How to use the Sentiment Index to find Trading Opportunities

The Sentiment Index had been a popular request from many customers looking to gain insight across the majority of social media platforms that interact heavily with crypto communities in attempt to gauge their outlook on not only the market, but also individual projects.

By utilizing Twitter, Reddit, and Telegram (possible Discord integration on the horizon), the Sentiment Index helps highlight the top projects with Very Positive feedback, while also pointing out those with Very Negative reception:

There are trading opportunities that may be present with both the Positive and Negative feedback, as this can provide you the additional information needed to boost your confidence in taking a Short/Long position.

If a project has “Very Positive” sentiment, but also has appreciated in Price by a great amount, then it might be wise to consider securing profits or shorting the project, as this likely could be the “Euphoria” phase of Market Psychology.

If a project has “Very Negative” sentiment, but also has depreciated in Price by a great amount, then it might be time to consider starting to add to the position, as there is a great Warren Buffet quote: “Be Fearful when others are Greedy and Be Greedy when others are Fearful”.

Now let’s take a look at an an example:

Let’s take a look at Filecoin, as this is the highest ranked position:

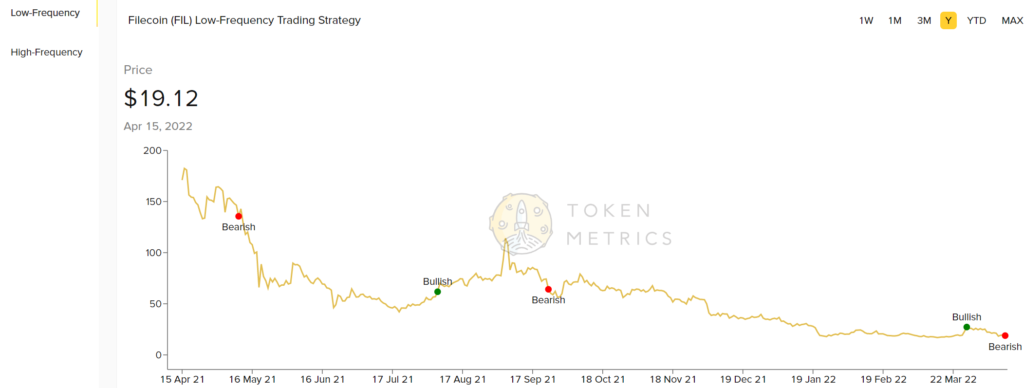

Sentiment on the project is very high so this is where I like to combine the verdict with the other tools on the Token Metrics platform in order to get a clear picture of my next move. From here, I will click on Filecoin and take a look at the indication under the “Technical Analysis” tab to see how it fares on our Visual Trends Indicator.

As we can see, the Visual Trends Indicator recently became Bearish on the project, despite the Positive sentiment. The Visual Trends Indicator is only considering the outlook of the chart’s structure and comparing it with past fractals, therefore the Social Media buzz could front run a Bullish development from either a Fundamental or Technology perspective, which is why in this case it would be important to research what is yielding the positive sentiment.

If there is a real development in Social Media, then you could be early to the party and look to start building a position before we flip “Bullish” on the Visual Trends Indicator.