From Rektember to a Brighter October

U.S. 10-year Note Yield: Daily

The shocking post-merge-down trade in crypto is driven by macro factors like a higher dollar and rising interest rates. We expected inflation to be old news, but that was not the case in September. U.S. 10-year note yields could reach as high as 3.69% before the interest rate panic ends.

S&P Futures: Daily

The problem with crypto started when stocks started to fall apart last week. The downside target in S&P (ES1) is 3726.

PAX Gold: Daily Chart

The Dollar (DXY) and U.S. interest rates may enter a blowoff top phase. This setup could mean an emotional run-up in DXY to 112 and a down move in Gold. If Gold continues to break down, it is worth looking at Pax Gold (PAXG) at 1610.

Ethereum: 4-hour

The talk in crypto is centered on the SEC coming after all proof of stake coins. This development, combined with a confirmed head and shoulders top in ETH, has people talking about a move to the head and shoulders top target of $800.

Bitcoin: 4-hour

Hidden pivot analysis in bitcoin points to the possibility of a new low for 2022 at $16,000. BTC would have to stay below $19,800 for this chart structure to be valid.

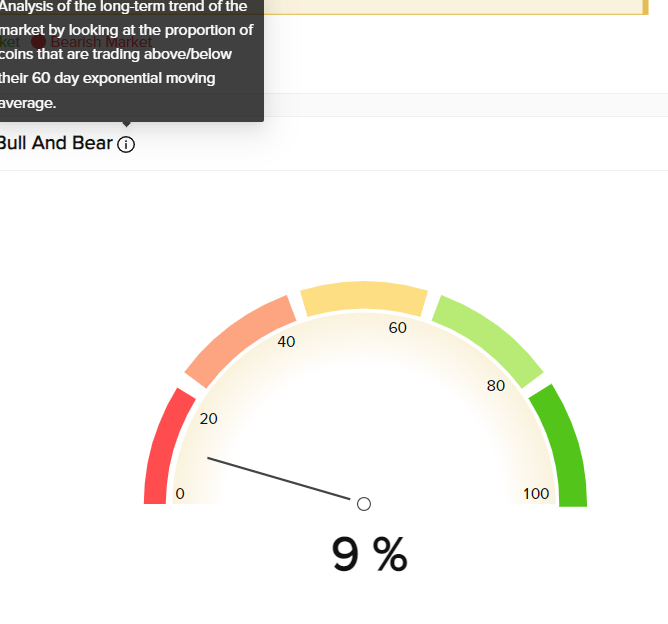

Token Metrics Moving Average Indicator

From a technical analysis point of view, the crypto market failed to rally because most big cap coins could not get above their 60-day exponential moving average. The 60-day EMA is an important indicator highlighted in a statistical study by the Token Metrics quant department.

Bottom Line

The post-merge decline has been a humbling experience. That says when the Fed fear trade has run its course headed into the Fall equinox on September 22. While the market is talking about chart points like $800 ETH and $16,000, those targets may not be attainable. There is “good” news about the post-merge decline. Gann’s seasonal work has changed. Pre-merge, that work showed a positive September followed by declines in October and November. Now, the pattern has changed. A negative September could set up a real bottom in crypto and a substantial upside during October and November.