RedStone is a next-generation decentralized oracle that delivers real-time, cost-efficient, and multi-chain data to blockchain applications. Unlike traditional oracles, it is optimized for Layer 2 networks, rollups, and non-EVM blockchains, ensuring broad interoperability and efficiency. RedStone addresses key challenges in blockchain ecosystems by offering accurate real-time off-chain data, low gas costs through custom data streams, and seamless cross-chain compatibility, making it a highly scalable and versatile solution for decentralized applications.

About the Project

Problem

Over the years, various Oracle projects have attempted to address the Oracle Problem, but many still face critical shortcomings. These include limited flexibility in tailoring data to specific needs, low update frequency, and scalability constraints regarding data volume and variety. However, if an oracle is compromised, the entire dApp becomes vulnerable, as the smart contract may still function correctly but with manipulated or faulty data.

The current Oracles suffered from delayed data access and non-atomic transactions, making smart contracts slower and more complex. To improve usability and interoperability, newer approaches store data directly on-chain, allowing instant access within a single transaction. However, this method has drawbacks, including high storage costs, infrequent updates, limited data customization, and scalability constraints. Storing data on-chain becomes impractical as network fees rise, forcing oracles to reduce update frequency. Moreover, the need to pool resources results in standardized configurations, restricting data customization. This approach also fails to scale, excluding many assets and new data types, such as Liquid Staking Tokens, Real World Assets, NFTs, gaming, and betting data. As DeFi expands, demand for low-latency, cross-chain, and diverse data solutions increases. Traditional oracle models struggle to meet these evolving requirements, underscoring the need for more efficient, scalable, and cost-effective oracle solutions.

Solution

RedStone introduces a novel oracle solution to overcome these limitations through an innovative, modular architecture. It offers affordable storage, on-demand data fetching, and customizable data streams to enhance efficiency and flexibility. Additionally, RedStone ensures cross-chain interoperability, allowing seamless data access across different blockchains. By prioritizing user autonomy and optimizing data transmission, RedStone provides a scalable and efficient Oracle solution tailored to DeFi’s evolving needs.

Its modular architecture optimizes scalability by decoupling data collection from data delivery, enabling seamless expansion across blockchain networks. This innovative design allows price feeds to be deployed on any supported chain without requiring modifications to the core data provider infrastructure. By removing the necessity for new node deployments with each integration, Redstone streamlines expansion, reducing costs and deployment time while upholding uniform security standards across all networks.

Key Features:

Multi-Chain Data Delivery – RedStone’s innovative modular architecture separates data collection from data delivery, enabling seamless scalability across blockchain networks. This design allows price feeds to be integrated into any supported chain without modifying the core data provider infrastructure. By eliminating the need for new node deployments with each integration, RedStone enhances efficiency, reducing costs and deployment time while maintaining uniform security standards. This approach has driven RedStone’s expansion to over 70 blockchain networks, ensuring reliable price data delivery with consistent security measures across all integrations.

Specialized Data Feeds – RedStone goes beyond conventional cryptocurrency price feeds, offering data solutions for emerging financial products and specialized digital assets. Its modular framework supports a wide range of complex instruments, including Liquid Restaking Tokens (LRTs), Bitcoin DeFi derivatives (BTCFi), and Real World Assets (RWA), each backed by customized validation parameters and aggregation models. By integrating data from institutional providers and traditional crypto markets, RedStone ensures data accuracy through multiple validation layers, including anomaly detection, market depth analysis, and cross-source variance checks. Each feed undergoes rigorous price aggregation and is validated through a consensus mechanism involving independent, collateralized operators.

High Security and Data Quality Standards – RedStone employs a multi-layered security architecture to ensure the integrity and reliability of its cryptocurrency price feeds. Inspired by critical systems engineering, its infrastructure consists of distributed nodes that independently verify data accuracy and redundant backup systems that guarantee continuous operation, even during partial outages. Through real-time monitoring, anomaly detection, and consensus-based price formation, combined with economic incentives for data providers, RedStone has maintained an impeccable track record with zero mispricing incidents. This reliability is reinforced through regular third-party security audits, continuous automated testing, and a sophisticated alert system that enables rapid responses to anomalies. The code has undergone multiple audits and is trusted by leading DeFi protocols.

Enhancing DeFi Protocols – DeFi protocols often face challenges in obtaining reliable price data for less popular tokens due to high costs and limited economic incentives for oracles. RedStone addresses this issue by supporting over 1,000 crypto assets, providing comprehensive data that includes interest rates, volatility metrics, and liquidity insights. By delivering real-time price feeds, RedStone enables accurate execution of trades, liquidations, and derivative transactions on DeFi platforms, enhancing both functionality and reliability.

Real-Time and Historical Data Access – One major limitation of traditional oracles is their slow data update intervals, often exceeding 10 minutes. RedStone significantly improves on this by providing refreshed data every 10 seconds for supported assets, with some already benefiting from a 2-second refresh rate. The team continues to enhance performance for even faster updates. Additionally, while most oracles prioritize real-time data, RedStone uniquely supports historical data on-chain. This feature empowers DeFi applications with valuable datasets for historical analysis, allowing them to introduce new metrics and advanced features.

Diverse Data Types – Unlike conventional oracles focusing solely on financial data, RedStone offers extensive data versatility. It supports various information, including financial derivatives, voting outcomes, political decisions, climate data, sports competition results, and more. This adaptability makes RedStone a powerful tool for applications beyond the financial sector. Currently, RedStone provides data feeds for various use cases, including LST & LRT protocols, financial derivative platforms, insurance dApps, prediction markets, dynamic NFTs, and blockchain gaming. This wide-ranging capability ensures that RedStone meets diverse needs within the DeFi ecosystem and beyond.

Data Offerings

RedStone offers three distinct data delivery methods-

Pull Method

The Pull Method minimizes on-chain storage costs by fetching data only when needed using RedStone’s EVM-Connector module. Data remains available in the Data Distribution Layer (DDL) until a transaction requests it. When transferred on-chain, a meta-transaction mechanism ensures integrity through signature verification. This method embeds data into a transaction’s calldata, reducing costs associated with continuous updates.

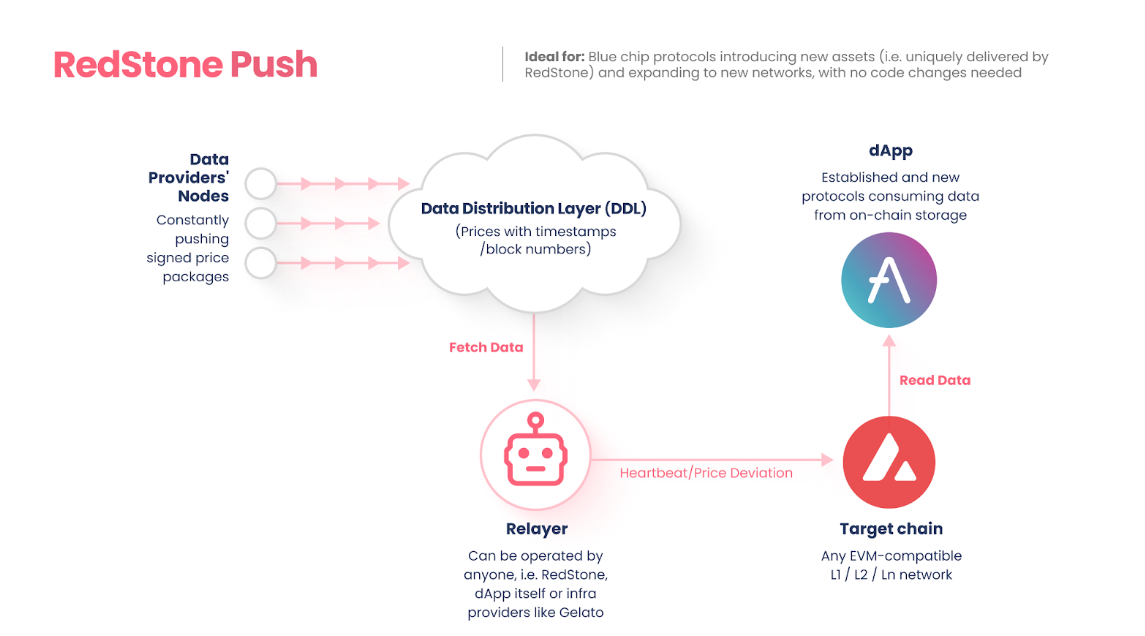

Push Method

The Push Method follows a traditional oracle approach where data is periodically pushed on-chain via a relayer based on predefined conditions. Designed for protocols requiring full control over data updates, this model ensures flexibility by allowing users to determine when and how price data is updated, unlike conventional push oracles with fixed parameters.

Hybrid Method

The Hybrid Method—RedStone ERC7412—combines both approaches, enabling multi-call transactions with verifiable off-chain data. This model, popularized by Synthetix, leverages the strengths of both pull and push methods to enhance efficiency and adaptability across blockchain ecosystems.

Market Analysis

The decentralized finance (DeFi) ecosystem has experienced rapid expansion, with continuous innovation in protocols and products. Between 2020 and today, the Total Value Locked (TVL) in DeFi has surged from $600 million to $177 billion, reflecting the sector’s exponential growth.

Blockchain oracles are crucial in this ecosystem by connecting blockchains to external, off-chain environments. They enable smart contracts to access real-world data, events, and systems, allowing them to execute based on external inputs. By serving as bridges between deterministic blockchain networks and the external world, oracles significantly enhance the functionality of decentralized applications (DApps) and expand the scope of blockchain-based automation.

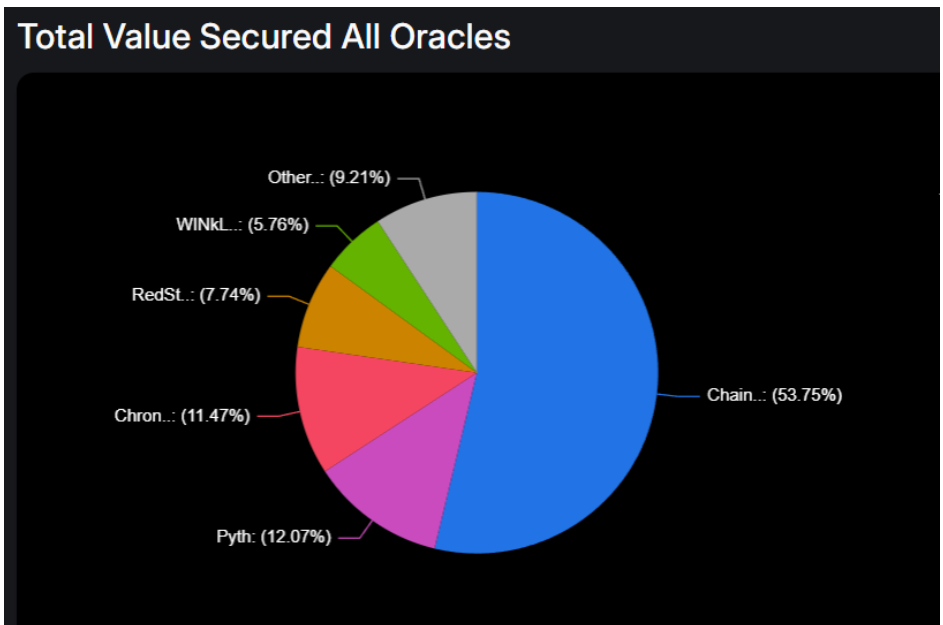

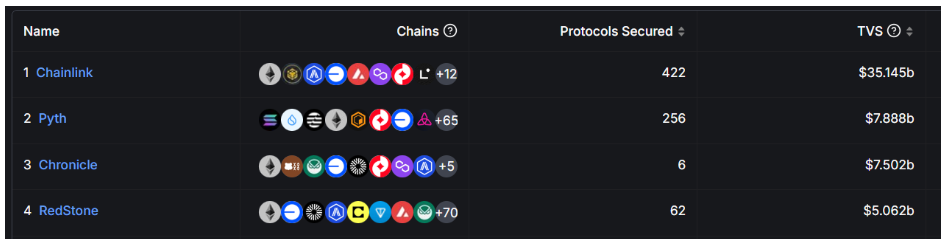

The oracle market remains a vital sector in the crypto space, valued at $10B even in a downturn. Chainlink leads with over 50% market share and $38B TVS, while Pyth and Chronicle are key competitors. RedStone stands apart through an efficient system for price feed updates. It fetches data directly from CEXes and DEXes for real-time accuracy and utilizes a modular Data Distribution Layer for transparent price dissemination. Supporting Push, Pull, and Perps liquidation models, RedStone ensures adaptable liquidation processes. Additionally, its OEV auction system fosters competition among searchers, reducing value leakage and directing benefits back to protocols and users.

Traction

RedStone has gained remarkable traction in the crypto space, securing a strong position in the oracle market. Its Total Value Secured (TVS) stands at $5 billion, making it the fourth-largest oracle provider by market share. Despite entering the industry later than some competitors, RedStone has rapidly established itself as a leading oracle solution.

Currently live on 70+ blockchains and supporting 1,250+ assets, RedStone holds a 7.74% share of the total oracle market. Its innovative architecture not only enhances scalability and efficiency but also enables advanced use cases such as Oracle Extractable Value (OEV). By optimizing price feed updates and minimizing value leakage, RedStone continues to push the boundaries of oracle technology.

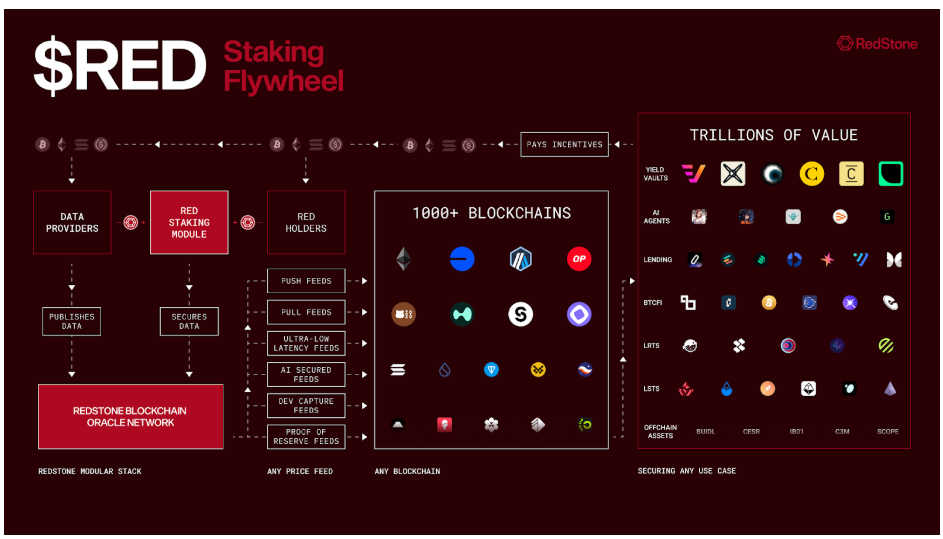

Token

$RED serves as a utility token within the RedStone ecosystem, enhancing the security of its oracle network through staking. Integrated with EigenLayer’s Actively Validated Service (AVS), $RED staking strengthens RedStone’s economic security by leveraging both staked $RED and potentially billions in EigenLayer deposits. Data providers stake RED to contribute to RedStone’s modular oracle network, while token holders can directly stake in RedStone AVS to support network integrity. In return, $RED stakers earn rewards from data users across hundreds of blockchains, receiving payouts in widely adopted assets such as ETH, BTC, SOL, and USDC.

The token supports RedStone’s mission to provide builders with reliable data on any chain for any use case and has a maximum supply of 1 billion tokens, with an initial float of 30%. Implemented as an ERC-20 token on Ethereum Mainnet, it will also be available on Solana, Base, and other networks. Nearly half (48.3%) of all RED tokens will be allocated to the RedStone Ecosystem & Community, covering Community & Genesis, Ecosystem & Data Providers, and Protocol Development.

The Token Generation Event (TGE) is expected to take place soon.

Investors

Team

RedStone was founded in 2021 as part of the Arweave incubation program and deployed its first mainnet integrations in January 2023. The company was co-founded by Jakub Wojciechowski and Marcin Kazmierczak, both bringing extensive expertise to the project. Jakub, with a background in computer science, has experience from DeltaPrime and OpenZeppelin, while Marcin, a former Google Cloud Product Manager, has been actively involved in the blockchain space since 2017, participating in numerous hackathons and conferences.

Conclusion

RedStone has emerged as a leading innovator in the DeFi ecosystem, addressing critical challenges in the Oracle landscape. Its approach overcomes key limitations of traditional oracles by offering affordable storage, on-demand data retrieval, flexible data streams, and seamless cross-chain interoperability. This enables efficient and scalable data management across multiple blockchain networks.

| Fundamental Analysis | |||||

| Max score | Options | Score | |||

| Problem | 10 | Moderate, somewhat persistent problem | 7 | ||

| Solution | 10 | Some uniqueness, moderate defensibility | 7 | ||

| Market Size | 10 | Large market, significant growth potential | 8.5 | ||

| Competitors | 10 | High competition, but room for differentiation | 7 | ||

| Use case | 10 | Use case with good potential | 8.5 | ||

| Current Traction | 10 | Solid traction, user engagement and retention growing | 8 | ||

| Unit Economics | 5 | Break-even or slightly positive unit economics | 2 | ||

| Tokenomics | 10 | Basic token strategy, potential for improvement | 7 | ||

| Product Roadmap | 5 | Basic roadmap, lacks detail or innovative features | 2 | ||

| Business Model | 10 | Proven business model with clear path to profitability | 9 | ||

| Go-to-Market Strategy | 5 | Basic GTM strategy, lacks detail or differentiation | 2 | ||

| Community | 5 | Acive and growing community | 4 | ||

| Regulatory Risks | 5 | Minimal regulatory risk, strong mitigation and adaptability | 5 | ||

| Total Score | 73.33% | ||||