XDC Network is a cutting-edge, enterprise-grade blockchain protocol that operates as a Layer-1, EVM-compatible, open-source hybrid solution. It is designed explicitly for tokenization within decentralized finance (DeFi), focusing on real-world applications. This high-performance platform is optimized for trade finance and asset tokenization, utilizing a unique delegated proof-of-stake mechanism known as XDPoS. This consensus model ensures rapid transaction processing, low gas fees, and an impressive capability of over 2,000 transactions per second (TPS).

About the Project

Vision – The vision of the XDC Network is to establish itself as a leading global blockchain solution for trade and finance. By facilitating lightning-fast transactions, maintaining minimal fees, and enhancing platform interoperability, the XDC Network creates an optimal ecosystem for developing and hosting Real World Assets (RWAs). This capability allows seamless integration into the digital economy, fostering greater efficiency and accessibility.

Problem – Ethereum, the pioneer of the smart contract industry, is actively seeking ways to enhance user experience and streamline processes. However, it currently faces challenges in efficiently processing transactions at a speed suitable for the financial sector. While Ethereum has revolutionized digital agreements through its self-executing contracts, the platform’s scalability and transaction speed limitations hinder its effectiveness for high-volume financial applications.

Solution – The XDC Network is actively addressing the limitations of existing blockchain solutions, particularly the transaction processing performance bottleneck that hampers Ethereum’s adoption in various industries, especially finance. As a high-performance blockchain platform designed for enterprise applications in trade finance and asset tokenization, the XDC Network utilizes the XinFin Delegated Proof of Stake (XDPoS) consensus mechanism. This innovative approach requires validators to perform a minimal amount of Proof of Work (PoW) when proposing new blocks, ensuring efficient consensus while consuming minimal energy and maintaining resistance to spam attacks.

By enhancing transaction speed and reducing costs, the XDC Network positions itself as a viable alternative for businesses seeking reliable blockchain solutions. Its architecture is tailored to support high transaction volumes, making it well-suited for financial applications where speed and efficiency are paramount. Its EVM compatibility allows developers to build autonomous decentralized applications.

Market Analysis

The concept of integrating real-world assets (RWAs) into blockchain technology has long captivated web3 entrepreneurs and startups. The vision of creating an interoperable and aggregated ecosystem encompassing tokenized equities, bonds, real estate, and various other asset types—free from the constraints of traditional finance, such as high transaction costs and information asymmetry—is a pursuit worth exploring.

However, the tokenization of RWAs presents unique challenges that must be addressed, including ensuring regulatory compliance, establishing reliable valuation methods, and developing robust frameworks for asset management and transfer. The XDC Network confronts these challenges directly by providing a secure and compliant environment for RWA tokenization and trading.

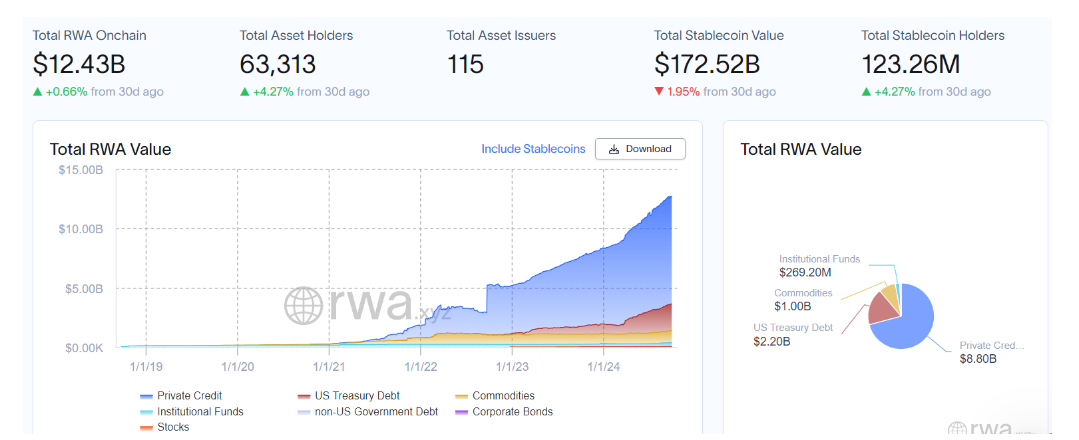

The market for RWAs is experiencing sustained growth, with increasing interest from major players in traditional finance. Notable firms like BlackRock and Franklin Templeton have propelled the tokenized treasury market to new heights, while private credit is also undergoing a resurgence. Additionally, non-U.S. tokenized debt, along with tokenized equities and real estate, is gradually expanding. Innovations in tokenizing alternative assets—such as carbon credits and air rights—are emerging, with several startups exploring their own RWA-focused blockchain solutions.

Currently, total on-chain RWAs have reached an all-time high of over $12 billion, excluding the substantial $175 billion stablecoin market. As interest in RWA tokenization continues to grow, the XDC Network is poised to play a pivotal role in transforming how assets are managed and traded in a decentralized manner.

Uniqueness – Designed for interoperability and compliance with ISO 20022 financial messaging standards, the XDC Network excels in facilitating trade finance, payment processing, and RWA tokenization. Its robust, scalable platform underscores a commitment to innovation, making it an attractive choice for businesses seeking advanced blockchain solutions.

With a strong infrastructure in place, the XDC Network ensures rapid transaction processing, minimal fees, and enhanced interoperability across platforms. This positions it as an ideal ecosystem for developing and hosting RWAs, enabling seamless integration into the digital economy.

Competitors

Several projects are emerging with similar goals in the blockchain space, each offering unique solutions tailored to specific industries.

MANTRA

Mantra is a security-focused Layer-1 blockchain designed to meet real-world regulatory requirements. It caters to both institutions and developers by providing a permissionless blockchain framework for permissioned applications. MANTRA is built using the Cosmos SDK and supports Inter-Blockchain Communication (IBC) along with CosmWasm integration. The platform is secured by a sovereign Proof-of-Stake (PoS) validator set and boasts scalability of up to 10,000 transactions per second (TPS). Additionally, it includes built-in modules, SDKs, and APIs to facilitate the creation, trading, and management of regulatory-compliant real-world assets (RWAs). MANTRA also focuses on enhancing user experience, making it easier for non-native users and institutions to transition into the Web3 space.

Traction- MANTRA Chain has delivered impressive returns this year, with its valuation surpassing $1 billion. The platform is actively expanding its ecosystem through the development of proprietary platforms and strategic partnerships. Notably, MANTRA has secured a $500 million asset tokenization deal with MAG Group, further boosting its growth and influence in the blockchain space.

Peaq

Peaq is another prominent Layer-1 blockchain project, aiming to power Decentralized Physical Infrastructure Networks and Machine Real World Assets. The peaq ecosystem already encompasses over 30 projects and applications, all working toward enabling decentralized management, configuration, and control of machines. Its mission is to empower individuals and organizations to own and manage smart machines in a decentralized manner, driving innovation in the field of machine-driven infrastructures.

Traction – Peaq has made significant strides by tokenizing over $45 million in assets and attracting more than 45 projects to build on its network. With ongoing development, Peaq is poised to launch its token soon, which is expected to enhance the platform’s capabilities and drive further adoption.

Features

- Zero gas fees – The XDC Network offers significant advantages, including near-zero gas fees, making it an ideal choice for cost-effective enterprise applications. It ensures swift and efficient transaction settlements with a block finality time of just two seconds. The network’s Ethereum Virtual Machine (EVM) compatibility simplifies the migration of tokens and projects, such as ERC-20 and ERC-721, enhancing accessibility for developers.

- EVM compatibility – This EVM compatibility empowers developers to create autonomous decentralized applications (DApps) on the XDC Network. Smart contracts execute seamlessly, facilitating trustless transactions with automatic contractual terms enforcement. The network’s high interoperability also allows for integration with legacy systems like SWIFT and ERP, ensuring secure data transfers across platforms.

- Performance & Scalability – The XDC Network can process over 2,000 transactions per second (TPS), significantly outperforming Ethereum’s standard throughput. Its rapid block times provide near-instant transaction finality, making it well-suited for institutional and enterprise use cases.

- KYC Regulation – The XDPoS consensus mechanism incorporates an independent KYC-based node, effectively addressing challenges related to anonymous network participants. This feature enhances regulatory compliance while promoting secure participation in the network.

Use Cases

The XDC Network leverages the advantages of both public and private blockchains to provide versatile solutions for enterprises. Here are some key use cases:

- Trade Finance: The network facilitates secure and efficient global trade financing, significantly reducing fraud risks and accelerating transaction times.

- Supply Chain Management: The XDC Network streamlines supply chain processes using smart contracts, lowering costs while enhancing transparency and traceability.

- Tokenization: Real-world assets, such as commodities and real estate, can be tokenized, enabling fractional ownership and more efficient trading.

- Cross-Border Payments: The platform supports fast and low-cost cross-border payments, minimizing reliance on intermediaries and promoting financial inclusion.

- Identity Verification: XDC provides a tamper-proof solution for secure identity verification, effectively mitigating identity theft and fraud risks.

Token

The $XDC token is the foundational utility token for XinFin’s Hybrid Blockchain, acting as a settlement mechanism for decentralized applications (DApps) built on the platform. Additionally, XinFin has introduced an Ethereum-based token known as XDCE, which can be exchanged with the $XDC utility token at a 1:1 ratio. This feature allows token holders to maintain their assets in either format. The ERC-20 token can also be swapped for XDC at the same 1:1 ratio, with transactions facilitated through the AlphaEx exchange, which supports all decentralized exchanges and enhances XDC liquidity.

XDPoS Consensus Mechanism – The $XDC Network employs the XinFin Delegated Proof of Stake (XDPoS) consensus mechanism, where coin holders delegate their votes to select network validators. This system facilitates transaction validation and allows token holders to participate in governance through voting.

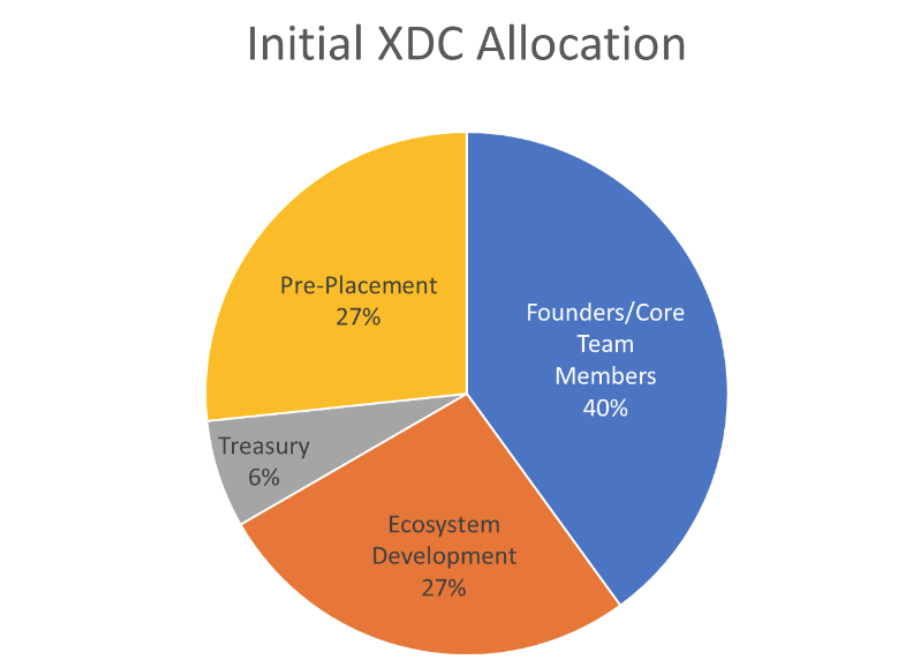

Supply Dynamics – The total supply of $XDC is influenced by three primary factors: pre-mining, minting, and burning. At the inception of the mainnet, 37.5 billion $XDC tokens were pre-mined. Masternodes generate approximately 86.7 million $XDC annually as rewards for validating transactions, introducing inflationary pressure on the total supply. Conversely, a portion of transaction fees from executed smart contracts is burned, creating a deflationary effect. Over time, the amount of $XDC burned will be anticipated to surpass the amount minted through masternode operations, leading to a deflationary trend within the network. By addressing these dynamics and utilizing its innovative consensus mechanism, the XDC Network aims to provide a robust and efficient platform suitable for various applications in trade finance and asset tokenization.

Team

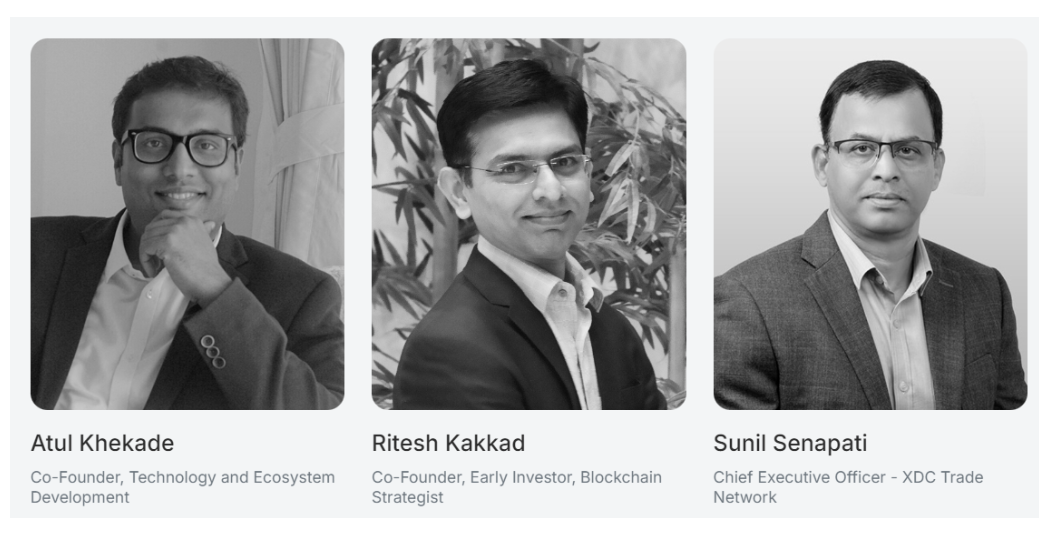

Atul Khekde and Ritesh Kakkad are the co-founders of the XDC Network. Atul, with over 14 years of experience in the technology sector, played a pivotal role in developing the first permissioned blockchain system for a consortium of major Asian banks. Additionally, he co-founded a multi-million-dollar revenue company focused on airline chartering. Ritesh Kakkad has a strong entrepreneurial background, also with over 14 years of experience. His expertise spans cloud hosting, cloud setup, and internet infrastructure. Sunil Senapati serves as the CEO of the XDC Network. His extensive experience includes roles at leading companies such as Oracle, Maersk, Bolero, and Monetago.

Traction

The XDC Network currently boasts a Total Value Locked (TVL) of approximately $9 million. Within its ecosystem, several notable projects are actively contributing to its growth, including Comtech Gold and the U.S. Treasury Securities Tokenization initiative by Yieldteq.

Comtech Gold (CGO) is an innovative digital asset fully backed by physical gold. Each CGO token represents one gram of pure gold, with the gold securely stored by Transguard, a reputable vault operator based in the UAE. This project exemplifies how blockchain technology can enhance asset security and liquidity.

On the other hand, Yieldteq’s U.S. Treasury Securities Tokenization represents a significant advancement in modernizing traditional financial instruments through blockchain technology. This initiative facilitates the tokenization of U.S. Treasury Securities, effectively bridging conventional financial systems with the emerging landscape of decentralized finance (DeFi). Such innovations are essential for integrating traditional finance with modern digital solutions.

Another key player in the XDC ecosystem is Stasis, which offers Stasis Euro (EURS), a digital version of the Euro. As a stablecoin, each EURS is pegged to one Euro, ensuring that sufficient real Euros are held in reserve to back all issued EURS.

The XDC Network continues to expand its ecosystem with various other projects that leverage its capabilities for tokenization and trade finance. By fostering an environment of innovation and collaboration, the XDC Network is well-positioned integrate of real-world assets into blockchain technology, ultimately enhancing efficiency and transparency across financial markets.

Conclusion

The XDC Network exemplifies the transformative potential of blockchain technology in the realm of Real World Assets (RWAs), offering a vision of a future where digital and traditional finance seamlessly converge. By addressing the current challenges associated with public blockchains, XDC stands out due to its hybrid blockchain technology, which features an immutable, transparent, and tamper-proof architecture. As RWAs gain traction in the financial sector, with major players increasingly participating in tokenized markets, the XDC Network is poised to play a pivotal role in bridging traditional finance with decentralized solutions. Its infrastructure supports various projects within its ecosystem, including initiatives focused on tokenizing U.S. Treasury Securities and other financial instruments.

| Fundamental Analysis | |||||

| Assessment | |||||

| Problem | Moderate, somewhat persistent problem | 2 | |||

| Solution | Some uniqueness, moderate defensibility | 2 | |||

| Market Size | Large market, significant growth potential | 3 | |||

| Competitors | High competition, but room for differentiation | 2 | |||

| Unique Value Proposition | Clear differentiation and value for customers | 3 | |||

| Current Traction | Early traction, user engagement starting to grow | 2 | |||

| Unit Economics | Break-even or slightly positive unit economics | 2 | |||

| Tokenomics | Basic token strategy, potential for improvement | 2 | |||

| Product Roadmap | Basic roadmap, lacks detail or innovative features | 2 | |||

| Business Model | Proven business model with clear path to profitability | 3 | |||

| Go-to-Market Strategy | Solid GTM strategy, clear target market and channels | 3 | |||

| Regulatory Risks | Moderate regulatory risk, solid mitigation strategy | 3 | |||

| Total | 60.42% | ||||