Our session today started with Bitcoin, Gold and Ethereum market Analysis by Forest.

Forrest has a YouTube channel called Sistine Research and a website at sistine.ai where he shares his research and indicators. He was asked if there were any other questions and then the conversation moved on.

Market Analysis by Forrest

- Crypto market is in a bullish trend.

- People are cautious due to bear market PTSD.

- Approach is to look for isolated opportunities and get in and out.

- Not doing a ton of longer-term value investing.

- Meme coins have run hard, but not playing the musical chairs game.

- Legacy market could collapse at any moment, with recession signals firing.

- Yield curve is super inverted, and the fed has probably topped out on interest rates.

- Could be heading into a recession in Q3 of this year.

- Being cautious, keeping a large allocation to Ethereum as a store of value.

- Moving in and out of speculative plays quickly to avoid getting burned.

- Technical analysis using margin pressure levels is being used to analyze Bitcoin charts.

- At the $30,958 level, there is a steep drop in incentive to buy and bid up Bitcoin, making it a key resistance point.

- The current correction is considered healthy, and re-entry into the range is being monitored.

- If aligned bullish, resistance at $29,354 should not be accepted, with a short trigger leading to a target of $27K.

- A symmetric triangle or wedge-like pattern is being observed, with accumulation back upwards being a good sign

- There is an uptrend in the market, with a symmetric triangle formation and a mark-up in price.

- Three local tops have been observed, and the market is now testing a margin pressure level that aligns with the trend line.

- If the market finds support in this region and reclaims the 29,354 level, it remains bullish.

- If both the trend line and the margin pressure level are lost, the market should flip short.

- There is a parallel channel, with the market likely towards the top of the trend channel.

- A correction back down to the bottom of the channel may occur.

- The level to watch is 29,354, as well as the trend line.

- Breaking the trend line suggests a downward trend, while holding suggests an upward or consolidating trend.

- Bitcoin dominance may have topped out, indicating a potential altcoin rally.

- Ethereum and the altcoin market are in a fast-growing tech sector and have strong fundamentals.

- Bearish divergence and resistance at the top of the range may lead to a pullback in Bitcoin dominance.

- A pullback in Bitcoin dominance could lead to a strong altcoin season.

- There is still room for many altcoins to see strong rallies, as some are still undervalued.

- A potential altcoin rally may occur in Q2 before a potential recession in Q3.

- The speaker thinks that there may be a pullback or recession in the US market in Q3, but acknowledges it is not an exact science.

- Historically, Q3 is a bad month for the S&P 500, with September, October, and November usually performing poorly.

- The speaker believes that the timing of the pullback will be in line with the yield curve bottoming out.

- Inversion of the yield curve is a strong signal for an incoming recession.

- The speaker notes that historically, the S&P 500 has not always topped out immediately after the yield curve bottoms.

- There may be a delayed effect of the yield curve bottoming out before the market experiences a pullback.

- The market can move very slowly and signals can take a long time to play out.

- The speaker suggests that the bullish trend may extend for another 3 months before a pullback.

- After the Fed pivots, it can take 6 to 9 months for the market to bottom out.

- We expects the Fed to pivot at some point this year or within the next 3-6 months

- The market crash has been predicted to begin after the Fed pivots

- The market is expected to hit bottom 6-9 months after the Fed pivots

- The bottom may not be as low as anticipated

- Timing of the market crash seems reasonable in Q3 but not exact science

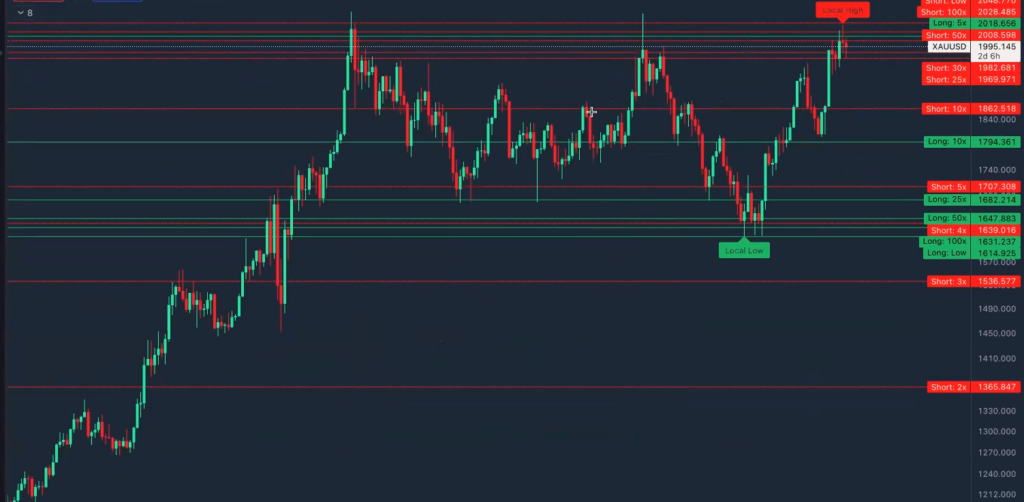

- Gold is currently facing resistance at a structural level of around $2,000, which is also a big psychological level.

- Psychological resistance at big even numbers has been backed by studies and affects price behavior.

- A pullback in gold could occur all the way back down to the 10x long level or to a logical level of 1862.

- Gold is typically considered a hedge against risk assets, but it has been running in line with the S&P 500.

- A good signal for support and resistance levels is the W deviation that came back down to the 1862 level.

- If looking for a gold entry off a trend entry, look for 1862 as a strong pullback level.

- If gold consolidates above the $2,018 level, then it could continue to move towards 2150.

- We analyzed Bitcoin’s price trends using a log rhythmic chart and easy bands.

- Bitcoin rarely drops below the green easy band level on a weekly chart, historically.

- The lowest possible realistic price for Bitcoin in a major crash, according to the speaker, is around 13K-15K, given the trend of the easy bands moving upwards.

- The bear market bottom is already in and that a scenario like the flash crash caused by COVID in the previous market cycle could cause a pullback and retest of the general volume zone around 20K.

- Double bottom at 19.7K is possible but unlikely in the short term, as they expect further continuation upwards before any rotation back down to 20K.

- It has been emphasized that 20K is an important level with strong support due to the volume node and recommend bidding for Bitcoin at that level if it reaches there.

The demand is expected to increase closer to the next Bitcoin halving, making new lows less likely unless there is a massive catalyst.

- There is still room for Ethereum to run in the current uptrend.

- A breakout and blow off top in the bear market rally is a plausible scenario, but not strongly favored.

- Previous bear market rallies have shown a strong rotation from the green easy band zone to the right easy band zone.

- Long-term margin pressure levels show a deviation above the 3 X long level, similar to what was seen with Bitcoin.

- Short-term trading strategy involves watching for a failure to reclaim the 2052 range, which could lead to a short down to the trend line, and potentially to 1824.

If the trend line breaks, that becomes the short trigger, and bids can be placed around the point of control for support.

On the daily timeframe, a larger allocation to Ethereum could be made off a large ascending triangle pattern, potentially in May.

It is suggested bidding with conviction around the 1600 area, with a potential run back to $2000 and up to 2600.

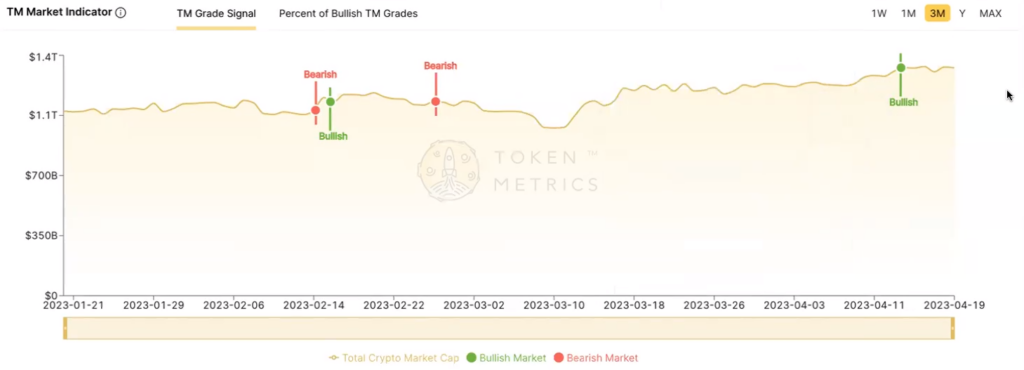

TM Market Analysis by Ian Balina

- Market page shows a bullish trend

- Need to be willing to adjust based on changing market conditions

- Currently in a risk-on environment

- Gate Bull and Bear indicator shifting upward

There is more risk and potential for meme coins and new products to perform well

It is advisable to take profits during this time.

- Returns are flowing from Bitcoin and slowly starting to head back into altcoins.

- Not a full-blown altcoin season yet and Bitcoin’s price has decreased from 31K to under 30K.

- Ethereum’s price has also decreased from 2,100 to 1,900.

Sector Analysis

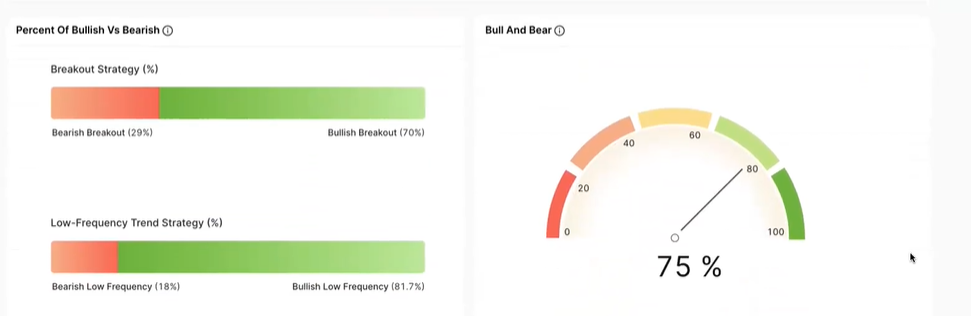

- Layer One’s have historically performed the best and have the most alpha.

- Ziliqa is up almost 5% and Exchange-based tokens like Uniswap and Yield Farming are doing well.

- All major sectors are at least 75% TM grade on average, with Layer-ones being the most.

- Returns are flowing from Bitcoin and slowly starting to head back into altcoins.

- Not a full-blown altcoin season yet and Bitcoin’s price has decreased from 31K to under 30K.

- Ethereum’s price has also decreased from 2,100 to 1,900.

Quick Announcement

Consensus Astro Mingle 2023

- Consensus Astro mingle event is being planned.

- The event is in Austin, Texas.

- The event will bring together communities from Token Metrics, Ventures, Astrobot Society, and Astra Dao.

- Astrobot and Astra Dao holders can log in and verify their ownership.

- Non-token holders can sign up for the regular ticket and will be put on a waitlist.

- The approval process will move people from the waitlist to the final list depending on attendance.

- TM Book NFT holders can also sign up for the event.

Updates on upcoming events

- I have booked tickets for Token 2049 conference in Singapore in September

- This will be their first time attending an Asian conference in a while, as last year’s conferences were mainly in Europe

- We have attended, such as Avon Summit in Barcelona and Solana Conference in Portugal

- Hong Kong was on lockdown during Covid, but there is now a resurgence in Hong Kong and Asia in general

- We plan to attend the conference and hopes to see members of their community there

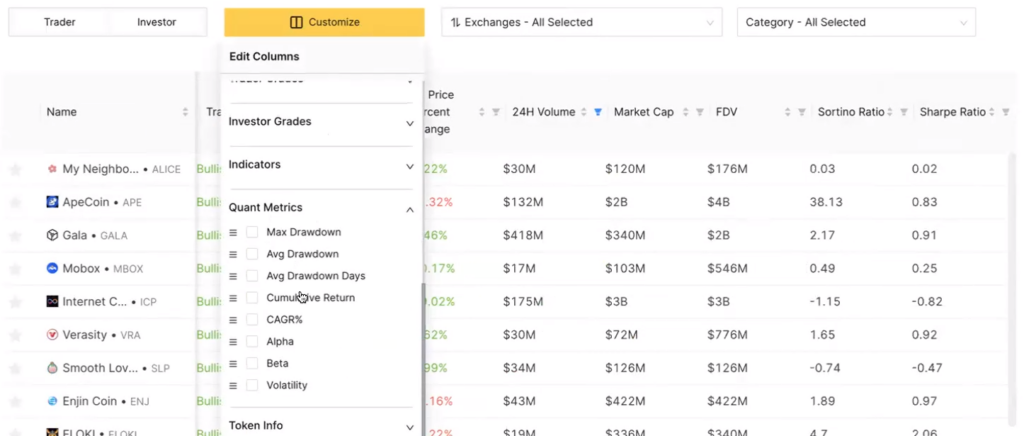

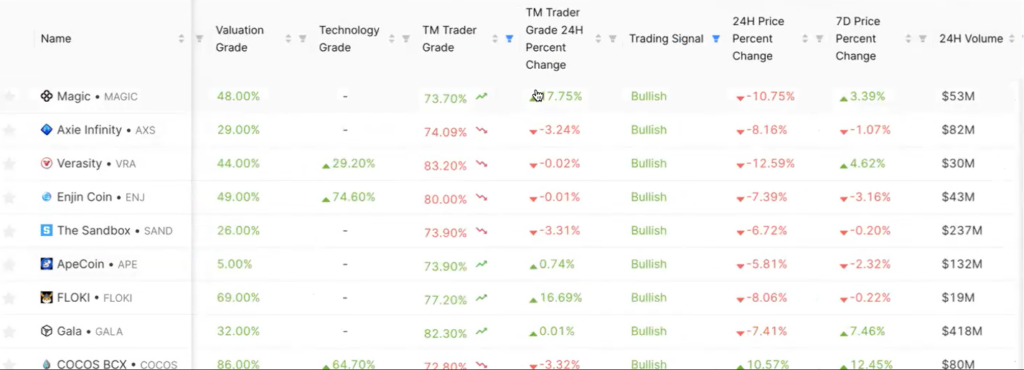

New Custom Filters

- We can screen tokens using custom filters.

- We started with a filter for Trader grade over 70% and then look for bullish signals with a Trader grade of over 80% (or 70% if there are no tokens over 80%).

- We also added a filter for trading volume of 10 million or more to ensure liquidity.

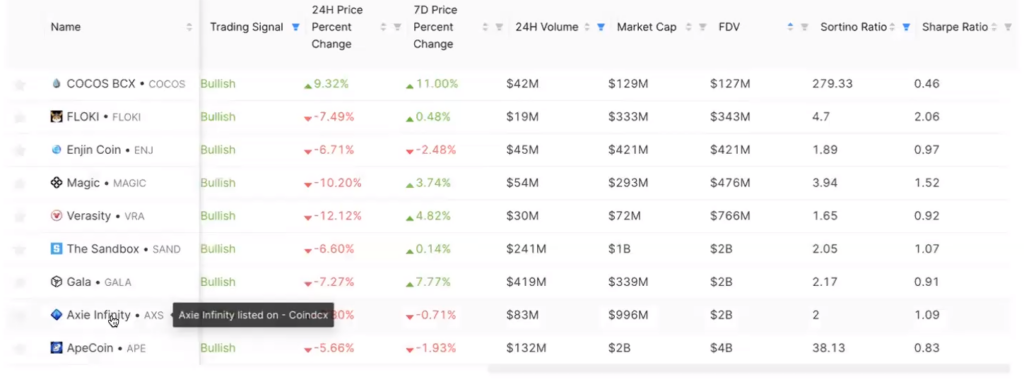

- We then add Sortino Ratio and Sharpe Ratio as metrics to evaluate risk and return.

- We used a Sortino Ratio threshold of 1.5 to identify tokens with good upside potential.

- We ended up with a list of 9 tokens that meet their criteria.

- We sorted the list by descending Trader grade and notice a trend towards gaming and the metaverse.

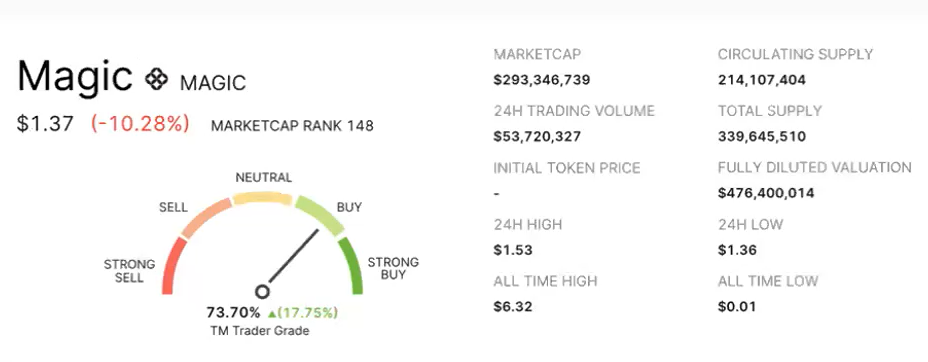

Magic

- Magic a potential narrative growing in the gaming industry, based on Twitter metrics and discussions.

- Trading in the industry could be based on the highest trade grade or sorting by ascending FDV.

- The latter approach is riskier but potentially more rewarding.

- We listed COCOS BCX, FLOKI, Enjin coin, and Bitcoin as examples of coins with varying degrees of risk and potential upside.

- I suggest starting with a list of all coins and filtering based on metrics like 24h trade volume and investor grade.

- By filtering for coins where the 24h trade volume has not declined, we narrowed the list down to four potential trades: FLOKI, Magic, Gala, and Apecoin.

Axie

- I am not inclined towards investing in Axie due to a large amount of sell pressure from 7% of the total tokens hitting the market, which could amount to $177 million.

- The positive news announcements could alleviate this pressure.

- The daily trading volume for Axie is $74 million, and unlocking more than 2 times that amount could cause significant pressure.

- Moving the price on Binance by 2% would require $370,000 worth of Axie, and moving it by 20% would require $3.6 million worth.

- Based on this analysis, it does not look like the right time to invest in Axie

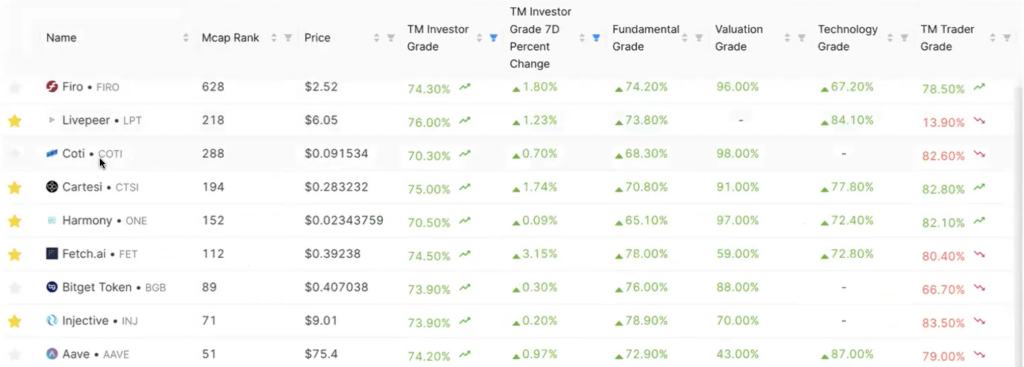

Investor Grade

- Filter by investor grade over 70%, trading volume over 10 million, and sorting ratio over 1.5 or higher, resulting in a list of 22 tokens.

- I suggested further filtering by finding low-cap coins with high potential upside.

- We listed a number of projects as potential long-term investments, including FIRO, Coti, Cartesi, Harmony, Fetch, Injective, MultiversX, Fantom, and Aave.

- It is suggested using investor grade as a method for finding high-quality projects to add to a watch list.

- The grades for most of the listed projects are not over 80, indicating some level of risk.

- We recommend conducting individual research and analysis before making any investment decisions.

Questions

When you talked about Sell pressure for Axie. Infinity is such data knowledge automated for inclusion and the TM. Grade?

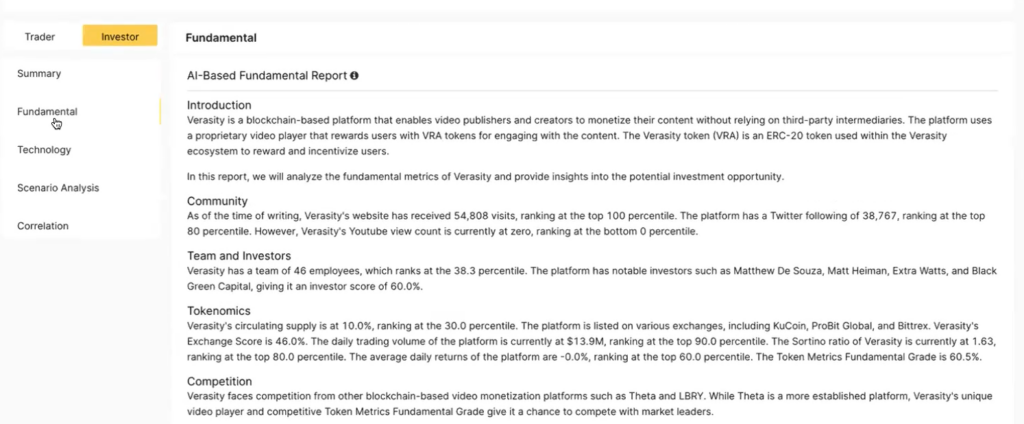

- Automated AI based investment reports have been added to project fundamentals

- Automated reports for different subgrades are in progress

- Tokenomics covers the rate of inflation of the token supply over time

- The grade considers the rolling average of inflation

- Total supply change over time is used, not data from token locks, etc.

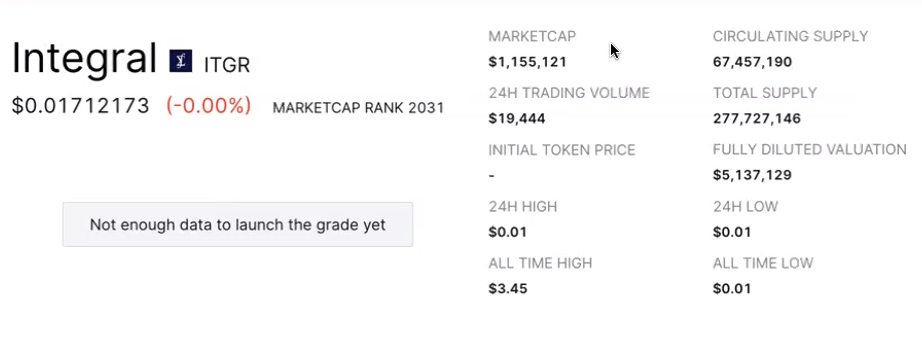

Integral

- I liked this project in the past but it did not perform well.

- The project had issues with tokenomics and anonymity of the team.

- Current market cap is 5 million FDV compared to 1 million earlier.

- Liquidity is low and the project is not very liquid.

- People have moved on to Uniswap V3 due to tough competition.

- The DEX market is currently very competitive.

- Uniswap is dominating the market.

Ian have a look on cfc St. Moritz would be nice for you

- There is an invite-only high-quality conference that someone on the list wants to look into

- We have been busy last year but plans to attend this year

- The conference is known for its high quality

I try to buy astra dial through Uniswap as well multiple times a few days ago, but it didn’t go through, Tom said. Low liquidity coin. Is there any all the way to buy it from us?

- You can buy on Uniswap Dex.

- We recommend keeping slippage under 5% for trades, with a maximum of 10% depending on market conditions

- If slippage is too high, it’s recommended to break up the trade into smaller trades.

VC Portfolio

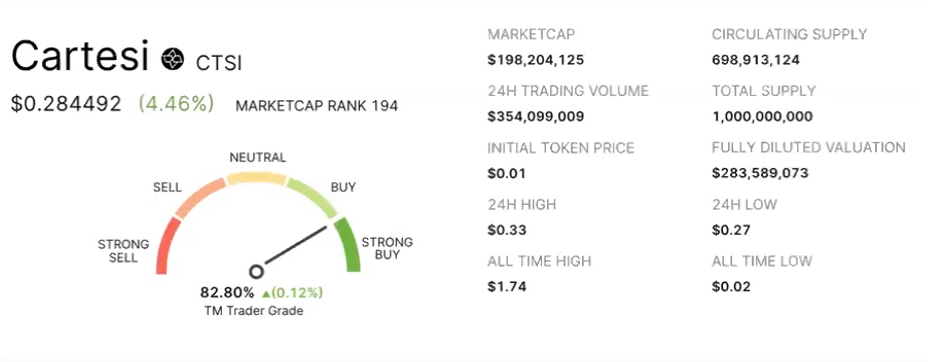

We’ve got Astra Dao, Celer Network, Cartesi, which which has been moving. It had a pretty good month.

Cartesi

- Trader grade is over 80%

- Investigator grade is rising and has reached 84% in the last month

- The portfolio has been doing relatively well

- There have been updates on Twitter about a launch of roll ups or something

- It’s worth keeping an eye on

- We also have Rocket Pool in the portfolio.

- We have been doing pretty well with Loopring, Ankr, Fetch, Ocean, Polygon, IOTEX, PNetwork, Solana, Octopus Network, TrueFi, Gitcoin, Bands, Harmony, Lido Dao, Livepeer Token, IDEX, Dusk Network, and Decentraland in the portfolio.

- There is an XRP trade, and we have gone heavy in ETH and committed to trades in Avalanche, Audius, Enjin, Bitcoin, Polkadot, Origin Network, Near, and Polymesh.

- We also made VC investments in Side Protocol and EthosX.

Side Protocol

- Side Protocol is a novel interoperable finance protocol for Web 3 that is part of the Cosmos ecosystem

- It enables interchain swaps on Cosmos

- We made an investment in Side Protocol this month

- Side Protocol has a current score of 83% and a code review score of 92%

- We is bullish on Side Protocol, but acknowledges some market risks

EthosX

- We also invested in EthosX

- EthosX is a DeFi platform focused on creating end-to-end financial derivatives on blockchains

- EthosX currently has a score of 70% and is expected to go up to 85%

- The project is backed by notable investors such as Y Combinator, Franklin Templeton, Ascensive Assets, Cogitent Ventures, and Asymmetry

Summary

- Currently focus is on small time horizons as well as swing trades.

- Probable Q3 would led to entering Recession.

- Potential trades for the current Time horizon FLOKI, Magic, Gala, and Apecoin

- Projects for long term suggestions FIRO, Coti, Cartesi, Harmony, Fetch, Injective, MultiversX, Fantom, and Aave.

- Our Long term holds Astra Dao, Celer Network, Cartesi,.

- VC investments Side Protocol & EthoX.