The overall market condition has not changed, and we are still in a bearish trend since the month of August. The altcoin season is not close as we are currently in the middle of the bitcoin season. This does not mean that there aren’t any opportunities in the market.

Short-term Trading Opportunity:

Lido Finance, a liquidity provider with the largest market share of staked Ethereum (74%), along with its peers (Rocket Pool & StakeWise) has seen an upward trend in recent times.

This is because of the announcement of the “Shanghai Hard fork”. According to @ThorHartvigsen on Twitter, “Once the withdrawals are enabled, staked Ethereum could flood the market and simultaneously reduce the TVL on protocols such as LIDO DAO”.

However, since Ethereum has the lowest staking ratio (14%) among the Layer 1 projects, this number might rise because users will have the flexibility to unstake Ethereum.

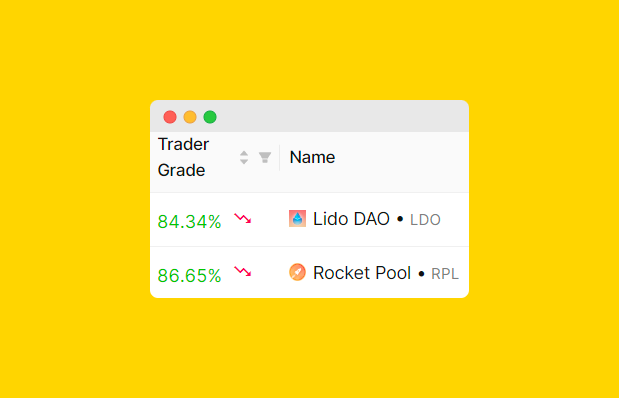

According to Token Metric’s trading grade, Lido, Rocket Pool, and StakeWise have a Trader Grade of 80+.

Lido Dao just turned bullish. It has a trader grade of 84.49% and an investor grade of 81.52%. A glance at the Resistance and support levels indicate that the next resistance stands at $1.85 – $2.25 – $3.50 respectively while the stop loss stands at $1.33.

Similarly, StakeWise just turned bullish and has a trader grade of 80.28%. A glance at the Resistance and support levels indicate that the next resistance stands at $0.14 – $0.15 – $0.16 respectively, while the next stop-loss stands at $0.11.

Unlike Lido and StakeWise, Rocketpool had turned bullish at the start of December. This could potentially mean that there is more money to be made in Lido and Stakewise compared to Rocket pool.

So, playing the “Shanghai hard fork” will be the trade narrative for the upcoming month.

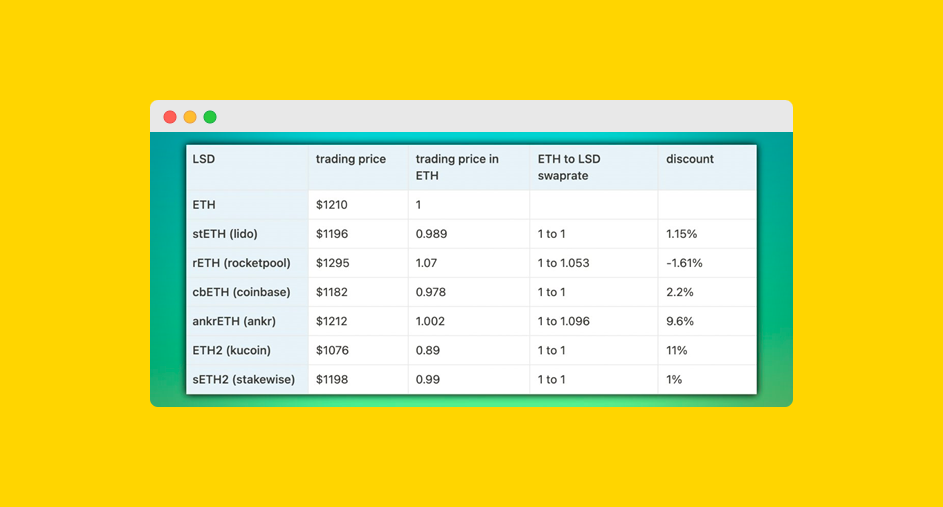

Additionally, there is an arbitrage opportunity available, as staked Eth at various platforms are trading at a discount and a premium.

Long-term Investing Opportunity:

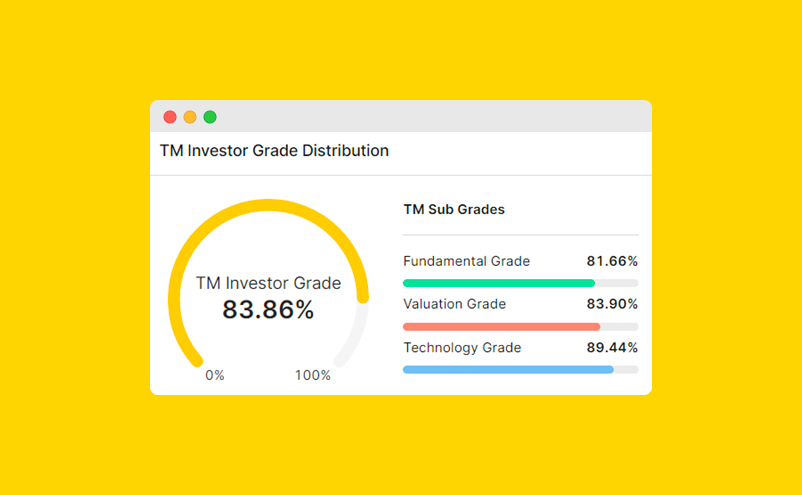

For long-term investing opportunities, it is ideal to evaluate projects with an investor grade of 80+ and add them to the watchlist. Some of these projects are Solana, Ankr, MultiverX, Aave, Cartesi, Celer, and IoTeX.

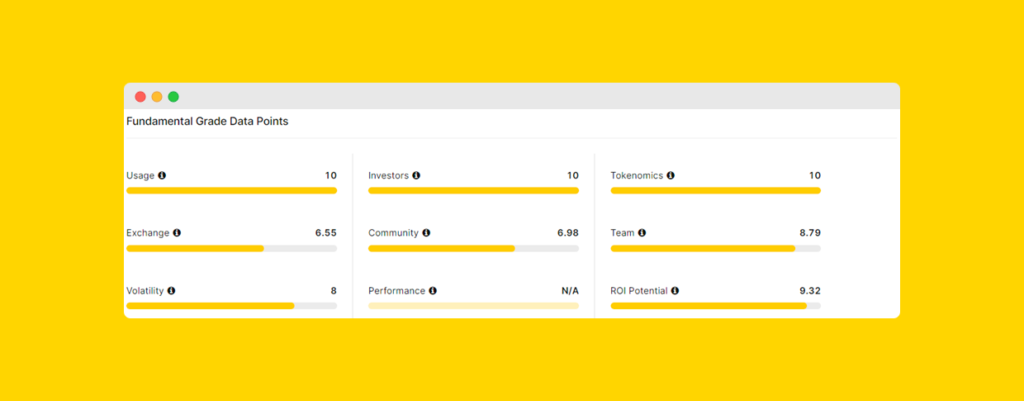

Our opinion about the next narrative in the upcoming investing cycle would be a multichain world, and Celer is one of them. Celer is an infrastructure project that connects blockchains and has a high investor grade of 86%.

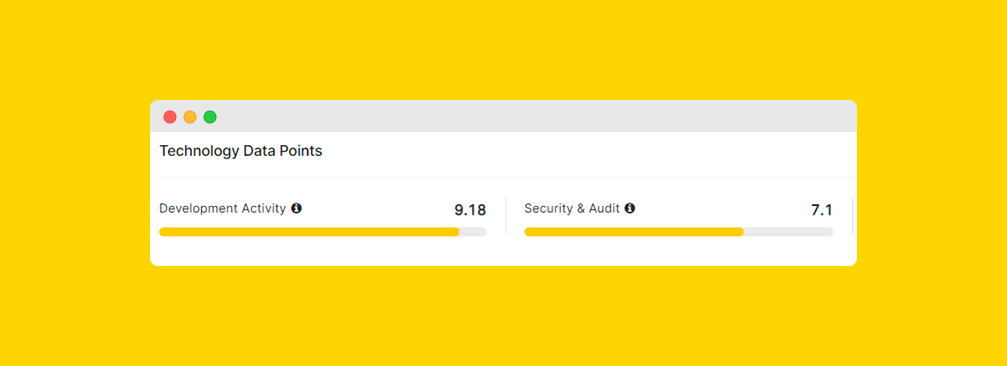

It has excellent tokenomics, investors, usage, development activity, and decent security.

IoTeX is another project to keep an eye on. It is a Layer 1 blockchain with a high circulating supply of 94%. It has an investor grade of 83%. In terms of relative valuation, IoTeX has a lot of room to grow.