Happy Thursday, TM Family!

Welcome to the Token Metrics Research | Daily newsletter, where we cover key market movements, regulatory updates, and early alpha for our readers and investors.

Let's dive in!

In Today's Edition

Pump.fun Rolls Out Dynamic Fee Model

Tokenization Surge Hits Stocks and Shares

Regulatory Thaw Enables Polymarket US Return

Majors Rotate: SOL Surges, ETH Upside Looms

Today's edition of Token Metrics Research | Daily Newsletter is brought to you by Pacaso.

Keep This Stock Ticker on Your Watchlist

They’re a private company, but Pacaso just reserved the Nasdaq ticker “$PCSO.”

No surprise the same firms that backed Uber, eBay, and Venmo already invested in Pacaso. What is unique is Pacaso is giving the same opportunity to everyday investors. And 10,000+ people have already joined them.

Created a former Zillow exec who sold his first venture for $120M, Pacaso brings co-ownership to the $1.3T vacation home industry.

They’ve generated $1B+ worth of luxury home transactions across 2,000+ owners. That’s good for more than $110M in gross profit since inception, including 41% YoY growth last year alone.

And you can join them today for just $2.90/share. But don’t wait too long. Invest in Pacaso before the opportunity ends September 18.

Paid advertisement for Pacaso’s Regulation A offering. Read the offering circular at invest.pacaso.com. Reserving a ticker symbol is not a guarantee that the company will go public. Listing on the NASDAQ is subject to approvals.

Now let's get back to the top stories of the day.

1. Pump.fun Rolls Out Dynamic Fee Model

Pump.fun has unveiled Project Ascend, a major update introducing dynamic creator fees tied to token market caps. The aim is to 10x builders' earnings and accelerate ecosystem growth on Solana. Under the new tiered structure, fees start at 0.95% for tokens under $300,000 market cap and taper down to 0.05% for those exceeding $20M, exclusively on PumpSwap.

This replaces May's flat 0.05% model, failing to reward smaller projects adequately. It applies retroactively to all coins, enabling existing communities to fund marketing, listings, and development without excessively burdening traders at higher caps.

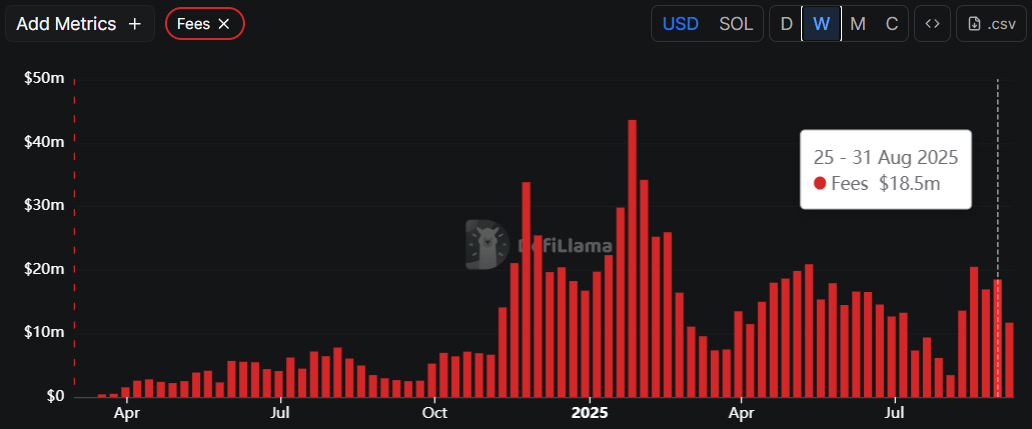

Pump.fun Weekly Fees

This shift comes amid Pump.fun's resurgence, reclaiming market dominance over rivals like Bonk with daily trader volumes of 100,000+ and 20,000+ new tokens launched daily. Total revenue has topped $784M, with an annualized run rate of $623M, fueled by aggressive PUMP token buybacks exceeding $68.9M, often directing over 100% of daily revenues back into the token.

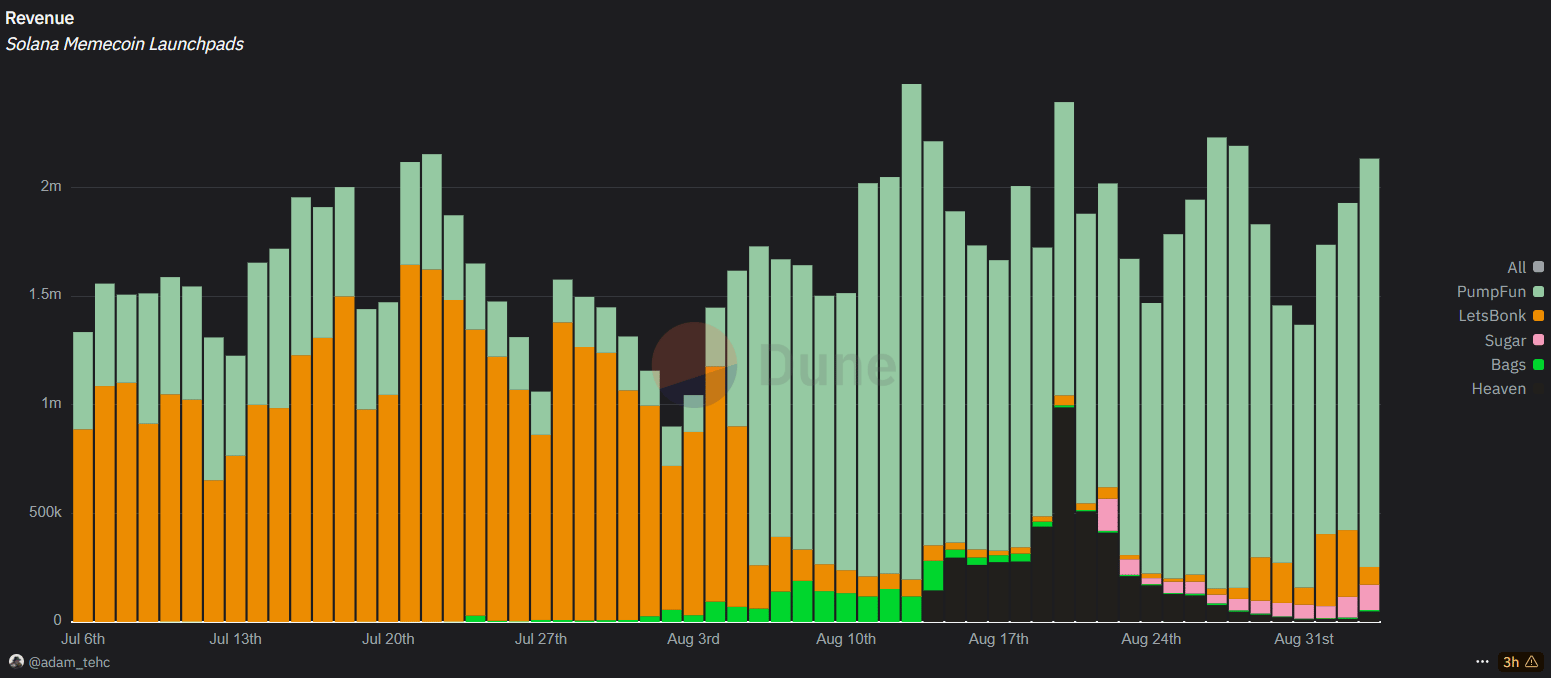

Daily Revenue for Leading Solana Memecoin Launchpads

For Solana memecoin natives, this means more sustainable projects: higher early-stage rewards could attract top talent like streamers and startups while preserving LP autocompounding and keeping protocol fees unchanged. However, only a fraction of tokens advance beyond bonding curves, so expect intensified competition in Pump.fun's 10–25% share of Solana token volume.

Co-founder @a1lon9 emphasized onboarding the world to Solana, signaling ambitions to solidify as the hub for high-growth communities. Investors should monitor PUMP's response, as enhanced creator alignment could drive long-term TVL and adoption.

2. Tokenization Surge Hits Stocks and Shares

Asset tokenization is accelerating, with Ondo Finance launching tokenized US stocks and ETFs on Ethereum, Galaxy Digital issuing its shares on Solana, and a new $147M Bitcoin treasury emerging in Europe.

Ondo's Global Markets platform offers over 100 equities like Apple and Tesla, plus Fidelity and BlackRock ETFs, to non-US qualified investors via Trust Wallet integration, enabling direct holding, swapping via 1inch, and use as collateral in Morpho vaults.

Priced via Chainlink oracles with LayerZero for cross-chain, it plans expansion to 1,000+ assets by year-end, though limited to US market hours for trading and excluding US/UK/EEA residents; tokens don't confer underlying ownership but boost accessibility for APAC, Europe, Africa, and Latin America users.

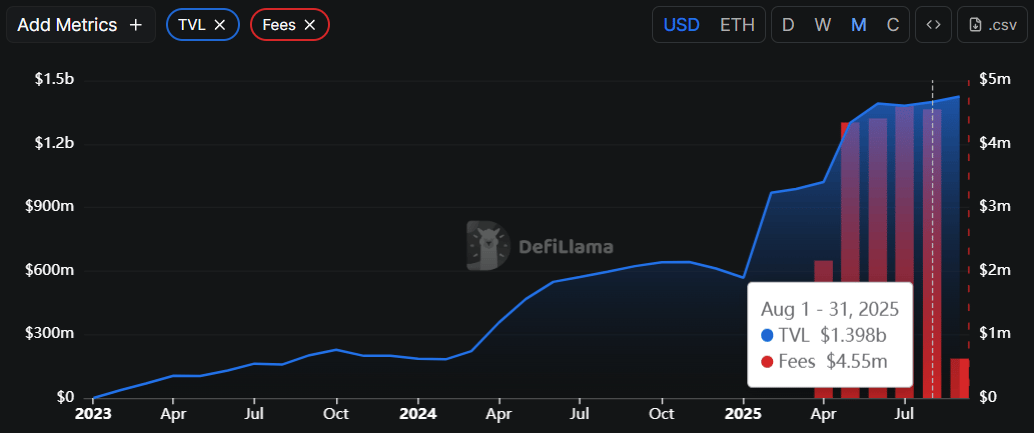

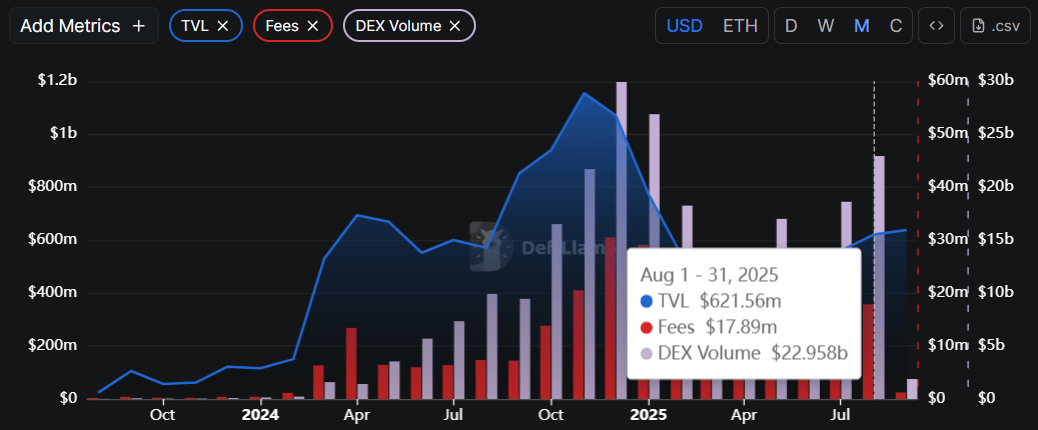

Ondo TVL and Monthly Fees

Partnering with Superstate, Galaxy tokenized its SEC-registered Class A shares on Solana, the first public equity natively on a major chain, granting full shareholder rights with real-time on-chain registry updates for verified, KYC'd holders. Already, 21 investors hold 32,374 tokenized shares, unlocking 24/7 transfers and potential AMM trading under the SEC's Project Crypto framework. CEO Mike Novogratz highlighted bridging tradfi with crypto's transparency and composability.

Meanwhile, Winklevoss Capital and Nakamoto Holdings-backed Treasury BV raised €126M (~$147M) to build Europe's premier Bitcoin treasury, holding 1,000+ BTC (~$110M) via a reverse merger with MKB Nedsense for Euronext Amsterdam listing under ticker TRSR. Backers include UTXO Management and Off the Chain Capital, positioning it against US giants like MicroStrategy amid post-ETF momentum.

These moves signal maturing RWA ecosystems for crypto investors. Ondo democratizes equities on ETH, Galaxy pioneers public chain equity on SOL, and Treasury BV could catalyze European institutional BTC adoption.

This edition of the newsletter is co-presented by The Marketing Millennials.

The best marketing ideas come from marketers who live it. That’s what The Marketing Millennials delivers: real insights, fresh takes, and no fluff. Written by Daniel Murray, a marketer who knows what works, this newsletter cuts through the noise so you can stop guessing and start winning. Subscribe and level up your marketing game.

Now, let's continue with the rest of the stories.

3. Regulatory Thaw Enables Polymarket US Return

US regulators are signaling a crypto-friendly shift, with SEC-CFTC coordination on spot products and CFTC greenlighting Polymarket's US relaunch after a three-year hiatus.

The agencies' joint Project Crypto and Crypto Sprint initiative focuses on guidance for leveraged and spot crypto trades. It encourages exchanges to file for registrations and emphasizes clearing, surveillance, and data dissemination to foster innovation stateside. This builds on prior reports, moving beyond enforcement toward clarity amid cases like Coinbase and Binance.

Polymarket, the leading prediction market, acquired CFTC-licensed QCX for $112M in July. This acquisition secured a no-action letter exempting certain recordkeeping for event contracts, paving the way for US operations without enforcement risks in defined scenarios.

Monthly Active Traders on Polymarket

Exiting the US in 2022 after an unregistered derivatives settlement, Polymarket now leverages QCX's DCM and DCO licenses. CEO Shayne Coplan hails the "record timing" approval and teases imminent launch. Backed by 1789 Capital (tied to Donald Trump Jr.), the platform saw 11,500 new markets in July, up 44% MoM, betting on politics, sports, and the economy.

This eases jurisdictional silos, potentially unlocking spot crypto listings on registered exchanges and boosting prediction market liquidity. Rival Kalshi's NFL partnerships underscore the trend.

4. Majors Rotate: SOL Surges, ETH Upside Looms

Market rotation favors altcoins as Solana outperforms Bitcoin, eyeing a rally akin to Ether's 200% surge, while BTC holds steady and traders pivot to ETH for September gains.

SOL has climbed 33% since early August, up 34% vs. BTC and 14% vs. ETH mid-month, driven by potential $2.6B inflows from DATs, ETF decisions, and upgrades like Alpenglow.

Arca CIO Jeff Dorman calls SOL the "most obvious long," noting its 1/5 ETH market cap amplifies flow impacts, with bets rotating into SOL betas like RAY and DRIFT.

ETH trades near $4,400, up 20% monthly, with Polymarket odds favoring a $5,000+ break on Fusaka upgrade and ETF inflows; risk reversals show renewed call demand amid macro bets on Fed cuts (92% probability).

BTC consolidates at $110K—$112K as a macro hedge against inflation and policy risks, with muted volatility and Polymarket capping it at $120K. Broader flows hit ETH betas like AAVE and AERO, signaling market breadth.

TVL, Monthly Fees and Monthly DEX Volume for Aerodrome

Meme of The Day

Helpful Links

Today’s newsletter is also powered by Stocks & Income.

Financial News Keeps You Poor. Here's Why.

The scandalous truth: Most market news is designed to inform you about what already happened, not help you profit from what's coming next.

When CNBC reports "Stock XYZ surges 287%"—you missed it.

What you actually need:

Tomorrow's IPO calendar (not yesterday's launches)

Crowdfunding deals opening this week (not closed rounds)

What real traders are positioning for (not TV talking heads)

Economic data that moves markets (before it's released)

The financial media industrial complex profits from keeping you one step behind.

Stocks & Income flips this backwards. We focus entirely on forward-looking intel that helps you get positioned before the crowd, not informed after the move.

Stop chasing trades that happened already.

Start prepping for the next one.

Stocks & Income is for informational purposes only and is not intended to be used as investment advice. Do your own research.

That's all for today. Let's talk tomorrow.