is less extractive, slowing Pump's chain plans and boosting Solana retention.

4. GENIUS Act, CLARITY Act, and Anti-CBDC Act Fail Procedural Hurdle

Crypto regulatory progress hit a snag on July 15, 2025, as the US House rejected a procedural rule to debate three bills. All 210 Democrats opposed, joined by 13 GOP hardliners demanding stricter CBDC bans in the GENIUS Act. Industry backing, including $141M from Fairshake PAC, couldn't bridge divides.

Key bills affected:

GENIUS Act: Senate-passed, regulates stablecoins, bans yield-bearing ones like Ethena's USDe. Could reduce ETH selling pressure, supporting its 5.96% ETH/BTC rise.

CLARITY Act: Clarifies SEC/CFTC roles for digital assets, ending "enforcement by regulation" for tokens like SOL/XRP.

Anti-CBDC Act: Prohibits Fed retail CBDCs over privacy concerns; previously House-approved.

President Trump announced a "deal" with 11 holdouts, eyeing a July 16 revote, though none occurred by midday. Markets dipped briefly but rebounded on ETF inflows and institutional holdings.

Meme of The Day