Executive Summary

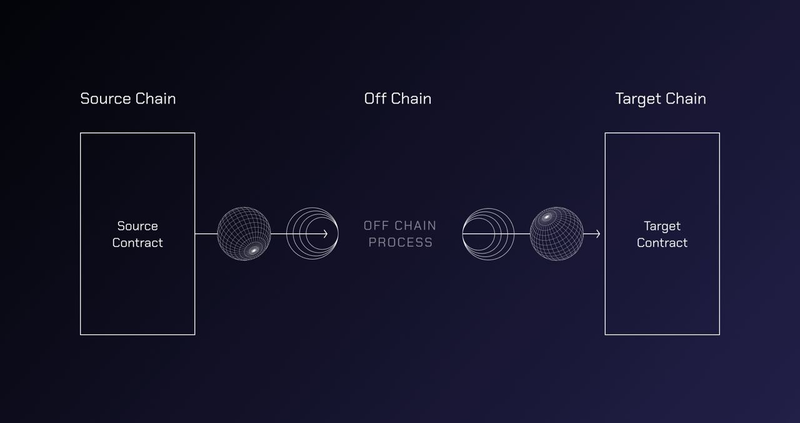

Wormhole is an interoperability protocol designed to enable the transfer of information and value between isolated blockchain networks. It is a state-of-the-art message-passing protocol that facilitates seamless communication among diverse blockchain ecosystems. While Wormhole does not function as a blockchain or a token bridge, its primary purpose is to facilitate various cross-chain interactions, such as exchanges, governance activities, and gaming applications. Wormhole additionally functions as an interoperability layer, enabling developers to construct and launch decentralized applications (dApps).

About the Project

Vision – To connect all the blockchains for seamless asset transfers and messaging.

Problem – The proliferation of blockchains has led to the emergence of numerous independent chains, resulting in limitations in communication and activities across them and liquidity fragmentation.

Solution – Wormhole was one of the pioneering interoperability protocols that stepped in to bridge liquidity gaps and enhance user experiences when navigating the vast array of blockchains available.

The protocol initially emerged as a token bridge, facilitating transfer between blockchains, particularly Solana and Ethereum. Subsequently, Wormhole evolved with Wormhole V2, adopting a more comprehensive role as an interoperability layer. This transformation allowed chains and decentralized applications to integrate and operate on the platform efficiently.

Features

- Cross-chain Communication: It enables diverse forms of cross-chain functionality, including asset bridging, exchanges, and governance, leveraging the strengths of multiple blockchain ecosystems.

- Gaming: It facilitates the deployment of multi-chain games on high-performance blockchains and bridges different blockchain environments, leading to a more seamless, faster, and cost-effective gaming experience. Moreover, the capability to transfer assets across chains enables the distribution of rewards across various protocols.

- Ease of Integration: The Wormhole SDK and Wormhole Connect widget simplify the integration of cross-chain capabilities into existing platforms and decentralized applications (DApps), improving the overall development process.

- Enhanced User Experience: Features like gasless transactions and gas dropoff help address common challenges in cross-chain interactions, such as high gas fees and complex bridging processes.

Market Analysis

The development of blockchain technology has experienced significant and exponential expansion, resulting in a current valuation of $2.6T. Forecasts indicate that this growth trend will persist, with new blockchains continually emerging. However, the emergence of blockchains has also caused liquidity fragmentation within the cryptocurrency realm. This fragmentation underscores a substantial demand for interoperability solutions such as Wormhole, as evidenced by the sector’s market capitalization of $2.5B. As the market expands, so does the demand for cross-chain products like Wormhole.

Thorchain emerges as Wormhole’s primary competitor, boasting a Fully Diluted Valuation (FDV) of $1.006B.

Investors

Traction

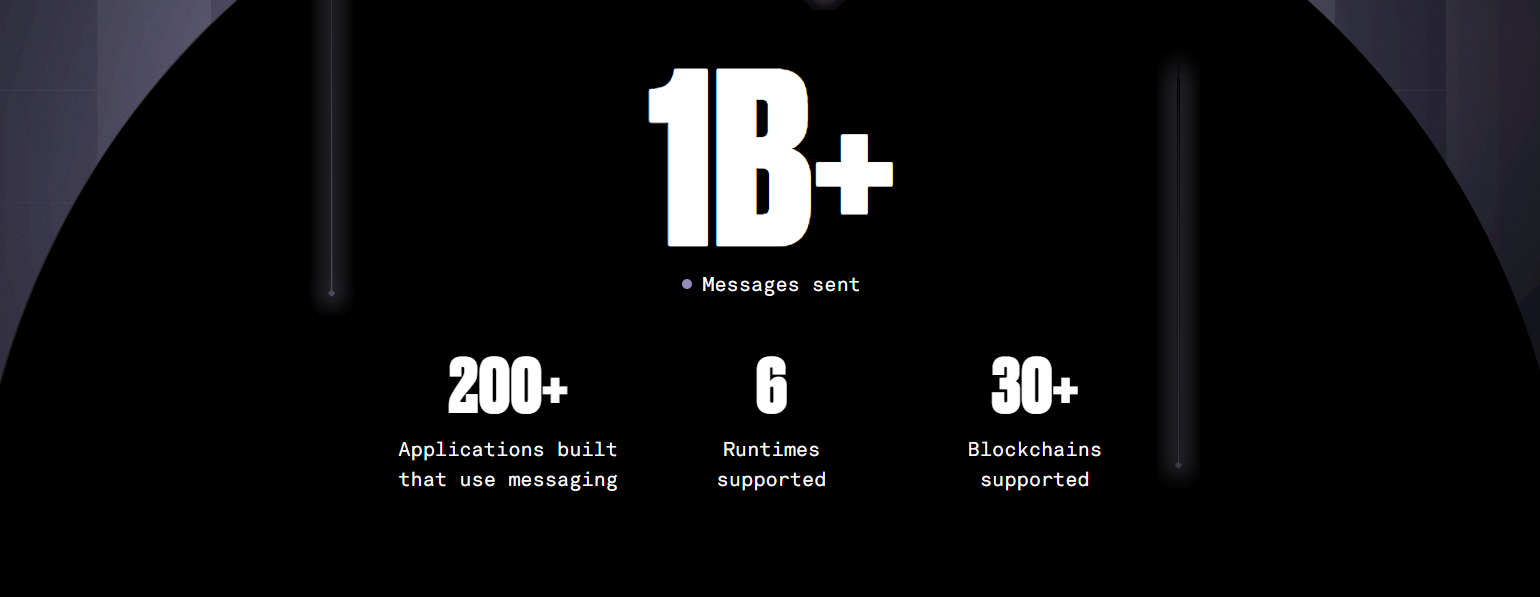

Wormhole emerged as a pioneer in cross-chain protocols, with its ecosystem now encompassing over 200 decentralized applications across 30 supported chains, including Ethereum, Solana, Cosmos, Polygon, and others. Since its inception, the protocol has processed over 1 billion cross-chain messages and handles more than 125,000 messages daily. These figures underscore the robust network Wormhole has established and its widespread adoption, positioning it as the premier cross-chain protocol in the present landscape.

Token

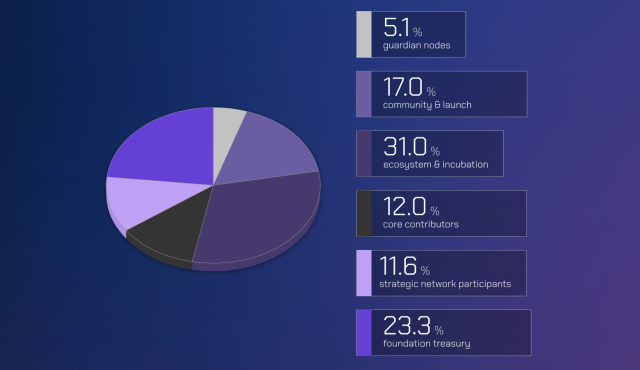

$W serves as the native token for the Wormhole platform. Its total supply is capped at 10 billion tokens, with a current circulating supply of 1.8 billion tokens. The remaining 82% of the token supply will be gradually unlocked according to a predetermined schedule.

Wormhole has a token-based governance model that allows token holders to shape the protocol’s development. Token holders can decide on token utility, fee adjustments, connection management, contract upgrades, and other governance-related matters. Wormhole aims to gradually decentralize its governance to empower $W holders over time.

Where can you buy the token?

$W can be brought from exchanges like MexC, [Gate.io](http://Gate.iohttps://www.gate.io/?ref=3018394), and OKX.

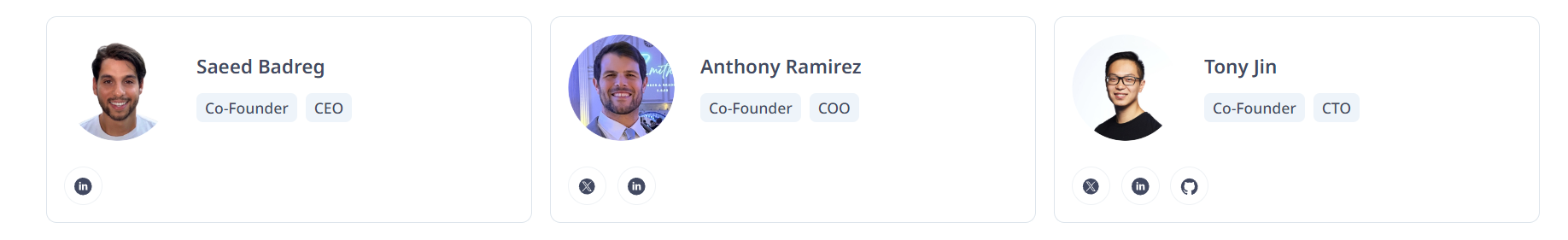

Team

Wormhole was established by Jump Crypto, the development division of Jump Trading Group. The team boasts extensive technical expertise and has demonstrated commendable progress thus far.

Conclusion

Wormhole is a prominent interoperability protocol that facilitates the smooth transfer of value and information between blockchain networks. Its commitment to interoperability has been instrumental in its widespread adoption and recognition within the blockchain community. Wormhole has solidified its position as a leader in the field and continues to expand its reach. Wormhole has successfully integrated with all major chains, positioning itself at the forefront of blockchain interoperability solutions. Given the dynamic nature of the cryptocurrency landscape, Wormhole is poised for a promising future.

| Fundamental Analytics | |||||

| Assessment | |||||

| Problem | Significant, long-term problem | 3 | |||

| Solution | Distinct, defensible solution | 3 | |||

| Market Size | Large market, significant growth potential | 3 | |||

| Competitors | High competition, but room for differentiation | 2 | |||

| Unique Value Proposition | Clear differentiation and value for customers | 3 | |||

| Current Traction | High traction, strong user growth and retention | 4 | |||

| Unit Economics | Positive unit economics, with plans for further improvement | 3 | |||

| Tokenomics | Solid token strategy, aligns with user incentives | 3 | |||

| Product Roadmap | Unclear or unrealistic product roadmap | 1 | |||

| Business Model | Proven business model with clear path to profitability | 3 | |||

| Go-to-Market Strategy | Highly effective GTM strategy, innovative and well-differentiated | 4 | |||

| Regulatory Risks | Minimal regulatory risk, strong mitigation and adaptability | 4 | |||

| Total | 75.00% | ||||