Greetings,

Despite the challenges faced by the crypto market in the last few months, Bitcoin has almost doubled in price, indicating a strong demand for the digital currency. While regulators and central banks are cracking down on crypto operations, investors are still looking to exit traditional fiat and cash systems and turn to crypto as a way to protect against inflation and economic uncertainty. It’s important to have a diversified portfolio mix of Bitcoin and other assets held through different platforms to potentially profit from the market in the long run. Investors should stay informed, remain cautious, and have a long-term perspective.

It is true that the current situation is not looking good, with inflation likely to increase further. Central banks and governments around the world are working together to cut off access to exit before inflation happens, and they are targeting crypto on-ramps and off-ramps. However, despite all of this, Bitcoin and crypto have had a good year so far, with rallies in price. This has been surprising to some, as they expected the post-FTX collapse to last longer. The crypto market is always full of surprises, and it will be interesting to see how it evolves in the future. Investors should stay informed and remain cautious, but there may still be opportunities to profit from the market.

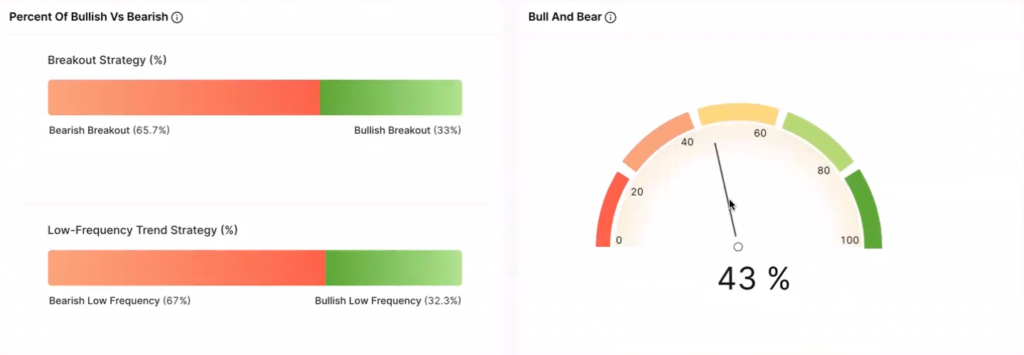

And right now in Bull and bear, and there it’s actually going slightly up versus yesterday. It is still not bullish. We are still in Bitcoin season.

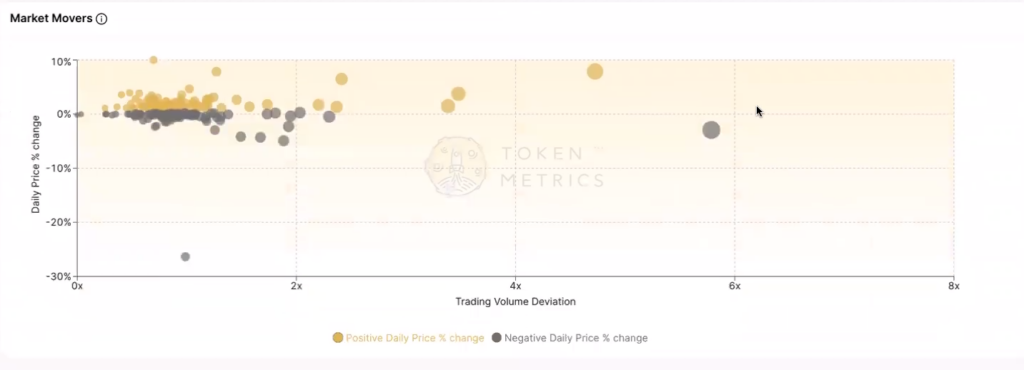

It seems that the current market conditions do not show any major opportunities to enter the market or risk capital at this time. It may be best to hold onto current assets and wait for better opportunities to arise.

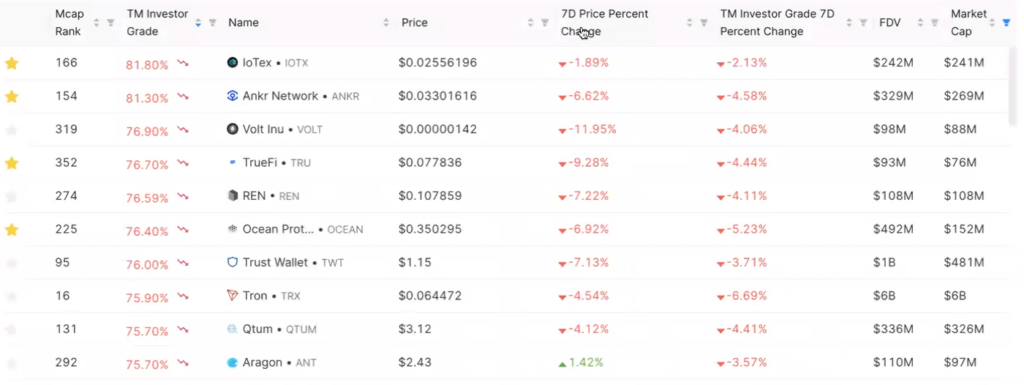

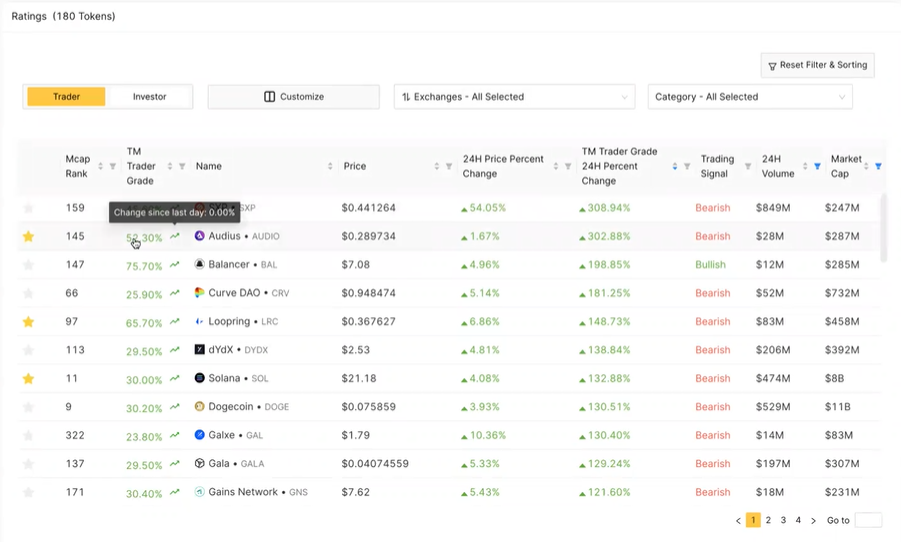

Looking at investor ratings and trader activity, there does not seem to be any major movements or trends indicating an immediate need to take action. It’s important to use filters and analyze market data to make informed decisions, and to stay patient and cautious during times of uncertainty.

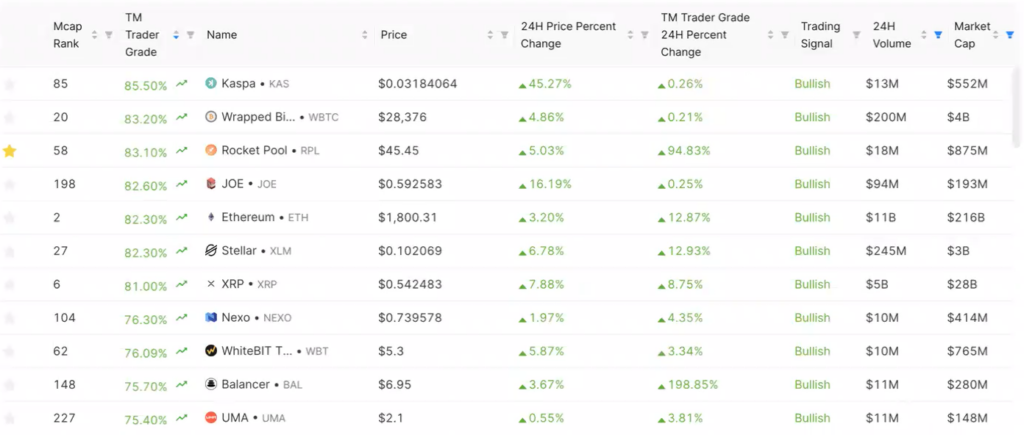

For trader view –

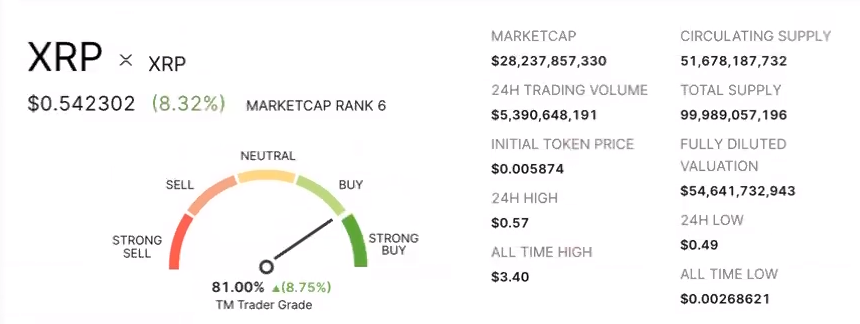

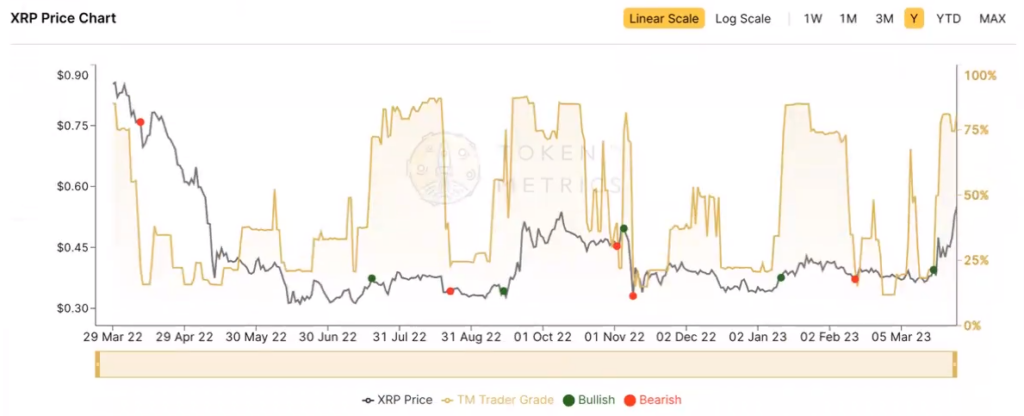

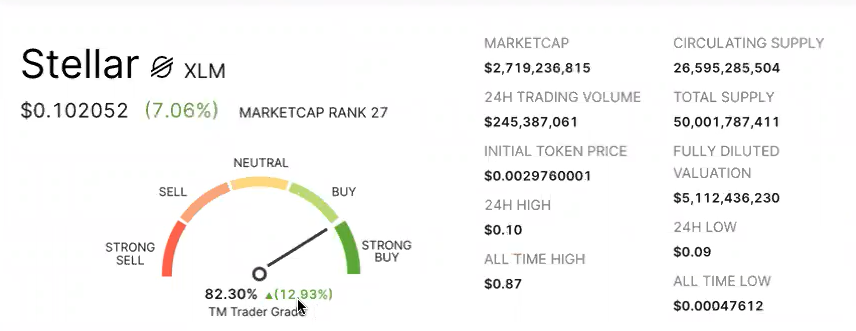

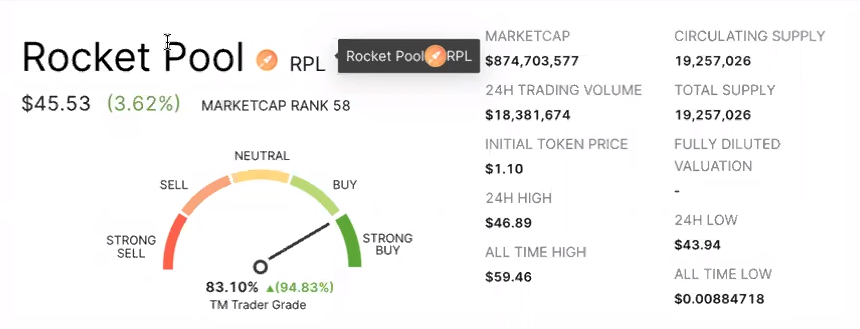

Rocket pool is is trending up again. It appears that large cap cryptocurrencies like Bitcoin and Ethereum are still leading the market, but XRP and Stellar are also trending upwards. There is speculation that XRP may receive a favorable ruling, which could be a catalyst for the entire market. Stellar is also seeing movement as it is a fork of XRP. Other movers include Cas and Amber from Avalanche, which are still showing movement. Stakes (STX) has also bounced back slightly.

XRP has received a positive integrated rating and is up almost 9%, with a bullish signal about 10 days ago. It’s important to stay informed and cautious during times of market volatility.

Stellar is actually up a lot more, almost 13% on Trader Grade, also turned bullish slightly 3 days after XRP, but not so good trading signal.

Rocket Pool with almost 95% trader grade and turned bullish yesterday with good Sortino ratio. It is connected with ETH Shanghai upgrade, launch date being announced, this happening next month in April. This can be a potential trade.

On Trading view, still in bearish trend because they close the long at 45. The red is still bearish hasn’t completely changed.

It is worth to trade. It is currently at $45.33.

Question if regulators just go after and shut down every exchange that doesn’t start with Nasdaq, What’s the future of crypto?

It’s true that it’s unlikely for US regulators to completely shut down non-US exchanges globally, and even if they do, someone else will come in to replace them. This has been seen in the case of BitMEX, where other exchanges like Bybit and GMX replaced them. While there are regulators going after projects like Sushiswap, it’s important to remember that crypto is now global, and there are jurisdictions that welcome it, such as the UAE and now Hong Kong. The future of crypto may be through decentralized exchanges (DEX) or centralized exchanges, but capital and liquidity will still flow into the crypto market. It’s important to stay informed and cautious during times of regulatory uncertainty and to consider the global nature of the crypto market.

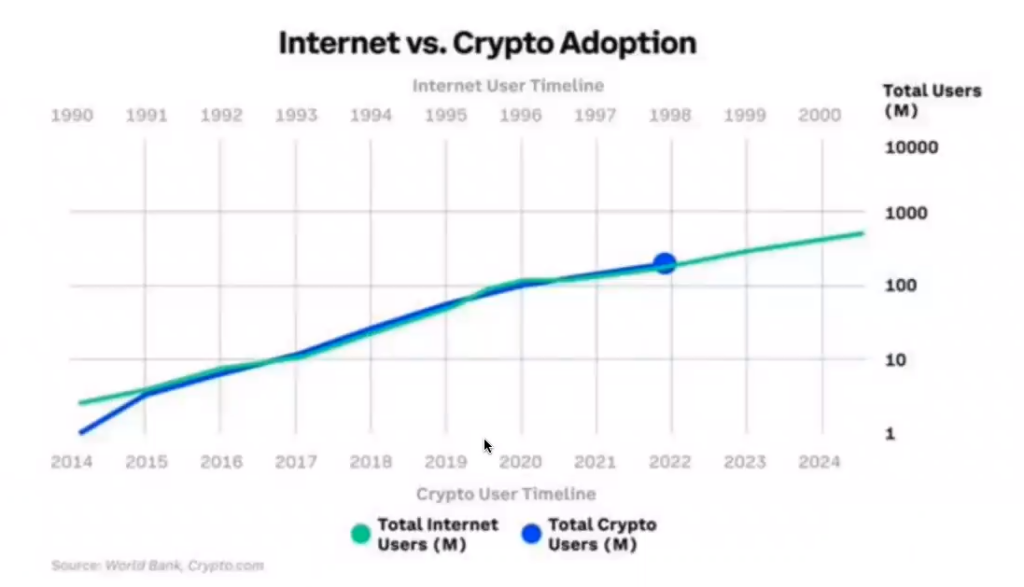

The long-term outlook for Bitcoin and cryptocurrency, pointing out that despite market volatility and regulatory uncertainty, it pays to be optimistic. Bitcoin and crypto will become even more popular as adoption grows, and that the trajectory of crypto adoption is similar to that of the internet.

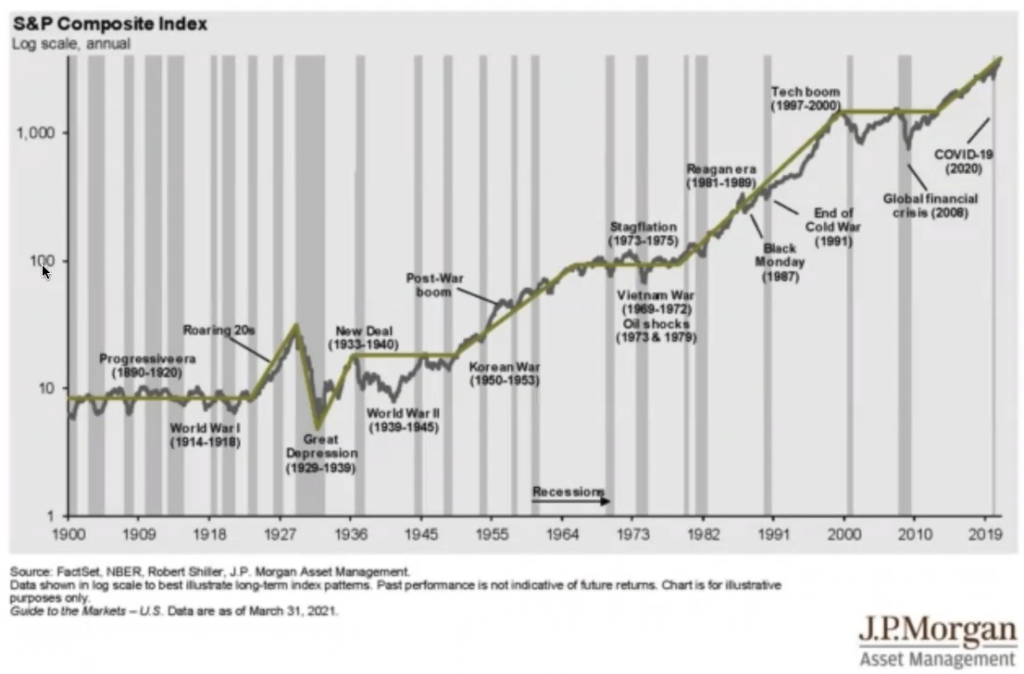

The big collapses may happen, but over the long-term, the market trend is upward. Despite regulators’ attempts to stop the growth of crypto, the train has already left the station and that Bitcoin and cryptocurrency are here to stay. Pointing to the history of the S&P Index over the past century as an example of how big collapses can happen in the short-term, but over the long-term, the trend is upward. The regulators may try to stop the growth of crypto, it is unlikely that they will be successful in doing so, and that the trend of adoption will continue despite regulatory uncertainty.

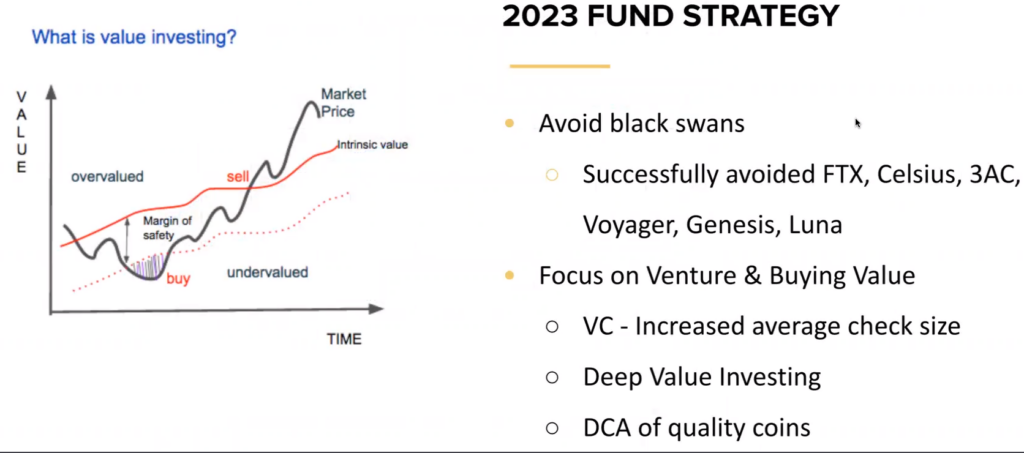

The importance of avoiding black swan events in the crypto industry, which can be challenging due to the high level of risk and the potential for hacking and other security issues. The investors should focus on quality projects and teams, and avoid hype-driven projects that are only in the market for short-term gains. This is particularly important during bear markets, when the quality of projects tends to rise as hype-driven projects fall away. Our own investment strategy involves making venture investments in quality projects and looking for deep value opportunities in the public markets.

Overall, focus on quality and a long-term outlook are key to success in the crypto industry.

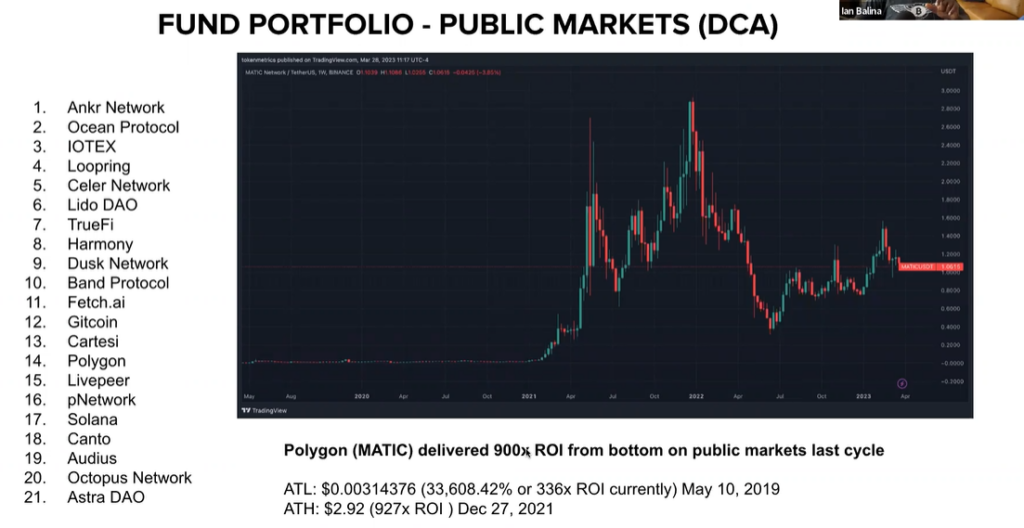

Our current front portfolio and projects on that on on public markets but the best way to really showcase this is to just look at the charts of products that have done well that you could have purchased on public markets.

It provides an example of a successful investment in Polygon (MATIC) which was available for purchase on public markets. The project was initially undervalued due to negative news during a bear market, but investors who did their research and bought the project at a low price point could have seen massive returns. An investment made at the all-time low of 0.003 cents could have resulted in a 300x return on investment if sold at the current price, or a 900x return if sold at the all-time high. If investors didn’t capture the full return, they could still have seen significant gains, with a third of the return resulting in a 300x increase in investment. It shows the potential for successful investments in quality projects on public markets, even during bear markets.

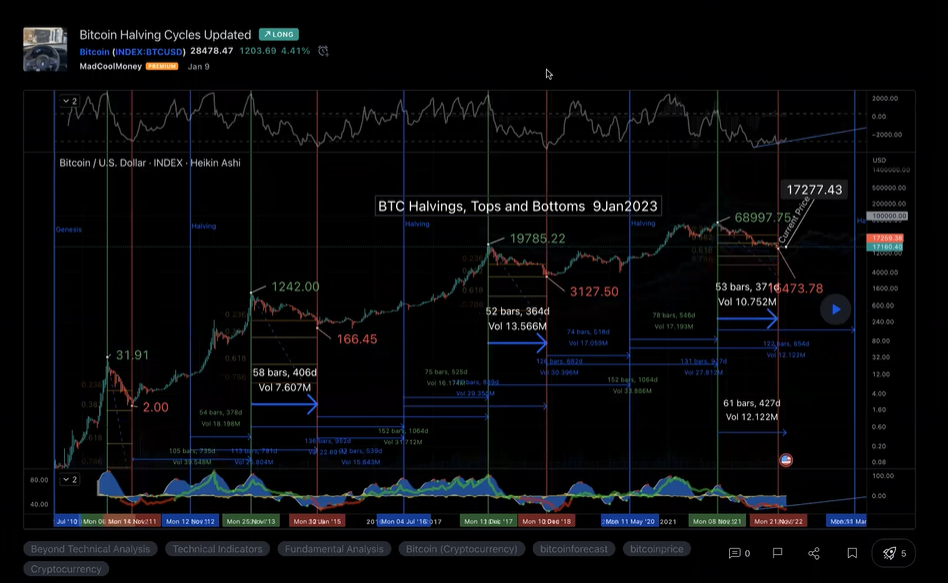

We discussed the strategy for generating life-changing wealth through investing in quality projects on public markets, particularly in the next market cycle, which is projected to increase the crypto market cap from $1 trillion to $10 trillion within the next 2-4 years. It has been suggested finding projects with good fundamentals and technology can result in returns of 100-200x or more, similar to the returns seen with Polygon. Upcoming events in the industry, such as the Ethereum 2.0 upgrade and the Bitcoin halving in March 2024, could impact the market. It is the important identifying bullish trends, such as high levels of staking and the rise of NFTs and smart contracts on Bitcoin with 15% of Ethereum staked while other protocols have over 70% of their asset being staked.

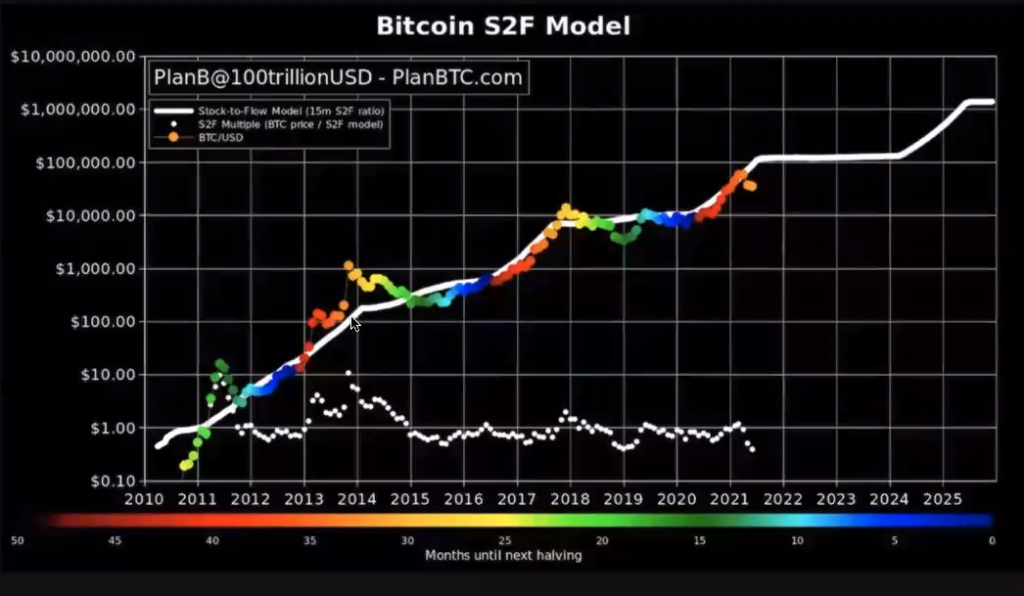

There are various factors that could impact the crypto market, particularly Bitcoin, in the coming years. We can note that the stock-to-flow model has been decent in predicting market trends, and predicts that Bitcoin will continue to rise in the long term. They highlight the upcoming Bitcoin halving as a potential catalyst for the market, and suggest that altcoins could see even greater returns than Bitcoin. The importance of layer two scaling solutions on Ethereum is also discussed, where partnerships between Coinbase and Optimism is worth noticing as they’re planning to onboard or anywhere from 100 Us 100 million users to a 1 billion users. Overall, we can notice bullish outlook for the crypto market in the next few years.

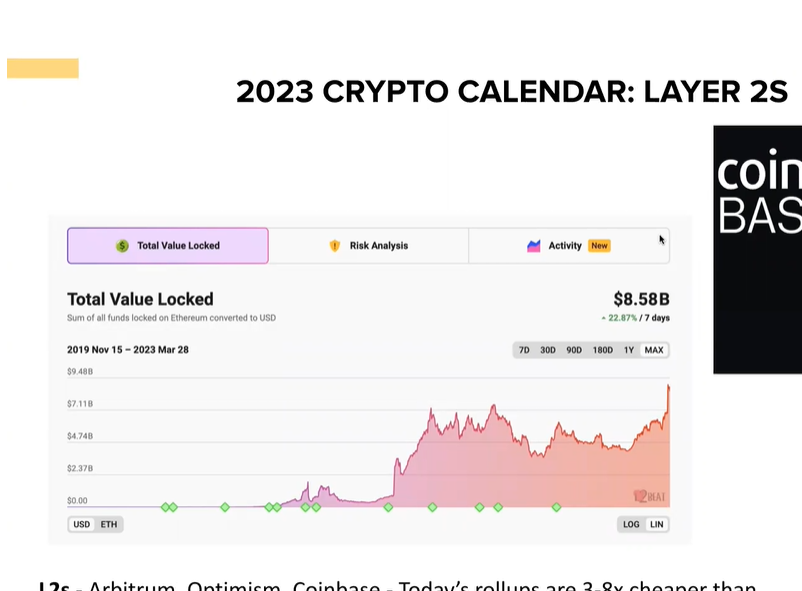

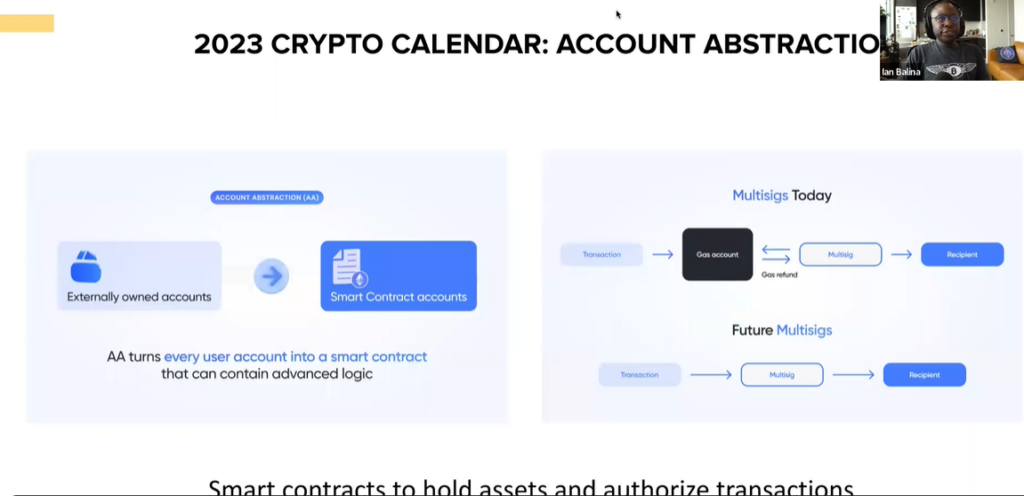

Various trends and developments in the Ethereum ecosystem have been discussed, including the rise of L2 solutions and optimistic rollups, which can make transactions cheaper and faster. The adoption of account abstraction is highlighted as a big narrative, as it can improve the user experience and make transactions on Ethereum more user-friendly. This is huge, and capital has been flowing into L2’s and the Ethereum ecosystem. You have over $8 billion in the Ethereum ecosystem, so this has been trending upwards.

Account abstraction is a recent development in the Ethereum ecosystem that can significantly improve user experience by making transactions more user-friendly. This technology enables transactions to be executed without requiring the user to hold the underlying token. Instead, the transaction fee can be paid in any token, which can be converted automatically by the network. This results in reduced transaction fees and faster transactions, making it easier for users to interact with the Ethereum network. Account abstraction is an important development to watch out for as it can have a significant impact on the adoption and scalability of Ethereum.

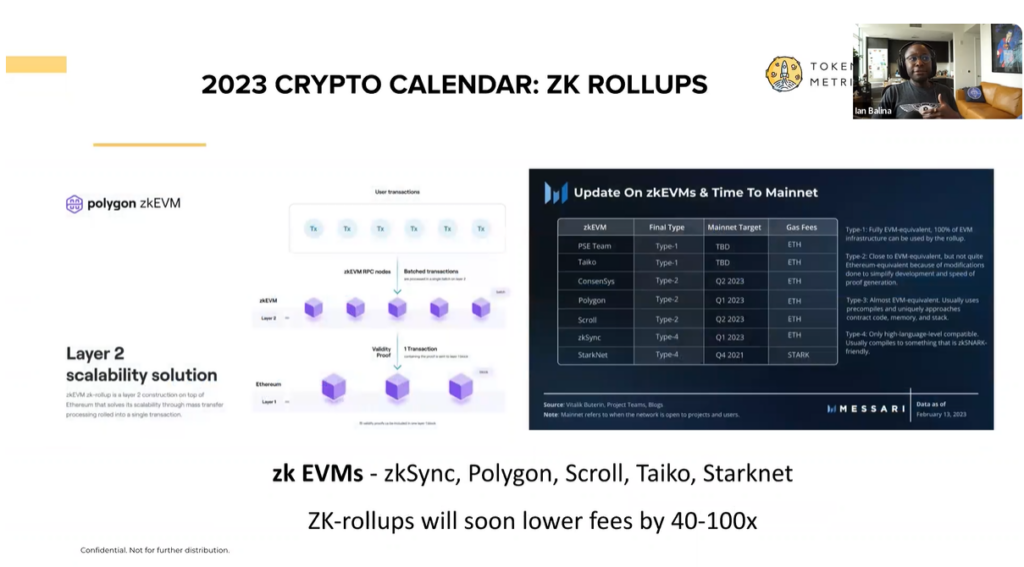

There are many upcoming projects and announcements in the Ethereum ecosystem, including the launch of ZK rollups, Polygon’s mainnet beta, and announcements from several other projects like StarkWare and Zk-Sync. It is important to highlight the potential of Taiko, a solid project that is yet to be published, and the importance of ZK rollups, which can make transactions significantly cheaper and more efficient. ZK rolls are worth keeping an eye on.

Additionally, there is an upcoming launch of a crypto-native phone from Solana, which could have significant implications for the adoption of cryptocurrencies. These developments are important to watch out for and could have a significant impact on the crypto market. The Solana team comes from Qualcomm, a leading telecom manufacturing company. If the phone is successful in attracting other crypto apps and gaining traction, it could be a significant improvement for the industry. A phone where other crypto apps can launch and get traction, this is huge.

For the trader option, what does a 20 plus jump and 24 h. Mean?

It is important to monitor trade data and metrics to identify potential trends and reversals in the market. For example, the SXP metric is a good data point to look at for identifying which projects are likely to move fast in the event of a market reversal. There are several upcoming projects to watch out for, including the crypto-native phone from Solana and the launch of new IDX on Cosmos. We checked social media and news sources for updates on specific projects, such as Balancer, can be helpful in understanding potential catalysts for price movements. To summarize, it is important to stay informed and monitoring various data points to make informed decisions in the crypto market. Balancer has exposure to Arbitrum. It could be a fundamental catalyst happening.

What’s the best way to get the zkSync airdrop?

Use the project. The text discusses various projects in the zkSync ecosystem, including Balancer, and DefiLlama. The speaker notes that while there may not be much traction for these projects yet, it is important to keep an eye on them and wait for well-known products to begin using them. Additionally, the zkSync’s token is not expected to be decentralized for about a year, unless something major happens. We must use the trade signals and signals for Trader Grade to monitor potential movements in Balancer’s price, which has seen a 20% change in trading volume on the 23rd. However, there may not be much alpha on this signal so trading carefully. Overall, the text provides valuable insights into the zkSync ecosystem and strategies for monitoring potential market movements. The token is about one year and this is not going to happen any time sooner.

I was thinking of a day trade based on this movement…

For Balancer, I would use trade grade signals.

To conclude today’s session, current market conditions are bearish but some tokens are showing signs of reversal. The upcoming Bitcoin halving event, which is one year away, and we must note Bitcoin is already almost at the target price. Additionally, the regulators are trying to prevent a mass exodus of funds from traditional finance into crypto, but I believe that crypto is here to stay in the long term.