Solv Protocol is a premier Bitcoin staking platform powered by its innovative Staking Abstraction Layer (SAL). Through SolvBTC, an inclusive Bitcoin Reserve, the protocol aims to unlock the full potential of Bitcoin’s $1 trillion asset base. With SolvBTC.LSTs (Liquid Staking Tokens), Bitcoin holders can explore diverse yield opportunities while retaining liquidity, enabling seamless participation in DeFi ecosystems. Solv Protocol’s goal is to create a platform where Bitcoin assets move fluidly across blockchain networks, unifying liquidity and maximizing Bitcoin’s utility. Presently, BTC holders face limitations in deploying assets on other blockchains, leaving significant BTC resources underutilized.

About the Project

Vision – The Solv Protocol is designed to unlock the full potential of over $1 trillion in Bitcoin assets, providing innovative solutions for holders seeking to maximize the utility of their investments. By leveraging this protocol, Bitcoin holders can access a diverse array of yield opportunities without compromising liquidity.

Problem – Bitcoin holders often find that their assets yield limited utility beyond price appreciation, despite Bitcoin’s status as the most secure blockchain. While staking has emerged as a potential avenue for generating additional yield from Bitcoin, the participation rate remains low. In contrast, nearly 28% of Ethereum’s supply is staked, facilitating billions in economic activity. If Bitcoin holders were to stake even a small portion of their holdings at similar levels, it could unlock an estimated $330 billion in additional value, significantly enhancing the overall economic landscape for Bitcoin.

Several challenges hinder Bitcoin holders from fully capitalizing on staking opportunities. Cross-chain complexity poses a significant barrier, as staking Bitcoin typically involves cumbersome transactions across different platforms and protocols. This complexity complicates the staking process and deters many users from engaging in these activities altogether. Additionally, limited programmability restricts the development of sophisticated staking protocols on the Bitcoin network. Unlike Ethereum, which supports native intelligent contracts that enable a wide range of decentralized applications and financial products, Bitcoin’s scripting capabilities are more basic, limiting innovation in this area.

Furthermore, liquidity issues present another substantial obstacle. Many Bitcoin holders struggle to maintain liquidity while participating in staking activities, as locking up their assets for extended periods can lead to missed market opportunities. This concern is particularly pronounced in volatile markets where timely access to funds is crucial. As a result, combining these factors creates a challenging environment for Bitcoin holders seeking to access staking rewards while preserving liquidity.

Innovative solutions are needed to simplify cross-chain transactions, enhance programmability through layer-two solutions or other mechanisms, and provide flexible liquidity options for users to address these issues and unlock the full potential of Bitcoin staking. By overcoming these barriers, it would be possible to create a more inclusive and dynamic ecosystem for Bitcoin holders, allowing them to participate actively in the growing DeFi landscape while reaping the benefits of their investments.

Solution

Solv Protocol is a decentralized platform aimed at enhancing yield and liquidity across significant cryptocurrency ecosystem assets by establishing a Decentralized Bitcoin Reserve. This initiative seeks to enable Bitcoin (BTC) assets to flow seamlessly across various blockchain networks, thereby unifying liquidity and increasing utility. Currently, many BTC holders cannot utilize their assets on other blockchains, leading to significant amounts of idle Bitcoin.

The Decentralized Bitcoin Reserve is built on three foundational pillars. The first is the Liquidity Consensus Network (LCN), which serves as the operational core for managing liquidity and facilitating cross-chain interactions. The LCN provides dynamic liquidity management, overseeing Bitcoin within the reserve and enabling asset transfers across different networks while ensuring transparency through auditable records and regular reporting.

The second pillar is the implementation of UTXO-3525, a protocol that aligns Bitcoin transactions with the ERC-3525 standard. This allows for transferring Bitcoin-related assets—such as BTC, Ordinals, and Runes—between the Bitcoin blockchain and EVM-compatible networks. This mapping enables features like uncollateralized borrowing and improved liquidity while supporting the reserve’s scalability.

The third pillar focuses on integrating traditional finance through a compliance bridge, creating an infrastructure that encourages participation from financial institutions. This includes tokenizing Bitcoin ETFs and implementing robust reporting and auditing capabilities to meet regulatory requirements.

Solv Protocol aims to transform idle Bitcoin assets into active participants in decentralized finance (DeFi) and traditional financial markets by addressing these critical areas.

Market Analysis

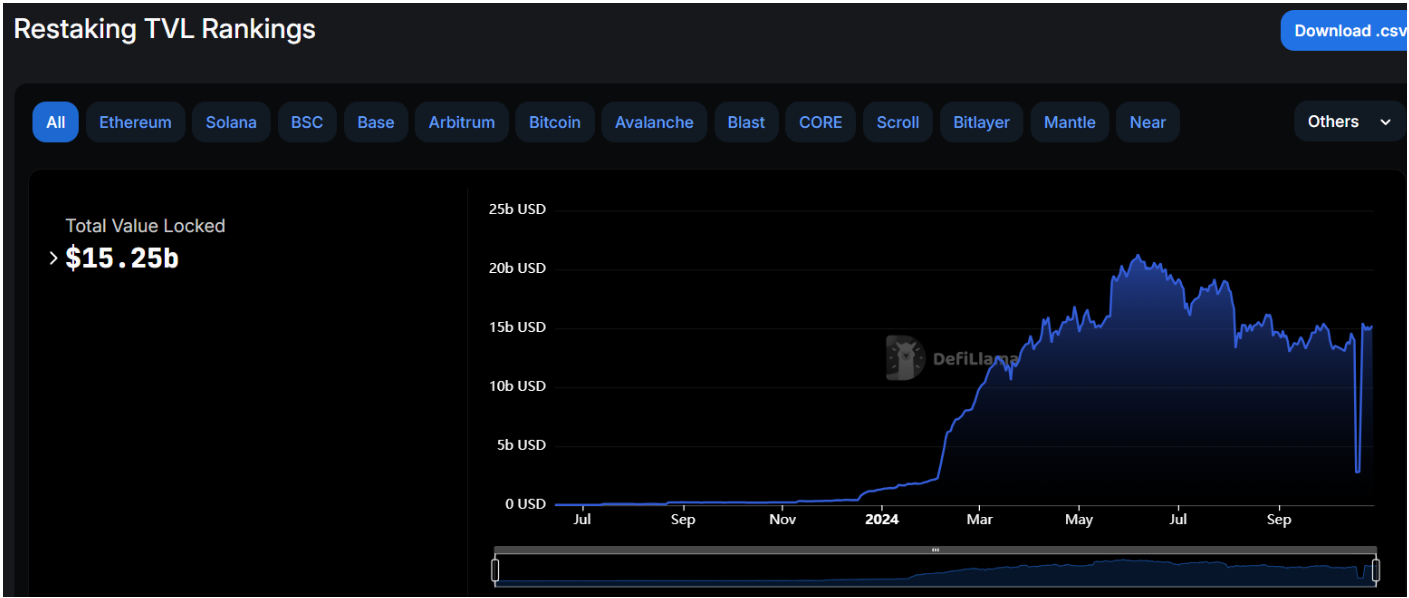

The liquid staking sector has emerged as one of the few areas within the cryptocurrency industry that has demonstrated consistent growth. According to DefiLama, the total value locked (TVL) in liquid staking currently stands at an impressive $45.31 billion, making it the largest segment among all crypto sectors. Additionally, the restaking platform has a TVL of $15.256 billion, highlighting the increasing adoption and significance of liquid restaking as a viable investment strategy.

This growth reflects a broader acceptance of liquid staking protocols, which allow users to stake their tokens while retaining liquidity and flexibility. By depositing tokens with liquid restaking providers, users receive tokenized representations of their staked assets, enabling them to participate in decentralized finance (DeFi) activities without sacrificing their staked holdings.

Competitors

Babylon – Babylon is a pioneering Bitcoin staking infrastructure project that aims to enhance the security of Proof of Stake (PoS) networks and decentralized applications (DApps). Its innovative protocol allows Bitcoin holders to stake their assets, earning rewards while simultaneously reinforcing the security of PoS chains and DApps. By integrating Bitcoin into the PoS ecosystem, Babylon not only increases the utility of Bitcoin but also contributes to the overall resilience and security of decentralized networks.

Uniqueness – The Solv Protocol simplifies the staking process through its Staking Abstraction Layer (SAL). This innovative framework automates Bitcoin staking, effectively eliminating the complexities associated with cross-chain transactions and liquidity challenges. By utilizing SolvBTC liquid staking tokens (LSTs), users can stake their Bitcoin while retaining the flexibility to utilize it across various blockchains. This feature enables them to earn rewards without locking up their assets, allowing for greater versatility in decentralized finance (DeFi) applications. As a result, Solv Protocol enhances the overall user experience and encourages broader participation in Bitcoin staking.

Features

Staking Abstraction Layer – The Staking Abstraction Layer (SAL) serves as the foundational infrastructure of the Solv Protocol, enabling users to stake their Bitcoin across various blockchains and creating a cohesive Bitcoin staking ecosystem. By abstracting the complexities associated with staking Bitcoin in multiple environments, SAL provides a unified interface for Bitcoin holders. This streamlined approach allows users to access a diverse range of yield-generating strategies while maintaining a liquid representation of their BTC, known as SolvBTC. As a result, Bitcoin holders can optimize their investment potential without sacrificing liquidity.

Cross-Chain Staking and Interoperability – SolvBTC is the primary asset representing staked Bitcoin and is designed to be interoperable with several blockchains, including Ethereum, BNB Chain, Avalanche, and Arbitrum. This interoperability is crucial for expanding the utility of Bitcoin within the broader cryptocurrency landscape. The protocol collaborates with systems such as Chainlink’s Cross-Chain Interoperability Protocol (CCIP), facilitating secure and efficient cross-chain transactions. This partnership ensures that assets staked on one blockchain can be utilized on another with minimal friction, effectively bridging different ecosystems and enhancing user experience.

Diverse Yield Source – Users of the Solv Protocol can generate yield through various strategies tailored to their investment preferences. These include restaking yields from staking Bitcoin on different blockchains, earning validator rewards by participating in the validation process, accessing decentralized finance (DeFi) opportunities across multiple chains, and engaging in on-chain trading using SolvBTC. This variety of yield sources empowers users to diversify their income streams and maximize investment returns.

Liquid Staked Tokens – Liquid Staking Tokens (LSTs) are central to the SolvBTC ecosystem, allowing users to maintain liquidity while participating in staking activities. These tokens enable users to freely move their LSTs across different chains, leveraging liquidity without being locked into a single platform. This flexibility is particularly advantageous in volatile markets where timely access to funds is essential for capitalizing on investment opportunities. Additionally, LSTs can serve as collateral for various DeFi applications, such as lending and yield farming, further enhancing their utility within the ecosystem.

Secure and seamless Use – SolvBTC enhances the Bitcoin DeFi experience by enabling seamless participation across multiple chains and protocols with minimal effort. Users benefit from transparent and verifiable proof of reserves, ensuring all assets backing SolvBTC are fully auditable and secure. Security is a top priority for the Solv Protocol, with robust measures such as proof of reserves and regular audits in place to protect user assets. This commitment to transparency fosters confidence among participants, allowing them to engage in decentralized finance activities without concerns about asset integrity.

Traction

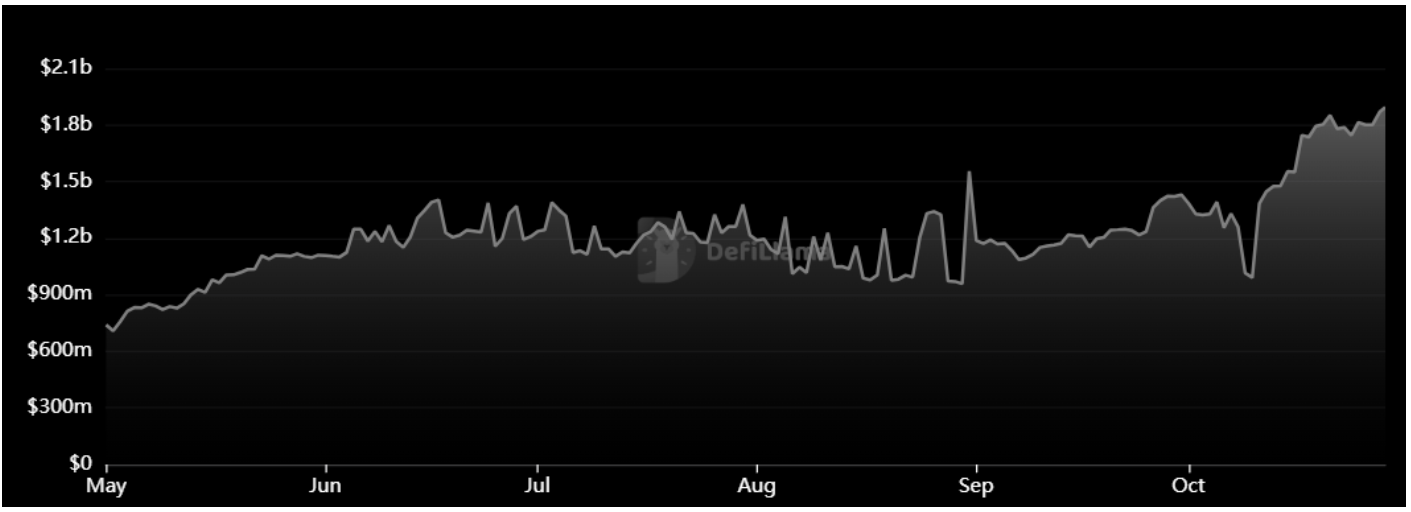

Solv Protocol has gained substantial traction, demonstrating both widespread adoption and a clear trajectory of growth within the decentralized finance space. According to DeFiLlama, the protocol’s Total Value Locked (TVL) stands at an impressive $1.84 billion, reflecting a steady increase in user engagement and asset flow. This high TVL situates Solv Protocol as one of the most prominent players within the Bitcoin ecosystem, signaling a strong market presence and trust among its users.

Partnerships – The protocol has built strategic partnerships with several leading blockchain networks, including Bitcoin, Ethereum, BNB Chain, Scroll, Linea, and Arbitrum, enabling enhanced cross-chain interoperability and liquidity movement. Solv Protocol’s collaboration with well-regarded yield partners, such as Babylon, Ethena, GMX, and Karak, further reinforces its robust ecosystem, attracting a growing community of users seeking diversified yield opportunities.

As Solv Protocol continues to expand its network and user base, it is establishing itself as a cornerstone in the DeFi landscape, driving new standards for liquidity access and utility across blockchain networks.

Investors

Recently, Solv Protocol raised $11 million to enhance its Staking Abstraction Layer (SAL), which aims to simplify Bitcoin staking and expand yield opportunities for users. This funding round has increased the protocol’s valuation to $200 million and its total funding to $25 million. The SAL technology addresses Bitcoin’s programmability limitations, unlocking new possibilities for staking and liquidity management within decentralized finance (DeFi).

Team

The founders of Solv Protocol, Ryan Chow, Meng Yan, and Will Wang, bring a wealth of experience and expertise to the project, significantly contributing to its vision and development.

Ryan Chow has a background in blockchain innovation and financial technology. Before co-founding Solv Protocol, he co-founded Beijing Unizon Technology, where he focused on integrating blockchain technology into the automotive industry’s supply chain. He has also worked as a financial analyst at Singularity Financial, where he researched blockchain technology’s application across various industries. His commitment to improving transparency and equality in finance is evident in his leadership role at Solv Protocol.

Meng Yan has a strong foundation in blockchain advisory and tokenomics design. His previous experience includes leading projects that focus on decentralized finance (DeFi) solutions. Meng’s insights into the challenges faced by the DeFi sector have been instrumental in shaping Solv Protocol’s approach to unlocking Bitcoin’s potential and creating a user-friendly staking environment.

Will Wang complements the team with his technical expertise and industry knowledge. His experience spans various roles within the blockchain space, where he has contributed to developing innovative solutions that enhance user experience and capital efficiency. Together with Ryan and Meng, Will has played a crucial role in proposing the ERC-3525 semi-fungible token standard, which is foundational to Solv Protocol’s product offerings.

Conclusion

Solv Protocol aims to simplify Bitcoin staking, making it more efficient and rewarding for users. By prioritizing flexibility, security, and cross-chain compatibility, the project seeks to unlock new opportunities for Bitcoin holders interested in exploring decentralized finance (DeFi) without encountering common barriers. The protocol has garnered significant attention and traction, supported by reputable venture capital firms, which underscores its potential as a noteworthy player in the cryptocurrency landscape.By integrating with multiple blockchain networks, Solv Protocol enhances the accessibility of Bitcoin in DeFi ecosystems. This innovative approach not only improves user experience but also fosters broader adoption of Bitcoin staking, positioning Solv Protocol as a significant contributor to the evolution of decentralized finance.

| Fundamental Analysis Score: | |||||

| Max score | Options | Score | |||

| Problem | 10 | Significant, long-term problem | 9 | ||

| Solution | 10 | Some uniqueness, moderate defensibility | 7 | ||

| Market Size | 10 | Large market, significant growth potential | 8.5 | ||

| Competitors | 10 | Emerging market with few strong competitors | 8.5 | ||

| Use case | 10 | Use case with good potential | 8.5 | ||

| Current Traction | 10 | High traction, strong user growth and retention | 10 | ||

| Unit Economics | 5 | Break-even or slightly positive unit economics | 2 | ||

| Tokenomics | 10 | No clear token strategy or poorly conceived strategy | 5 | ||

| Product Roadmap | 5 | Unclear or unrealistic product roadmap | 1 | ||

| Business Model | 10 | Proven business model with clear path to profitability | 9 | ||

| Go-to-Market Strategy | 5 | Solid GTM strategy, clear target market and channels | 4 | ||

| Community | 5 | Big, strong and active community | 5 | ||

| Regulatory Risks | 5 | Minimal regulatory risk, strong mitigation and adaptability | 5 | ||

| Total Score | 78.57% | ||||