Market Update

The Dollar and DOGE

Dollar Index (DXY): Daily

Past performance is not indicative of future returns

The Dollar Index (DXY) has topped, or has it? On the one hand, the DXY down move is encouraging for crypto. On the other hand, the Williams Oscillator looks like it did back in August. If DXY is above 112, it could set up a move to 120. This picture makes me want to wait until after the Fed meeting to get aggressively long crypto.

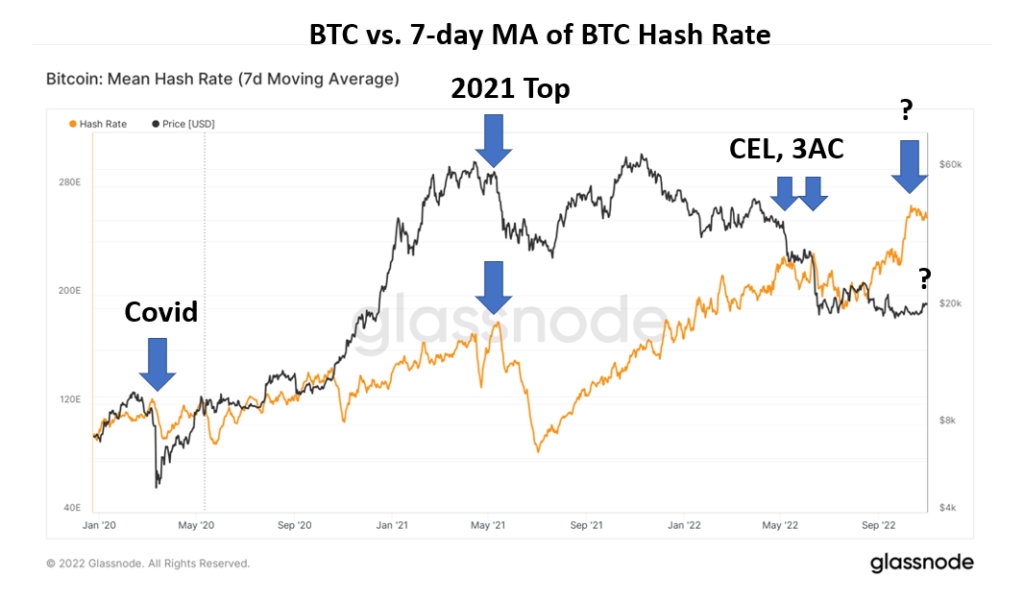

Bitcoin: Daily vs. Hash Rate

Past performance is not indicative of future returns

The bitcoin hash rate is spiking sharply. The BTC hash rate spiked before significant declines like the covid lockdown and the 2021 BTC top. There were also two spikes in the hash before the two big drops during the 2022 crash. This picture could mean a bitcoin miner might be in trouble. BTC must prove it can rally to invalidate this theory.

Etherium: Daily

Past performance is not indicative of future returns

If ETH can get above and stay above $1,790, a move to $2,226 is possible. If the recent ETH rally fails and ETH falls below $1,425, some reputable technical analysts think much lower prices are likely.

ZEC: Daily

Past performance is not indicative of future returns

The Williams oscillator points to a big move coming in Zcash. To state the obvious, ZEC will need BTC to wake up to move to the upside.

DOGE: Daily

Past performance is not indicative of future returns

Bottom Line

It is hard to know whether the late October rally was the start of something bigger or is a sucker’s rally. If the Fed acknowledges that the rate hike program will end in 2022, then crypto could explode higher. If the Fed continues to talk tough and there is a failed rally in crypto, tax-loss selling may weigh on BTC and maybe ETH. Hope for the best, but beware of the failed rally.

DOGE may be the exception. It’s either that DOGE is the wild pump that happens before the market dump. That happened in the past when Ape coin topped at $15 in April, right before the crypto market crashed.