Happy Friday, TM Family!

Welcome to the Token Metrics Research | Daily newsletter, where we cover key market movements, regulatory updates, and early alpha for our readers and investors.

Let's dive in!

In Today's Edition

Crypto Market Cap Crosses $4 Trillion

First Major U.S. Crypto Law Ushers in Regulatory Clarity

Satoshi-Era Bitcoin Moved to Galaxy Digital, Worth $4.8 Billion

Ethereum's Corporate Adoption Accelerates

Today's edition of Token Metrics Research | Daily Newsletter is brought to you by The Rundown AI.

Start learning AI in 2025

Everyone talks about AI, but no one has the time to learn it. So, we found the easiest way to learn AI in as little time as possible: The Rundown AI.

It's a free AI newsletter that keeps you up-to-date on the latest AI news, and teaches you how to apply it in just 5 minutes a day.

Plus, complete the quiz after signing up and they’ll recommend the best AI tools, guides, and courses – tailored to your needs.

Now let's get back to the top stories of the day.

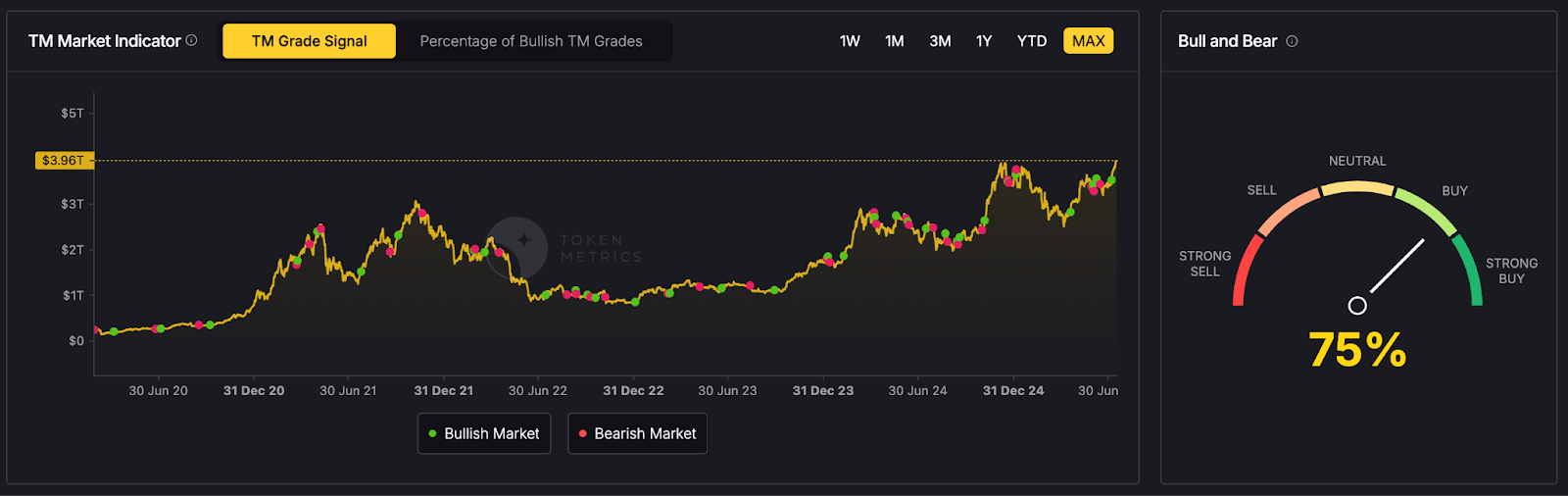

1. Crypto Market Cap Crosses $4 Trillion

The cryptocurrency market has officially entered uncharted territory, surpassing a $4 trillion valuation for the first time. This milestone, driven by explosive rallies in XRP and ETH, signals a potential rotation from Bitcoin dominance into higher-beta altcoins, fueled by institutional inflows, ETF momentum, and regulatory tailwinds.

The total crypto market cap reached approximately $4.003 trillion, with over $260 billion in 24-hour trading volume. Bitcoin still commands about 59.91% dominance at $2.39 trillion, trading above $120,000, but the real fireworks came from altcoins. XRP surged 20% to a new all-time high of $3.64 (eclipsing its 2018 peak), while ETH climbed 11% to over $3,642, its highest since early 2025.

U.S. legislative breakthroughs (more on that below) have sparked optimism for deregulation under the Trump administration, with persistent ETF inflows and on-chain growth. Institutional demand is accelerating, as seen in corporate ETH adoption and Bitcoin's breakout near its ATH of $123,000. Market sentiment is exuberant, reminiscent of 2021's peak, but with stronger fundamentals like improved tech and regulated products.

2. First Major U.S. Crypto Law Ushers in Regulatory Clarity

In a historic "Crypto Week," the U.S. House of Representatives passed the Guiding and Establishing National Innovation for U.S. Stablecoins (GENIUS) Act, marking the first comprehensive federal crypto legislation. This, alongside the Clarity Act for market structure, represents a seismic shift toward mainstream adoption, providing long-sought rules for stablecoins while addressing broader digital asset oversight.

The GENIUS Act was cleared following Senate approval. Provisions mandate 1:1 backing with USD or liquid assets (e.g., T-bills), annual audits for issuers over $50B market cap, monthly disclosures, and priority for holders in bankruptcies. It exempts stablecoins from securities status but enforces AML rules and coordinates global interoperability.

The Clarity Act complements this by defining digital commodities (CFTC oversight) vs. securities (SEC), exempting decentralized protocols from some rules, and allowing self-custody. It heads to the Senate, with Chair Tim Scott targeting its completion by September 30. An anti-CBDC bill was passed narrowly, blocking Fed-issued digital dollars over privacy concerns.

Industry cheers abound, SEC Chair Paul Atkins called it "clear rules" for safer, faster transactions; Blockchain Association and Coinbase hailed U.S. leadership in digital finance. Sen. On X, users buzzed about regulatory clarity as the top catalyst, with posts predicting boosts for ETH, RWAs (e.g., Ondo, BlackRock BUIDL), and compliant stables like USDC.

This ends years of regulatory limbo, unlocking TradFi entry. Think banks issuing stablecoins, tokenization booms, and reduced SEC lawsuits. Compliance could mean dominance for issuers like Tether (USDT) and Circle (USDC), but non-banks face hurdles. The U.S. edges ahead in the global crypto race, potentially spiking adoption in DeFi, payments, and RWAs.

3. Satoshi-Era Bitcoin Moved to Galaxy Digital

A dormant Bitcoin wallet from the Satoshi era (inactive since 2011) has fully transferred its 80,000 BTC holdings, valued at around $9.6B total, to Galaxy Digital, igniting fears of a massive sell-off amid BTC's near-ATH prices.

Blockchain intel from Arkham shows outflows from Galaxy to exchanges like Coinbase, Gemini, Bitstamp, Binance, and Bybit (e.g., 6,000 BTC ~$706M), suggesting OTC sales. The whale's identity remains unknown, but it's linked to early mining.

Transfers occurred as BTC hovered above $118,000-$120,000, near its $123,000 ATH. While OTC deals minimize price pressure, the sheer volume (~0.38% of BTC supply) could trigger volatility if dumped on open markets. Past awakenings have caused dips, but strong ETF demand might absorb it.

This echoes 2021 whale sales in a bull market with institutional buffers. For holders, it's a reminder of supply overhang from ancient wallets (~1.5M BTC dormant pre-2013). As a prime broker, Galaxy likely facilitates liquidation for a high-net-worth entity or estate. Monitor on-chain flows for sell signals; if absorbed quietly, they reinforce BTC's liquidity depth. Unlocking old coins could fuel ecosystem growth. Pairing with regulatory positives, this whale's timing might bet on policy-driven highs.

4. Ethereum's Corporate Adoption Accelerates

SharpLink Gaming (NASDAQ: SBET), dubbed Ethereum's biggest Wall Street bull, is ramping up its ETH treasury strategy by boosting a stock sale from $1B to $6B, signaling corporate confidence in ETH as a reserve asset akin to Bitcoin's MicroStrategy playbook.

The firm, now holding over 321,000 ETH (~$1.1B at $3,600/ETH), filed to sell an additional $5B in shares, with $721M already raised from the initial $1B prospectus. This follows a $425M private placement led by Consensys in June, with Ethereum co-founder Joseph Lubin joining as chairman. Proceeds explicitly fund ETH purchases for treasury reserves.

This aggressive pivot positions SharpLink as ETH's corporate champion, mirroring MicroStrategy's BTC success. It highlights ETH's appeal via staking yields (~3-5%) and DeFi utility, potentially inspiring more firms amid ETF inflows and regulatory clarity.

For natives, this validates ETH as a treasury staple, expect copycats in Web3 projects turning into "treasury companies." Share dilution could pressure SBET stock, but ETH's upside (staking, EIP-1559 burns) offers asymmetric rewards. Accumulating ETH for long-term holds and watching related alts surge on ecosystem momentum is a good strategy.

Meme of The Day