TOKEN METRICS WATCHLIST

We scored many projects this week. Here are a few you should know about:

- Voltz

- SYNTHR

- Kaspa

- Xverse

- Poolshark

Please keep in mind that some of these projects have not yet been subjected to our code review process, but we want to call them out here for preliminarily catching our eye based on our fundamental analysis process.

Voltz (Website – Documentation)

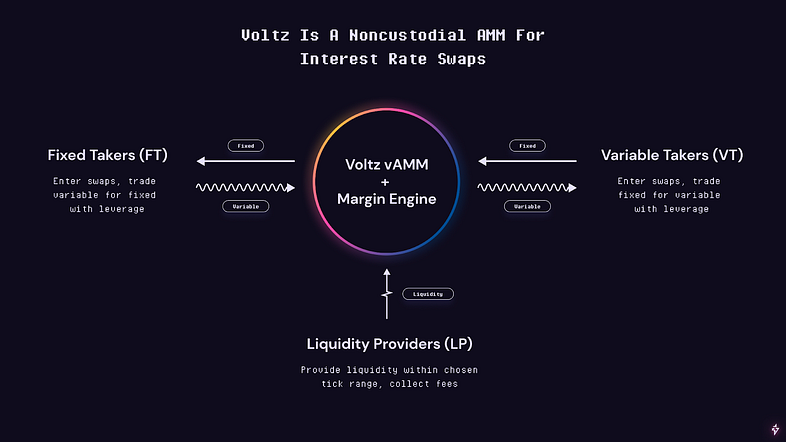

Voltz is a noncustodial Automated Market Maker (AMM) for Interest Rate Swaps (IRS). The platform lets users exchange fixed interest rates for a variable rate and vice-versa. Voltz uses a Concentrated Liquidity Virtual AMM (vAMM) for price discovery, and the Margin Engine manages the underlying assets. It also gives users 10-15x leverage and is 3,000x more capital efficient than alternative interest rate swap models.

Why we like it

The Defi market is evolving, but little significant has happened in the swaps segment. This is where Voltz comes into the picture with its innovation. Voltz was the first to bring AMM to Interest Rate Swaps. Concentrated vAMM combined with the asset management by the Margin engine provides an attractive deployment of capital. It also enables liquidity providers to add concentrated liquidity to the vAMM in custom fixed-rate ranges. This gives LPs more customisability and increases the capital efficiency of their liquidity, which in turn increases fee generation potential. The feature of leverage to traders and Liquidity Providers (LPs) enhances their earning potential. Voltz has an early mover advantage and is heading the DeFI market in a new direction.

Investors

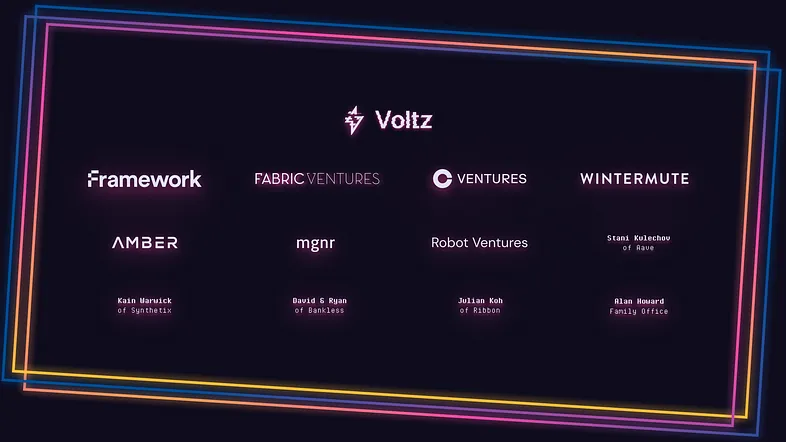

Voltz has had seed financing of $6M. The round saw participation from Fabric Ventures, Coinbase Ventures, Amber Group, Wintermute, Robot Ventures, Mgnr, Entrepreneur First, Backed, and NEMO (the friendly apes behind DegenScore), in addition to an exciting group of angels, including Stani of Aave, Kain of Synthetix, David and Ryan of Bankless, Julian Koh of Ribbon, Alan Howard Family Office and many more.

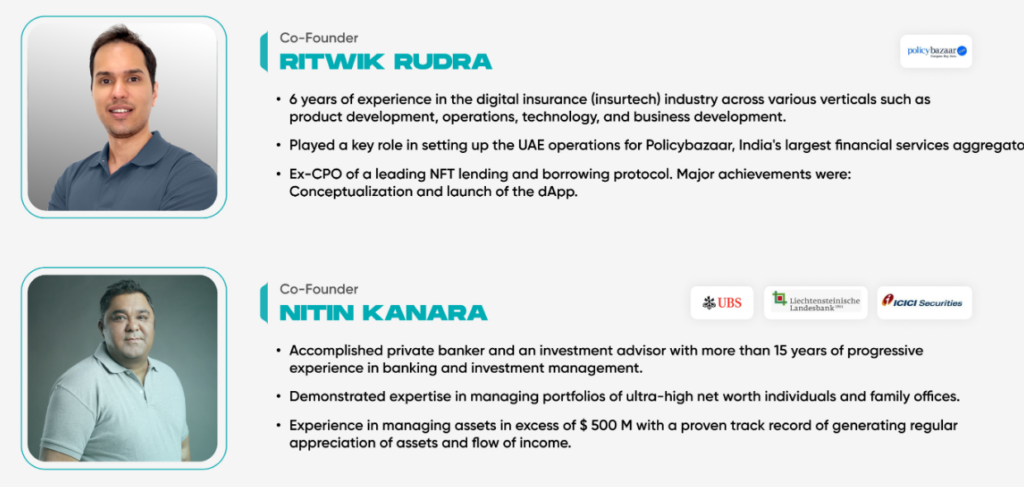

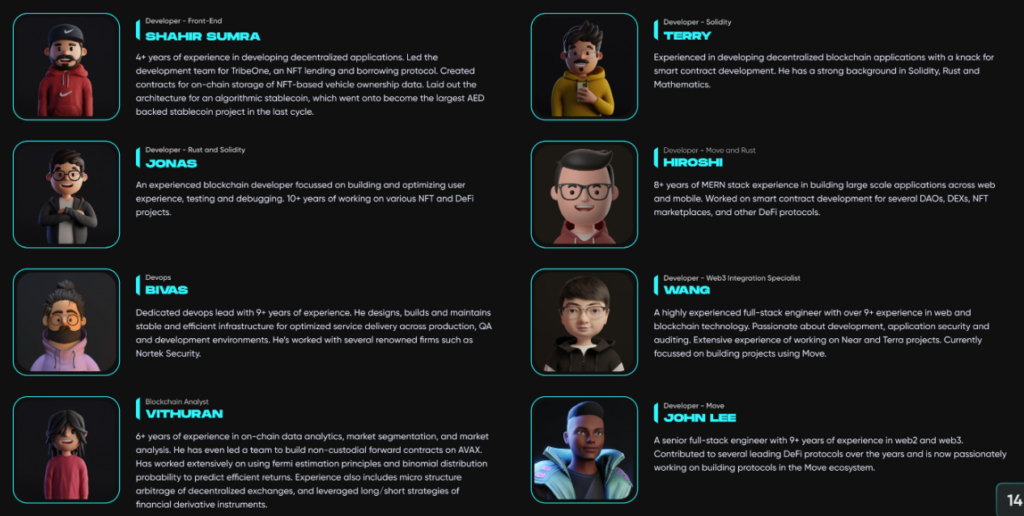

The Team

The team has quality experience in Web 3 and has worked with reputed companies. Some of them have also been part of the founding team for other startups.

Token Utility

TBA

Where can you buy the token

TBA

SYNTHR (Website – Documentation)

SYNTHR is a platform that lets users transfer and mint synthetic assets permissionless. To obtain the synthetic asset user have to provide collateral, usually a stablecoin, and depending on the Loan-to-Value (LTV) ratio, the synthetic asset is produced. SYNTHR allows access to trading derivates and financial assets on different blockchains. Their goal is to make trading accessible to all in the DeFi world while covering all their limitations in the traditional financial world.

Why we like it

The synthetic assets market is enormous and has been around for a while but it has specific vulnerabilities. SYNTHR is working to eliminate all of them. It offers users zero slippage (a significant expense to traders) and is available 24/7. The platform also enables the easy transfer of assets between different chains in a decentralized manner. They also allow yield farming on synthetic assets powered by an auto yield optimizer. Part of the user’s collateral will be injected into credible third-party interest-bearing protocols to increase capital efficiency. SYNTHR also offers less price volatility for its synthetic assets. All these factors make SYNTHR an attractive opportunity.

Investors

The Team

Token Utility

$SYNTH is the native token for the platform. The utility is as follows-

Governance- The $SYNTH token holders can vote on various proposals on the platform.

Revenue generation- A portion of fees generated on the platform will be distributed among the token holders.

Where can you buy the token

TBA

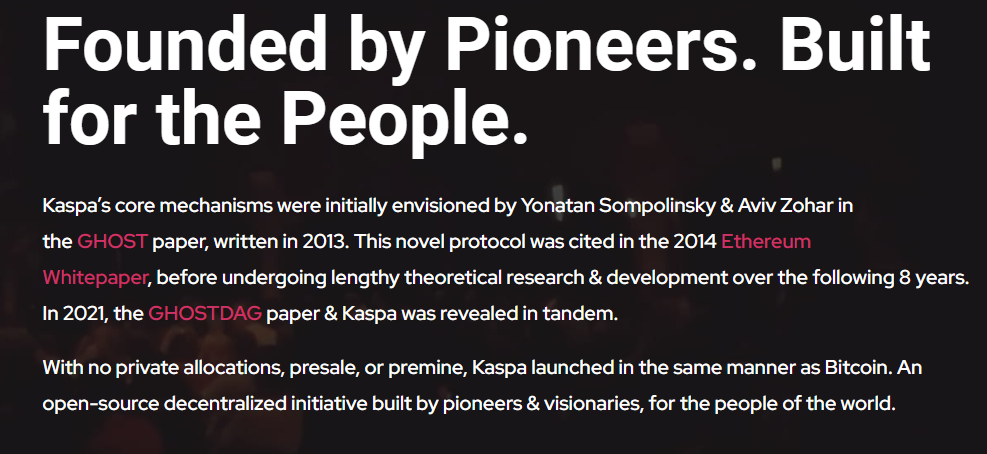

Kaspa (Website – Documentation)

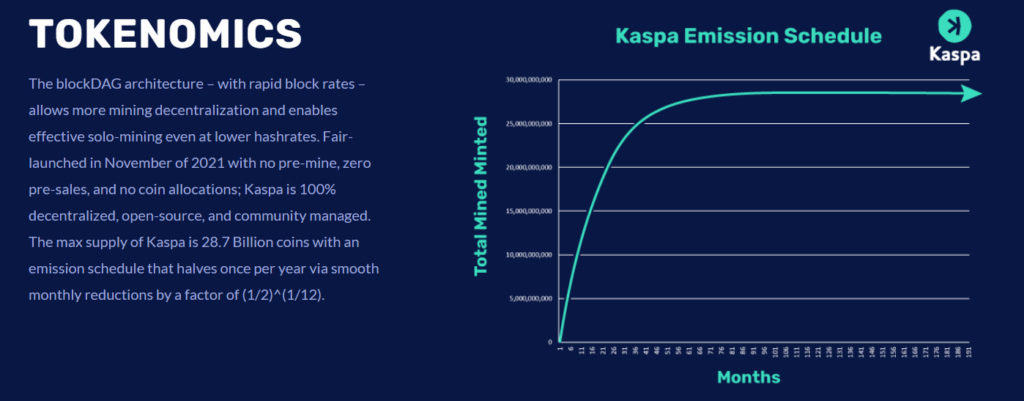

Kaspa uses blockDAG – an advanced blockDAG protocol providing the fastest, open-source, decentralized & fully scalable Layer-1 ecosystem. It is a proof-of-work cryptocurrency. Unlike traditional blockchains, blockTDAG does not orphan blocks created in parallel; instead allows them to coexist and orders them in consensus. This also ensures that the Nakamoto consensus is achieved.

Why we like it

Many Crypto projects today are controlled by a central entity. On the other hand, Kaspa is a community project, completely open source with no central governance – following the ethos of coins like Bitcoin, Litecoin, and Monero. They are solving the biggest problem in blockchains- The Blockchain Trilemma. Kaspa’s blockDAG network generates multiple blocks every second for posting transactions to the ledger. The transactions are confirmed within ten seconds, making them feasible for daily use. This makes the network faster and more scalable. All this comes with the highest security. Kaspa uses the Proof-Of-Work consensus model so that the network’s decentralization is not compromised. The operating nodes in the ecosystem are also spread around the globe. The project offers a perfect and better alternative than the available internet currencies.

Investors

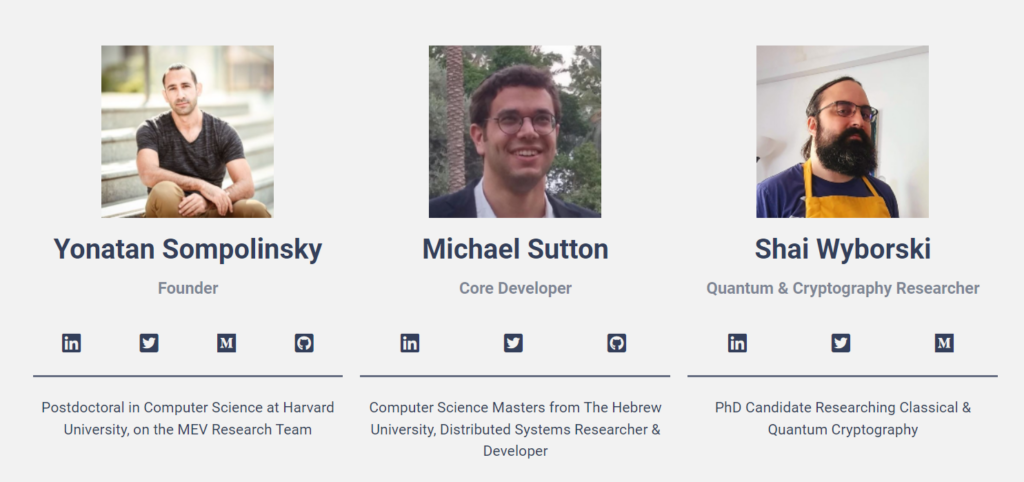

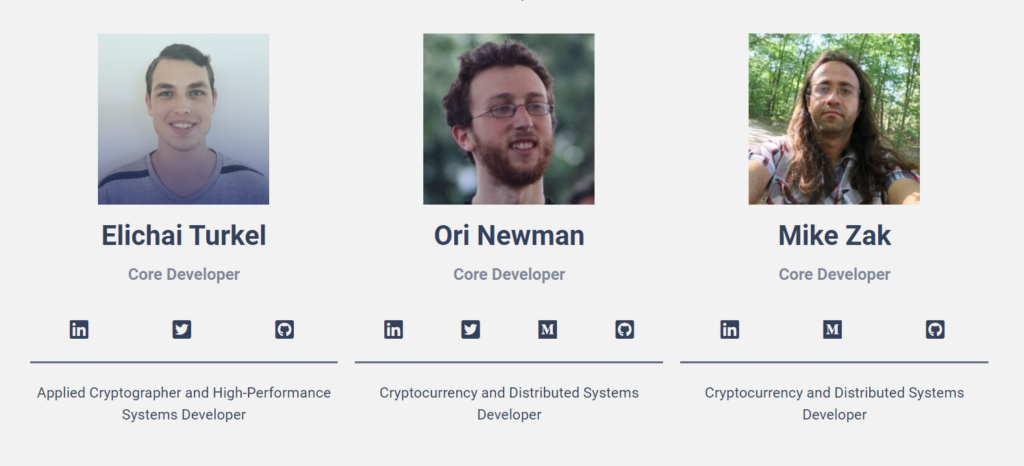

Team

Apart from them, countless volunteers contribute to the Kaspa ecosystem.

Token Utility

Where can you buy the token

You can install a Kaspa Wallet to send and receive Kas, Kaspa’s cryptocurrency.

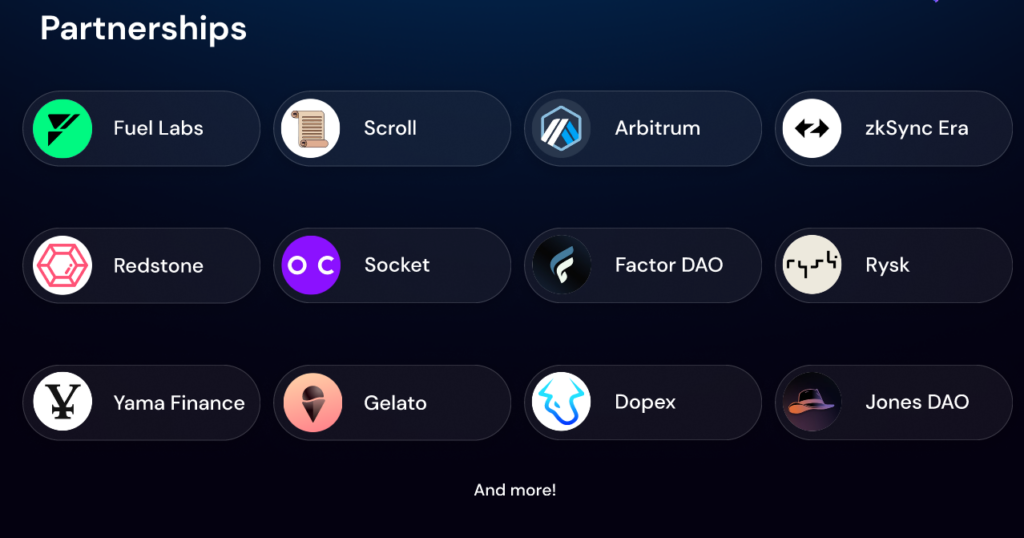

Xverse (Website – Documentation)

Xverse is an advanced and user-friendly Bitcoin Wallet. It offers a gateway to all the Bitcoin protocols like Swaps, trading NFTs, lightning integration, etc. Xverse aims to be a platform for all Bitcoin projects. It is available for Chrome on desktop and for iOS and Android.

Why we like it

Bitcoin pioneered the Crypto revolution and is considered the best digital asset. Lately, there has been a lot of development going on in the Bitcoin blockchain- Lightning network, Stats, and Ordinals. They are exploring new paths for the oldest cryptocurrency, which brings users more features and use cases. Xverse wants to be a part of it. It’s a wallet that lets users make the best use of all the options. This also serves as a competitive advantage. Xverse will generate revenue by charging a tiny fee for all the services availed by the users. EIt has been downloaded 140,000 times since its launch proving its adoption.

Investors

TBA

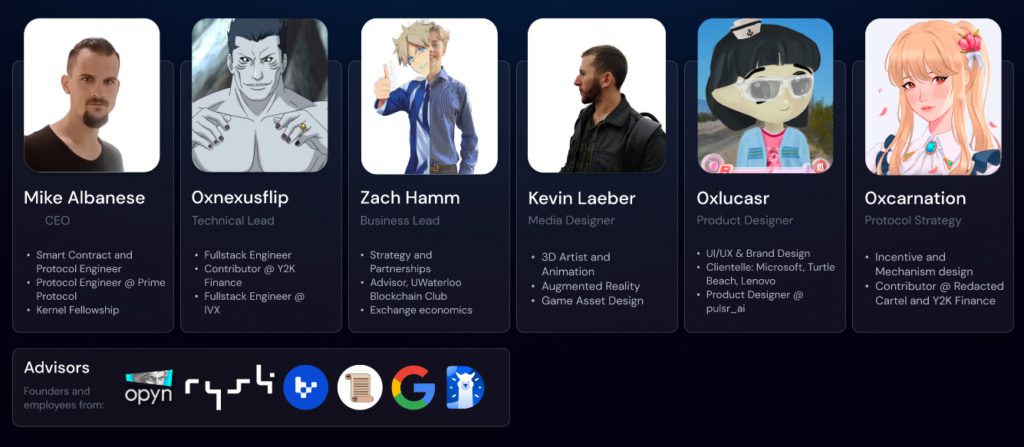

The Team

Ken Liao is the founder and CEO of Xverse. The team consists of dedicated, talented individuals having relevant experience.

Token Utility

TBA

Where can you buy the token

TBA

PoolShark (Website – Documentation)

The Poolshark Protocol is a collection of non-custodial smart contracts that serve as a decentralized exchange. It offers directional and bidirectional liquidity, making it an ideal platform for Liquidity Providers(LPs). By providing directional support, LPs can express their views on a given pair and increase the liquidity available to the market. Poolshark employs three types of positions: Limit, Cover, and Range.

Why we like it

Liquidity Providers face a significant issue of impermanent loss when they stake their tokens on Decentralized Exchanges(Dexes). Poolshark addresses this by allowing liquidity providers (LPs) to choose from multiple types of positions. This will enable them to better reflect their beliefs on the market and manage their risk as they see fit. They alsowould allow LPss to make directional bets and hedge their impermanent loss with directional liquidity. Letting one-sided LP positions help them capture volatility as yield. Overall, the flexibility offered by the Poolshark Protocol positions makes it an attractive option for liquidity providers looking for a customizable and secure way to participate in decentralized exchanges.

Investors

The Team

Token Utility

TBA

Where can you buy the token

TBA