Happy Friday, TM Family!

Welcome to the Token Metrics Research | Daily newsletter, where we cover key market movements, regulatory updates, and early alpha for our readers and investors.

Let's dive in!

In Today's Edition

Ethereum Eclipses Bitcoin in Spot Trading Volume

Stripe and Paradigm Launch Tempo

Nasdaq Scrutiny Hammers Crypto Treasury Stocks

Kraken Acquires Breakout: Bolstering Prop Trading Ecosystem

Sora Ventures' $1B Bitcoin Treasury Fund

Justin Sun's WLFI Token Freeze: A Test for DeFi Principles

Today's edition of Token Metrics Research | Daily Newsletter is brought to you by Pacaso.

Keep This Stock Ticker on Your Watchlist

They’re a private company, but Pacaso just reserved the Nasdaq ticker “$PCSO.”

No surprise the same firms that backed Uber, eBay, and Venmo already invested in Pacaso. What is unique is Pacaso is giving the same opportunity to everyday investors. And 10,000+ people have already joined them.

Created a former Zillow exec who sold his first venture for $120M, Pacaso brings co-ownership to the $1.3T vacation home industry.

They’ve generated $1B+ worth of luxury home transactions across 2,000+ owners. That’s good for more than $110M in gross profit since inception, including 41% YoY growth last year alone.

And you can join them today for just $2.90/share. But don’t wait too long. Invest in Pacaso before the opportunity ends September 18.

Paid advertisement for Pacaso’s Regulation A offering. Read the offering circular at invest.pacaso.com. Reserving a ticker symbol is not a guarantee that the company will go public. Listing on the NASDAQ is subject to approvals.

Now let's get back to the top stories of the day.

1. Ethereum Eclipses Bitcoin in Spot Trading Volume

For the first time in over seven years, Ethereum's monthly spot volume on centralized exchanges has surpassed Bitcoin's, clocking in at nearly $480B versus BTC's $401B in August.

This milestone isn't just a data point; it's a signal of deepening institutional interest in ETH, fueled by spot ETF inflows. ETH has surged 105% year-to-date, outpacing BTC's 18% gain, thanks to corporate treasury programs and whale rotations.

Public companies like BitMine Immersion and SharpLink Gaming have disclosed multi-billion-dollar ETH purchases, bolstering treasury holdings.

Notably, at least one BTC whale swapped long-held Bitcoin for $4B in ETH, hinting at a broader capital reallocation. As Paul Howard from Wincent aptly put it, "Q4 is where I expect we hit new all-time highs in all the majors off the back of potential US rate cuts."

For investors, this suggests ETH as a higher-beta play, potentially cushioning against volatility if rate cuts materialize. Keep an eye on BTC whale wallets rotating into ETH, it's where the blue-chip action might concentrate.

2. Stripe and Paradigm Launch Tempo

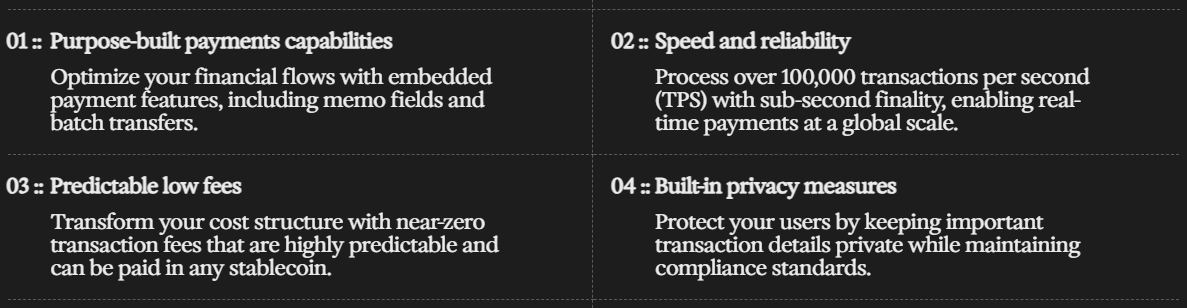

Stripe and Paradigm have incubated Tempo, a high-speed blockchain optimized for payments, in a bold move to capture the trillion-dollar stablecoin market.

Currently in private testnet, Tempo boasts over 100,000 transactions per second with sub-second finality, EVM compatibility via the Reth execution client, and features like stablecoin-neutral fees paid through an enshrined AMM.

Design partners include heavyweights like Visa, Deutsche Bank, Shopify, Nubank, OpenAI, and Revolut, targeting use cases from remittances and global payouts to AI-driven microtransactions.

Stripe CEO Patrick Collison highlighted its potential for "agentic payments," while the project plans a shift to permissionless validators. This isn't just another layer; it's Stripe's deepest foray into on-chain infrastructure, competing with rivals in the race for efficient cross-border flows.

Tempo could supercharge stablecoin adoption, reducing friction in DeFi and TradFi integrations. Expect it to draw liquidity from USDC and USDT issuers, potentially boosting on-chain volumes as it goes public.

3. Nasdaq Scrutiny Hammers Crypto Treasury Stocks

Crypto treasury firms are under siege, with stocks tumbling amid reports of heightened Nasdaq oversight. The exchange is demanding shareholder approvals for crypto purchases and threatening delistings for non-compliance, exacerbating declines in a market where BTC, ETH, and SOL dipped 2-4%.

Names like KindlyMD (down 16%, 90% from peak), American Bitcoin (down 20% post-listing), Metaplanet (down 8.6%, 70% from high), Bitmine Immersion (down 8.6%), and SharpLink Gaming (down 10.5%) bore the brunt. Even MicroStrategy held relatively steady, down just 1.8% but 30% off its 2025 high.

In Asia, the narrative is "outperform or die," as BTC treasury firms vie against ETFs. Strive's Matt Cole emphasized scale, that firms need $1B+ balance sheets and clear risk frameworks to compete, and suggested perpetual preferred equity for leveraging BTC's scarcity. Ethereum? Dismissed as too equity-like for treasuries.

For investors, this scrutiny could constrain fundraising, pushing treasuries toward transparent, scaled models. BTC treasuries remain compelling amid fiat debasement, but ETFs offer a safer, passive alternative. Watch for accumulation signals in BTC above $110,500.

This edition of the newsletter is co-presented by Stocks & Income.

Wall Street has Bloomberg. You have Stocks & Income.

Why spend $25K on a Bloomberg Terminal when 5 minutes reading Stocks & Income gives you institutional-quality insights?

We deliver breaking market news, key data, AI-driven stock picks, and actionable trends—for free.

Subscribe for free and take the first step towards growing your passive income streams and your net worth today.

Stocks & Income is for informational purposes only and is not intended to be used as investment advice. Do your own research.

Now, let's continue with the rest of the stories.

4. Kraken Acquires Breakout: Bolstering Prop Trading Ecosystem

Kraken has acquired Breakout, a 2023-launched prop trading platform that funds skilled traders via performance evaluations.

Breakout's model requires traders to pass risk-discipline tests for funded accounts up to $100,000 (aggregate $200,000), with 90% profit retention, 5x leverage on BTC/ETH, and support for 50+ crypto pairs. Having issued 20,000+ funded accounts, it's now integrated into Kraken Pro for a seamless ecosystem.

Kraken's Arjun Sethi called it a "filter for scalable signal," while Breakout's Alex Miningham sees it as pairing trader-first innovation with global infrastructure. This follows Kraken's buys of NinjaTrader and Capitalise.ai, signaling expansion in trading tools.

Potential impacts are enhanced security, broader market access, and terminal upgrades for prop traders. For crypto-natives, this democratizes capital access, potentially spiking on-exchange volumes and attracting talent, a win for merit-based trading in a maturing market.

5. Sora Ventures' $1B Bitcoin Treasury Fund

Sora Ventures is raising a $1B fund to back Bitcoin treasury firms in Asia, with $200M already committed from regional partners. Targeting Japan, Hong Kong, Thailand, and South Korea, it aims to replicate BTC-first models, building on investments like Metaplanet's $6.6M BTC buy and stakes in Moon Inc., DV8, and BitPlanet. Founder Jason Fang called it a "historic moment" for institutional convergence.

The fund will support existing treasuries, spawn new ones, and foster global synergies, accelerating BTC as a reserve asset amid fragmented Asian efforts. Implications can be regional adoption, potentially countering U.S./EU dominance and injecting liquidity into BTC treasuries. Investors should monitor for synergies with local pioneers; this could catalyze Asia's BTC treasury boom.

6. Justin Sun's WLFI Token Freeze: A Test for DeFi Principles

Tron founder Justin Sun is clashing with World Liberty Financial (WLFI), a Trump-backed DeFi project, over frozen tokens. After transferring ~50M WLFI ($9M) to HTX-linked wallets, his holdings were blocked amid sell-off fears, despite denials of dumping.

Sun, an early investor and advisor who pledged $75M in WLFI and $100M in TRUMP memecoins, argued tokens are "sacred and inviolable," urging an unlock to uphold blockchain fairness.

WLFI, valued at over $30B at launch, saw a 24% price dip, with HTX moving 60M tokens to Binance. Community speculation includes verbal no-sell agreements, but Sun claims transfers were routine tests.

This saga highlights DeFi's tension between decentralization and control. Freezing erodes trust, potentially damaging WLFI's credibility. For holders, it's a reminder that even high-profile projects aren't immune to governance pitfalls. Ongoing talks may resolve it, but watch for ripple effects on Trump-linked tokens.

Meme of The Day

Helpful Links

Today's newsletter is also powered by The AI Report.

Used by Execs at Google and OpenAI

Join 400,000+ professionals who rely on The AI Report to work smarter with AI.

Delivered daily, it breaks down tools, prompts, and real use cases—so you can implement AI without wasting time.

If they’re reading it, why aren’t you?

That's all for today. Let's talk tomorrow.