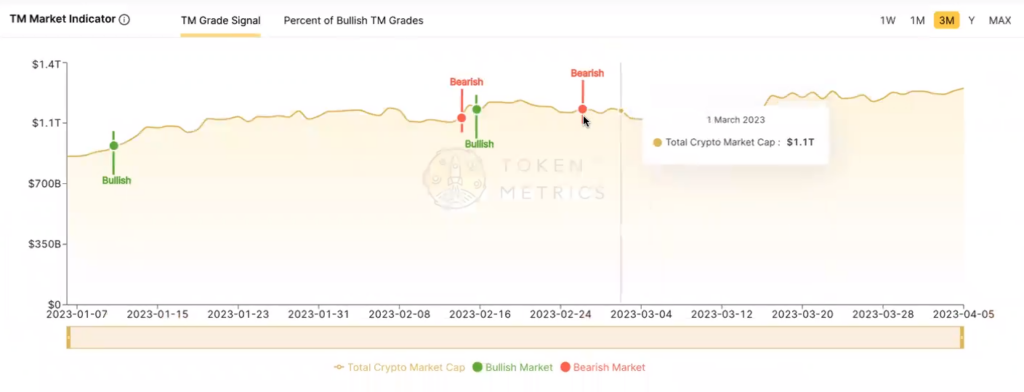

The crypto market is trending upwards after a slow, gradual climb in total market cap.

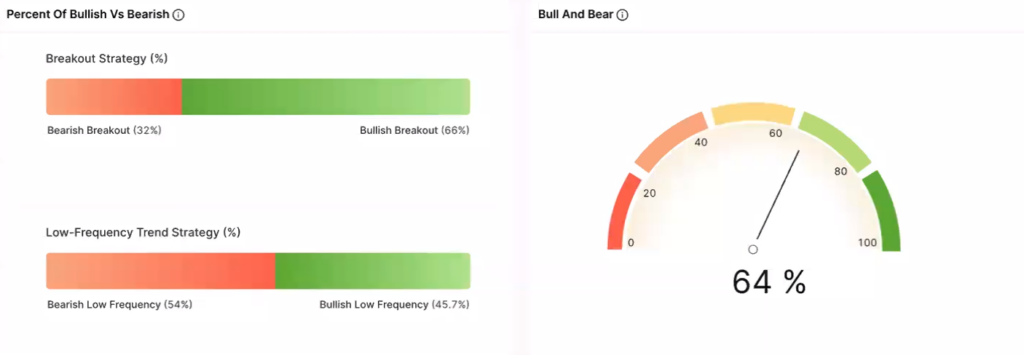

The Bull and Bear Gage has gone up by 13% in the last 24 hours.

- There are more bullish breakouts across different team grades.

- Bitcoin is leading the way and is currently below 13 on the Bitcoin season indicator, which is the lowest it has been since June of last year.

- Despite market fluctuations and floods, Bitcoin has maintained its price and is attracting investors.

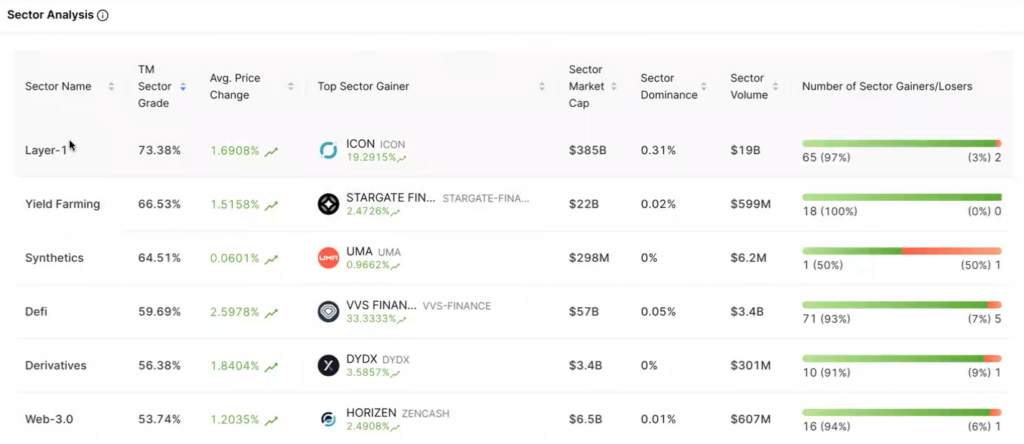

- Most gains in the market are currently in L-One’s layer, with Icon up over 20%.

- Icon has had a big week with upgrades and a focus on Korean projects, which has driven the price increase.

- Analysts suggest looking for undervalued swing trades or long-term investments in the current market.

- TM Venture has made recent investments in new ventures and a list of these projects is available on the private Alerts Telegram channel.

- The list includes information on the projects, including links to their websites, Twitter accounts, and documents.

- Interested parties can contact TM Ventures for more information on any of the listed projects.

- Metis has announced the development of a Hybrid Rollup that aims to combine the efficiency of

- Optimistic Rollups with the security of Zero Knowledge Proofs to accelerate the growth of the Web3 economy.

- Zero-knowledge rollups (ZK-rollups) are layer 2 scaling solutions for Ethereum Mainnet that process transactions off-chain and then only post summary data to Mainnet. They are faster than Optimistic rollups due to their use of compression techniques and only need to provide validity proofs to finalize transactions.

- Ethereum rollups are a scaling solution designed to make the Ethereum blockchain faster and cheaper by grouping multiple transactions together and presenting them to the blockchain as a single transaction.

- Obscure (obscu.ro) is an alert solution for Ethereum that brings privacy and scale using 150 enclaves. It is a hybrid between Optimistic and ZK roll-ups and was developed by a team with a good history, including engineers from R3 who helped design Corda.

- TM Ventures is looking into new projects and has identified VoltZ as a potential investment.

- VoltZ (voltz.xyz) is a novel defined primitive powering leveraged interest rate swaps.

- VoltZ is the first-ever synthetic interest rates swap AMM, utilizing concentrated liquidity to create a market that’s 3,000 times more capital-efficient.

- The project is backed by several reputable investors, including Coinbase, Ventures, WinterMute, Amber, Ventures, Stanley of Ave, and co-founders of Ribbon Finance and Synthetics.

- The code for VoltZ is very well-encoded and has received a score of 94%, which is rare for DeFi products.

- The team is waiting for code reviews to be completed before making a final investment decision.

- TM Ventures is currently researching EthosX as a potential investment opportunity.

- EthosX is a crypto trading platform that TM Ventures is considering investing in.

- The project has undergone a code review and is considered solid.

- EthosX is backed by reputable investors, including Y Combinator, Franklin Templeton, Cogitent

- Ventures, Asymmetry Ventures, and the Premium Group or VIP Group.

- TM Ventures is still in discussions regarding investing in EthosX but is sharing the link for those interested in learning more. (Ethosx.xyz)

- TM Ventures is considering investing in Side Protocol, a project from the Cosmos ecosystem.

- The project has undergone a code review and scored between 83-85%, which is considered decent.

- TM Ventures is sharing the link for those interested in learning more about Side Protocol .

- Investors are encouraged to review the links and reach out to TM Ventures if interested in investing. (side.one)

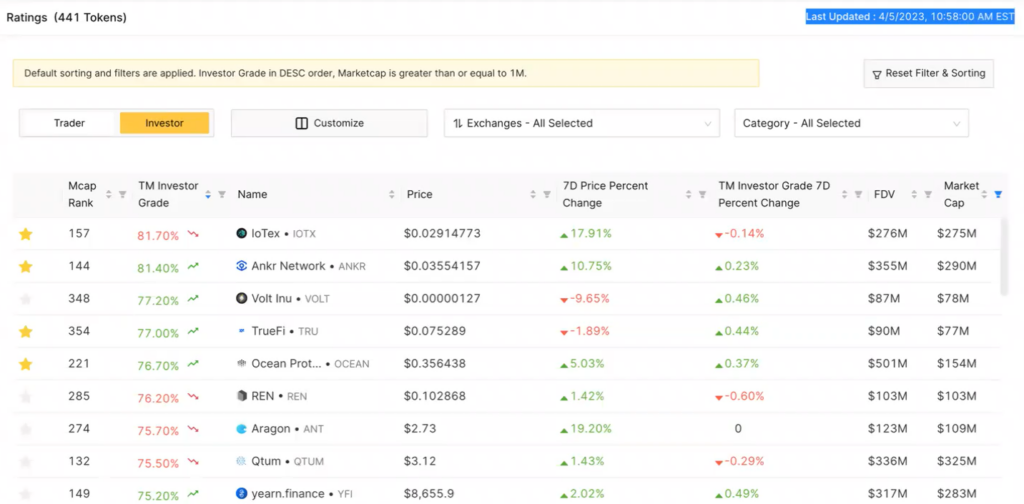

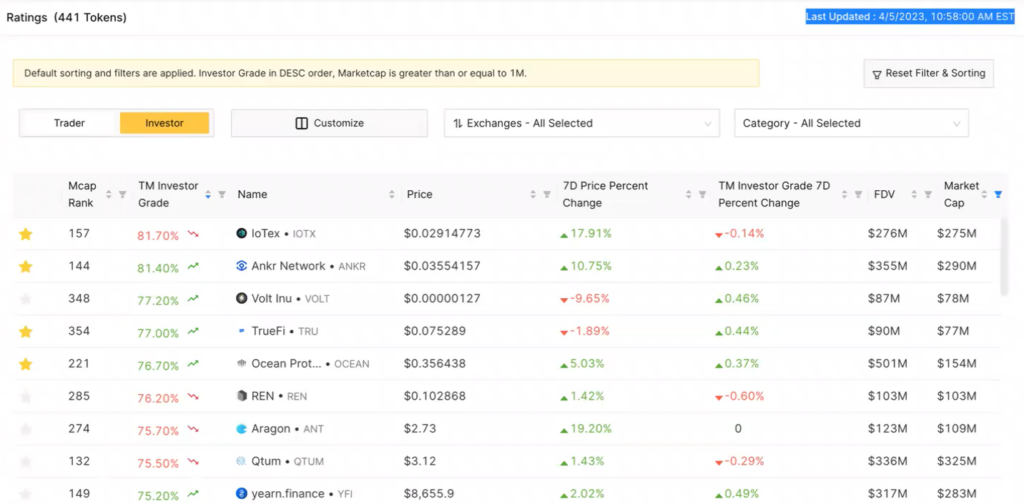

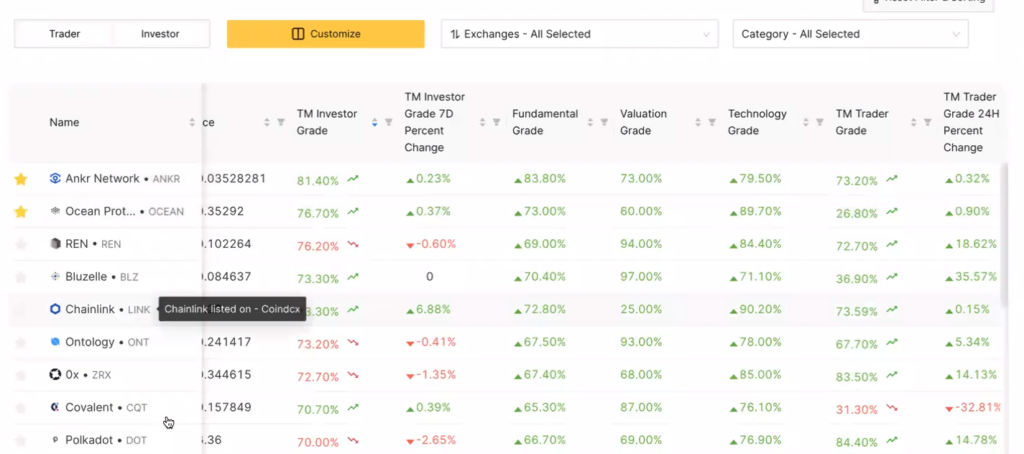

- Investor grade results –

- Ankr has received a strong long-term technical score of 89 based on historical trading patterns, indicating it may be a strong buy-and-hold investment opportunity.

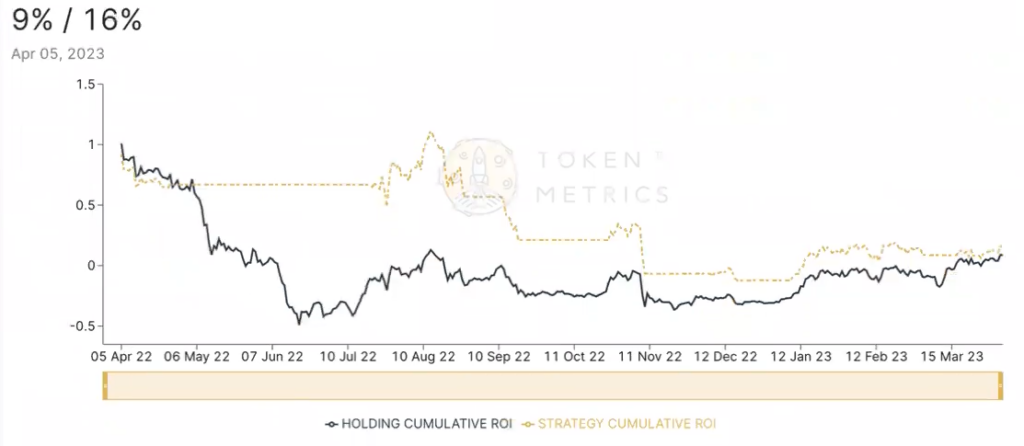

- Crypto markets experienced significant declines in June, with Bitcoin seeing its largest monthly price drop since 2011 (37.3%), while Ether was down 45%.

- A diversified portfolio is less affected by systemic risk but more sensitive to an investor’s time frame and risk tolerance.

- IoTex and Ankr Network are leading in terms of long-term investor grade.

- Chia is a project that TM Ventures is watching, and if it goes over 80%, it could be a good competitor to BTC for those who want more environmentally-friendly options.

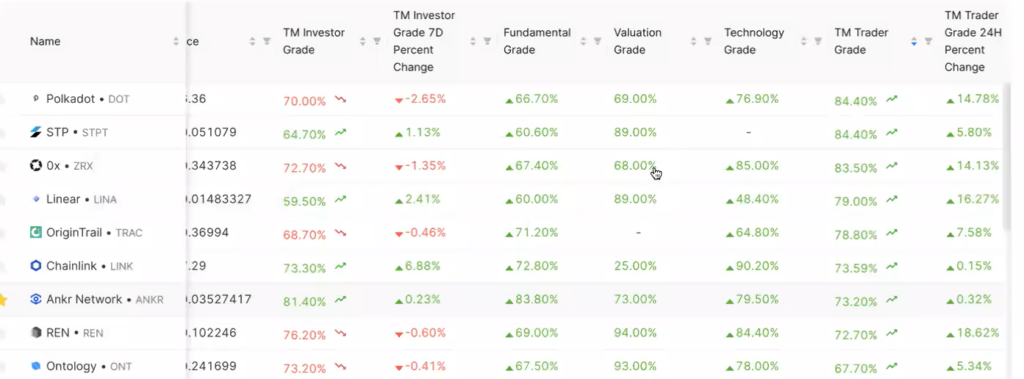

- Trader grade results –

- Lido is a liquid staking solution for Ethereum, Solana, and Polygon that allows users to stake tokens and receive daily rewards in the form of liquid stTokens. Lido has supported networks like

- Ethereum, Polygon, and Solana, with staking rewards totaling $535,004,995.

- Lido will no longer accept new stake deposits for Polkadot and Kusama starting March 15th, 2023, due to the termination of development and technical support for the platforms.

- Lido has warned holders of staked Ethereum (stETH) that the token’s peg to Ethereum has slipped, potentially leading to collateral liquidations.

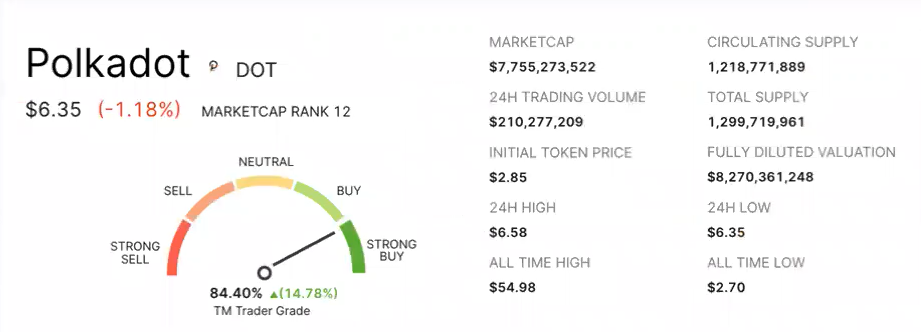

- Polkadot (DOT) has been turning bullish, and it might be a good time to start looking at investing in it.

- Injective is over 80, and they recently launched a Solana virtual machine, though it remains to be seen how much adoption it will get.

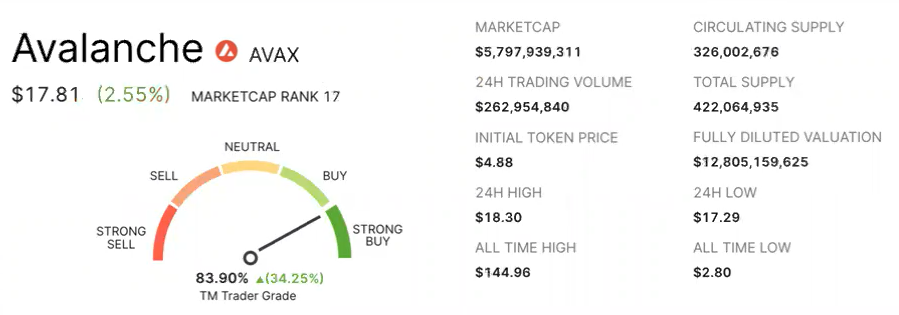

- Avalanche, Ethereum, Bitcoin, and Stellar are currently experiencing bullish movements, and L1s are currently the place to be.

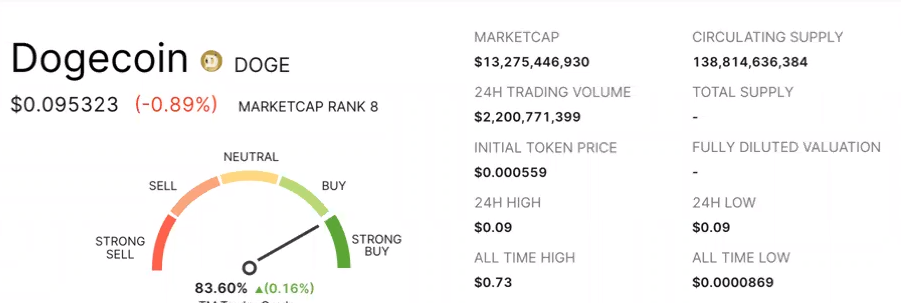

- Twitter recently had the Dogecoin logo as its logo, leading to speculation that Elon Musk is bullish on Dogecoin and that it could become the currency for Twitter.

- Helium Mobile will be hosting an event for Consensus in Austin on April 27.

- The Solana phone demos have been sent out, and pre-orders are currently available for secure early access.

- The launch dates for the Solana phone and Helium Mobile’s event may be around the same time.

- It’s possible that Helium Mobile’s event may serve as the actual announcement event for the Solana phone launch.

- Investing in Polkadot provides opportunities but also involves more risk, and Polkadot price predictions vary.

- Polkadot is considered a good L1 to start looking at, with over 90% of its tokens being liquid and a FDV of around 8.3 billion.

- Compared to other smart contract platforms, Polkadot is undervalued relative to its ecosystem projects.

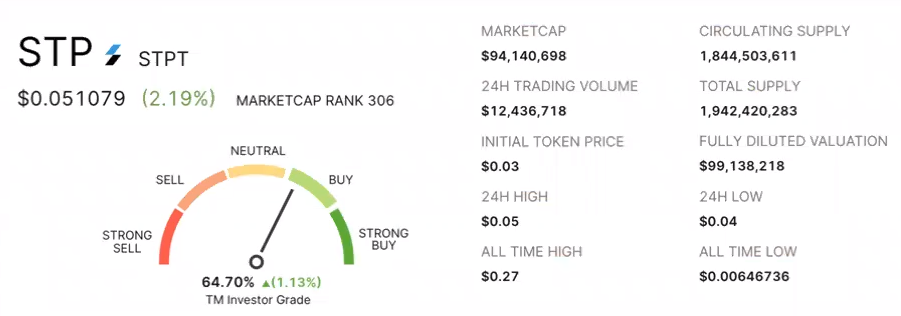

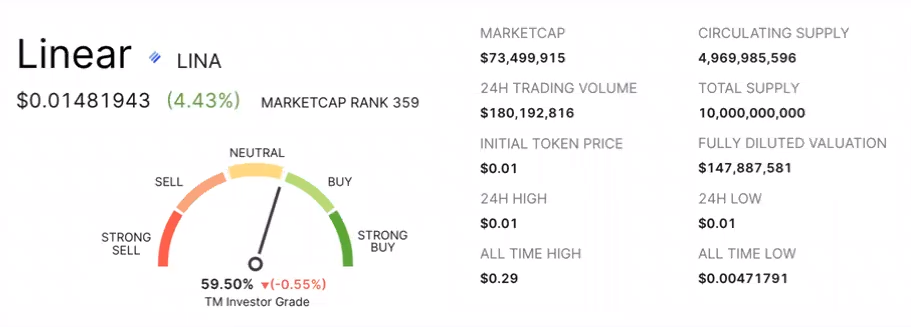

- Popular Polkadot projects for traders include STP, 0X protocol, Linear, OriginTrail, Chainlink, and REN.

- Linear has changed the most among Polkadot projects, with over 16% change in the last 24 hours.

REN is still moving, despite previous concerns about its status.

- Ankr Network and Ocean are two Polkadot ecosystem projects that have a high investor grade.

- When sorting Polkadot projects by investor grade, there doesn’t appear to be any standout projects at the moment.

- Not much in STP, so we’ll leave this for now.

- Linear is a Polkadot ecosystem project that has seen significant movement, rising almost 80% in the last 16%.

- Linear is a cross-chain Delta one asset protocol that enables trade of liquid assets quickly, seamlessly, and cost-effectively, with cost and composability.

- Linear’s application includes building LUSD and accepting the next to Linear tokens and other major cryptocurrencies.

- Polkadot uses Substrate, a blockchain-building framework that uses WebAssembly, and it uses libp2p for networking.

- Polkadot is a network protocol that allows transfer of arbitrary data, including cross-chain registries and computation, across both public, open, permissionless blockchains, and private, permissioned blockchains.

- The Polkadot architecture comprises the relay chain, parachains, and bridges, with bridges becoming essential in the DeFi landscape and still under development.

- We can keep this in watch list.

- Avalanche is up about 34% and has good alpha, making it a strong contender for investment.

- Trades being considered: Polkadot, Avalanche, and Dogecoin.

- The plan is to hold until the trader grade indicator is below 75 and the signal flips to bearish.

- Focus will be on large-cap cryptocurrencies (“the L ones”) as they have been performing well in the current market.

A quick Announcement

- Two conferences are coming up this month: NFT NYC and Consensus in New York.

- The dates are not specified, but they will be in a week or two and I plan to attend both events.

- I am open to meet-up with anyone interested in attending.

- We are considering organizing an event for Astrobots and Astra Dao during Consensus.

- If there is enough interest, the speaker will put together the event.

- I will be in New York for about a week from April 26 or 27.

- We have not been keeping up with investing in different NFTs, and have been sticking to Blue Chips and well-known projects such as Board Apes and Mutant Ape Yacht Club.

- We made an NFT investment in Bandit Network, which is an NFT aggregator platform.

- I believe that investing in new NFT projects during a bear market can be challenging due to low liquidity.

- The recent launch of platforms such as Blur and Up or Up and See Pro, which may change the NFT market.

- Its important focusing on liquidity and large cap NFTs during uncertain times.

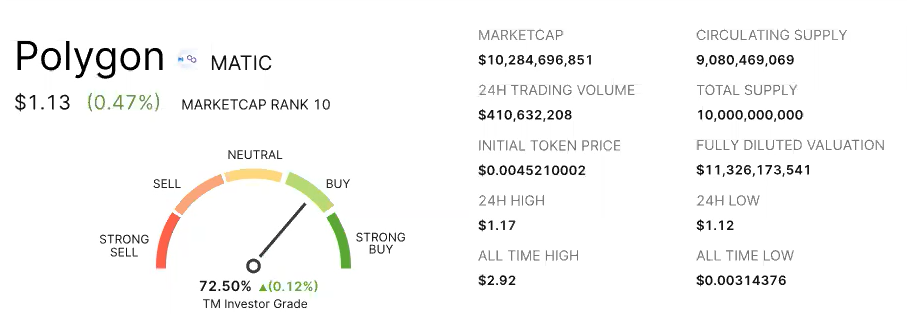

Thoughts on Polygon ZK Evms

- The Zk Evms Space is a promising area for crypto and Eve investors.

- Polygon is a strong player in the space, with an Fdv of over 11 billion dollars.

- Zk Evms like Scroll and Zksync are also competitive, with high valuations.

- Skiro is a hybrid project with a lower Fdv of 30 million dollars and a promising team and technology.

- The Zk Evm Space is becoming crowded with many players, including ConsenSys and Starknet.

- The key question is which project with the token will win the market.

Any thoughts on Republic Note, token from Venture Capital platform Republic.

- Republic has a good deal flow in the crypto space and has done many projects in the space

- Republic is one of the leading investors in Obscuro last round and has done other projects in the space

- Props was involved with Republic but had to shut down due to legal issues with Reg. A+ and Sec.

- I think Republic is a good platform in general.

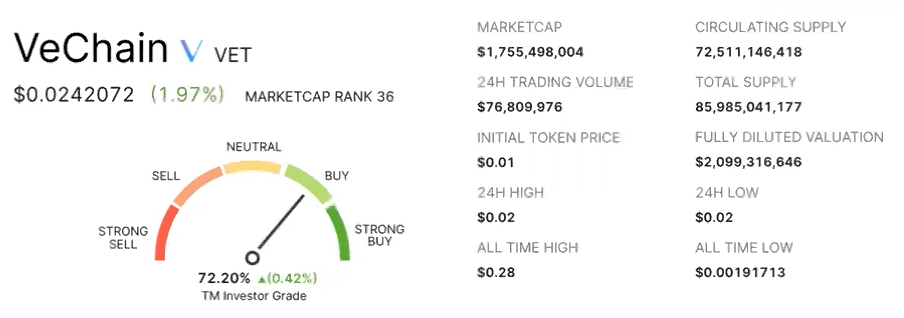

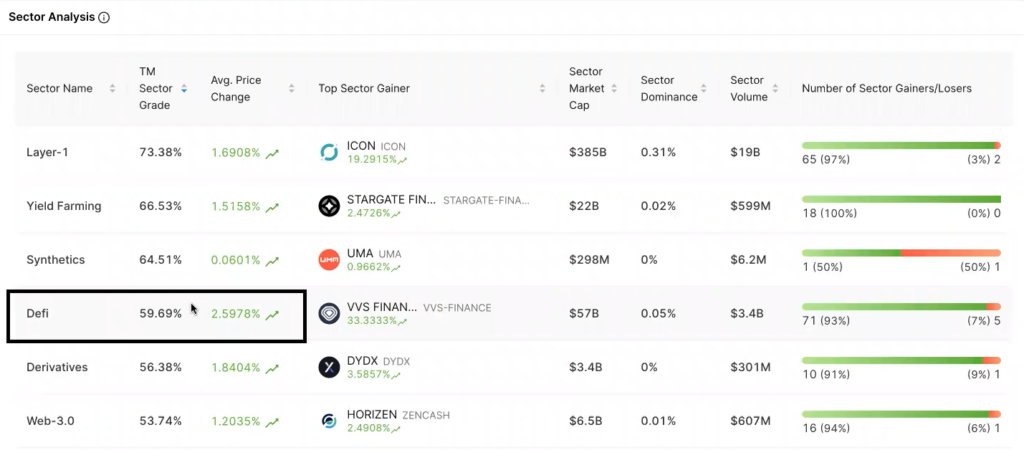

Talked to some big VCs. They’re all scooping up DeFi big ones. Do you think it’s coming back?

- Defi is expected to make a big resurgence in the near future.

- The average sector growth rate for Defi is around 60%.

- L1 (Layer 1) is where most of the games will be flowing to.

- Other altcoins may also benefit from the resurgence in Defi.

- Injective was sold due to the Binance lawsuit.

- Loopring is another Defi project to consider.

- NFTs are also a part of the Defi ecosystem.

- NFTs had issues with selling out, but they were burnt and became more valuable.

How can you get access to invest?

If your customer, I would say, just contact and just tag us in an on on telegram, or even even better. Just email ventures at tokenmetrics.com. And we’ll check if products are still racing. Just tell us which ones you like.