Happy Monday, TM Family!

Welcome to the Token Metrics Research | Daily newsletter, where we cover key market movements, regulatory updates, and early alpha for our readers and investors.

Let's dive in!

In Today's Edition

MegaETH Sale Oversubscribed 3x in Minutes

Corporates Double Down on BTC, ETH Treasuries

Stablecoin Ecosystem Goes Global

Rate Bets Ignite Inflows, Stocks Amid BTC Caution

Today's edition of Token Metrics Research | Daily Newsletter is brought to you by CoW Swap.

Best Price. Every Trade.

Built for active crypto traders. CoW Swap always searches across every major DEX and delivers the best execution price on every swap you make. Smarter routes. Better trades. No wasted value. Find your best price today. So why trade on any one DEX when you can use them all?

Now let's get back to the top stories of the day.

1. MegaETH Sale Oversubscribed 3x in Minutes

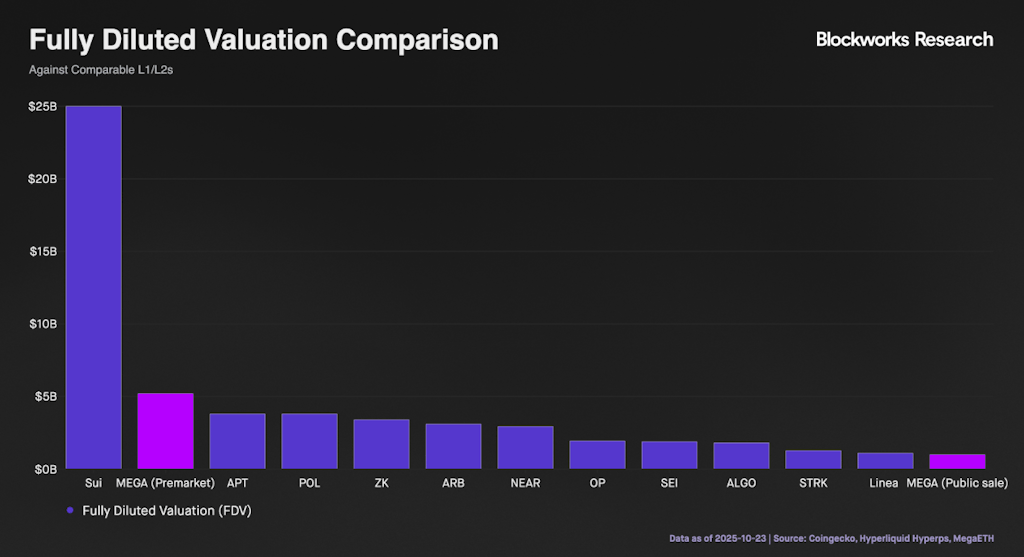

MegaETH's public auction for its MEGA token, a real-time Ethereum L2 aiming to slash latency to microseconds, sold out in under 30 minutes, raising the $50M cap at a baseline FDV of $1B but clearing at over three times demand for an implied valuation of over $ 3 B.

Bids topped $150M in USDT, with premarket perps on Hyperliquid pricing it at $5B FDV and Polymarket odds at 89% for a post-launch flip above $2B. This follows a $20M seed round from Dragonfly and Vitalik, along with a 4.75% buyback from pre-seed holders to tighten the supply.

This isn't just hype, it's a masterclass in community bootstrapping. The English auction's low entry ($2.6K minimum bid) and 10% lockup discount for U.S. accredited investors rewarded early believers, echoing airdrop economics without the farm meta.

MEGA's utility in sequencer rotation and "proximity markets" could juice L2 TVL if mainnet delivers sub-1ms txs. Risk? Oversubscription masks execution bets; watch for post-TGE dumps if liquidity floods. For L2 portfolios, this validates real-time infrastructure as the next phase of the throughput war, positioning them selectively ahead of the November testnet.

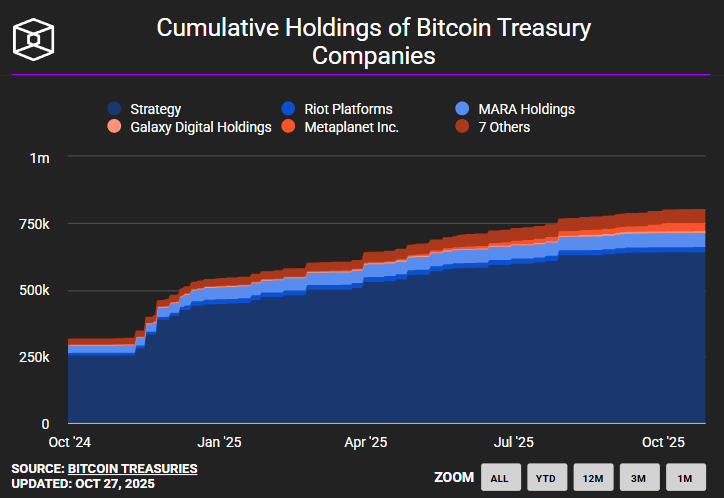

2. Corporates Double Down on BTC, ETH Treasuries

Treasury mania hit warp speed: MicroStrategy (now Strategy) scooped up 390 BTC at an average of $111,000, pushing its hoard to 640,000 BTC ($74B market value, 3% of the supply), funded via $43M in preferred stock sales.

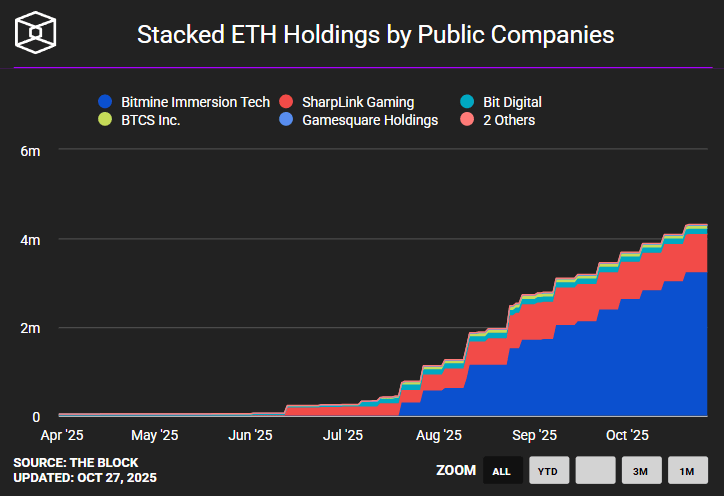

BitMine Immersion, chaired by Tom Lee, added 77K ETH ($319M) to hit 3.3M ETH ($13.7B, 2.7% of circulating supply), eyeing 5% dominance with backers like Ark and Pantera.

Enter Strive: Vivek Ramaswamy's BTC treasury vehicle surged 45% premarket (80% WoW) on a merger with Semler Scientific, creating the first all-stock BTC treasury play and filing for social media monetization.

These aren't retail FOMO buys; they're conviction bets on uncorrelated assets amid equity correlations spiking to 0.7. Strategy's "42/42" plan ($84B raise by '27) and BitMine's velocity (88% of global DAT volume with MSTR) scream liquidity premium for treasury proxies.

Strive's merger adds yield via social tipping, blending BTC beta with meme-adjacent revenue. Implication? 190+ public BTC holders now, but ETH treasuries like BitMine's "supercycle" thesis (open interest back to June lows at $2.5K ETH) could flip the dominance script.

This edition of the newsletter is co-presented by Proton Mail.

Proton Mail gives you a clutter-free space to read your newsletters — no tracking, no spam, no tabs.

Now, let's continue with the top stories of the day.

3. Stablecoin Ecosystem Goes Global

Stablecoins aren't sleeping: Pantera's Mason Nystrom doubled down on the $1T thesis, spotlighting Hyperliquid's USDH bidding war and Paradigm/Stripe's Tempo L1 for payments disruption.

Japan countered with JPYC, the first global yen-pegged token, backed by JGBs yielding >3%, redeemable fee-free, and tapping 16.85% of FX volume.

In Europe, ClearBank joined Circle's Payments Network for instant USDC/EURC minting under MiCA, eyeing tokenized treasuries and $19.4B YTD payment volumes.

IBM's Digital Asset Haven with Dfns adds custody for 40+ chains, while tZero eyes a 2026 IPO to scale RWA tokenization ($35B market).

This is the evolution of rails, as yen's convertibility (post-'80s reforms) unlocks on-chain USD/JPY pairs, while MiCA bridges TradFi to DeFi. Sky's $100M pivot to Superstate's 8.35% crypto carry fund signals yield compression forcing diversification beyond Treasuries (now <4%).

For natives: stUSDS-like risk tokens are alpha; RWAs hit escape velocity if tZero lists. Watch USDH/Tempo for payment flow capture, $1T isn't hyperbole if FX migrates on-chain.

4. Rate Bets Ignite Inflows, Stocks Amid BTC Caution

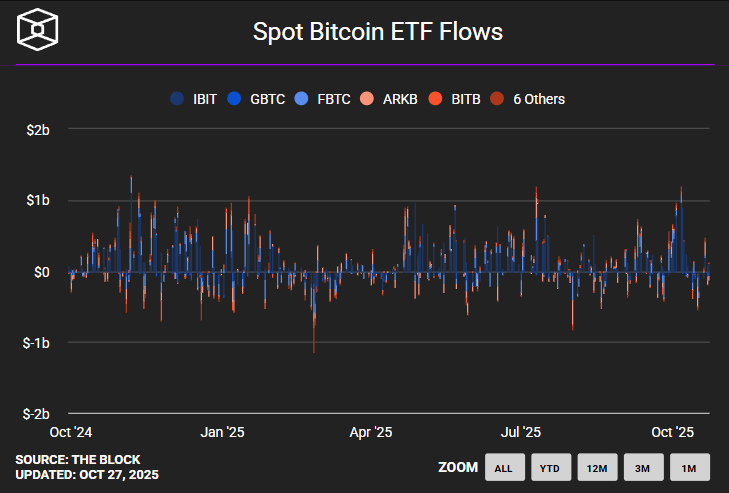

Rate-cut euphoria reversed $513M in outflows with $921M in inflows into global ETPs, with the U.S. snagging $843M, and BlackRock's IBIT alone garnering $324M, driven by sub-CPI data and Fed whispers.

Crypto stocks popped 5-10%: MSTR +4.1% premarket, Strive/MARA riding Trump's China trade thaw (70% odds of Xi meet by month-end). BTC breached its 50-day SMA at $ 115,200 (MACD bullish cross), but CoinDesk's BTI remains bearish; volume at 44% signals calm before the FOMC.

Trump's "deal imminent" vibe de-risks the "leverage channel" Lee flags, crypto thrives in risk-on equity upswings. Inflows lag behind 2024 ($30B YTD vs. $41B), but ETH's $169M outflows hint at a rotation toward BTC dominance.

WazirX users score a legal win: Indian court halts XRP socialization post-2024 hack, affirming crypto as a form of trust property. Mt. Gox deadline slips to 2026, more supply overhang dodged. Stay nimble; this relief rally could extend if Xi delivers.

Meme of The Day

Helpful Links

Today's newsletter is also powered by Money.com

Could you go from being $50k in debt to $20k?

If you feel you're languishing in debt, debt relief companies can take over negotiations with your creditors and potentially get them to accept up to 60% less than you owe. Sounds too good to be true? Our debt relief partners have already helped millions of Americans just like you get out of debt. Check out Money’s list of the best debt relief programs, answer a few short questions, and get your free rate today.

That's all for today. Let's talk tomorrow.