Happy Monday, TM Family!

Welcome to the Token Metrics Research | Daily newsletter, where we cover key market movements, regulatory updates, and early alpha for our readers and investors.

Let's dive in!

In Today's Edition

Market Update: Weekend Surge Drives Total Cap Higher

Zora's Integration with Base App

BNB Hits New All-Time High

Galaxy Sells 80,000 BTC for Satoshi-Era Investor

Today's edition of Token Metrics Research | Daily Newsletter is brought to you by Pacaso.

Big investors are buying this “unlisted” stock

When the founder who sold his last company to Zillow for $120M starts a new venture, people notice. That’s why the same VCs who backed Uber, Venmo, and eBay also invested in Pacaso.

Disrupting the real estate industry once again, Pacaso’s streamlined platform offers co-ownership of premier properties, revamping the $1.3T vacation home market.

And it works. By handing keys to 2,000+ happy homeowners, Pacaso has already made $110M+ in gross profits in their operating history.

Now, after 41% YoY gross profit growth last year alone, they recently reserved the Nasdaq ticker PCSO.

Paid advertisement for Pacaso’s Regulation A offering. Read the offering circular at invest.pacaso.com. Reserving a ticker symbol is not a guarantee that the company will go public. Listing on the NASDAQ is subject to approvals.

Now let's get back to the top stories of the day.

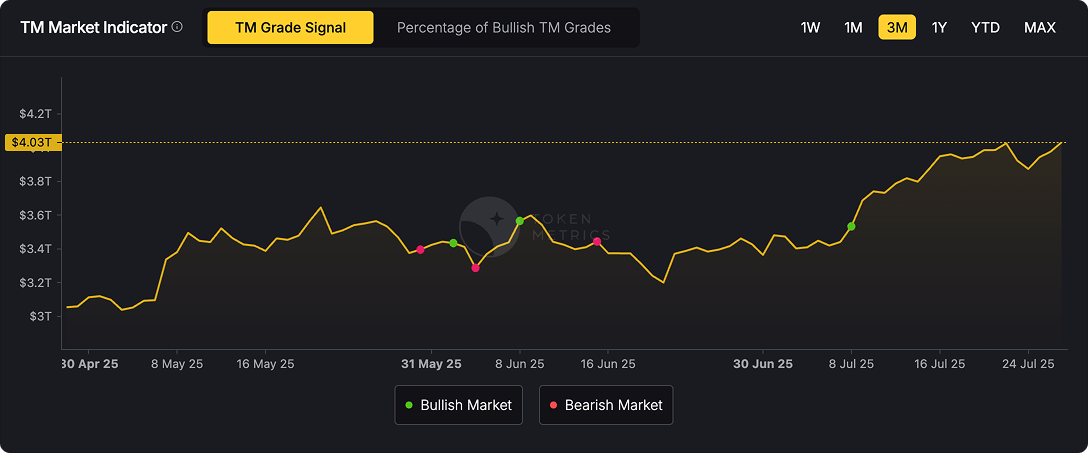

1. Market Update: Weekend Surge Drives Total Cap Higher

The crypto market staged a robust recovery over the weekend, adding roughly $78B in value. Total market capitalization now stands at $3.9T, driven by renewed risk appetite. Bitcoin (BTC) zoomed to $120,000, while Ethereum (ETH) neared $4,000 at $3,932, posting a 3.7% daily gain. Other majors like BNB and Solana also contributed, with altcoins rotating into the mix as BTC dominance dipped to 59.66%.

The leading catalyst is President Trump's EU tariff deal, which reduced levies to 15% and eased macro uncertainty, lifting broader risk sentiment. This spilled into equities (S&P 500 futures up) and crypto, with traders interpreting it as a green light for reduced trade tensions and potential Fed dovishness.

On-chain, Bitcoin's realized capitalization surpassed $1T for the first time, signaling deepening holder conviction and liquidity. Ethereum benefited from $1.9B in ETF inflows last week.

2. Zora's Integration with Base App

Zora, the NFT and social content platform, has been one of the week's standout performers following its deep integration with Coinbase's rebranded Base App. The ZORA token surged 842% in the past month, pushing its market cap above $260M.

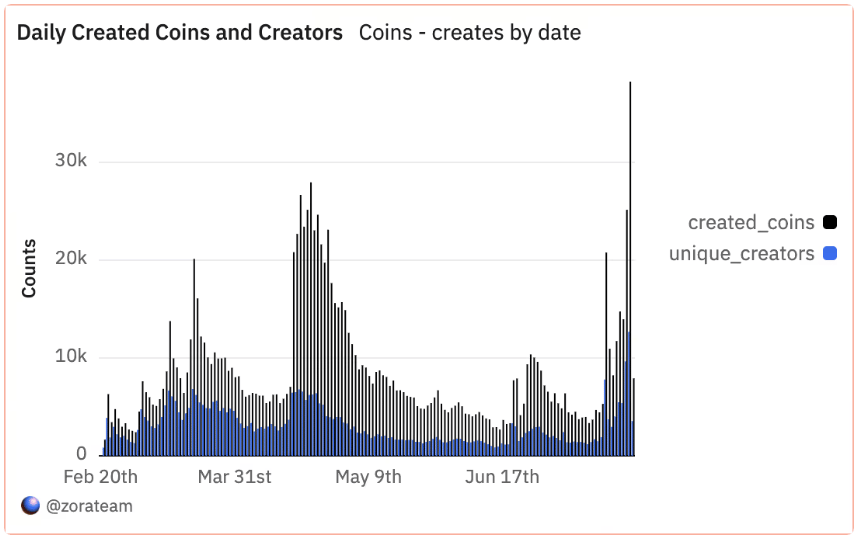

Base App's rebrand on July 16 integrated Zora's content tokenization tech, enabling seamless posting, chatting, and one-tap ERC-20 minting for social media content. This "content-to-coin" flywheel has exploded activity: Daily token creations jumped from 4,000 to 38,000 peak, trades from 30,000 to 150,000, and volume from $1M to $6M+. Creator earnings spiked to $30,000 daily, with 12,000+ unique creators active. Binance Futures listing with 50x leverage further amplified the rally.

3. BNB Hits New All-Time High

BNB shattered its previous record this weekend, reaching a new ATH of $858, up 8% last week and 30% over the month. Its market cap surpasses $116B and has overtaken Solana. The rebound from $761 lows was swift, and it is trading near $836 as of this morning.

Windtree Therapeutics committed $520M to BNB for its treasury, one of the most significant non-BTC institutional buys, stabilizing after a correction. Binance Chain's ecosystem expansions are also a catalyst, including AI/DeFi startups in its accelerator and token burns reducing supply, bolster fundamentals.

4. Galaxy Sells 80,000 BTC for Satoshi-Era Investor

Galaxy Digital executed the largest notional BTC sale ever: 80,000 BTC (~$9B at $118k) for a Satoshi-era investor as part of estate planning. The coins, dormant since 2011, moved to exchanges but were absorbed with minimal impact. BTC dipped briefly to $115k before rebounding above $118k.

This sparked heated debate: Analyst Scott Melker suggested early whales may be "losing faith" amid Bitcoin's shift to institutional finance, clashing with cypherpunk roots. Others dismiss it as pragmatic planning, not conviction loss, emphasizing maturing capital flows. On-chain, the sale pulled ancient coins into circulation, but BTC held steady, highlighting market depth.

Meme of The Day