Happy Friday, TM Family!

Welcome to the Token Metrics Research | Daily newsletter, where we cover key market movements, regulatory updates, and early alpha for our readers and investors.

Let's dive in!

In Today's Edition

Trump's Crypto Clemency: CZ Pardoned, SBF's Shadow Looms

Satoshi's Ghost Stirs: 14-Year Dormant Miner Wallet Awakens $442M Fortune

TradFi's Tentative Tango: JPMorgan and Sygnum Unlock BTC/ETH

Macro Crosshairs: CPI Shadowboxing, Trump-Xi Elixir Lifts BTC

Today's edition of Token Metrics Research | Daily Newsletter is brought to you by Crypto 101.

The Smartest Free Crypto Event You’ll Join This Year

Curious about crypto but still feeling stuck scrolling endless threads? People who get in early aren’t just lucky—they understand the why, when, and how of crypto.

Join our free 3‑day virtual summit and meet the crypto experts who can help you build out your portfolio. You’ll walk away with smart, actionable insights from analysts, developers, and seasoned crypto investors who’ve created fortunes using smart strategies and deep research.

No hype. No FOMO. Just the clear steps you need to move from intrigued to informed about crypto.

Now let's get back to the top stories of the day.

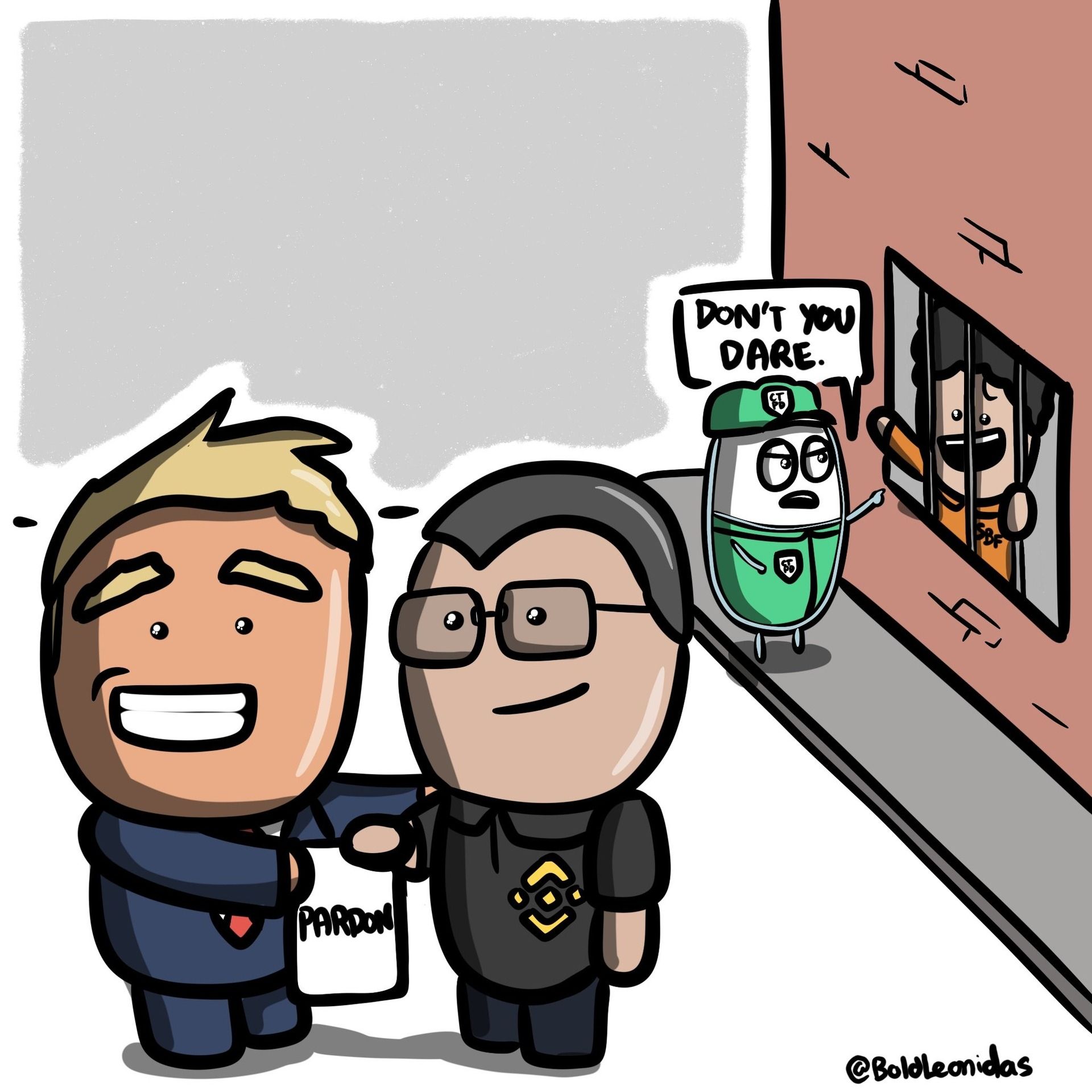

1. Trump's Crypto Clemency: CZ Pardoned, SBF's Shadow Looms

In a move that has sent shockwaves through boardrooms and backrooms alike, President Trump has issued a full pardon to Binance co-founder Changpeng "CZ" Zhao, erasing the remnants of his 2023 guilty plea for anti-money laundering lapses that resulted in a four-month sentence in a low-security lockup and a $4.3B fine for Binance.

Trump, defending the decision in a press gaggle yesterday, shrugged off personal ties, "I don't believe I've ever met him", while blasting the Biden-era DOJ as a "war on crypto" machine. White House Press Secretary Karoline Leavitt echoed the sentiment: "The Biden Administration's war on crypto is over."

CZ, ever the statesman, fired back on X: "Deeply grateful... We will do everything we can to help make America the Capital of Crypto." The timing? Eerily synced with Binance's fresh $2B Abu Dhabi infusion via Trump-linked World Liberty Financial's USD1 stablecoin. BNB spiked 5% in the ensuing hours, while the WLFI token leaped 15%, and broader sentiment indices turned green.

But the real intrigue? Ripple effects for FTX's fallen wunderkind, Sam Bankman-Fried (SBF). Polymarket odds for an SBF pardon jumped to 12% (from 7%), while Kalshi odds rose to 16% (up 9 points), fueled by SBF's recent appearance on Tucker Carlson's show and his parents' lobbying efforts in Trump's orbit.

It is essential to note that SBF's fraud conviction, tied to $8B in customer fund misuse, poses a steeper barrier than CZ's compliance slip. However, Trump's spree (recall Ross Ulbricht's January executive order) signals a pro-crypto reset. Senate Democrats, led by Elizabeth Warren and Maxine Waters, fired back with a condemnation resolution, decrying it as "pay-to-play" favoritism amid Trump's family crypto ventures.

Our Take: This isn't just absolution; it's a gauntlet thrown at the SEC's feet. Expect accelerated market structure talks, as the CLARITY Act markup could slip to November amid shutdown chaos. However, with bipartisan venom rising, true reform hinges on CFTC primacy for non-securities.

2. Satoshi's Ghost Stirs: 14-Year Dormant Miner Wallet Awakens $442M Fortune

Deep in Bitcoin's history, a wallet from 2009, mined when BTC was basically worthless, just blinked after 14 years of silence. It moved 150 BTC (about $16.5M at current prices) to a new spot, leaving 3,850 BTC ($420M) behind. Chain trackers like Lookonchain claim it's an old miner's stash from the time when everyone was experimenting.

Why now? Folks are whispering about quantum computers. These super-machines could one day crack old wallet keys like eggshells, think "steal today, unlock tomorrow." Google's latest technology significantly reduces errors, and the Fed even warned about it last month. No panic yet, upgrades like Taproot help shield things—but old addresses like this one are sitting ducks.

We've seen this before: Other ancient wallets dumped billions this year. It barely moves the market (just 0.003% of all BTC), but it reminds us to update those dusty holdings.

Quick Take: Not a sell-off signal, but a nudge to secure your position, possibly shifting 5-10% to quantum-safe options. BTC held steady at +2% yesterday, which could spark upgrades that boost the network in the long term.

This edition of the newsletter is co-presented by CoW Swap.

UN-Limited Limit Orders

Why pay gas for limit orders that never execute? With CoW Swap, you can set an unlimited number of limit orders – more than your wallet balance – then cancel them all at no cost to you. Try Limit Orders.

Now, let's continue with the top stories of the day.

3. TradFi's Tentative Tango: JPMorgan and Sygnum Unlock BTC/ETH

Big banks are dipping their toes deeper into our pool. JPMorgan's saying by year's end, rich clients and funds can use Bitcoin or Ethereum as collateral for loans. No need to sell and pay taxes, just borrow against what you hold, through safe custodians. It's like pawning your gold watch without losing it. CEO Jamie Dimon, who once trashed BTC as "tulips on steroids," now says he'll fight for your right to HODL.

In Switzerland, Sygnum's rolling out MultiSYG next year: Borrow against BTC with multi-signature wallets (you and pros control the keys, no shady re-lending). Plus, Revolut just grabbed a EU license in Cyprus to offer trading, staking (up to 22% yields), and stablecoins across Europe, over 280 tokens, all regulated.

This ties into AI payments too: Stripe thinks smart AI money moves could unlock a $350B market, with their new blockchain layer leading the charge.

Quick Take: Huge for unlocking trapped cash, think $1T in crypto sitting idle. Great for ETH/BTC holders; lending apps like AAVE could double volumes. With bond yields dropping, this beats parking in Treasuries.

4. Macro Crosshairs: CPI Shadowboxing, Trump-Xi Elixir Lifts BTC

Yesterday's CPI print? A smidge hot at 3.2%, higher than hoped, strengthening the dollar and trimming odds for significant Fed cuts. BTC wobbled to $108K but climbed back to $109,500, ignoring the drama. Why the shrug? The White House has scheduled Trump-Xi talks for October 30 in Seoul, marking the first meeting in ages and potentially easing trade tensions over chips and metals. Stocks perked up too (S&P futures +0.3%), but gold slipped on inflation fears.

Options pros see BTC swinging 1.4% today, ETH more at 2.9%. Privacy coin Monero surged into double digits on its hide-and-seek appeal, while risk gauges, such as junk bonds, flashed yellow, echoing BTC's quiet strength but conveying wary vibes.

On the hot side: AI data centers are exploding. Oracle's $38B debt deal for massive builds (tied to OpenAI) has lit a fire under "AI miners" like CleanSpark (+7%) and Bitfarms (+12%), prompting them to pivot to power-hungry AI jobs. Prediction markets are on a tear too: Polymarket's eyeing $12-15B funding, Kalshi's at $10B valuation with sports bets pouring in ($2B weekly volumes combined).

Meme of The Day

Helpful Links

Today's newsletter is also powered by AltIndex.

When AI Outperforms the S&P 500 by 28.5%

Did you catch these stocks?

Robinhood is up over 220% year to date.

Seagate is up 198.25% year to date.

Palantir is up 139.17% this year.

AltIndex’s AI model rated every one of these stocks as a “buy” before it took off.

The kicker? They use alternative data like reddit comments, congress trades, and hiring data.

We’ve teamed up with AltIndex to give our readers free access to their app for a limited time.

The next top performer is already taking shape. Will you be looking at the right data?

Past performance does not guarantee future results. Investing involves risk including possible loss of principal.

That's all for today. Let's talk tomorrow.