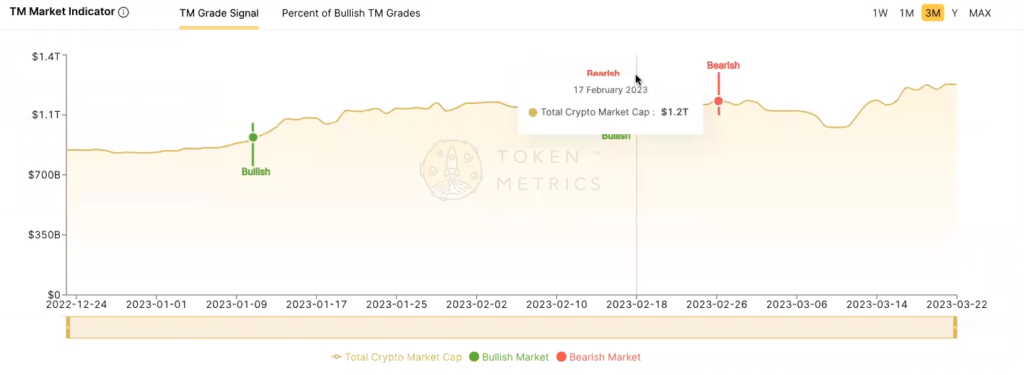

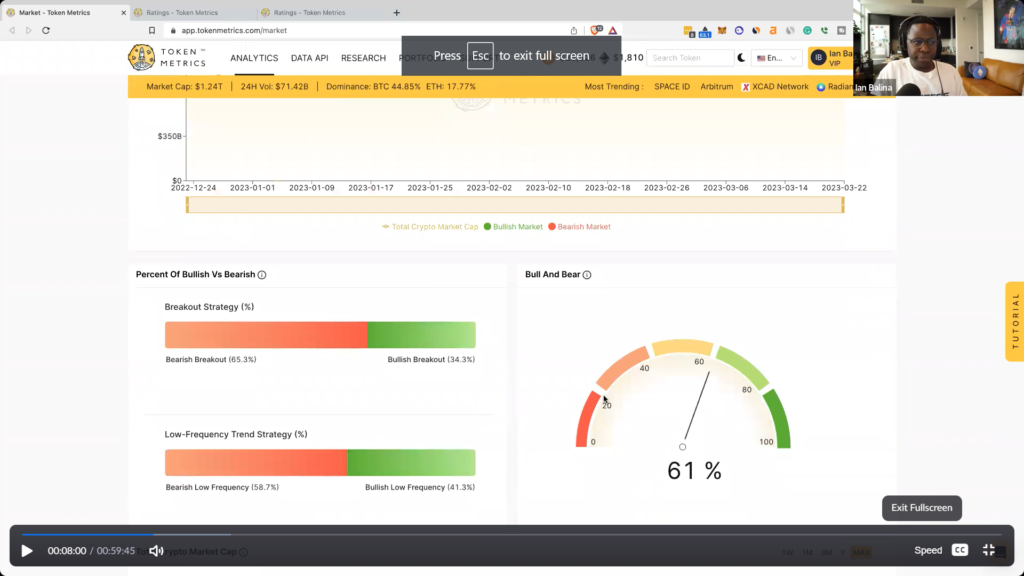

Most things are still the same, in the bearish environment, although we were trending upwards, and even though it was bearish, adding more risk into the market. It is expected to add more capital into the market, because the Bull and Bear gauges were trending upwards. We were anticipating heading into a bullish market.

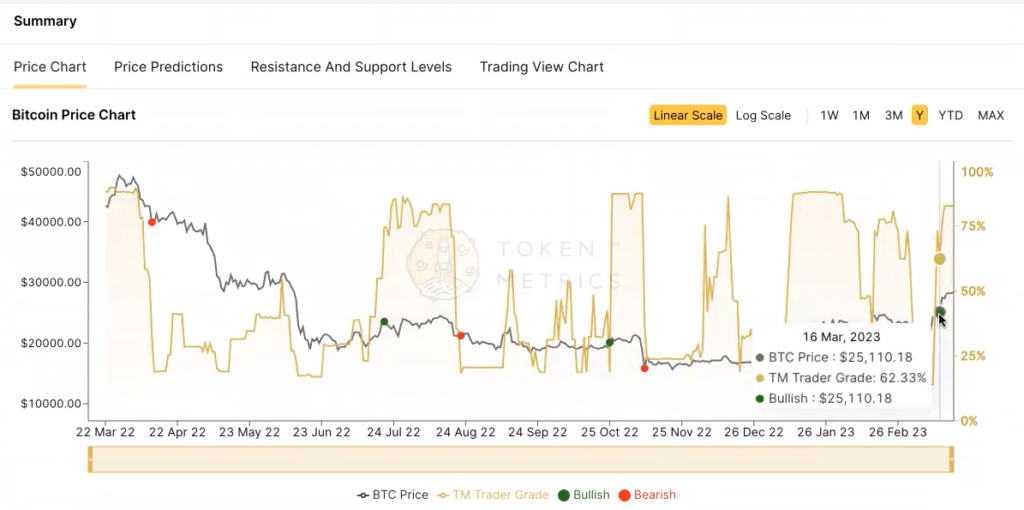

So in the last few weeks, it was as well as 20%, but it was in the low range and trending up when as high as 71%. But now it’s pulled back slightly.

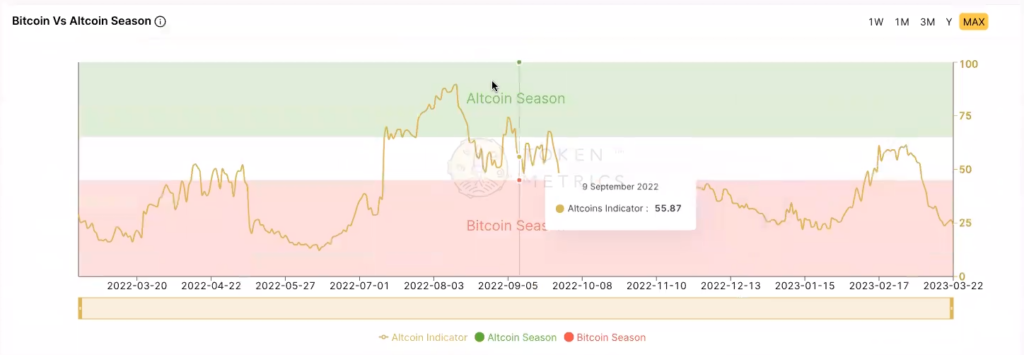

Main thing to keep in mind here is basically Bitcoin season Altcoin season. So we’re still technically in Bitcoin season.

We have people making incredible price predictions that Bitcoin is going to a $1 million but based on Central Banks printing money and hyperinflation beginning in the US, within 90 days, I think that’s quite an aggressive prediction. It could be right in terms of direction.

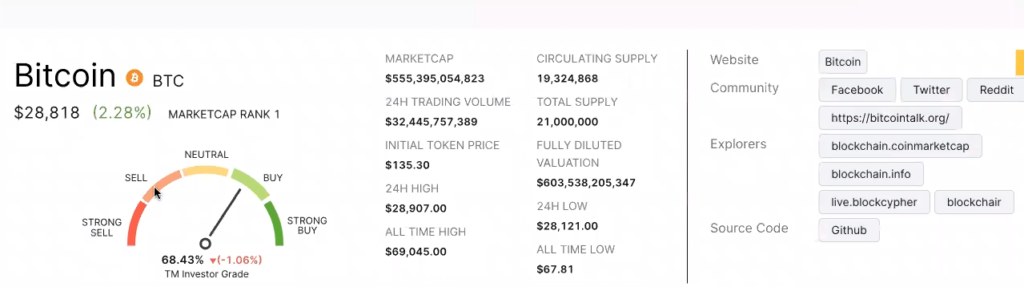

Bitcoin is pushing towards 30k even though on investor grade, it’s at 68%, which is low. It is moving upwards.

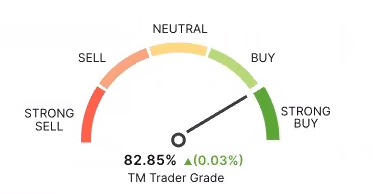

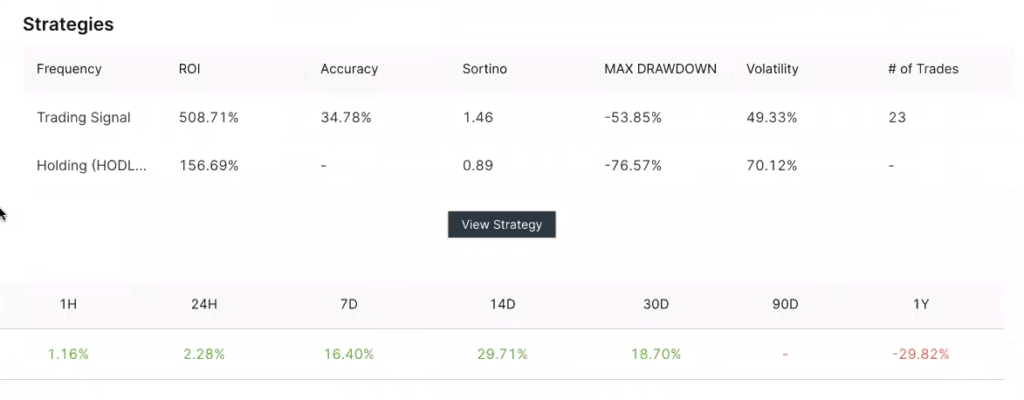

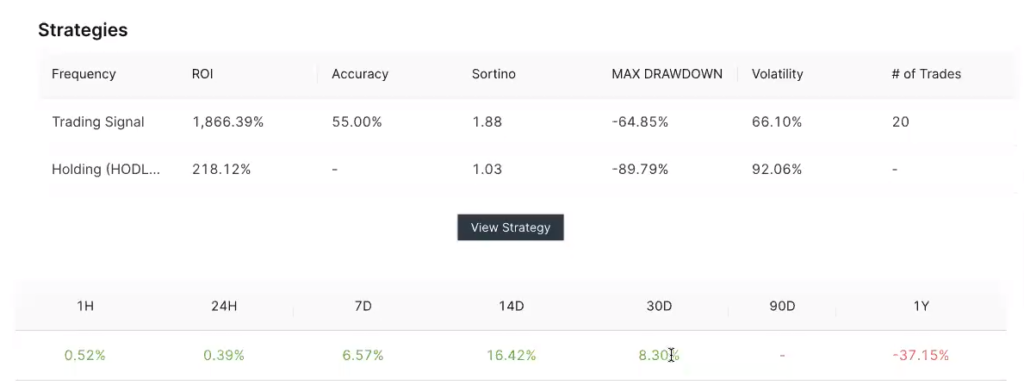

The trading signal looks good. On the trading side, it’s over 80%. As a trade, it makes sense to get into Bitcoin. It turned bullish on the 16th of this month.

Sortino ratio looks good too. So if you want to trade right now, it does make sense to be in Bitcoin, based on this data.

Bitcoin has gone up only 18 to 19% this month.

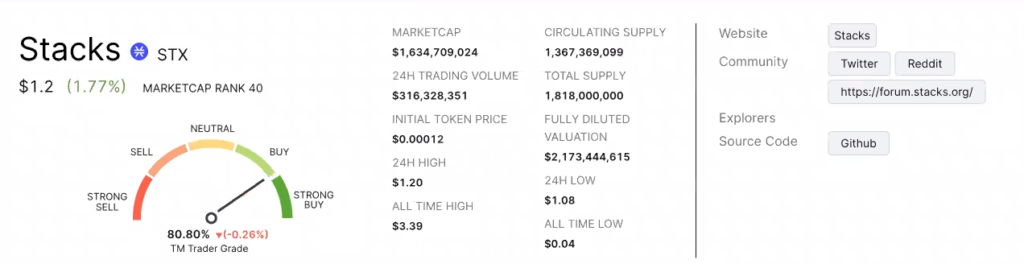

With Bitcoin trending up, it is essential to see what is moving up with Bitcoin. We do think Bitcoin will be up, but there isn’t any money to be made in Bitcoin. The last time I checked, Bitcoin went bullish. It is excellent to check Stacks. If Bitcoin goes to a million, Stacks will also rise as it has a lower FDV or market cap but is tied to the Bitcoin ecosystem.

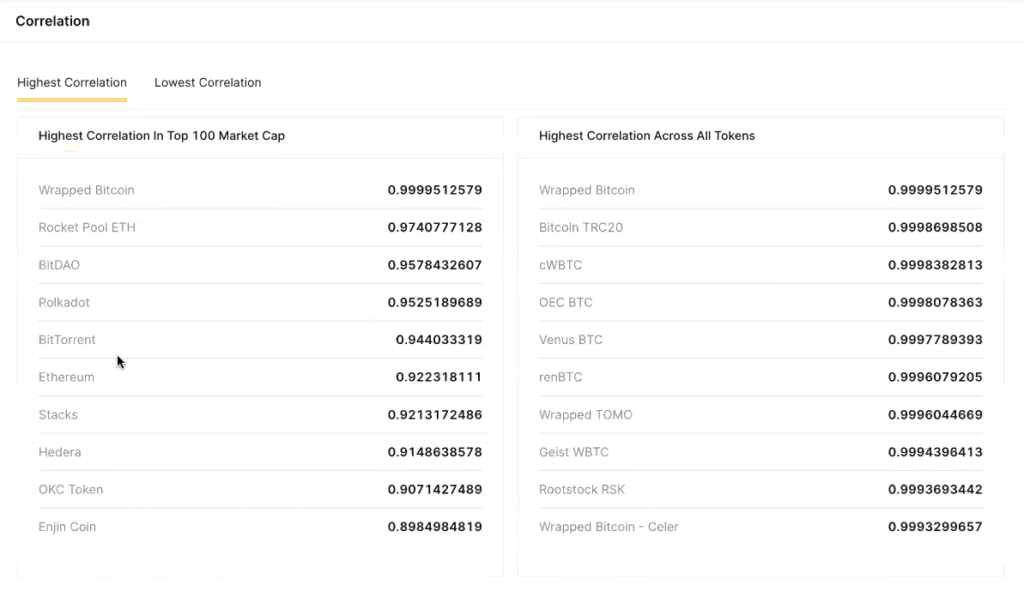

Looking at the correlation, we have Polkadot, Ethereum, Stacks, and Hedera. I like Ethereum and Stacks. There is a high correlation between Ethereum and Bitcoin. Based on my interpretation of the correlation data, Ethereum and Stacks are good options.

Lets do some analysis of Stacks. You can keep some Bitcoin as well but also keep Stacks as trades, as Stacks is highly correlated with Bitcoin.

We can see that Stack went over 100% in the last month in comparison to 20% of Bitcoin.

Stacks is an old coin with over $2 billion FDV versus Bitcoin. There is an additional risk, meaning it can go down faster and harder than Bitcoin.

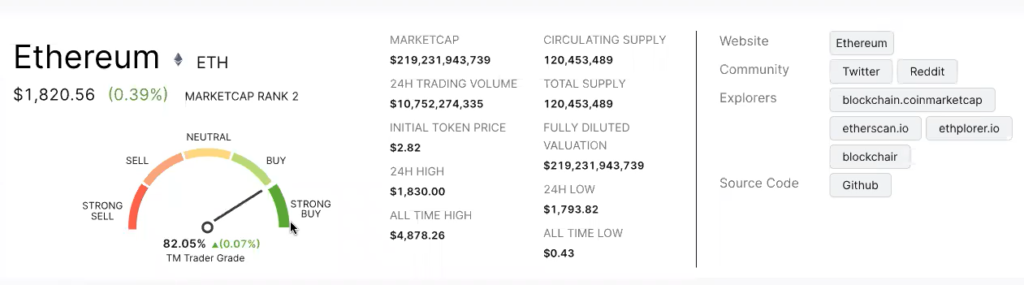

If you want to invest in something steady and safe, we can see Ethereum also turned bullish. With TM Investor Grade to around 71%, and on the trading side, it’s above 82%.

Ethereum went bullish on on March 17, so a day after Bitcoin. This shows how correlated ETH and BTC.

ETH has a higher Sortino ratio of 1.8 almost a 2. It only about 8% up in the last month or so.

If you have enough ETH and want to find something else that correlates with BTC, look at Stacks. Other coins are also appearing in the correlation chart, like BNB. I would not invest in BNB because of regulatory purposes, although it has outperformed BTC and ETH.

Multiverse X – We already have this in our long-term portfolio.

Cosmos – Bullish in the Cosmos ecosystem, and Cosmos 2.0 is due to enhanced security and tokenomics to their cryptocurrency. Based on the performance and current data, it isn’t the right time to get into Cosmos.

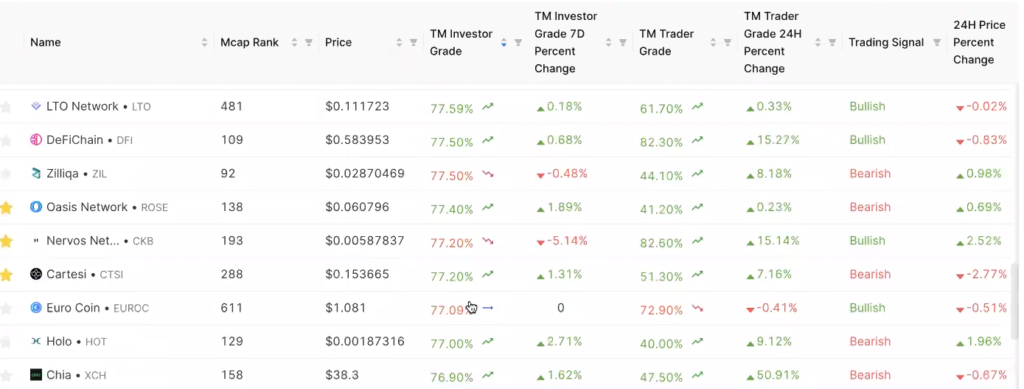

Further analyzing the market, everything has stayed the same regarding investor grades. I see that there are no new tokens worth looking into.

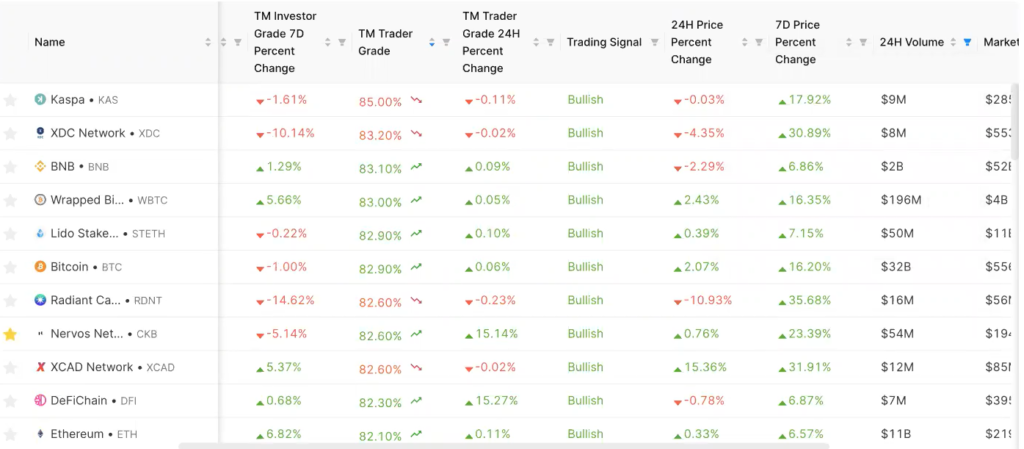

If we go towards the trading side, setting the volume filter to 5 million, we get these results –

We can see Kaspa, which is not very impressive. We can see BTC and Lido Stake (STETH), the large caps I would be in. Stick to Ethereum for those who want to earn some yield.

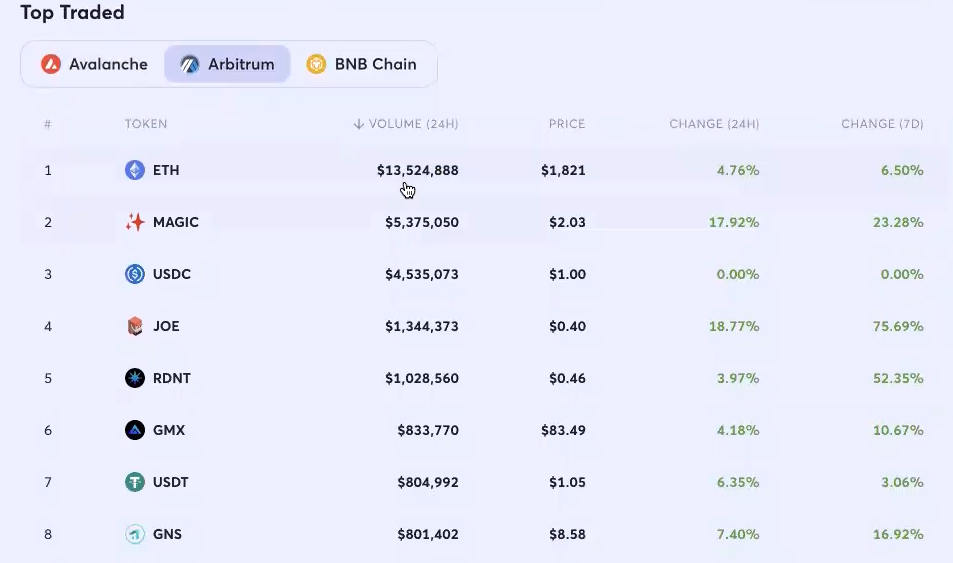

We looked at JOE in the Astrobot webinar, but FDV was too high. It was trending because it’s now on Arbitrum. People anticipating Arbitrum to do well, trade in the Arbitrum ecosystem, and expect capital and fusion should look at Radiant on Arbitrum.

JOE – We know from Avalanche and have launched on Arbitrum, Optimism, and BNB.

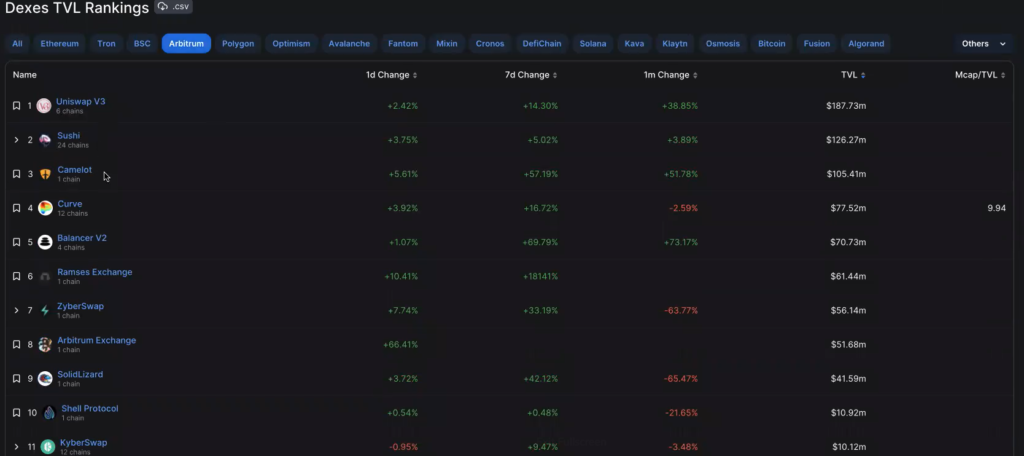

Dexes TVL Rankings

Joe V2 is at number 12 with much competition and little to trade.

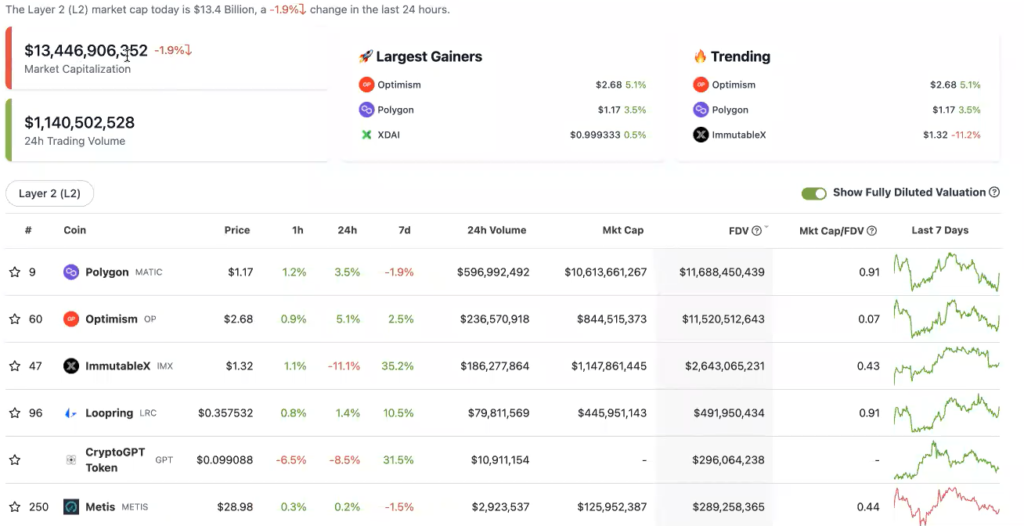

Arbitrum has higher TVL than Polygon, almost 2 times more than Polygon. Optimism and Polygon have same TVL.

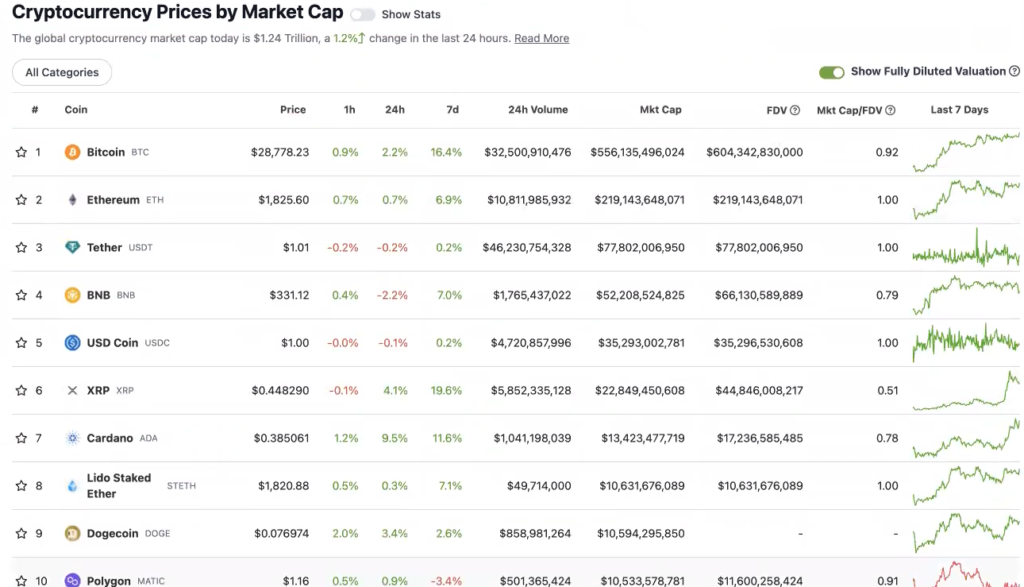

If we look at the top cryptocurrencies by Market Cap, Polygon is among the top ten, higher than Solana, but Arbitrum is anticipated to be higher FDV than Polygon.

Top Layer 2 (L2) Coins by Market Cap

Overtime, Arbitrum will be among the top ten cryptocurrencies.

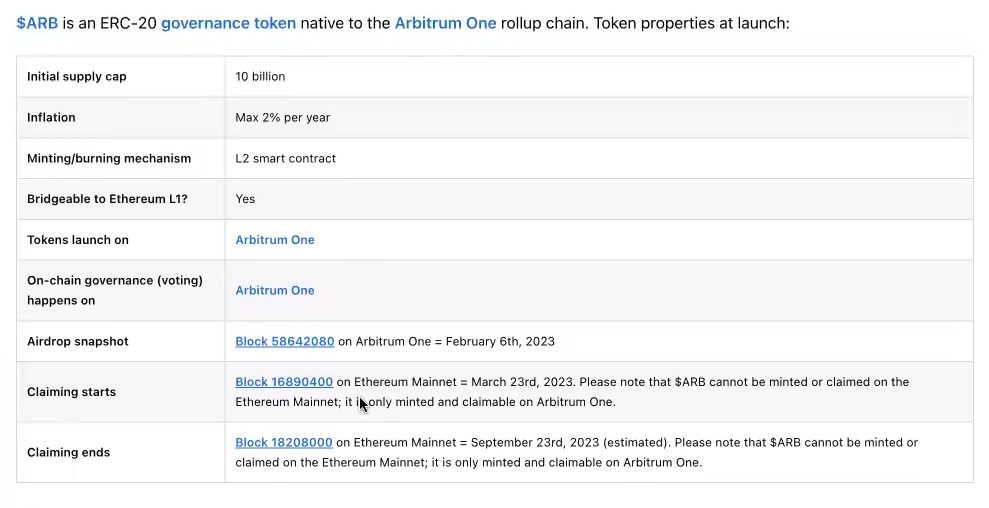

Main thing to look out for, in Tokenomics, is the supply.

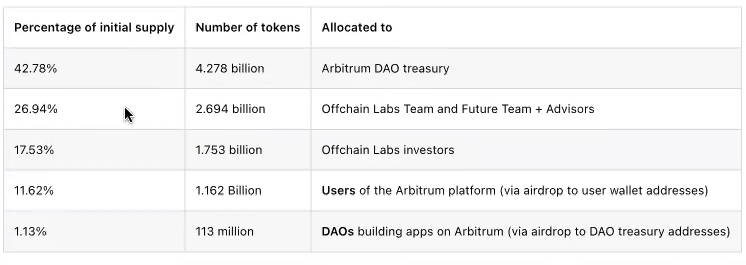

Initial token allocation & airdrop distribution

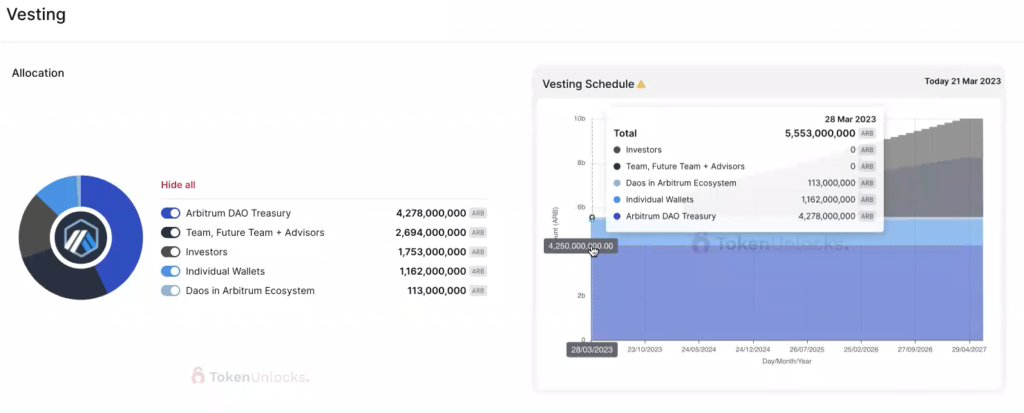

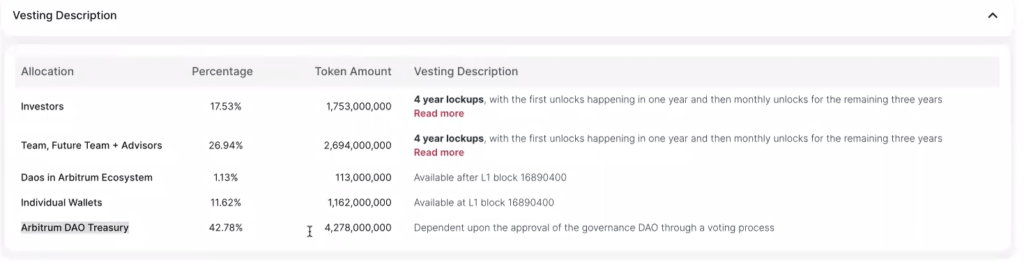

There are 10 billion tokens, with about 43% going to the treasury and about 27% to the team and advisors, but 18% to investors and about 12% to airdrop users. All that will unlock in less than 24 hours, and then 1% going to DAOs. And then, there is going to be a governance vote.

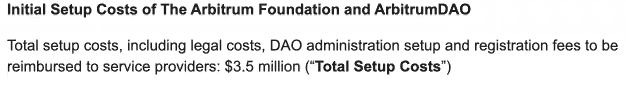

Costs

With 3.5 billion tokens transferred to the treasury and 750 million moved to the administrative budget wallet, which equals 4.3 billion. We’re looking at 14.5 billion in market cap, higher than Polygon and Optimism.

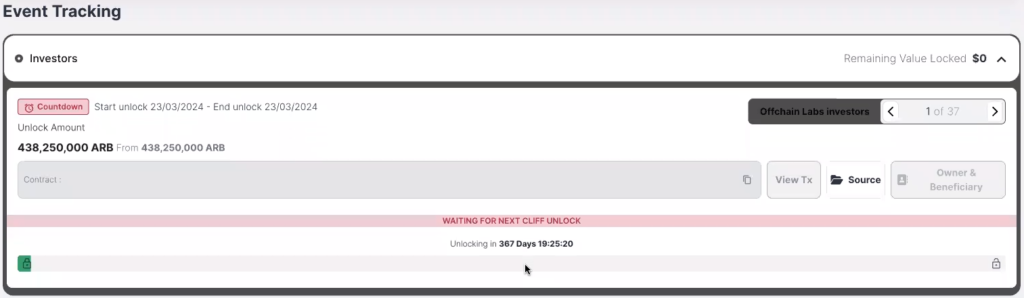

If we go to ‘Token Unlocks’, to see their schedule,

Investors are locked up for a year. Same with the team and advisors.

Now, we have 1.1 billion unlocking in 21 hours. It’s unlocked in terms of the DAO treasury. These tokens will then be available for a governance vote to transfer to their DAOs. I don’t know when lockup is going to be on.

We have two ranges; only 12% of the supply is liquid in 24 hours. If that happens, we can use those metrics to calculate market cap and FDV. In the worse case, the long term is better tokenomics. If DAO is liquid, it will be additional pressure in the short term. But in the long term, we have over half the token supply. There’ll be little emission schedule or inflation in the future, so around 56% of the tokens will be liquid.

My price prediction range for Arbitrum is from 30 cents to $1.5. I expect Arbitrum to be among the top 10 and have a higher FDV than Cardano. It is pushing the top 5. Having the top 5 cryptocurrencies to have an airdrop is very rare.

To conclude, we’re looking at 14.5 billion in market cap, which makes Arbitrum higher than Cardano, bringing it to the top 10 market cap-based projects, between Cardano and Xrp, definitely higher than Polygon and Optimism. We are looking at somewhere between the $0.30 to $1.50 range, so there can be a good profit.

How do you plan an airdrop?

I would use the trading view indicator because, with Token Metrics, we can only give it a trading grade once we have 90 days’ worth of price action.

The trading view indicator is based on price action, giving you an essential perspective. We have to use the data we have here already.

This green cloud means it’s bullish. Red cloud is parish right for those of you who are new to trading the indicator. And, when it’s long, it means hold; when it’s short, it means to get out. The blue clouds are at the top of the range. I would check the charts and only sell 10 to 20% when it peaked and then wait for months. See how things are going, and then take more profits. I wouldn’t sell everything. I would sell a maximum of a quarter. Let’s say it pumps. I would still sell about 25% and take some profits. Then just see how things are going.

Optimism is working with Coinbase, which is good. But Arbitrum has twice the TVL of Polygon and Optimism. Most products in crypto in DeFi are launching on Arbitrum and looking to launch it on Layer 2. I would want to have exposure to that.

Any thoughts on liquidity pools? Are there any out there? Two projects for liquidity pools caught my attention: Gamma Strategies and Ichi. We are not endorsing these tokens for market makers and utility. You can find them directly on Uniswap.

Any thoughts on liquidity pools. Are there any out there?

For liquidity pools, two project caught my attention – Gamma Strategies and Ichi. We are not endorsing these tokens but just for market makers and for utility. You can find them directly on Uniswap.

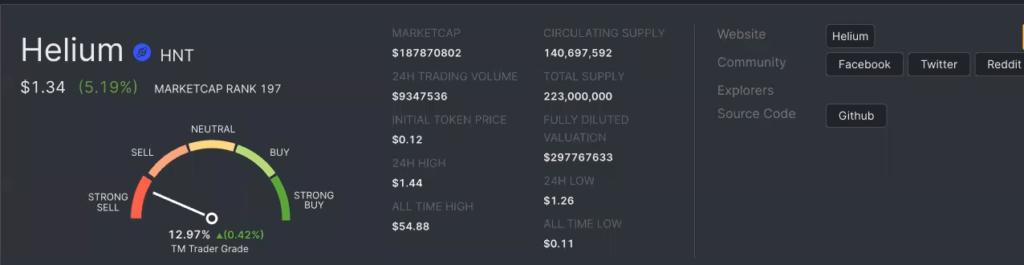

Helium – We’ll wait for the trader and investor grade to improve. As you can see, Trader Grade is very low, so until that improves right now, it’s not a good time.

t is expected to be liquid until they launch the sold tokens. Different exchanges are expected to relist it. Right now, it’s on US and Gate.io, OKX, and KuCoin. Not a good time to be in it right now because people are getting out before the closing. So if you’re trading it, I would not be trading in that, but I think it can ‘bounce back.’ You have to wait for that ‘bounce back’ to happen.

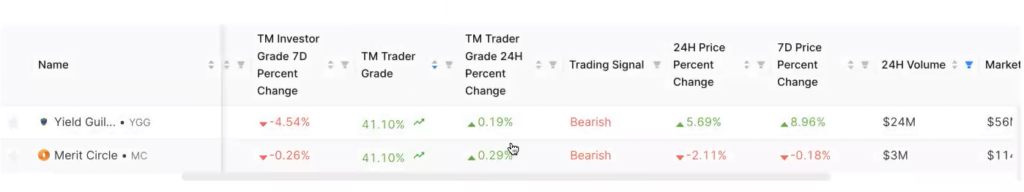

Gaming Guilds – With lower investor and trader graders, we’ll not be looking into these.

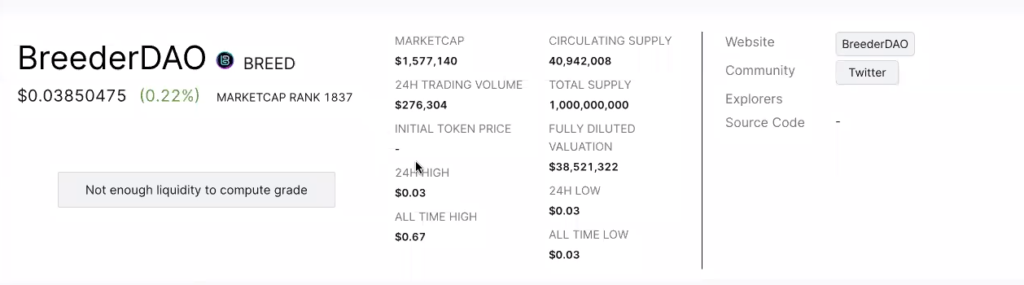

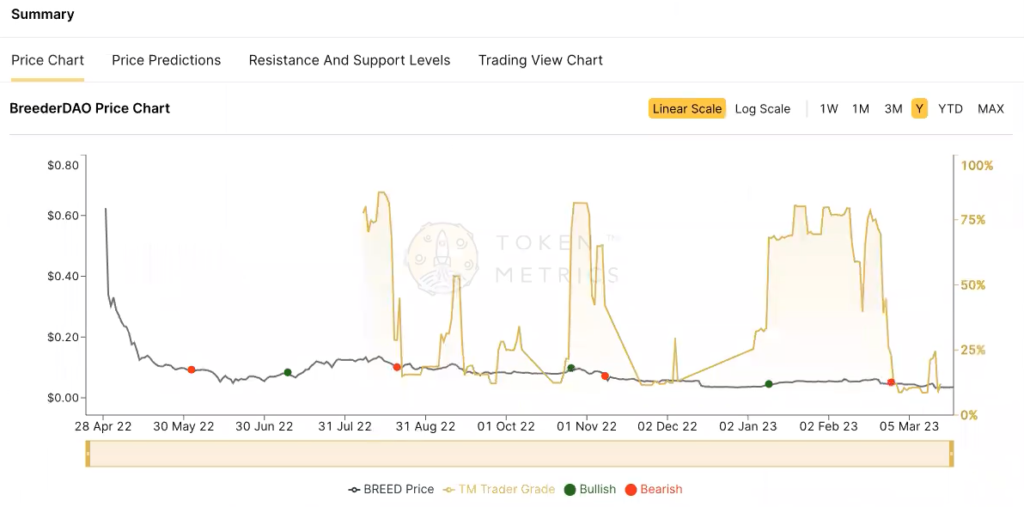

Breeder DAO – This is down by 40% in the last month.

I would not put much effort into it. Market Cap is 1.5 million with almost 40 million dollars FDV; it will underperform until tokenomics improve.

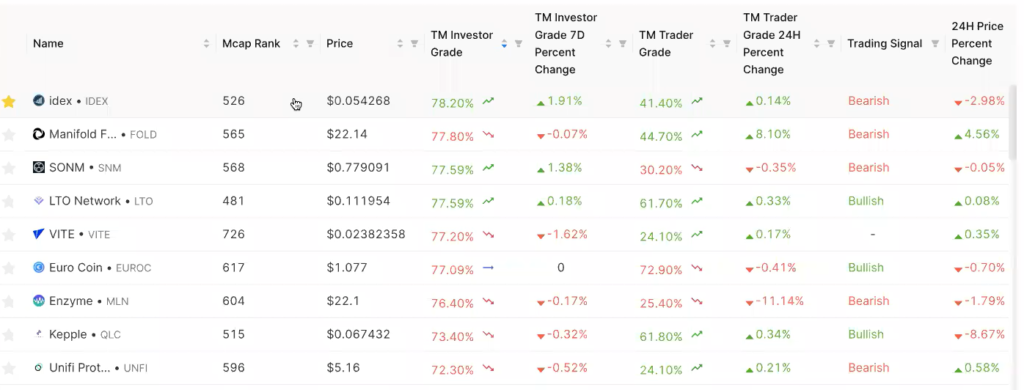

Getting results based on Sortino ration, and FDV –

All of these are low-caps, hence, very risky.

Further, limiting the search to Binance, Kucoin and Gate, we got these results.

ECOMI – It was at a very low trade grade in 2019, with very low prices, and then it boomed. When it pumped, that could happen if a narrative picks back up and an old project happens to be one of the top 2 or 3 in that sector, but that’s tough.

We are always looking for new projects and narratives but not so much for new micro caps. That is possible that they will come, but we can’t force it. You have to wait for them to arrive.

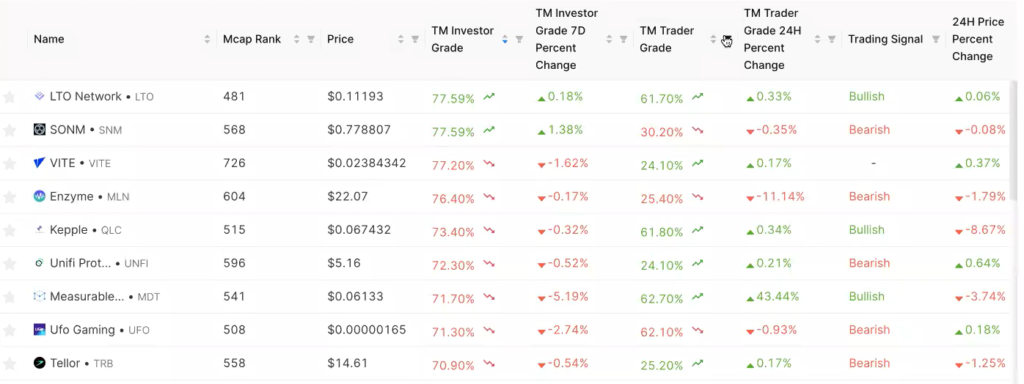

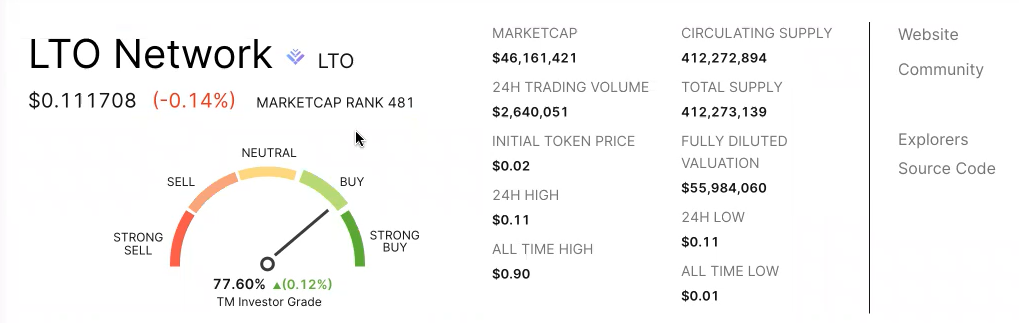

LTO Network – I am unsure about this based on the available data.

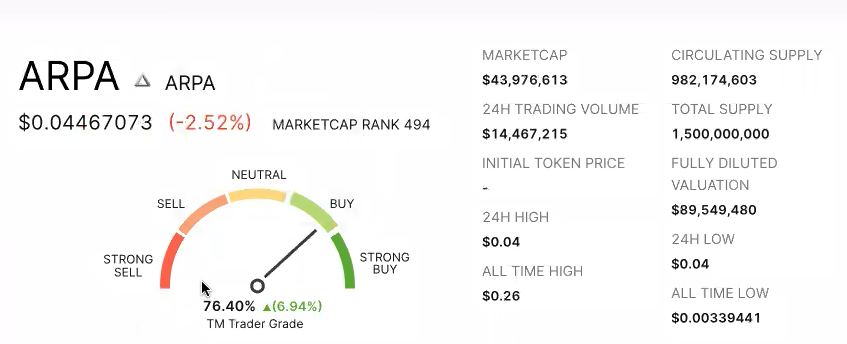

ARPA – This is the one we are trading right now but I am not sure if it is going very well. It was an interesting project with Chinese narrative. We got into this as a long term.

IDEX V3 – It is a hybrid approach. It is on the Polygon network. I am considering keeping an eye on this. It is undervalued relative to its fundamental and technology grade.

Astra DAO – Auditing is in process. We are expecting to launch in 2 weeks. We are looking into an early April launch with Data API and indices.

Magic Eden – They’re launching in a bitcoin market. It is one of the largest cross-chain, the way I view this is. This is not going to scale up.