Executive Summary

peaq represents a multi-chain Layer 1 blockchain engineered to optimize Decentralized Physical Infrastructure Networks (DePIN). Its architecture facilitates scalability beyond 10,000 transactions per second (TPS) while maintaining a notably low transaction cost of approximately $0.00025. Peaq prioritizes environmental sustainability within its blockchain framework and leverages the extensive developer ecosystems of Ethereum, the largest, and Polkadot, the second-largest, within Web3.

Features

peaq supports EVM & ink! (Rust) Smart Contracts and Pallets, providing developers with a versatile toolkit. It offers an array of backend functionalities essential for DePINs and dApps, including self-sovereign Machine IDs, role-based access control, seamless machine payment processing, machine data storage, Machine NFTs, data indexing, autonomous AI agents, and more. Developers can access Rust-based functions through the peaq SDK in JavaScript, streamlining processes such as assigning identities to machines, robots, and devices within a concise codebase of 15 lines.

peaq’s multi-chain capability fosters seamless interaction with Polkadot, facilitates cross-chain machine identities with Cosmos, and establishes bridges to Ethereum. The platform operates on an economic model designed to incentivize users and machines within the Economy of Things. This model rewards machines and developers that engage, contribute, and drive transactions within the network, cultivating an engaged and mutually beneficial ecosystem.

Security and Decentralization: peaq prioritizes security and decentralization by inheriting these traits from Polkadot’s Layer 0. Shared Security ensures all connected Layer 1s benefit from validators’ economic security.

Throughput and Scalability: peaq boasts scalable throughput, leveraging Polkadot 2.0 advancements to handle 1,000,000 transactions per second by accessing Layer 0’s resources.

Transaction Fees: Users enjoy low-cost transactions as low as $0.00025, facilitated by peaq’s architecture and leveraging Polkadot Layer 0’s efficient blockspace.

Sustainability: peaq utilizes an eco-friendly blockchain design, relying on validators rather than energy-intensive mining for block production, reducing energy consumption and carbon footprint.

Developer Ecosystem: Leveraging Web3’s most significant and second-largest developer ecosystems, peaq supports EVM and Substrate, enabling seamless deployment for Ethereum and Polkadot developers.

Smart Contracts and Pallets: peaq natively supports ink! smart contracts and Substrate pallets. It also integrates with Substrate’s Frontier for EVM compatibility.

Deploying Business Logic: EVM Smart Contracts: Direct deployment of Solidity contracts or migration from Ethereum/EVM chains without modifications. ink! Smart Contracts: Rust-based ink! contracts can be written or migrated from other Substrate-based chains. Substrate Pallets: Flexible addition of functionalities through Substrate’s modular approach, akin to Lego blocks, accessible via the Substrate marketplace.”

peaq Market Analysis

DePIN stands as a pioneering concept, leveraging the potent capabilities of blockchain and Web3 technologies to revolutionize the ownership and operation of tangible infrastructure. This innovative approach represents a pivotal shift in digital evolution, departing from the centralized architectures of Web2 and embracing the decentralized, user-centric ethos intrinsic to Web3 and DePIN. At its current stage, the DePIN Market reflects a substantial market size of $7.5B, with a projected exponential growth trajectory estimated to reach an astounding $3.5T by 2028, underscoring its immense potential for expansion and transformation.

The peaq Network strategically positions itself to seize this burgeoning opportunity. As a multi-chain Layer 1 blockchain expressly optimized for DePIN, peaq is committed to enabling individuals to construct networks that reimagine the distribution and accessibility of machine data and value. By empowering users to create networks that prioritize the democratization of machine data, peaq endeavors to foster a more inclusive and equitable landscape for decentralized infrastructure. Through this initiative, peaq aims to catalyze a paradigm shift that places control and ownership of machine data back into the hands of a wider spectrum of users, unlocking new dimensions of innovation and collaboration.

Use cases

Empowerment to construct diverse dApps or DePIN for interconnected machines is now feasible across global landscapes. Machines, spanning land, sea, sky, and space domains, find robust support within peaq’s infrastructure, offering comprehensive tools for developing applications tailored to vehicles, robots, and devices across all domains.

Cars- The transportation landscape embraces decentralization, with innovations like peer-to-peer electric car charging, enabling all cars to charge without intermediaries. Decentralized ride-sharing apps, owned by drivers and users, empower communities for fairer services. Likewise, deliveries, akin to Instacart, offer goods delivered by autonomous or conventional vehicles. As autonomous taxis emerge, apps are expected to shift to decentralized models. Additionally, fully automated restaurants are evolving towards community ownership for more tailored service.

Robots- Communities are exploring using humanoid robots to tackle repetitive or hazardous tasks, effectively minimizing obstacles to widespread integration. While fully automated cafés and restaurants have emerged, the progression toward community ownership and governance marks the next evolution in their development. This shift aims to align these establishments more closely with the communities’ needs and preferences. In data privacy, control over one’s intimate data holds paramount significance. Granting individuals the power to decide whether to sell or retain such data is pivotal in reclaiming ownership and agency over personal information. Moreover, agricultural practices are witnessing a transformative shift towards farms operated and overseen by decentralized autonomous organizations (DAOs). This innovative approach fosters transparent and inclusive decision-making processes within the agricultural sector, showcasing the potential for community-driven advancements in farming methodologies.

Routers- Communities are at the forefront of constructing cutting-edge 5G networks, leveraging crowd-sourced physical infrastructure to establish dependable, high-speed connectivity. Similarly, implementing LoRaWAN networks, characterized by their long-range and low-power capabilities for various Internet-of-Things (IoT) applications, relies on publicly-sourced physical infrastructure. Moreover, communities are developing robust and swift Wi-Fi networks, harnessing collective efforts to build reliable connectivity through crowd-sourced physical infrastructure.

Trading and Asset Management- EoT Exchanges (DEX) enable direct asset swapping within your digital wallet, eliminating intermediaries and ensuring secure and transparent transactions. Automated Market Makers, powered by algorithms and community oversight, facilitate trading for niche assets, promoting efficient market operations. Additionally, Machine Tokenization and Asset Management empower the democratization of machine capabilities, enabling the tokenization of assets and fostering democratic asset trading and management systems.

DeFi Instrument- Machine Lending and Borrowing operates within a decentralized network where machines offer computational power or storage in exchange for tokens, providing a mechanism for borrowing resources within this decentralized framework. Machine Derivatives introduce trading avenues encompassing futures, options, and swaps based on machine performance through decentralized smart contracts, offering diverse trading opportunities. Meanwhile, Machine Yield Farming involves lending machine resources to dApps and protocols, earning token rewards as an incentive for participation. Furthermore, Machine Liquidity Mining incentivizes contributions to liquidity pools dedicated to decentralized machine services, allowing participants to earn tokens for their contributions.

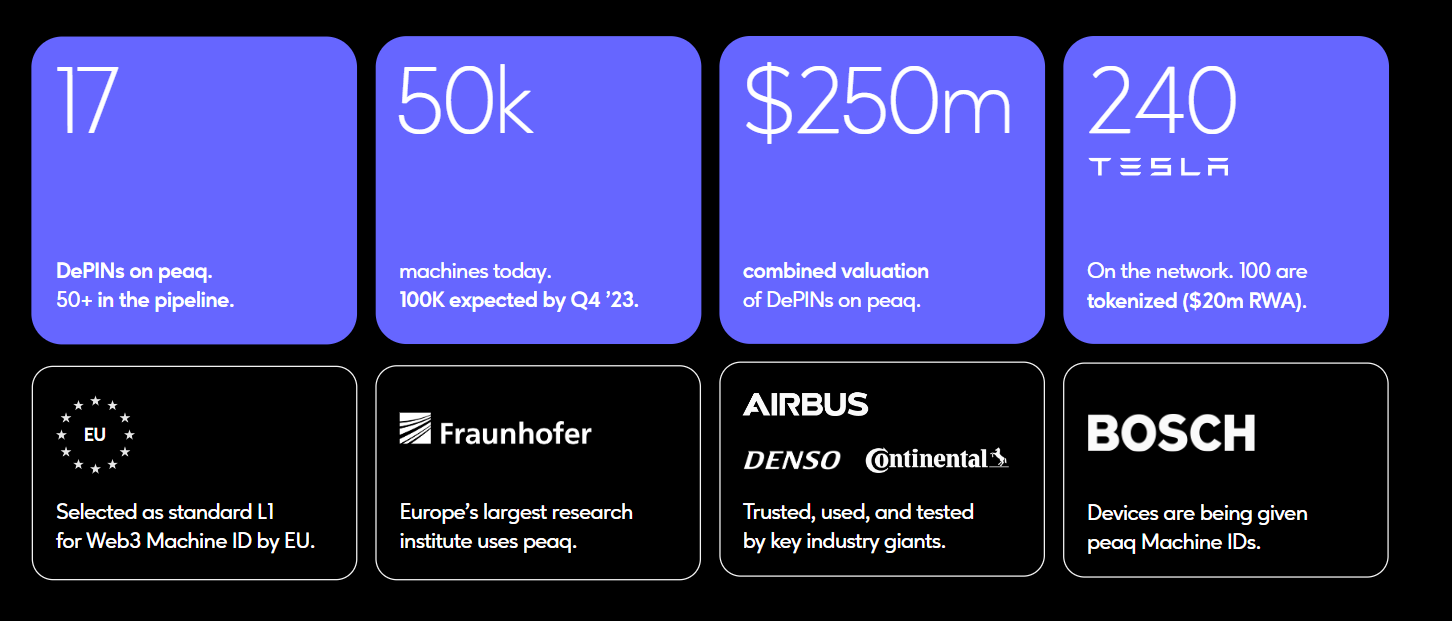

Adoption

Owing to its robust capabilities and rich features, peaq is rapidly gaining traction within the industry. Presently, the peaq network hosts 17 active DePINs, with an additional 50 DePINs in various stages of development. Supporting this infrastructure are over 50,000 machines, with projections indicating a doubling of this number by the following year. The collective valuation of DePINs currently operating on the peaq network stands at an impressive $250 million, underscoring the network’s burgeoning significance within the market. The steady expansion of DePINs and machine participation underscores the growing confidence and utilization of peaq’s offerings within the industry. This substantial growth trajectory signals a promising future for peaq as a key player in the decentralized infrastructure landscape.

Token

- PEAQ Token: This is the native token on the peaq mainnet, represented by the symbol $PEAQ.

- KREST Token: Specifically designed for peaq’s canary network, KREST operates as its dedicated token, identifiable by the symbol $KREST.

- AGUNG Token: Operating as the token on peaq’s testnet, AGUNG tokens are solely intended for development and testing on the AGUNG platform. These tokens are free and can be freely obtained for testing purposes. AGUNG tokens, denoted by the symbol $AGUNG, can be acquired once every 24 hours from the AGUNG Faucet to facilitate testing procedures.

Utility

- Transaction Fees: PEAQ/KREST tokens are essential for paying transaction fees within the peaq/krest networks, ensuring consistent token demand with each network interaction.

- Governance: Token holders wield voting rights for network governance, promoting decentralized decision-making aligned with community interests.

- Network Participation: Collators and delegators contribute to block production, earning rewards in PEAQ/KREST tokens for their involvement.

- Economy of Things Engagement: PEAQ/KREST tokens enable Machine DeFi liquidity provision and voting, offering token holders a share in network earnings.

- Staking for Reputation: Machine owners stake tokens to vouch for their machine’s reliability, enhancing network trustworthiness and incentivizing quality service provision.

Team and Investors

The founders boast extensive expertise within the Internet of Things (IoT) domain, drawing from a wealth of experience that enriches their capabilities. Their profound skill set and seasoned backgrounds form a solid foundation for the project. This expertise is further complemented by a dedicated and experienced team, collectively contributing diverse talents and perspectives to drive the project’s success.

Investors

Conclusion

Peaq is poised to revolutionize the burgeoning Decentralized Physical Infrastructure Networks (DePIN) market, which is anticipated to experience substantial growth. The distinct features and versatile use cases of peaq position it strategically to capitalize on this market expansion. With a diverse range of applications, peaq offers a variety of use cases, reinforcing its adaptability and potential impact across different sectors. Notably, the project already has ongoing developments and additional initiatives in its pipeline, underscoring a commitment to continuous innovation and growth within the evolving DePIN landscape. This proactive approach further solidifies peaq’s standing as a dynamic and forward-thinking contributor to the decentralized infrastructure sector.

| Fundamental Analysis | |||||

| Assessment | |||||

| Problem | Significant, long-term problem | 3 | |||

| Solution | Some uniqueness, moderate defensibility | 2 | |||

| Market Size | Large market, significant growth potential | 3 | |||

| Competitors | High competition, but room for differentiation | 2 | |||

| Unique Value Proposition | Clear differentiation and value for customers | 3 | |||

| Current Traction | No or very limited user engagement | 1 | |||

| Unit Economics | Positive unit economics, with plans for further improvement | 3 | |||

| Tokenomics | Basic token strategy, potential for improvement | 2 | |||

| Product Roadmap | Clear roadmap, innovative and achievable milestones | 3 | |||

| Business Model | Proven business model with clear path to profitability | 3 | |||

| Go-to-Market Strategy | Basic GTM strategy, lacks detail or differentiation | 2 | |||

| Regulatory Risks | Minimal regulatory risk, strong mitigation and adaptability | 4 | |||

| Total | 64.58% | ||||