Executive Summary

Symbiotic is a restaking protocol that empowers new decentralized networks and applications to enhance their security through a shared security mechanism, enabling users to compound their interest rewards. It employs a flexible and modular approach to restaking. It prioritizes maximizing capital efficiency, providing a scalable architecture, and offering customizable security agreements without excessive governance or permission layers. With Symbiotic, networks maintain complete control over their staking and restaking processes by enabling direct deposits of any ERC-20 token.

About the Project

Vision – To provide a shared security mechanism through its restaking protocol.

Problem – New cryptocurrency projects often face challenges and high costs in developing and maintaining robust security systems. Even if successful, they cannot match the robust security of established players like Ethereum.

Solution – Symbiotic is a restaking protocol that allows any asset to be staked on its platform. These staked assets are then leveraged by various protocols to enhance their security, also providing additional rewards for the staked assets.

Business Model – Users restake their liquid staked derivatives (LSD) on Symbiotic, which are then provided to operators for security protection. These operators offer validation services to application chains, which, in turn, pay rewards. These rewards are subsequently distributed among the operators, restakers, and Symbiotic.

Features

- Modular Design: Symbiotic features a highly flexible and modular architecture, supporting restaking with various ERC-20 tokens, not just stETH. This provides users with a broader range of options.

- Customizable Rewards and Slashing: Symbiotic networks can fully customize punishment and reward mechanisms. The adaptable restaking logic allows networks to adjust to evolving requirements seamlessly.

- Permissionless: Symbiotic’s immutable core contracts offer builders choice and control over shared security agreements without unnecessary governance, slashing committees, or permission layers.

- Open: Symbiotic ensures maximum capital efficiency by sourcing node operators and economic security through an extendable collateral base and scalable architecture.

Market Analysis

Blockchain technology has experienced remarkable growth since its inception, with the market currently valued at $2.6 trillion and optimistic projections indicating continued expansion. A notable recent development in the crypto space is the concept of the restaking mechanism, which has seen significant adoption. This mechanism offers a novel use case and additional reward-earning opportunities. The total value locked (TVL) in liquid staking protocols has already reached $18 billion and continues to grow.

Competition – Restaking has gained substantial traction in blockchain, with projects like EigenLayer pioneering this new frontier. EigenLayer’s model allows users to deposit staked assets (such as stETH) and earn additional rewards by restaking them on other blockchains. EigenLayer leads the market with a TVL of $15 billion. Another key player is Karak, which has a TVL of over $1 billion and is similar to Symbiotic.

Symbiotic is emerging as a new contender in the restaking arena. Like EigenLayer, users can restake their existing staked assets to earn additional rewards. Symbiotic features a highly flexible and modular architecture, supporting restaking with various ERC-20 tokens, not just stETH, thus offering users a broader range of options.

Traction

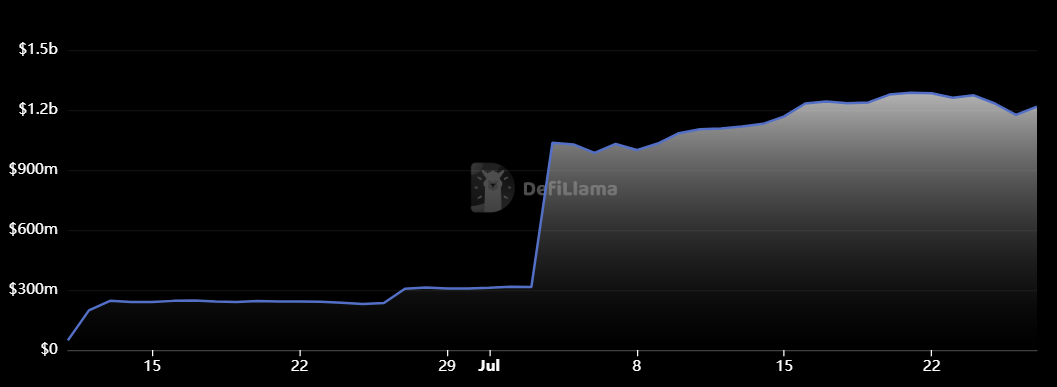

Symbiotic has garnered significant user traction, amassing a TVL of over one billion dollars and highlighting its rapid adoption. Additionally, Symbiotic has integrated with other protocols, such as Ethena, Layer Zero, and Aizel Network, to expand its growth further and reach. These integrations enhance Symbiotic’s ecosystem, providing users with a broader range of applications and services. As a result, Symbiotic continues to solidify its position in the blockchain space, attracting more users and developers who seek to leverage its versatile and scalable platform.

Investors

Conclusion

Unlike EigenLayer, which primarily accepts Ethereum (ETH) and certain ETH derivatives, Symbiotic allows restaking any ERC-20 token. This broadens its usability and potential integration with various decentralized applications. Symbiotic’s permissionless shared security model enables networks to maintain control without being tied to a single blockchain, offering greater versatility than protocols focused solely on Ethereum. The platform’s design supports a multi-asset, network-agnostic approach, enhancing scalability and economic security sourcing. These factors and the project’s high total value locked (TVL) make Symbiotic noteworthy.

| Fundamental Analysis | |||||

| Assessment | |||||

| Problem | Significant, long-term problem | 3 | |||

| Solution | Distinct, defensible solution | 3 | |||

| Market Size | Large market, significant growth potential | 3 | |||

| Competitors | Emerging market with few strong competitors | 3 | |||

| Unique Value Proposition | Clear differentiation and value for customers | 3 | |||

| Current Traction | High traction, strong user growth and retention | 4 | |||

| Unit Economics | Positive unit economics, with plans for further improvement | 3 | |||

| Tokenomics | No clear token strategy or poorly conceived strategy | 1 | |||

| Product Roadmap | Unclear or unrealistic product roadmap | 1 | |||

| Business Model | Proven business model with clear path to profitability | 3 | |||

| Go-to-Market Strategy | Basic GTM strategy, lacks detail or differentiation | 2 | |||

| Regulatory Risks | Minimal regulatory risk, strong mitigation and adaptability | 4 | |||

| Total | 68.75% | ||||