NFTs Explained: What Are Non-Fungible Tokens?

May 11, 2022

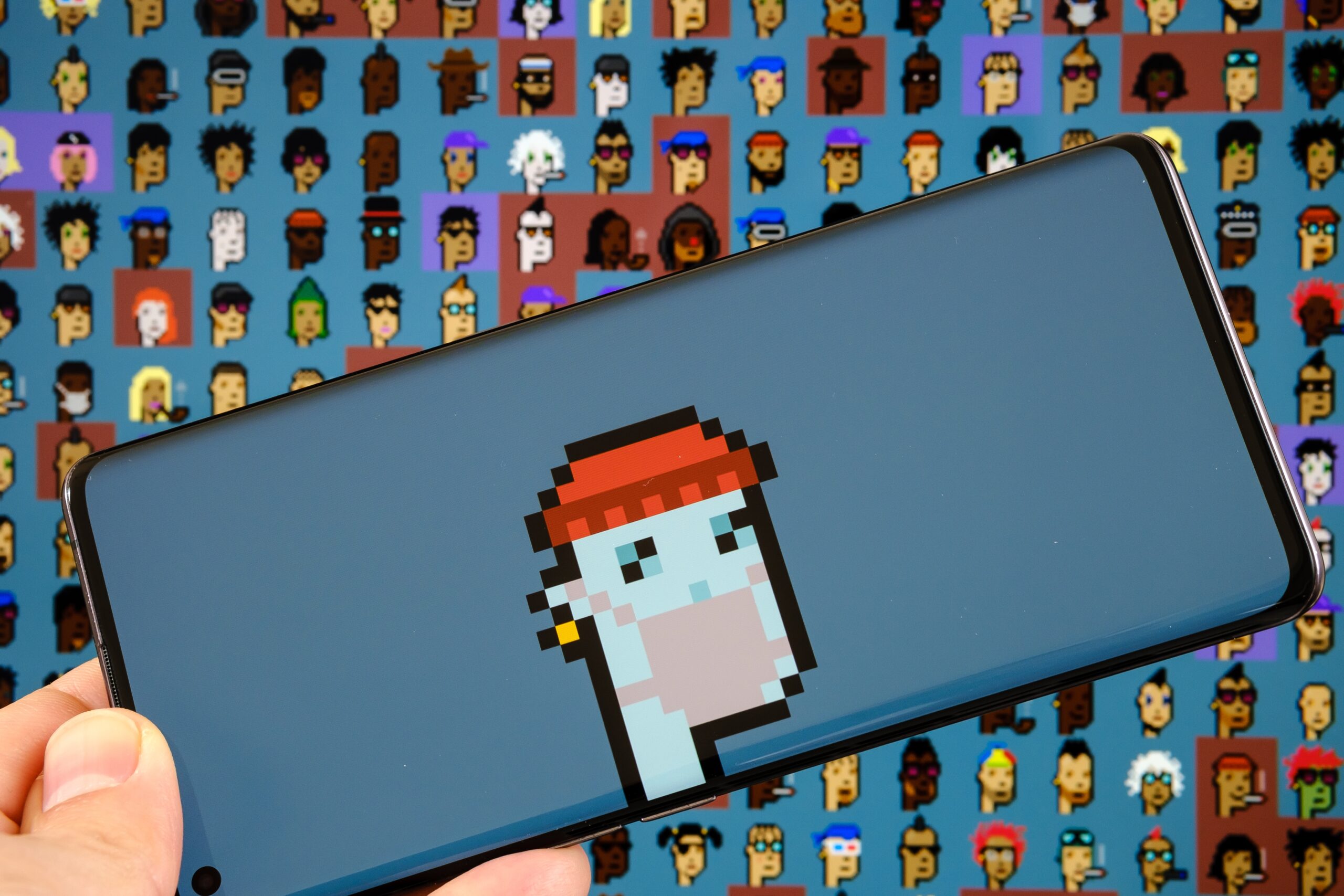

NFTs are currently exploding in popularity. They are taking the digital art and collectibles market by storm! In the past year alone, NFTs have become a cultural phenomenon catching the eye of significant crypto enthusiasts, digital art creators, and even celebrities. The world of NFTs is ever-so-growing and many believe they will be the basis of owning assets online as the Web 3.0 ecosystem expands and adoption increases. So, what are non-fungible tokens?

NFT Basics

NFT stands for Non-Fungible Token. Non-fungible means that it is unique and can not be replaced or replicated. In other words, non-fungible tokens are one-of-a-kind digital files, and the information, or metadata, that backs the NFT is logged on a blockchain. A blockchain is a public digital ledger that records transactions on the decentralized web. This means that the entire history (creator information, properties, transactions, and smart contracts) of an NFT is backed by a blockchain. As a comparison, fungible tokens, such as Bitcoin, Ethereum, Solana, etc, store value while NFTs store data on the blockchain.

NFTs are backed by DeFi protocols. As opposed to centralized exchanges, like the NYSE or banks, NFT tech is backed by DeFi. DeFi, or decentralized finance, is a peer-to-peer financial model that uses blockchains as ledgers. These protocols allow developers to generate decentralized applications through tokenization and smart contracts. The most popular DeFi protocol for NFTs is Ethereum but other protocols like Solana, Binance Smart Chain, Tezos, and others can store NFT metadata. Much like how varying fungible tokens run on varying blockchains, differing NFTs are compatible with different chains and DeFi protocols.

NFTs can be anything such as art, collectibles, music, profile pictures (pfp), DAO memberships, event tickets, gaming assets, virtual land, domain names, and so much more. They can either be completely digital assets or tokenized versions of assets that exist in the real world. Most of the current excitement is around using this technology to sell virtual art.

Characteristics of NFTs

- Digital ownership: People who have NFTs in their wallets own and control the NFT

- Permanent: NFTs have data permanently stored within the token. This information includes images, messages, signatures, or any other data

- Permissionless: NFTs can be built on a permissionless blockchain like Ethereum

- Programmable: An NFT is just a selection of code on a blockchain. It can be programmed to have several attributes. For example, an NFT artwork might be programmed to pay the artist royalties on every secondary sale of that artwork

- Unique: NFTs are unique, and that uniqueness can be confirmed on a blockchain

How to Get Started

Anyone can make an NFT in a few steps. First, get your media ready; NFTs support a range of files like MP3 audio, JPG, PNG, and GIF images, and even 3D files like GLB. Next, set up a non-custodial wallet to securely store the cryptocurrency you will use to buy, sell, and create NFTs. Wallets are also important for signing in and creating accounts on NFT marketplaces. NFT creators must buy Ethereum, or other fungible tokens depending on the blockchain being used, to cover the cost of NFT to be minted. With this, connect the wallet to an NFT marketplace like Rarible or OpenSea. Tap the “Connect” button in the top right corner of the screen. Your account is created and you are ready to create, mint, and sell your first NFT. Finally, upload your file to the platform and describe your asset. Decide if you would like to create a standalone piece or multiple NFTs of the same piece, royalty, and others. Start minting — the process requires ETH for transaction approvals. Your digital artwork is now ready to be traded and purchased on the marketplace.

NFTs trade on the blockchain, so there’s lots of freedom to what can be done with them, including:

- Buying and selling them on a marketplace

- Trading or gifting them

- Using them in dApps-like games

- Showcasing your public NFT inventory within a dApp or on social media

NFT Secondary Markets

Creators make NFTs via blockchain-based minting platforms to retain more control over their creative output. Once NFTs are minted on a non-custodial wallet-compatible website, collectors and traders can sell these assets on the secondary market. Here is a list of the most used NFT secondary sales sites:

- OpenSea: OpenSea is the first and largest marketplace for NFTs. A core part of its vision is that open protocols like Ethereum and interoperable standards like ERC-721 and ERC-1155 will enable vibrant new economies. OpenSea is building tools that allow consumers to trade their items freely, creators to launch new digital works, and developers to build rich, integrated marketplaces for their digital items. It recently launched the beta version of its Solana-based NFT marketplace that is integrated into its platform.

- Coinbase NFT: Coinbase recently opened its NFT marketplace in its beta version to the public. This marketplace acts as a social media platform in which users can not only buy and sell NFTs but also interact and showcase their collections via user profiles, likes, and comments. Coinbase owns a huge piece of the fungible token trading market and its NFT platform was set it up to capture a wider audience of those involved in the NFT market. Coinbase NFT has the goal of making minting, purchasing, showcasing, and discovering NFTs easier than ever. Coinbase helped millions of people access Bitcoin for the first time and Coinbase NFT aims to do the same for Non-Fungible Tokens.

- Solanart: Solanart is the first and largest fully-fledged NFT marketplace on Solana. Users can get quick and easy access to digital collectibles and explore, buy, and sell NFTs that run on the Solana blockchain.

- Rarible: Rarible is a do-it-yourself NFT marketplace where you can mint NFTs when and how you please. Creators are highly favorable toward Rarible, as the minting process is free, easy, and unrestricted. Rarible’s native governance token “RARI” is used to incentivize platform users and give the community members a voice. That unrestricted access means Rarible has become a place for people to mint counterfeit versions of existing NFTs and pass them off as the original. To an extent, this is an inevitable reality of DIY minting platforms.

- Nifty Gateway: Nifty Gateway is owned by the Gemini crypto exchange and has become one of the NFT ecosystem’s most prevalent marketplaces. They focus on user-friendly and viral drops by celebrated artists like Beeple, Trevor Jones, Pak, and more.

- SuperRare: SuperRare (SR) is one of Ethereum’s debut crypto-art NFT marketplaces. Artists must be accepted to the platform before they can participate. You can discover tokenized digital art, buy and sell it, and showcase your collection on the platform.

The demand for secondary NFT sales is growing rapidly which has led to high amounts of innovation throughout competing platforms. Much like the beginning of Web 1 and 2, the genesis of Web 3.0 has created competition in the open market which forces these platforms to find ways to better attract, serve, and retain customers.

Notable NFT Projects

This thriving NFT market has led to the launch of a multitude of high-value projects. Here are some of the most notable NFT-based companies on the market right now:

- Yuga Labs: a blockchain technology company that develops Ethereum-based NFTs and digital collectibles. Yuga got its start with the launch of Bored Ape Yacht Club, one of the most valuable NFT collectibles in the space. The apes are a limited NFT collection where the token itself doubles as a membership to a swamp club for apes. This project has seen a floor price of over 150 ETH at its all-time high and remains dominant over its counterparts. Since the apes, Yuga has rewarded its holders with free dog NFTs, Mutant Serum that produces mutant apes, and deeds for its Metaverse known as Otherside. Yuga Labs recently acquired Larva Labs which places high-value projects like Cryptopunks and Meebits under the Yuga brand as well. Yuga is backed by large investors like Coinbase, Samsung, and Mark Cuban which has caused it to become a huge force in the Web 3.0 industry.

- Doodles: a collection of 10,000 Ethereum-based NFTs that are made up of hundreds of exciting visual traits designed by Burnt Toast. The Doodles collection also includes dozens of rare heads, costumes, and colorways of the artist’s palette. The Doodles universe is ever-expanding and new experiences like Space Doodles and Dooplicator are only available to collectors. While the universe expands, the brand grows, and collectors can expect exclusive access to the latest products, merchandise and events through ownership. The Doodles saw an all-time high floor price of over 20 ETH.

- Okay Bears: a collection of 10,000 Solana-based NFTs. Owning an Okay Bear grants holders access to a virtuous community that will transcend the internet into the real world. The Bears currently hold an all-time high floor price of over 225 Sol.

Investing in NFTs

NFTs have proven to be a beneficial form of investment. They provide value for the tokenized asset – NFTs provide a means for physical objects (like artwork) to become tokenized, guarding against forgeries, establishing ownership and generally protecting the artist’s interests. This creates scarcity and increases value. Additionally, they give investors more liquidity. They also enhance the capacity for growth and development. NFTs offer growth and development for a number of sectors, like real estate; people can own their assets, rent them out, and otherwise decide what they want to do with them.

The Future of NFTs

Representing assets and proving their ownership is crucial functionality for blockchain technology. Digital art, collectibles, and in-game assets are just the start. Our homes have different addresses, our cars have unique VINs, and even people have an individual social security number. NFTs present a new and effective way for people to potentially purchase land, gold, or other non-fungible real-world assets. The global market cap for gold and real estate exceeds $300 trillion. If even 0.1% of that figure were tokenized, it would nearly double the total crypto market cap.

Tokenized real estate is a massive opportunity for increasing ordinary people’s financial independence. Real estate in general is one of the earliest and most lucrative forms of investing, but the entry barriers have become far too great for the average person to meaningfully participate. Investors in tokenized real estate will be able to put in as much as they can afford and still partake in real estate investing.

In 2018, a $30 million Manhattan luxury property became the city’s first property on the blockchain. Tokenization of property also lets real estate developers skip the hassle of traditional bank financing and instead finance their projects through other means.

Nike recently became interested in the NFT field. They recently filed a patent for NFT-enabled sneakers called “CryptoKicks.”

In 2019, high-end fashion brand Louis Vuitton announced plans to use NFTs to track the ownership of different luxury fashion items. They could use NFTs to track the entire history of a bag, from the factory where it was made to the closet where the owner stores it.

NFTs also give us the ability to tokenize things like certifications, degrees, and licenses. This will let us issue, maintain, and track these certifications within a blockchain. Sensitive data like medical records could be tokenized and protected using blockchain technology, giving us greater control over our data.

The real potential for NFTs lies in the ability to immutably show ownership of any non-fungible commodity, whether that commodity is real or virtual. The applications for NFTs are truly endless and we have only scratched the surface.